TLDR

Derivative Trading crypto involves financial trading contracts that derive their value from the underlying price movements of a crypto asset. These contracts allow traders to speculate on the asset’s future price without owning it. With high market volatility, trade contracts on a reliable trading platform, enabling investors to buy or sell bitcoin and other cryptocurrencies, are crucial for risk management.

Crypto derivatives trading provides market participants with a tool to set a price at a future date, enabling them to manage risk and hedge against market price changes. Trading volumes have increased, and transaction costs are lower than in traditional financial markets. However, regulatory concerns exist.

The expiry date, strike price, and funding rate are essential in trading strategies. Trading platforms offer both spot trading and crypto futures and options. The market automatically settles these leveraged contracts, and auto deleveraging can occur if the underlying asset’s price moves against the buyer.

Introduction

In recent years, derivatives have been blamed for much of the wrong in the financial market. For the uninitiated, it can be challenging to understand why derivatives exist. Still, if you dig deeper, you see a different picture.

What we learn is that derivatives help keep markets stable. They let you transfer risk and make more profit. People who want to be safe can pass on risks and opportunities to make money to people willing to take more risks.

What Are Derivatives Trading?

When they first emerged as a phenomenon in the financial world, the purpose of derivatives was to stabilize exchange rates in trading goods sold internationally. Still, derivatives can be based on anything. Common underlying values for derivatives are commodities, shares, bonds, currencies, indices, interest rates, or cryptocurrencies.

The derivative is a bet in a contract between two or more parties. Derivatives link to underlying values such as products, raw materials, currency, or cryptocurrency, and people often use them as protection against unfavorable price developments in these underlying assets.

Trading Derivatives

At the same time, it is also possible to trade derivatives. This has become very popular as, through trading in derivatives, you can achieve a return with less capital investment than you would need if you had bought the underlying asset.

The fluctuations in the price of these underlying assets primarily determine the cost of the derivatives. Still, at the same time, the derivatives are not the same as the underlying asset. The fees can vary independently of the underlying asset price. Derivatives are usually bought through brokers, stock exchanges, or crypto exchanges.

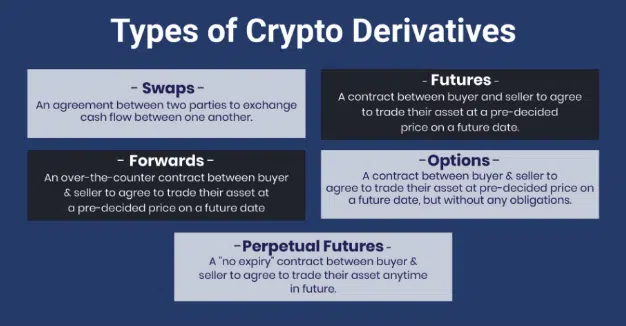

Generally speaking, derivatives can be divided into two main categories :

- The first is derivatives with contingent claims. This contains derivatives such as, for example, options.

- The second category is derivatives with future claims. This category includes such products as futures contracts and swaps.

Futures Contracts

The large fluctuations in the value of cryptocurrencies are difficult for some players in the market to handle. Bitcoin ATM operators and those running crypto mining or payment services, where Bitcoin or other cryptocurrencies are accepted as payment, exemplify players who need specific stability in the industry.

Derivatives with future claims are helpful in the crypto market because they enable owners of Bitcoin and other cryptocurrencies to set stable prices in time. Futures contracts are one of the most common derivatives in the crypto market.

For cryptocurrency, futures contracts work the same way as other underlying assets. Roughly speaking, a buyer and a seller agree on a fixed price and time to sell a cryptocurrency in a futures contract. This means that you can, for example, set a price for your Bitcoins at a future time when you will need them.

Futures contracts are also helpful for speculators willing to take on more risk with the potential for a more significant upside. The person who sells a futures contract is the party who expects the underlying values of a derivative contract to go down in price. In contrast, the buyers will usually be the ones who wish these values to go up in price.

Permanent Futures Contracts (Perpetual futures)

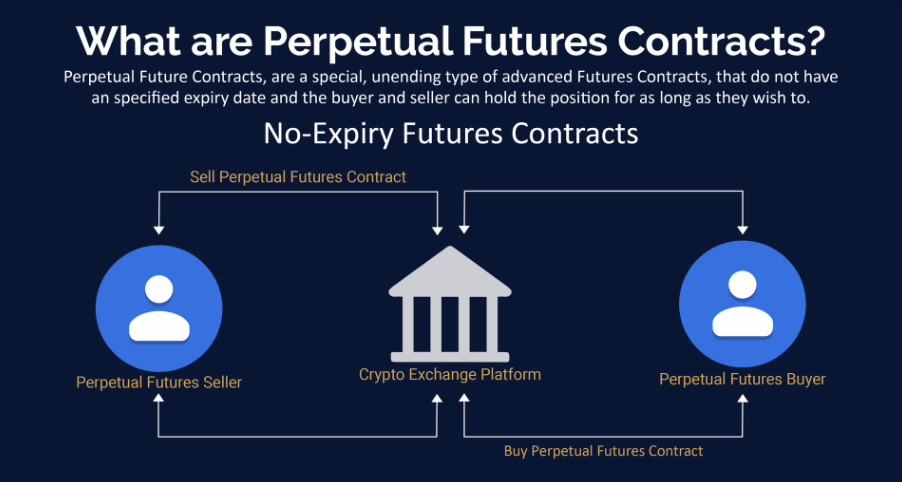

Common futures contracts are often settled on a monthly or quarterly basis. On the other hand, permanent futures contracts do not have a specific end date but use a daily pricing and settlement mechanism. Prices are set more often than once daily, but how often this is done varies between crypto exchanges.

When trading derivatives in crypto, the advantage of this type of contract is that it doesn’t force you to commit to a specified price or end the contract on a given date. If it’s not profitable, you can continue to hold the contract for as long as you like. The disadvantage of this arrangement is that you can quickly pay a lot if you sit with such an agreement for extended periods.

Future Spread

Future spread contracts are relatively new in the crypto market and allow you to buy one futures contract and sell another futures contract simultaneously. This enables you to trade in the direction of the market with less risk, as you are not as exposed to short-term fluctuations, which can often be significant in the crypto markets.

With future spread contracts, you trade on the difference between the two different futures contracts. You can buy the spread to make money when the difference in value between the various contracts increases. At the same time, you can sell the spread to make money when the difference in the value of the different contracts decreases.

Derivative Swaps

Currency Swaps are financial instruments that can stabilize the difference in the market between two underlying values over time. A swap makes it possible for one party to hedge against a downturn in the market so that you do not lose money by converting the values of the other currency.

The other party assumes the risk of potential losses when values are exchanged again but gains any profit if the market rises. This arrangement leaves one side with security and the other with risk and profit potential. You will see this type of derivative more often in the OTC market.

Options

Options are an effective way for investors to protect themselves against changes in the price of Bitcoin or other cryptocurrencies. You have “put” options and “call” options.

A “put” option gives the investor the right to sell at an agreed price at an agreed time without him having to do this. A “put” option is often used to make money when the market drops. A “call” option gives the investor the right to buy at an agreed price at an agreed time. Call options are usually used by optimistic traders who expect the market to go up.

Shorting allows you to make money when the market is down.

In trading, you usually start with a purchase and end with a sale. Shorting, or short selling, is a strategy for trading where you change the standard chronological order. When you short a cryptocurrency, you start by selling it and then rebuy it later, hopefully for a profit.

Shorting is a method of making money from the decline in the value of a cryptocurrency or other underlying values. Selling futures contracts is a way of shorting cryptocurrency. Shorting can also be done using swaps or options.

Trusted Partners

Leverage And Margin Trading

Because trading in derivatives often involves minimal changes in the price of the underlying values of the derivative, trading in products usually takes place in combination with leverage and margin. The margin is the money you borrow from your broker to “give” an investment.

Leverage is using the money you borrow from your broker, with security in your portfolio, to make the most of your resources.

To start leverage trading, visit the Binance exchange.

More details

Binance is a great combination of low fees, deep liquidity and multiple cryptocurrencies and trading pairs. We have tested every aspect of it and it STILL holds its reign as the top exchange in the world. In our view, it is the perfect crypto exchange for both newbies and advanced traders alike.

-

Biggest exchange in the world.

-

Industry's lowest trading fees.

-

Advance trading options like leverage trading.

-

600+ crypto options, 150+ for the US.

-

Lucrative on-site staking options.

-

Hiccups in account verification.

-

Less regulated than some competitors.

-

The corporate structure is not transparently.

Opportunities To Multiply The Profit On Your Transaction

Simply put, leverage is when you borrow money to increase the effect on the derivative transaction. With gearing, it is possible to achieve a much larger profit than if you only use your own money. This implies that, for example, by using 10x leverage, you can achieve a profit ten times larger than what you would have earned if you had only used your own money.

Careful! Your Loss Can Also Be Multiplied

Leverage can be an effective way to increase the possibility of profit from a relatively modest investment. At the same time, it is imperative to remember that leverage can multiply your loss. Leveraging can be a very effective way to lose money if you don’t know what you are doing.

When you trade with leverage, it also means that you are borrowing money, so you have to pay interest. Usually, this will be a small part of the gain if the market goes as planned, but if things do not go as planned, the interest rates will also contribute further to the loss.

On most products, achieving between 3 and 20x leverage is common. Still, there are other products, such as perpetual future contracts, where you can find leverage of as much as 100x. The products where you have access to so much leverage are products where there is less chance of market-bankruptcy price manipulation.

Leverage Can Be Used To Reduce The Negative Consequences Of Hacking.

Hacking is always a risk when transferring cryptocurrency to a crypto exchange. Therefore, avoiding unnecessarily large values sitting in the crypto exchange is essential. When using leverage to achieve the same result, you will need much smaller values transferred to your crypto exchange account. Thus, you can avoid risking these values.

A Strong Trend For Derivatives In The Crypto Market.

The market for derivatives in the crypto market has now reached about 20% of the size of the spot market. In the conventional markets, we see that the total crypto volumes in the derivatives market are now approximately ten times as large as the world’s combined gross domestic product. This tells us that there is still a tremendous potential for growth for derivatives in the crypto market.

There has recently been a lot of interest among institutional investors in using Bitcoin and other cryptocurrencies as an effective hedge against inflation. This all points to the fact that we probably have long, solid growth ahead of us in the crypto derivatives market.

The large fluctuations in the crypto market make derivatives a popular method of reducing exposure to price fluctuations. At the same time, derivatives open up many more opportunities and strategies for those in the market who want to make money from price fluctuations.

Derivatives Can Be Essential For Institutional Investors.

Many believe that a mature derivatives trading market needs to be added for the crypto market to attract institutional investors. With institutional investors, large amounts of new capital enter the market, which will drive up the values of cryptocurrencies. This is, therefore, the background for some of the general enthusiasm around derivatives in the crypto market.

Derivatives are essential for institutional investors, especially in the volatile crypto market, as they allow for much greater control over investments and limit losses. With trading volume already in the hundreds of billions of dollars, we are soon at the level where the institutional players will be interested in participating.

So far, the most common product among derivatives has been cryptocurrency futures contracts, but swaps and options have also become popular.

Do Derivatives Lead To The Reduction Of Price Fluctuations In The Crypto Market?

Since its inception, one of the significant challenges within the crypto market has always been the strong price fluctuations. These fluctuations have been attractive to investors and traders with a risk appetite. Still, at the same time, the price fluctuations have held back development, preventing cryptocurrencies from fulfilling their role as means of payment.

Derivatives were initially introduced to ensure stable exchange rates for products sold internationally. The results helped buyers and sellers by introducing a system that absorbed the currency risk in the international transaction between buyer and seller.

The research says introducing derivatives has reduced exchange rate fluctuations in the conventional currency market. This is in line with common sense, which dictates that when any upswing or downswing in price can be used for profit, these upswings and downswings will eventually become less and less frequent as more traders take advantage of the opportunities.

Introducing derivatives into the crypto market over time will result in generally reduced fluctuations in the value of cryptocurrencies, but this will happen over time. Fortunately, the individual can realize the stabilizing benefits of using derivatives in the crypto market by using the derivative products themselves.

Derivatives In The OTC Market

The OTC market is the best choice for those who trade large cryptocurrency volumes. Sometimes, you can influence the price if you quickly buy or sell large amounts of cryptocurrency on a crypto exchange. When dealing with the OTC market, you also have much more freedom regarding agreements you can enter into.

Derivatives can be traded in the OTC market in private transactions between the parties. These contracts are more flexible and would like to be adapted to the parties’ needs. Remember that you have far greater counterparty risk in such transactions than you have if you trade with a crypto exchange that offers regulated and standardized products.

Derivatives On Crypto Exchanges

Most derivatives trading will go through crypto exchanges specializing in this area. Crypto exchanges offer carefully thought-out and clear derivative market products that are better secured than the alternatives in the OTC market.

Derivatives found on crypto exchanges are currently strongly dominated by Futures contracts. Still, other derivatives such as Swaps, options, future spread contracts, and permanent futures contracts have also made a strong entry into the market. The popularity of these products is increasing.

Risks When Trading Derivatives In The Crypto Market.

Trading in derivatives is a high risk in any market. Suppose you need a better idea of what you are doing. In that case, there is a big chance that you can lose money, so it is essential to move carefully when you start trading, think carefully about the risks you take for any trade and spread the risk beyond a carefully balanced portfolio.

Time Decay

In time-limited derivatives, maturity is a risk taken into account. The closer you get to the date when the derivative expires, the greater the chance that the scenario you had envisioned will only happen if the trend is already on its way there. Time decay will have a genuine impact on the price of the derivative.

Counterparty Risk In The OTC Market

In the OTC market, where you trade directly with the counterparty without going through a crypto exchange, counterparty risk can be genuine. Remember that derivatives are contracts. This means that the only thing that can guarantee your payment is the ability to pay your counterparty and the legal system that may come into play if your counterparty refuses to pay.

A lot can happen here. For example, situations can arise where the counterparty “gambles” and enters into derivative contracts that bankrupt them. In such cases, you must expect to miss all or part of the winnings.

In other situations, the counterparty may refuse to pay for itself. This can be a considerable risk if the agreement falls under a jurisdiction where it is difficult for you to exercise your rights. The same may apply if your counterparty resides in a jurisdiction where it is difficult or expensive for you to exercise your right. Here, you must tread carefully and know who you are dealing with.

Hacking And Digital Theft

Hackers stole around $4.5 billion in crypto market-related crime in 2019. This was more than double the amount from the previous year. The crypto industry is a rapidly growing industry. Still, at the same time, it is also a relatively new industry with a generally high degree of complexity.

There needs to be more qualified developers in the industry. The strong growth is pushing some of the smaller players in the industry to use less competent developers, which often results in less secure systems where weaknesses can be exploited. A recent example of hacking occurred in September 2020 when values equivalent to 150 million dollars were stolen from the Kucoin crypto exchange in Singapore.

Exchange Risk

Cryptocurrency operates in many places in a legal gray area. The same applies to many crypto exchanges that facilitate trading in cryptocurrency. A relatively recent example of the risks of crypto exchanges is the Canadian crypto exchange Quadriga, where one of the company’s founders appears to have absconded with $215 million from 76,000 customers.

Market Manipulation

Another risk with crypto exchanges is that compared to exchanges in the conventional economy, they have much less volume. Therefore, there is still more manipulation of the crypto markets than the conventional ones.

Some strategies used to manipulate the crypto market are hidden orders, “wash trading” using several crypto exchanges, and forced liquidation of portfolios.

Fluctuations

A relatively well-known risk in the crypto market is the risk of strong fluctuations. This is perhaps a well-known risk, but at the same time, it can be easy for new traders who are not used to the crypto market to underestimate how significant these fluctuations can be and how easily you can lose your money if you don’t consider this.

The crypto market is also less regulated than other more established financial markets. You still see political decisions which, at times, strongly influence developments in the market. This may relate to cryptocurrency within a market or, in other cases, to a specific cryptocurrency.

In addition, the crypto market is full of surprises. For example, one may experience that the cryptocurrency one invests in can be split in two in a fork. Sometimes, a cryptocurrency can be terminated so that you lose all the underlying values, for the derivative disappears.

Advantages And Disadvantages Of Derivatives In The Crypto Market

Advantages

Derivatives are handy tools for both companies and investors. They are often used to set prices and hedge against unfavorable price changes or other risks at a low price. Leveraging means this “insurance” becomes cheaper, and you don’t have to tie up cash.

The fact that you can often use leverage in combination with derivatives makes them an excellent form of insurance against unexpected events in the market that can be negative for the company.

For investors and traders who make money by predicting where the price development and other trends in the market are going, derivatives make it possible to make money from the price changes in a product, a cryptocurrency, or different values without having to lay out the total sum that it would cost to buy the product itself.

Disadvantages

Although derivatives are based on fluctuations in the value of other securities, some factors make it challenging to match the price of the derivative with the underlying values. Among other things, derivatives are sensitive to changes in how much time is left before they expire and how much it costs to hold the underlying values and interest rates.

The derivatives have no intrinsic value but derive all their value from the underlying values. They are, therefore, more sensitive to market-related risks, such as fluctuations related to supply and demand for the derivative. Prices can experience changes regardless of what happens to the cost of the derivative’s underlying values.

In the OTC (Over-the-counter) market, there may be a risk of default by the counterparty. This is less risky if you trade through an exchange with guarantees or insurance that prevent this.

The Future Of Derivatives In The Crypto Market

Derivatives have already taken on a beneficial role in the crypto market through products that stabilize and reallocate risk to those who want it. Thus, much of the risk can be concentrated among those who like extra adrenaline by derivatives trading in crypto. In contrast, those with less appetite for risk can finally stop biting their nails and get the sleep they have been waiting for for so long.

Derivatives also lay the groundwork for more prominent institutional investors to be able to enter the crypto market on a much larger scale with levels of risk acceptable to their clients. Therefore, derivatives in the crypto market are both natural, necessary, and fascinating developments in the crypto market that many people are looking forward to.

There are several crypto derivatives exchanges to choose from, each with its advantages and disadvantages. When looking for the best exchange, consider transaction costs, market liquidity, and regulatory concerns. Some popular options include Binance, and Bybit.

Yes, you can buy and sell crypto derivatives just like traditional financial contracts. Derivatives trading crypto allows buyers to speculate on the future price movements of a crypto asset without actually owning the underlying asset. Unlike futures, crypto options provide the buyer with the right, but not the obligation, to buy or sell the underlying asset at a predetermined price on or before the expiry date.

The crypto derivatives market has grown significantly in recent years, with total trading volumes surpassing those of spot trading for crypto assets. Bitcoin futures, in particular, have seen a surge in popularity among institutional investors. Despite its growth, the crypto market is still relatively small compared to the traditional derivatives market, with market efficiency and liquidity remaining areas of concern.

Yes, trading Bitcoin derivatives, including futures and options, is possible. Trading crypto derivatives allows investors to manage risk and potentially profit from the price movements of Bitcoin without holding the actual asset. However, as with any investment, it is important to consider the risks involved before starting to trade.