TLDR

Leverage trading is a financial strategy allowing traders to borrow from brokers and purchase an underlying asset. Since it can multiply returns, traders can profit more without spending much capital. Yet, if the leveraged position fails to maintain at a certain level, traders must pay extra funds to the broker. Otherwise, the position will be closed out. To prevent this from happening, traders can use risk management tools, such as stop-loss orders and take-profit orders, to help them.

What Is Leverage Trading? How Does It Work?

Leverage trading is an investment strategy. Traders use their borrowed funds, aka capital, to invest in an asset, whether a currency, stock market, or security. With these leveraged trades, traders can generate higher returns from their initial capital by multiplying their position size.

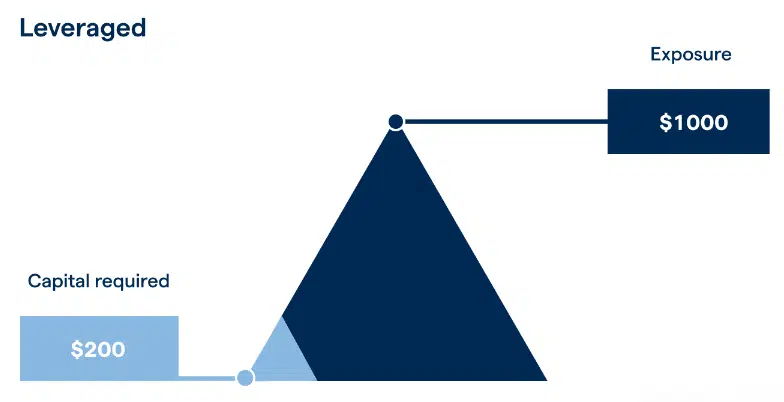

Traders use leverage with the borrowed capital from a broker to increase their exposure to an asset. For example, if a trader only has $100 in deposit but wants to invest $1000, they can borrow $900 from a broker. The amount depends on the broker and the asset they want to start trading with leverage.

Despite being a profitable and powerful tool for traders to earn income from their assets, it comes with risks. Traders may need to sell their assets outright at a loss price to repay the borrowed capital if their assets are declined. This is also known as a margin call.

Thus, before getting into leverage trading, traders should think twice about the risks that come with the rewards. In addition, traders should always understand the underlying assets and market volatility of their desired trading before making the final decisions.

Margin Trading in Crypto

Aside from trading in traditional markets, traders can also use margin trading in crypto. Let’s have a look at margin trading.

What Is a Margin Call?

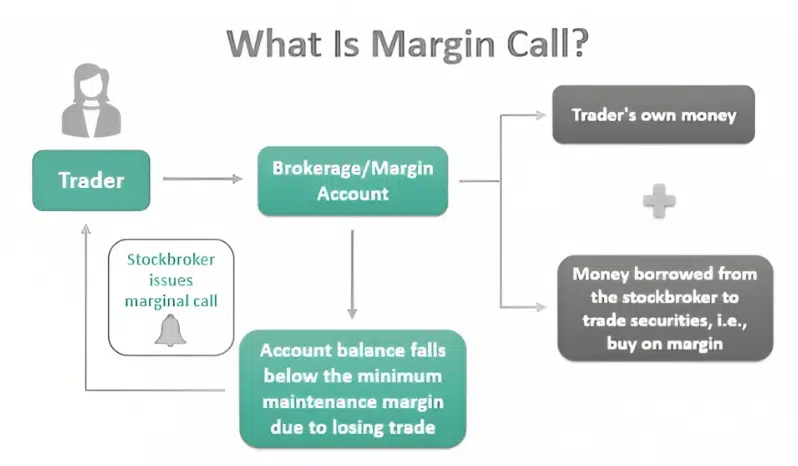

A margin call is a demand from a broker or an exchange for an investor to deposit additional funds into the margin account. This happens when traders must get the minimum margin requirements for a leverage position to lose value.

When a trader opens a leverage trading, they must maintain a certain margin in their account to cover potential losses. The amount of margin required depends on the leverage position size. Therefore, a margin call will occur if the position’s value drops and the required margin amount falls below the maintenance margin.

When that happens, the broker will notify the trader to deposit additional funds to bring back the margin to its desired level. If the trader fails to do so, the broker will close out the trader’s position to have sufficient funds to cover the losses.

To avoid this, traders must maintain sufficient account margins to cover potential losses. Likewise, traders must understand its risks and rewards before making trading decisions.

Margin vs. Leverage

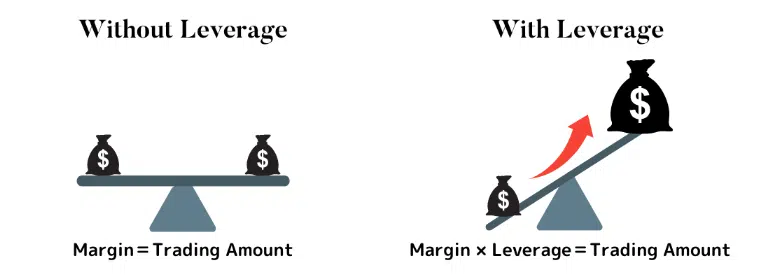

Although margin and leverage trading seem to have similar concepts, they have a major difference.

For margin trading, it refers to the amount of funds a trader puts as a deposit. As for leverage trading, it refers to the number of funds a trader invests in a transaction.

In margin trading, there is a thing called margin requirements. Margin requirements refer to a borrowed fund’s minimum amount to be kept in the trader’s account. Brokers are the ones who set the margin requirement, and it can vary based on current market price, market volatility, different crypto exchanges, and many more.

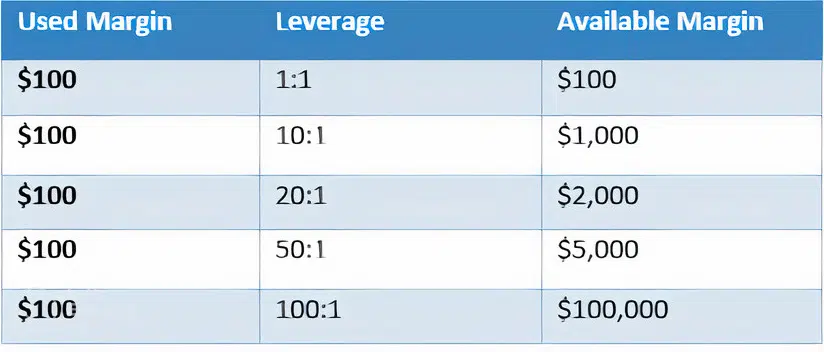

On the other hand, leverage trading has a thing called leverage ratio. It refers to the ratio of a borrowed fund to the trader’s initial capital. The leverage ratio allows traders to increase their investment returns and exposure dramatically.

With the margin requirement and leverage ratio, traders will use it to calculate how much deposit they must put in their account to start trading and maintain their position.

What Is Leverage Ratio?

The leverage ratio measures a trade’s total exposure compared to its initial margin or requirement. It may vary due to factors such as the underlying market currently trading, position size, etc.

The less liquid a financial market has, the lower its trading leverage. This is to protect traders’ positions from rapid price movements. On the other hand, such as the Forex market, which has higher liquidity, will have high leverage ratios for traders.

What Is the Formula for the Leverage Ratio?

Leverage ratio = Assets / Equity

How Much Leverage Should You Use?

According to some research, like Audacity Capital or BabyPips, it is wise to choose no more than 10:1 for beginners. In contrast, professional traders can choose 50:1 or even higher leverage, such as 100:1. Still, it is up to the trader to make their final decision.

Please note that although the higher leverage trading you have, the more profitable your income will be, it also comes with high risk. Thus, it is recommended to consider risk tolerance, position size, trading capital, exchanges, and many others before deciding.

What Is the Maximum Leverage Offered in Different Financial Markets?

Maximum leverage may vary in different financial markets. It depends on the financial assets and leveraged products that are offered.

Here are some maximum leverage offered in different financial markets:

- Forex: 1:2 – 1:1000

- Futures: 1:2 – 1:50

- Cryptocurrency: 1:2 – 1:500

- StormGain: 1:500

The higher the leverage is, the higher the risk of losing position. Thus, traders must take extreme precautions to prevent potential losses. In addition, brokers might change the maximum leverage based on market conditions.

Examples of Leveraged Trading

There are different kinds of crypto leverage trading for traders to choose from. Traders can leverage trade in a short-term or long-term position according to their preferences.

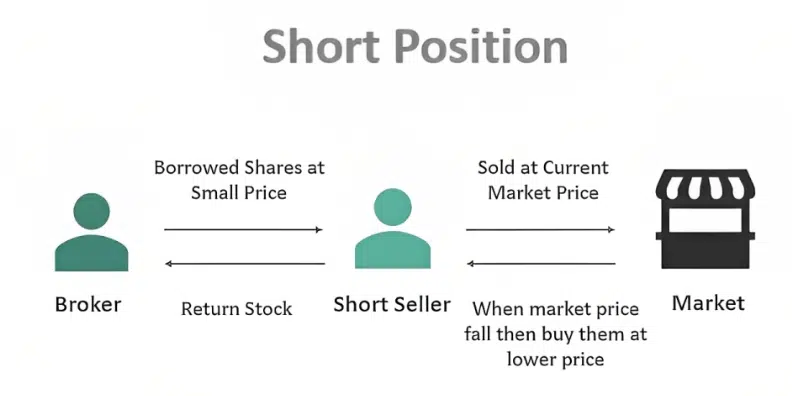

Leverage Trading a Short Position

A short position means the traders borrowed an underlying asset from a broker. Then, they will sell it immediately at its current market value. When the asset is at a lower price, traders will buy it and return to the broker. With this, traders can earn a profit between the sale price and the buyback price.

However, this is a risky attempt. After all, there are no limits to the potential losses associated with short selling. It is only wise to do it once you are experienced enough.

Leverage Trading a Long Position

A long position means traders borrow funds from the broker to own an asset. As its value gradually increases, traders will earn profits between the buying and selling price and pay back the borrowed funds with their profits and a certain amount of interest.

However, when there are potential profits in leverage trading, there will also be potential losses in it. Thus, traders must use risk management strategies to avoid getting a margin call if they lose more funds.

Protecting Your Trading Account From a Margin Call

Now, we have a better understanding of what margin trading is. Let’s find out how to avoid getting a margin call when trading. Also, we will talk about some risk management tips you can use if needed.

Stop-Loss Orders vs. Take-Profit Orders

Stop-loss and take-profit orders are risk management tools for traders to lower their risk and maintain profits when leveraging.

A stop-loss order limits traders’ potential losses in stock trading. Once the order is placed, it will automatically sell the position when it reaches a certain price. With this, traders won’t need to monitor their positions daily to avoid losses, which saves time and effort.

Aside from that, stop-loss orders also help with decision-making, preventing traders from holding onto positions longer than intended. By placing a stop-loss order, traders can reduce stress or anxiety from monitoring their investments for a long time.

On the other hand, a take-profit order helps traders execute positions at a certain price level to maintain their profits. It is mostly used in the short position or high volatility market to lock in profits.

Both orders are used together to manage risk and profits. By using both orders, trades can ensure that their position will be executed as soon as it moves downhill while also maintaining their profits when it moves to their desired price level.

Risk Management Tips for Leveraged Trading

Although crypto exchange leverage trading is highly profitable, it also comes with many risks if you are not cautious. Here are some risk management tips to prevent potential losses in crypto leverage trading.

For beginner traders or anyone who wants to try a new strategy, it is recommended to use a demo account before getting on with a real one. A demo account helps you see how much you can handle without risking losing real money.

Aside from that, having a separate account to trade crypto in is also a wise choice. Since the crypto market is unpredictable, having another account with some of your funds and a fixed capital is best when trading crypto exchange. This way, if things go downhill, you won’t be in a crisis of losing your money.

Most importantly, traders need to keep their emotions in check. Avoiding letting negative emotions rile you up when making decisions will help to prevent potential losses. Thus, using a proper trading strategy and risk management tools will help with rational decision-making. In addition, here is an article for you to control your emotions and understand why you may be vulnerable to stress.

Setting up Your Margin Trading Account

Step 1: Create a Leverage Trading Account

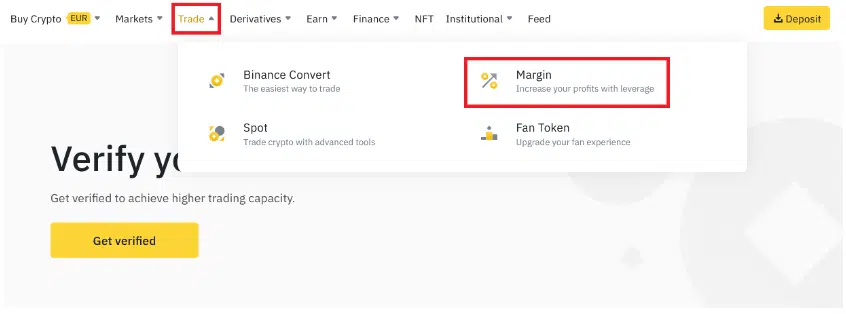

For Binance, go to your trading account. Then, hover at the [Trade] and click the [Margin] button.

Step 2: Set Your Leverage Ratio and Maximum Leverage

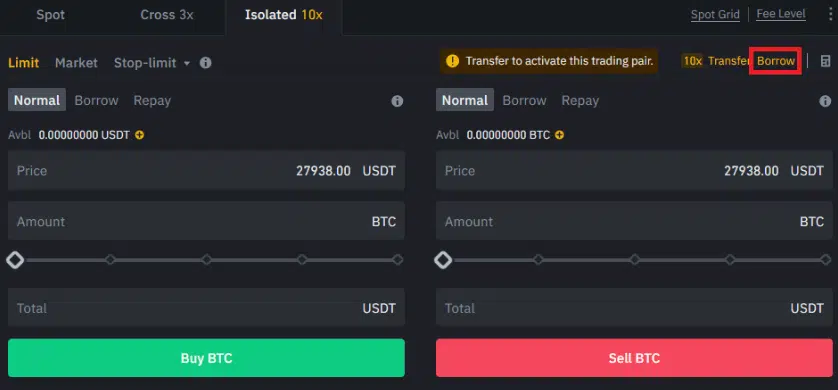

Once you click on the [Margin] button, scroll to the bottom and choose what type of leverage trading you want (Spot, Cross 3x, Isolated 10x). Then, click the [Borrow] button on the right side.

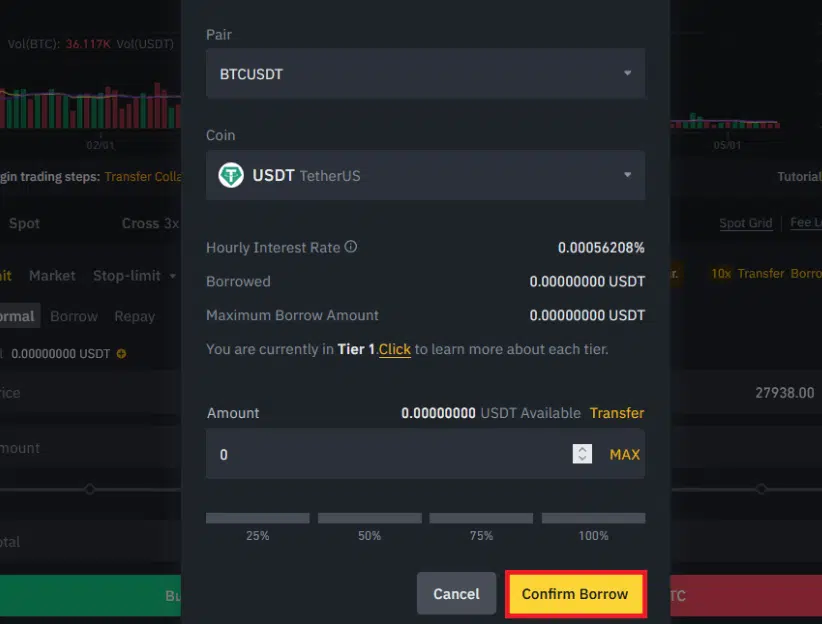

Then, choose your desired pair and coin to borrow. After that, click the [Confirm Borrow] button once you have chosen your preferences.

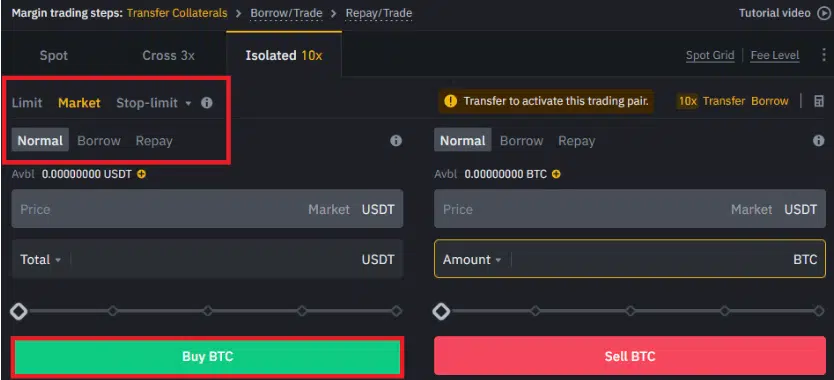

Step 3: Create Your Leverage Trading Positions

After you have borrowed the collateral, you can start trading. Choose your desired order type and trading strategy. Then, fill out the buy price amount before clicking the [Buy BTC] button.

Now, you have a leverage trading position on the go!

Step 4: Avoid a Margin Call

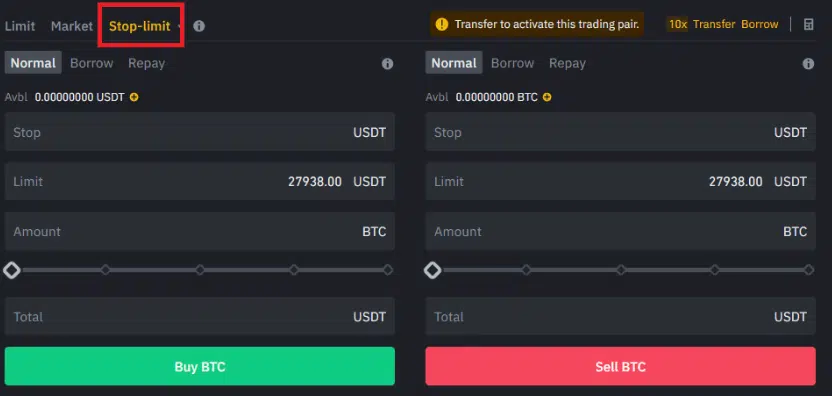

To avoid a margin call, click the [Stop-limit] button. Then, fill in the price level that you wish to stop at.

More details

Binance is a great combination of low fees, deep liquidity and multiple cryptocurrencies and trading pairs. We have tested every aspect of it and it STILL holds its reign as the top exchange in the world. In our view, it is the perfect crypto exchange for both newbies and advanced traders alike.

-

Biggest exchange in the world.

-

Industry's lowest trading fees.

-

Advance trading options like leverage trading.

-

600+ crypto options, 150+ for the US.

-

Lucrative on-site staking options.

-

Hiccups in account verification.

-

Less regulated than some competitors.

-

The corporate structure is not transparently.

Retail vs. Professional Leveraged Trading

Retail leveraged trading is designed for traders trading with the leverage of their own money. These traders are also called retail clients and are not experienced traders with risk management measures.

On the other hand, professional leveraged trading is for professional traders who have experience trading leverage and is knowledgeable enough to invest with proper risk management measures. These traders have access to higher-leverage trading but are also responsible for managing their own risks.

These two leveraged tradings differ by experiences, knowledge, account sizes, etc.

What Are Some Other Leveraged Trading Products?

The financial markets provide a few leveraged products for traders to multiply their returns and increase profitability.

Here are a few choices:

- Futures

- Options

- CFDs (Contracts for Difference)

- ETFs (Exchange-Traded Funds)

Futures and Options are contracts that traders can buy or sell an underlying asset. A future contract is executed on a certain date, while an option contract can be executed any time before the expiry date.

CFDs are financial contracts allowing traders to observe a financial asset without owning it. CFD trading can be used on margin, meaning traders can control a bigger position with less capital.

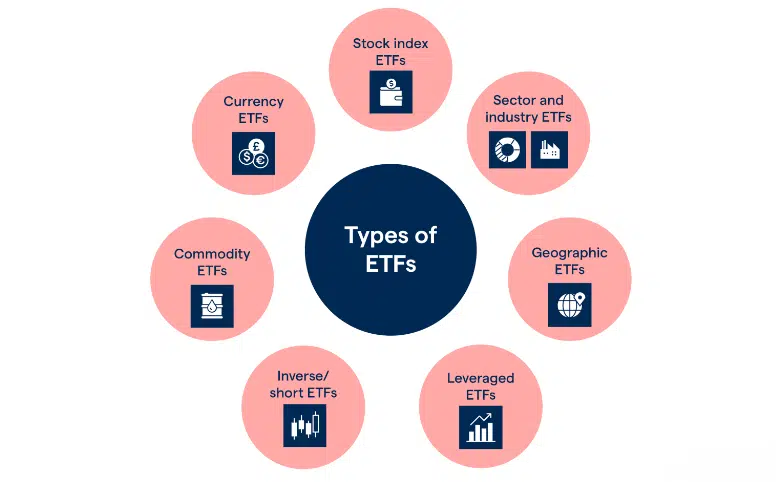

ETFs are a kind of investment fund that is used in stock trading. Traders can use it to track an underlying asset’s index, commodity, assets, or values. It provides trades with a bigger exposure and multiple returns.

You can look at IG Group, Investopedia, ProsperUs, or other trading platforms for a more detailed explanation and chart comparison of their leveraged products.

Leverage Trading: Benefits and Risks

Flexibility is one of the benefits that leverage trading offers. Traders can leverage trade on both short-term and long-term positions, enabling them to earn significant profits if used wisely.

Besides, traders will have to get bigger exposure in the financial markets. This will benefit them to diversify their portfolios without restrictions from trading with only a few positions.

Also, traders can multiply their potential profits and buying power and control a larger position with less initial capital used. A larger position will allow traders to earn more profits without needing huge capital. This benefits those who don’t have enough money for a bigger open position.

Even though it has many great benefits to offer traders, some risks should be considered.

One of the risks is that leverage trading comes with margin calls. If the position’s value decreases, leverage traders will need to pay additional funds to the broker to cover up the losses, or they will lose the position.

Aside from that, leverage trading comes with great risk, and most traders are likely to experience losses. Thus, for many traders who are not prepared or lack confidence in their trading, the higher their leverage ratios are, the more stressful they will become, which might cause them to make a wrong move on the next step and lose more money. Another factor for being overwhelming also can be due to the fast-paced trading that traders have to face.

Although many countries allow traders to do leverage trading, some countries or regions still prohibit certain currencies trading overall. There are specific rules and regulations regarding leverage trading in different countries. Thus, it is important to check if there are any restrictions before trading in certain countries.

You will need to know your total value and the amount of capital in your trading account. For example, if you have $10,000 worth of position and $1,000 in your account, your leverage ratio will be 10:1 (Assets/Equity). You can control $10 of your position per $1 in your trading account.

CFD (Contracts for Difference)

ETF (Exchange-Traded Funds)