Enjinstarter Review 2024: Is it The Best Launchpad?

TL;DR

In this Enjinstarter review, I’ll thoroughly explore the IDO launchpad’s features, pros, and cons.

Launched in 2021, Enjinstarter has earned quite a reputation among its competitors for hosting quality IDOs, making it cost-effective and more accessible to all investors.

Since its inception, it has pushed 80+ IDOs and raised $10.4 million for multiple projects. They offer investors an average ROI of 142.4% YTD. Plus, it supports projects on multiple chains, including Efinity, Binance Smart Chain, and Solana.

Let’s dig in!

Enjinstarter Overview

| Category | Details |

|---|---|

| Coinweb Rating | ⭐ ⭐ ⭐ ⭐ (4.7) |

| Launched In | 2021 |

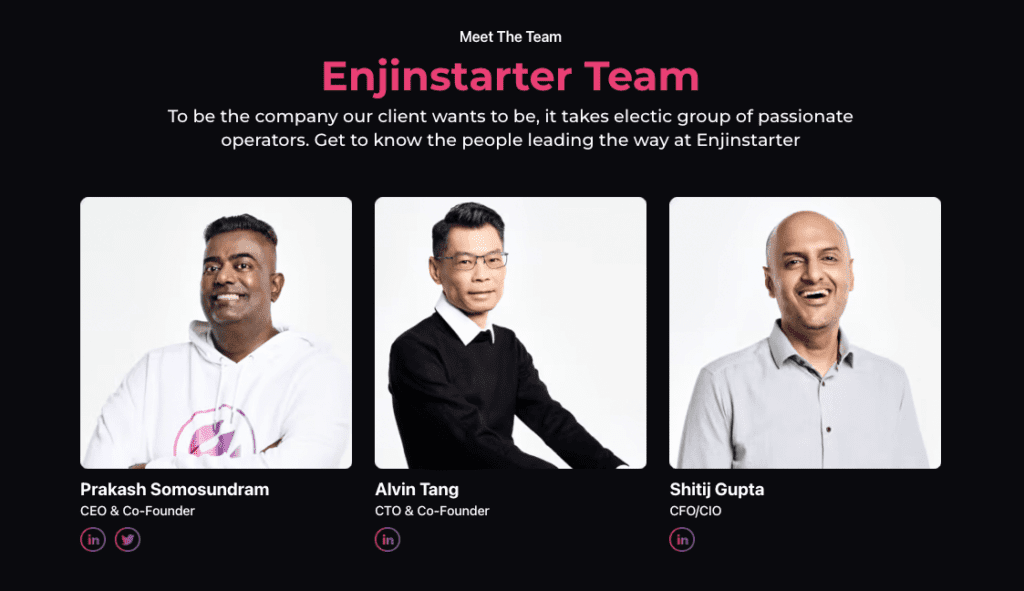

| Founded By | Prakash Somosundram & Alvin Tang |

| Portfolio Projects | 80+ IDOs |

| Average ROI | 142.4% |

| All Time High (ATH) ROI | 53.7x |

| Minimum Investment Cap | 1,250 EJS |

| Key Features | Cross-chain Support, Protection Protocol, Project Incubator |

What is Enjinstarter?

Enjinstarter is a next-generation incubator, advisor, and launchpad for promising Web3 entrepreneurs entering this space. They have supported 80+ companies and raised over US$10 million.

They have a strong community with over 200k members worldwide, including Southeast Asia, India, Turkey, North America, Indonesia, and Spain.

Founded in 2021 by Prakash Somosundram and Alvin Tang, the company’s founders bring extensive experience from their involvement in diverse blockchain projects, including PathDAO and MetaOne. Enjinstarter raised US$5 million in their Series A round from True Global Ventures 4 Plus.

What adds to its credibility is its initial approval from Dubai’s Virtual Assets Regulatory Authority (aya.foundation) in April 2023 and its membership in the Open Metaverse Alliance. That means they are set to be the world’s first fully regulated web3 launchpad.

EnjinStarter’s track record includes offering consultation services to projects like Hatten Land, GCEX, and the KAIF Platform. With a focus on carefully curated projects, they’ve consistently provided early investors with big ROIs and gamefi projects with launch support.

Who should use Enjinstarter?

Here is who we think should use it:

Early-stage DeFi startups

Whether you are an early-stage game developer or an established one, it has a virtual accelerator program.

The launchpad assists you in integrating blockchain, guidance on monetization, and effective marketing strategies. Plus, you get valuable support for using NFTs/Virtual items in fundraising and community building.

Savvy investors

Unlike other launchpads, Enjinstarter offers a more accessible path to exclusive investment opportunities. It has a tiered allocation system with benefits, including Guaranteed Allocation Pools (GAP) and exclusive investment rounds.

For instance, you can secure a guaranteed allocation by staking a minimum of 25,000 EJS (equivalent to approximately $1,750).

This offers a significant advantage over platforms like Seedify, where you must lock in 10,000 (~ $7,000) SFUND for the same opportunity.

What makes Enjinstarter a good choice?

Here is why it is a solid choice:

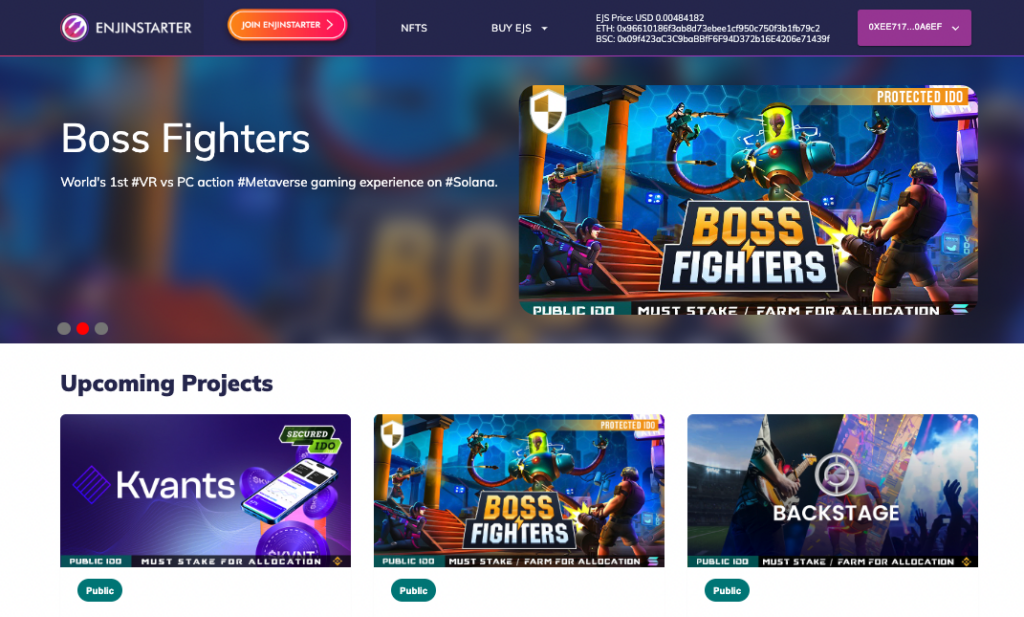

The website’s intuitive design

I was amazed by the smooth interface of their website; everything worked swiftly and looked appealing. It brilliantly combines a clean, minimalist design with just the right amount of information, making it easy to navigate and find what you need.

I appreciate that their team is fully doxxed (unlike other launchpads), and they display their values on the homepage. You get a comprehensive overview of projects, accessible on laptops and smartphones.

Cross-chain support

Enjinstarter’s standout feature is its cross-chain support. It fully supports many EVM chains. Although the combination of ETH private blockchain and Polygon is pretty decent, the ETH-BSC bridge makes sending EJS and wEJS tokens to these chains easy.

So, regardless of the blockchain a Web3 project operates on, the crowdfunding platform welcomes early crypto projects.

Enjinstarter supports projects launching on the following blockchains:

- Near

- OKX

- SUI

- ETH

- Binance Smart Chain

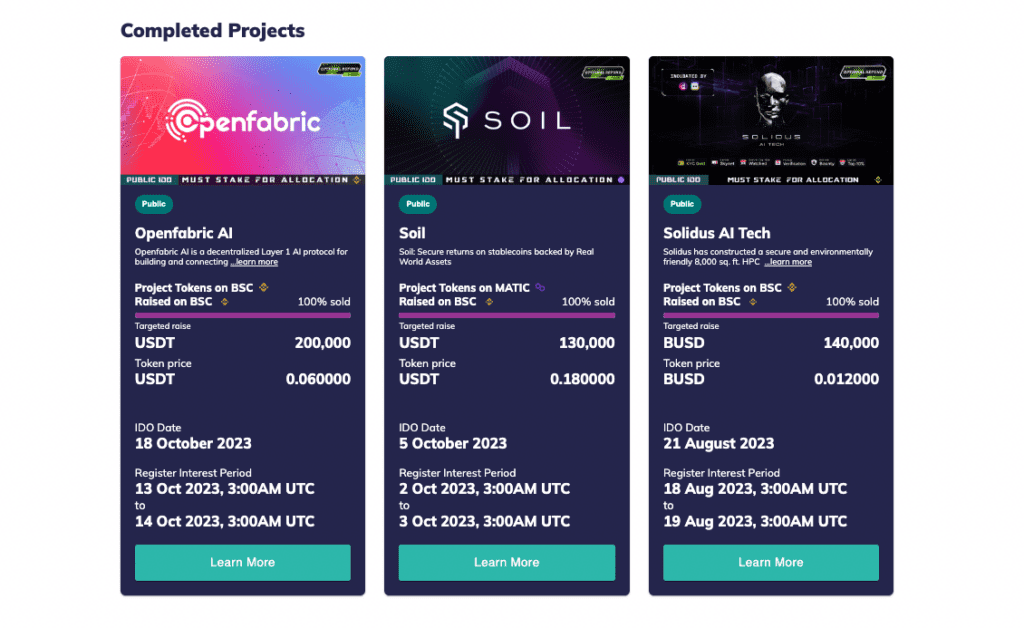

Over 80+ portfolio companies

Enjinstarter has launched over 80+ IDOs and raised $10.14 M with a $85 million market cap. Their return on investment (ROI) averages 0.45x, which is fair when you compare it to Seedify’s 0.61x. However, the numbers on return fluctuate a lot depending on the bull/bear market.

As an investor, It gives a quality assurance that they have been doing consistent launches in the non-bull market. This approach gives all investors an equal chance to get a decent allocation in top projects.

If you’re into gaming, which I believe will be a huge narrative next bull, you should check out Enjinstarter’s upcoming projects. Some of their big hits have been Chaingpt, SophiaVerse, HyperGPT & WorkX.

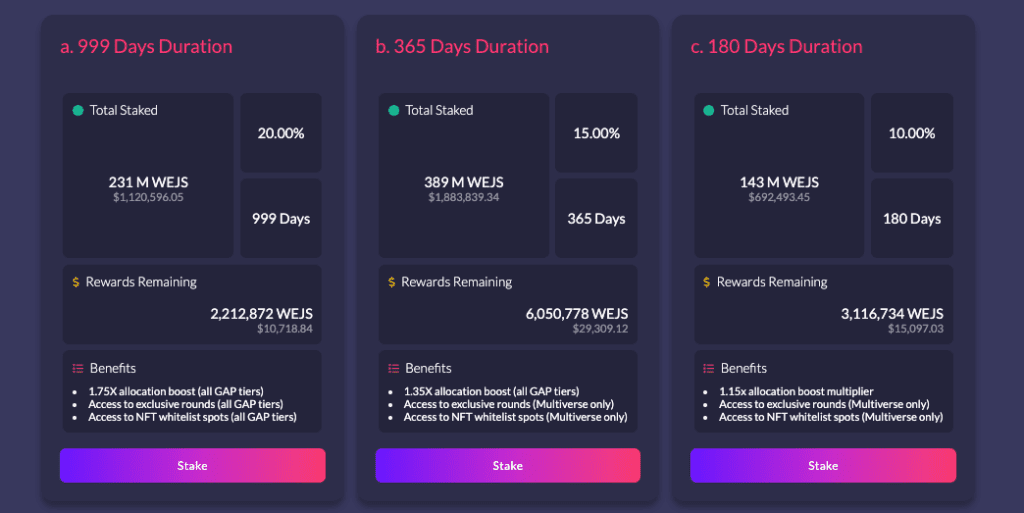

Enjinstarter’s tier system

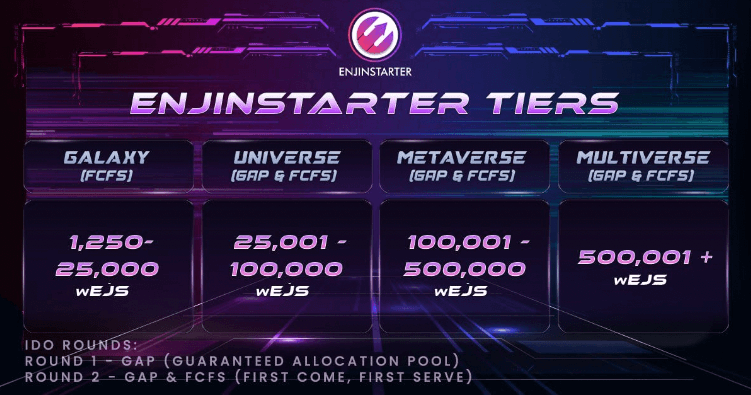

Let’s explore the allocation tiers on Enjinstarter:

| Tier | Staking Requirement | IDO Round | Allocation Boost | Other Benefits |

|---|---|---|---|---|

| Galaxy | 1,250 – 25,000 WEJS | FCFS (First Come, First Serve) | None | None |

| Universe | 25,001 – 100,000 WEJS | GAP (Guaranteed Allocation Pool) | 1.5x – 6x | Access to private rounds for 999D pool |

| Metaverse | 100,001 – 500,000 WEJS | GAP (Guaranteed Allocation Pool) | 15x – 75x | Access to private and exclusive rounds for 999D pool |

| Multiverse | 500,001+ WEJS | GAP (Guaranteed Allocation Pool) | 84x – 420x+ | Access to private and exclusive rounds for all pools |

Galaxy Tier

To qualify for the Galaxy Tier, you must stake between 1,250 and 25,001 wEJS tokens. Your allocation in this tier depends on the number of tokens you stake. For example, I staked 20,000 wEJS and received $23.85 in allocation in WorkX.

However, the specific allocation for the “First Come, First Served” (FCFS) round is determined based on the remaining or unsold tokens from the “Guaranteed Allocation Pool” (GAP) round.

Universe Tier

The Universe Tier requires you to stake at least 10,001 wEJS tokens. In this tier, you receive a base allocation of $6.00 if you meet this minimum staking requirement.

This tier offers comparatively better allocation even at the base level, and the range of estimated allocation in the FCFS round remains dependent on the remaining tokens from the GAP round.

Metaverse Tier

To enter the Metaverse Tier, you must stake at least 25,001 wEJS tokens. You’ll receive a base allocation of $30.00 if you meet this requirement.

If you stake around 500,000 wEJS tokens, the highest allocation for a specific project would be $149.40. This tier offers a higher base allocation and maintains the allocation range dependency on the GAP round’s remaining tokens.

Multiverse Tier

The highest tier, the Multiverse Tier, demands a minimum stake of 500,001 wEJS tokens. You’ll receive a base allocation of $168.00 when you meet this requirement.

Like the other tiers, staking more wEJS tokens increases allocations for all IDOs. This tier provides the highest base allocation and potential for substantial returns.

How to get started with Enjinstarter

Follow these steps to get started:

More details

Enjinstarter is a Web3 launchpad that offers investors a cost-effective way to participate in early stage blockchain projects. With a minimum staking requirement of 1,250 wEJS, you can access a multi-chain launchpad with over 80+ successful IDOs. The incubation program for new projects makes it a solid developer pick.

-

80+ completed projects.

-

Average ROI of 0.45x.

-

Frequency of launches.

-

Cross-chain support.

-

Lowest participation cap.

-

EJS token volatility.

Step 1: KYC Your Web3 Wallet

First things first, visit the Enjinstarter website and tap [Getting Started]. There, you will find an option to get your wallet KYC-approved through Blockpass.

You can do it using your ID, passport, or driver’s license. Once approved, you’ll receive an email indicating that you have been approved.

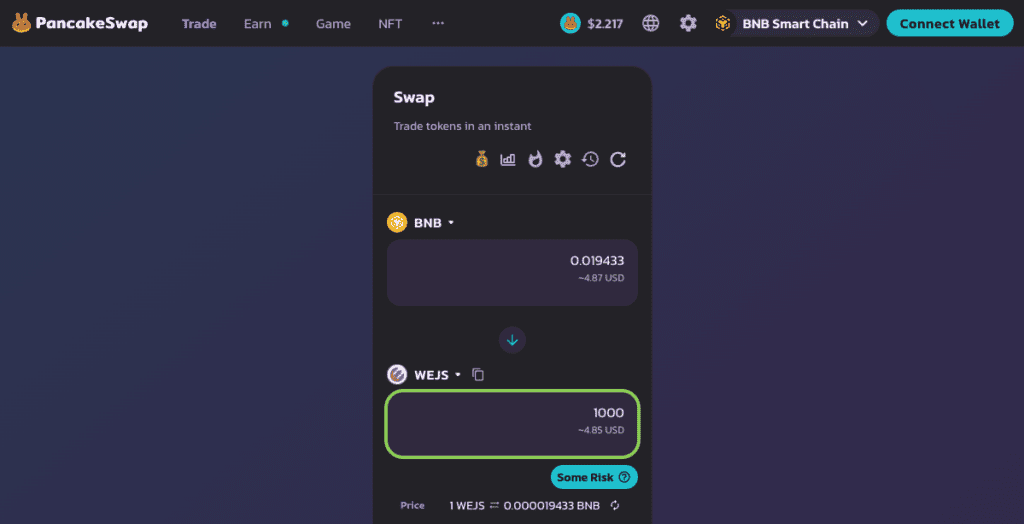

Step 2: Buy Enjinstarter tokens

Next up, you will have to buy the wEJS tokens from the following exchanges:

- Pancake Swap

- Gate.io

- MEXC

Step 3: Stake wEJS tokens

Then, go to the launchpad and choose any pool from the five options and stake. The minimum stake requirement is 1,250 WEJS tokens.

We recommend choosing the pools with longer lock-ups as they have more benefits.

Step 4: Register interest in the IDO

Once the tokens are staked, go to Launchpad and pick your preferred project. When done, tap the [Register Interest] on your chosen IDO. You can also see the registration guide.

Step 5: Check IDO allocations

Following that, check your IDO allocations by visiting the launchpad. Once there, connect your KYC-approved wallet and navigate to the [Active Projects].

To check your allocations, tap [Allocations & Claims].

Step 6: Purchase tokens

After reviewing your allocations on the launchpad, you can obtain tokens during the IDO event by tapping the [Participate] button.

Key features of Enjinstarter

Let’s explore some key features:

EJS Token For Governance

My stockpile of EJS tokens opened numerous doors when exploring the IDOs on Enjinstarter. The more EJS I staked, the higher my tier and the larger my slice of the allocation pie in each IDO.

With a total supply of 5 billion, the EJS token’s distribution focuses more on long-term community development.

Here is the breakdown of distribution:

- 37% for token sale rounds.

- 20% for the team and advisors.

- 15% for the ecosystem fund.

- 10% for liquidity provision.

- 10% for community rewards.

- 5% for marketing and partnerships.

- 3% for reserve fund.

Enjinstarter Protection Protocol

Eninstarter’s Protection Protocol is designed to make the IDO investing process more transparent.

Here is a breakdown of its key features:

- Price, Vesting Terms and Conditions: This rule is put in to maintain the token’s price for the first 24 hours at or above the IDO price for the initial Token Generation Event (TGE). It ensures that the price remains stable, ensuring a fair launch by protecting against abrupt price plunges.

- Minimum Liquidity Requirement: Enjinstarter requires projects to inject a certain amount of liquidity. This ensures the project’s commitment. Once the project has enough liquidity, you can buy/sell project tokens once listed on exchanges. Otherwise, it would lead to high slippage or a lesser amount received.

- Delay policy: The launchpad ensures that the sale-to-listing timeframe lasts 15 days. This ensures all transactions are completed 24 to 72 hours before the listing. But if, for some reason, the listing is delayed beyond 21 days, Enjinstarter steps in to automatically refund the sale. Pretty safe, right?

- Refund policy: Suppose there’s a situation involving shady practices, significant technical issues, or negative media effects for the project, which could lead to high volatility. In that case, EJS has the authority to step in and issue a full or partial refund.

Incubator for selected projects

Enjinstarter Incubation Centers’ main goal is to cherry-pick the best blockchain-based games and projects.

Once they have shortlisted the projects, their team, with partners like Starter Capital, offers all kinds of administrative, innovation, and launch support to them.

However, where it stands out from other launchpads is its end-to-end support. So, when a project has completed its incubation period, Enjinstarter helps them develop strategies to make the best out of Enjinstarter’s holistic ecosystem.

Plus, the launchpad helps run capital-raising campaigns and build communities, including roadshows. After funds are collected and everything checks out, they introduce the projects to DAOs, Market Makers, and media partners. Then comes the CEX listings; let’s discuss them in detail.

Partnerships with CEXs

Thanks to Enjinstarte’s partnerships with Centralized Exchanges (CEXs), getting listings on top exchanges is no longer a challenge for new projects.

They connect projects with CEX partners, which means easier access to well-known exchanges, more visibility, and investor interest.

Enjinstarter also ensures enough liquidity from the start and offers valuable support for projects to navigate the listing process.

Some of these exchanges include

Drawbacks of Enjinstarter

Here are some drawbacks:

Lack of information on the website

You’ll need to contact the team to access Enjinstarter’s tokenomics, whitepaper, or additional details, as they are not mentioned on the website. This could be challenging for first-time investors trying to understand the goal of the launchpad.

Token price

The price volatility of the EJS token compared to similar Ethereum cryptocurrencies could deter potential users and investors. A significant price decline could affect the platform’s economics and rewards for participants. Meanwhile, high token prices might create entry barriers for new users and investors.

Enjinstarter’s Alternatives

DAOMaker: Compared to Enjinstarter, DAOMaker is considered the top player in the launchpad market, with $68 million raised for 128 successful projects. However, it has an entry price of $165, higher than Enjinstarter’s $6.

BullPerks: If you are looking for better ROIs, BullPerks may be an alternative option to Enjinstarter, thanks to its 130.83x average ATH ROI. Plus, it has 65+ projects on its launchpad, with $15 million raised capital for IDOs.

More details

BullPerks, with its tier system, is a fair and community-dedicated platform giving access to early-stage Web3 investments. The launchpad has raised $15 million for over 65+ projects, with an ATH ROI of 37.61x. Additionally, its integration with 23+ blockchains makes it a strong choice for crypto projects and investors.

-

65+ successful IDOs.

-

37.61x ATH ROI.

-

$15 Million raise.

-

23+ blockchain integrations.

-

Hassle-free token claiming.

-

No guaranteed allocation.

-

Obligation to maintain public sale price.

-

$1M public raise cap for projects.

Enjinstarter Review: Our Verdict

Having successfully launched 70+ IDOs with ATH (All Time High) ROIs reaching 7.61x, it is a trusted platform for Web3 investors.

Their project is focused on the web3 ecosystem and has cross-chain bridges to handle the major protocols.

The main thing the project has going for itself is its focus on purely one niche, which means they’re a specialist, but also limits itself with the scope of projects to take on.

Overall, it is a great option both from a project perspective and an investor perspective entering the space.

Enjinstarter has shown promise as a launchpad, supporting multiple blockchains and focusing on blockchain gaming and integration. However, its effectiveness may vary based on individual preferences and project goals.

Enjin is generally well-regarded in the blockchain and gaming as an effective platform for raising capital. It's known for its NFT technology and gaming-related products, making it a reputable brand within its niche.

Enjinstarter is a blockchain launchpad platform based on Enjin's JumpNet that assists early-stage blockchain games and projects in raising capital, development, and launch. It's part of the Enjin ecosystem and supports blockchain integration for gaming through innovative ways.

There are four tiers: Galaxy, Universe, Metaverse, and Multiverse, each with its own staking requirements and allocation benefits. They determine how much allocation you receive IDOs. The higher the tier, the more you need to stake, but the larger your allocation potential.