TL;DR

In this comparison, I’ll explore how to pick the best IDO launchpad, including its types, benefits, and drawbacks.

In Web3, these launchpads work both ways, helping startups raise money while investors get early access to their offerings, with the potential to earn profits (sometimes between 1x and 100x).

There are five types of launchpads covering all types of blockchain projects:

- Initial Coin Offering (ICOs)

- Initial DEX Offering (IDOs)

- Initial NFT Offering (INOs)

- Initial Game Offering (IGOs)

- Initial Exchange Offering (IEOs)

While all these launchpads have benefits like low fees and investment opportunities, they have their share of drawbacks – most prominently regulatory challenges and scams.

What is an IDO Crypto Launchpad?

The IDO launchpad, sometimes called a crypto incubator, is a decentralized exchange (DEX)-based platform where new projects are introduced and get funding.

Before a project hits the public market, its tokens are available to early-stage investors. This is a great deal for them as they can benefit from future price increases and earn profits. However, like always, the highest risk comes with the highest reward.

On the other hand, the incredibly low launch costs make these launchpads attract more crypto projects.

So, these IDO platforms are common ground for both parties, with air token distribution among retail investors and discourage tactics like “pump-and-dump.“

Normally, most platforms vet the projects and potential investors, including KYC/AML verifications.

Who should use these launchpads?

Here is who should use these:

Web3 projects

When a new project kicks off, it wants support for getting listed on the best crypto exchanges and has an engaged community for fundraising and marketing support. These launchpads are here to deliver exactly that kind of support. Depending on the IDO/launchpad and what they can offer, this could be a stepping stone for new blockchain projects looking to launch.

Pro crypto investors

Unlike traditional finance that requires accreditor investors, these Web3 launchpads are open to everyone with no exclusivity to participate in the token sale and offerings. This allows anyone to capitalize on future price growth by getting into token sales at a low cost.

Furthermore, these platforms offer high-potential launches and project insights (tokenomics, pricing, and launch dates).

How to use a launchpad?

Using a launchpad is similar to beginning with DEXs and CEXs. Here’s a step-by-step guide:

- Choose your preferred launchpad and register an account using either a crypto wallet or your email.

- Complete the KYC (Know Your Customer) verification for transparency.

- Fund your wallet according to the platform’s specified requirements – usually with USDT/USDC.

- Explore the ongoing crypto projects on the launchpad and sign up for early listings. Once successfully registered, proceed with your participation.

Types of crypto launchpads

Let’s explore different types:

Initial coin offering (ICO) launchpads

As one of the oldest and most commonly used fundraising methods in Web3, an Initial Coin Offering (ICO) launchpad is the simplest of all.

What sets it apart from other launchpads is that in an ICO, the new crypto project offers its native utility token to investors; in return, the investors that come in at an early price might get significant returns once publicly listed.

In this process, launchpads benefit both investors and project creators. The creators of a Web3 project simply share their ideas, product utility, funding needs, and other essential details with the launchpad, which handles the rest.

ICOs have faced criticism for their lack of regulation. China, for instance, banned them because they were seen as potential tools for money laundering. This makes these token launch platforms somewhat risky.

Pros:

- Requires less time.

- A simple process.

- Decentralized and safe.

- Early access to new tokens.

Cons:

- Lack of security tokens.

- Offered by non-reputable entities.

- Low success rate.

- Regulatory issues.

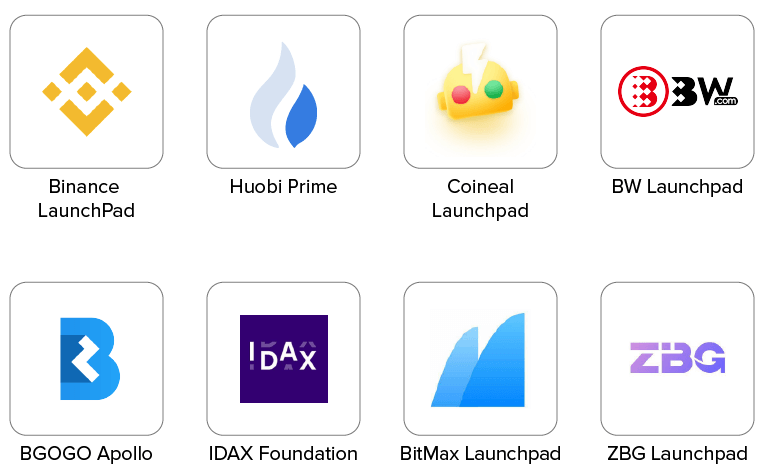

Initial exchange offering (IEO) launchpads

The birth of Initial Exchange Offerings (IEOs) was introduced to resolve the issues with the ICOs. In this fundraising method, it’s like having trusted platforms such as Binance or Kucoin watching over everything. This adds a layer of trust and safety for the people using it.

However, the exchanges run the show for startups looking to raise money through new tokens.

Token issuers must cover a listing fee (usually $100,000 – $1,000,000) and give a portion of the tokens they sell to the exchange. Although the exchange hosts the sale of the project’s early tokens, these tokens are available for trading after the successful IEO.

Unlike ICOs, where you send your money to a smart contract, in IEOs, you need to make an account on the exchange, put money in it, and buy the startup’s tokens.

So far, IEOs have been quite successful as more and more cryptocurrency exchanges are getting into it.

Pros:

- Exchange’s reputation adds to credibility.

- Strict vetting and KYC.

- Hassle-free listing for new crypto projects.

- Bigger community

Cons:

- High listing costs.

- Compliance issues.

Initial DEX offering (IDO) launchpads

As the name suggests, an Initial DEX Offering (IDO) launchpad is a decentralized platform (like Uniswap or Pancakeswap) for Web3 projects to offer early releases and raise money.

In a typical IDO, investors put their money into a smart contract before a project releases its token. This decentralized system ensures immediate trading with a transparent approach to raising funds.

These launchpads are comparatively safer than others as they focus on only picking high-quality projects. Still, risks are involved because we operate decentralized, and vetting procedures might not be of the highest caliber.

IDO projects’ token value is determined by how much of the token will circulate on the DEX, not set in advance, reducing fraud risks.

Since the 2017 bull run, IDOs have rapidly risen in popularity as the go-to method for up-and-coming projects to get funding. That’s primarily because these launchpads already have a strong following, which startups can use to benefit in the early stages.

Pros:

- Enables immediate liquidity.

- Equal opportunity for investors.

- No third-party intervention.

- Access to worldwide investors.

Cons:

- Requires knowledge to vet projects.

- Subject to extreme volatility.

- Risks of scams.

Initial NFT offering (INO) launchpads

An Initial NFT Offering (INO) launchpad is a platform that assists projects in raising money by selling Non-Fungible Tokens (NFTs) to investors. You can look at it as fundraising through NFTs instead of tokens.

To kick things off, the project creators share their roadmap, NFT collection, and sale terms with the INO launchpad. The launchpad then takes the time to vet the project carefully and sometimes verifies the users’ identities.

If everything checks out, the project makes a limited number of NFTs or a stake in the project. These NFTs go up for sale on the launchpad, and enthusiasts like you and me can buy them.

Once you own these NFTs, you can benefit from their rarity or benefits. Alternatively, you can exchange them for tokens if that is in the project’s roadmap. Depending on the platform’s rules, you can swap your NFTs with fellow enthusiasts.

Pros:

- Lower entry barriers.

- Promotes a strong community sense.

- Holders become project advocates.

Cons:

- Potential Ponzi schemes.

- Lack of liquidity.

- Regulatory uncertainty.

Initial game offering (IGO) launchpads

An IGO launchpad is where you find exciting new GameFi projects just starting. It’s a way for game creators to raise funds, like how ICOs work for tokens.

Initial Game Offerings (IGOs) differ from ICOs regarding what is promoted. ICOs usually offer project tokens, while IGOs offer things that can be part of video games, such as NFTs.

These gaming NFTs include mystery boxes, land, characters, skins, or weapons.

IGOs are also directed toward the gaming community, so you get highly specific users. An ideal example would be BSCPad, which is focused on developing gaming projects on Binance Smart Chain (BSC).

They can be considered social hubs that bring project teams and investors together. These platforms promote conversations, idea-sharing, community building, and teamwork, creating better games and strong, interconnected communities around them.

Pros:

- Quick funding for projects.

- Retain equity.

- Developers get total control.

- Better chances of future funding.

Cons:

- It could be an all-or-nothing scheme.

- Lengthy funding times.

- Risks of failure.

What factors to consider when choosing crypto launchpads?

Consider these factors when choosing a launchpad:

Security and reliability

Security and reliability go hand-in-hand. Therefore, as a user, choosing a platform with features like multi-factor authentication, encryption, KYC/AML verification, and secure cold storage is impeccable.

If possible, vet the launchpad’s team members and ensure their compliance with regulations, as the most dependable platforms will have you well-versed in Web3.

Project selection criteria

Once platform credibility is established, the next thing to consider is how they select projects presented to their community. For that, we recommend checking past projects and return performance.

Also, understand how likely their supported projects are to fit into and succeed in the larger ecosystem. This can give you a sense of whether they’re committed to choosing the best projects or pushing many projects as they earn a percentage of the amount raised.

Token distribution and lockup periods

Launchpads usually decide how to allocate the available tokens for sale. For allocation distribution, It’s best to use transparent methods like lotteries or first-come-first-served. And the big red flags are if they favor big players or insiders, as they can lead to higher token allocation to a few members.

Meanwhile, from an investor’s perspective, it is a good sign if the projects ensure longer lockup periods (token distribution between 24-46 months). This can stabilize by discouraging early token selling, ensuring a long-term commitment to the project.

Liquidity and exchange listings

Good liquidity is paramount in trading, so check how easily you can buy and sell the launchpad’s tokens. Also, see if the launchpad has a good history of getting tokens listed on exchanges because that makes them more attractive to the launchpad and IDO market.

What are the benefits of crypto launchpads?

Here are some advantages:

- An active community: Crypto Launchpads play a key role in creating an active community of investors. It is a win-win for both the projects and the people putting in their money. This community helps improve the project, highlighting loopholes, networking prospects, and access to industry experts, creating a collaborative environment.

- Early investment in top projects: Crypto launchpads allow all crypto enthusiasts to join early-stage projects with the potential to win big. They can get the tokens at low prices and become part of promising blockchain ventures from the very start before they reach a broader audience.

- A secure ecosystem: Crypto Launchpads typically perform rigorous due diligence on projects before featuring them on their platform. This process covers the proposed idea’s utility in Web3 and a roadmap for the future. It helps weed out bad projects that could be a rug pull or any other scam.

- No waiting period: Especially in IDOs and INOs, there’s no waiting period or processing delay. You can start using the tokens or NFTs immediately, providing instant liquidity.

- Low fees: Launchpads vary in their fee structures for new projects, with some charging only a nominal fee or nothing for listings. That’s because their goal is to highlight the most promising projects and effectively reduce any entry barriers. The startups only need to present their idea, while the launchpad team will handle the rest of the initiation steps.

Drawbacks of crypto launchpads

Here are some drawbacks:

- High-level risk: Although launchpads thoroughly review emerging crypto projects, the new startups have substantial risks, like high volatility and lack of regulation. This makes it a breeding ground for Web3 scams, especially during the crypto market peak.

- Lack of vetting process: While trusted launchpads often offer thorough due diligence services, not all consistently secure high-quality projects for participants. For example 2017, almost 80% of the ICOs were scams.

- Many guaranteed allocations: Certain launchpads implement tiered systems where token holdings determine allocation in new projects. This structure can lead to uneven distribution and token price manipulation as users accumulate tokens for allocations and then sell them post-allocation.

- Long redemption times: At times, there can be considerable delays in token redemption after participating in a launchpad offering. This lock-up period may cause liquidity problems for investors and expose them to price volatility when the tokens finally become available on public exchanges.

The Future of Crypto launchpads

Crypto launchpads are all set to change how crypto projects receive funding, focusing on investor confidence and more adoption of blockchain technology.

These launches will likely improve the overall cryptocurrency market by filtering out Ponzi schemes. This will benefit investors and provide Web3 startups with new opportunities to showcase their ventures and attract a community of enthusiasts.

As the market continues to grow yearly, we will see a rise in crypto launchpads. That’s because they open the doors for everyday investors previously reserved for big institutions and venture capitalist firms.

This democratization of investment opportunities is set to simplify cryptocurrency investments, leading to a broader and more robust cryptocurrency market in the future.

Whether crypto launchpads are a good investment depends on your financial goals and risk tolerance. They offer opportunities to invest in early-stage promising crypto projects, which can be lucrative but come with risks.

The safety of crypto launchpads varies depending on the platform. Reputable launchpads prioritize security measures, but the crypto space can still be risky. So, choosing IDO launchpads with a strong track record in terms of project launch, security features, and a transparent process is crucial.

Crypto launchpads typically generate revenue through fees. These include listing fees paid by promising blockchain projects, a portion of the tokens sold during initial offerings, and trading fees generated when tokens are listed on exchanges.

You can buy tokens from crypto launchpads on popular cryptocurrency exchanges. Simply register on a reputable exchange that lists tokens from Launchpad projects, deposit funds, and trade for the tokens you're interested in.