TLDR

This step-by-step guide evaluates newer crypto projects effectively to determine legitimate projects from scams and fakes. It offers a clear methodology, with no technical explanations, for analyzing crypto projects and how to determine successful crypto projects when looking for a potential crypto investment.

It highlights the financial, technical analysis, and fundamental aspects that every investor should look for when deciding the future success of a crypto asset. This aims to provide a clear guide on what the community supporting a project should look for to determine the initial and continued success.

A step-by-step guide on how to evaluate a crypto project:

- Step 1: Check the fundamental qualities

- Step 2: Check the technical aspects

- Step 3: Evaluate the financial strength of the project

Why evaluating a crypto project is important

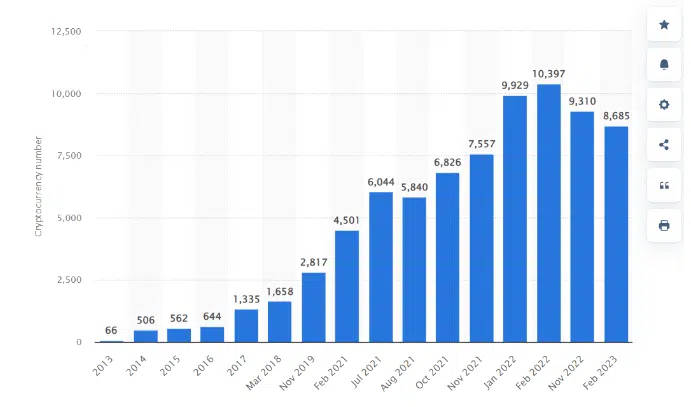

In the past decade, no technological innovation has seen a larger adoption rate than cryptocurrencies and blockchain technology. The massive gains on these digital assets, led by Bitcoin, have set off a gold rush, with the average investor always looking for the next big thing in the stock market.

Other enthusiasts use blockchain projects, following the teachings of Satoshi, to decentralize their finances and bring decentralized governance to the Web 2 industry. Over the years, blockchain technology and crypto have provided real-world use cases. They constantly show the massive potential to revolutionize various industries and sectors, such as e-commerce, gaming, social media, and more.

In the past decade, no technological innovation has seen a larger adoption rate than cryptocurrencies and blockchain technology. The massive gains on these digital assets, led by Bitcoin, have set off a gold rush, with the average investor always looking for the next big thing in the stock market.

Other enthusiasts use blockchain projects, following the teachings of Satoshi, to decentralize their finances and bring decentralized governance to the Web 2 industry. Over the years, blockchain technology and crypto have provided real-world use cases. They constantly show the massive potential to revolutionize various industries and sectors, such as e-commerce, gaming, social media, and more.

A step-by-step guide on evaluating a crypto project

Before investors ‘ape’ into a crypto project, it is important to check several aspects. In this section, we will detail three crucial aspects investors should look for before investing their hard-earned cash into a project: technical and development, fundamental qualities, and financial aspects.

In each aspect, we provide a step-by-step guide on how investors and enthusiasts can evaluate a crypto project and the relevant information silos that can guide them when selecting a crypto project.

Step 1: Fundamental qualities of a project

Before jumping into any crypto investment, checking the pillars the project is built on or the fundamental qualities is important. In this section, we discuss the fundamental qualities of cryptocurrency projects that every investor should know before taking a position on a digital asset.

Check the official website

The main official page of the project is essential to understanding what the project is all about and its features. It is the main landing for any interested party; hence, the website must be readily available, highly functional, interactive, and share all information.

If a project lacks a reliable website or the main website does not highlight features and major information, it is probably advisable to think twice before investing in it.

Check the provided social sites

Another important indicator of good fundamental qualities of a project is having active social media sites. In crypto, active communities are everything, and a good project should show the presence of a strong and interactive community around its various social media channels and pages. This shows genuine interest in the project and could be a good reference point for investors.

To analyze a crypto community, it is important to check the activity of the community rather than just the number of followers. A small, active community play is likely to show a positive sign rather than a large, inactive one.

Check the team members

A strong community requires a strong leadership presence to steer the project forward. While crypto is all about decentralization, projects usually require strong teams to keep the development process going and rally the community behind the project.

When evaluating a crypto project’s team members, some of the qualities investors need to check include their experience, their previous history in crypto, the structure of the team, and their advisors.

Partnerships in the industry

Finally, the amount and quality of partnerships with other established brands and crypto companies could be a good sign for the project. Partnerships in the industry show trust in the project and could help the project grow its community faster than those with no partnerships.

Step 2: Technical and developmental progress

The importance of looking at the technical and development of a project cannot be understated. While many crypto investors overlook this while doing their due diligence, the technical progress is important as it reflects the ability and commitment of the project to deliver its vision and value to its users and investors.

Below, we discuss some key steps you should take when evaluating a crypto project’s technological, technical, and developmental progress.

Read the official whitepapers

Solid crypto projects typically include technical whitepapers, litepapers, and user manuals. These documents cover the project’s vision, problem-solving intentions, solutions, tokenomics, etc.

These papers, like the Bitcoin whitepaper, should be written and make it easy for the reader to understand the project. Duplicated and poorly written whitepapers should raise the investor’s doubts about the project and should not be worth spending their time and money on.

Trusted Partners

Check Git/ GitHub pages

One of the most important aspects to look for in a project is its developmental progress. Projects often share their GitHub or Git pages. These offer insight into the team and community development progress.

Reviewing these pages, investors gauge update frequency, recent maintenance, contributor count, and commits. This helps understand project popularity and community support. They also show the project’s many issues and pull requests, which can indicate its functionality and reliability.

Check its roadmap

Roadmaps provide a business plan for executing project goals and informing investors and stakeholders. A well-outlined and structured plan should show every developmental milestone and when they expect to achieve these goals.

For ongoing projects, it’s crucial to review the roadmap and confirm past milestones’ achievements.

Step 3: Financial aspects of the project

This is the crunch of the evaluation process of any crypto platform. The financial aspects of a project reveal stability and economics and offer insights into its value proposition.

When looking at the financial aspects of a crypto project, there are several key factors to look out for. These include how the project raises funds, the distribution of tokens, management of tokens, release schedules, token burn schedules, and more.

Today’s tools break down crypto projects’ financial structure, including Coinmarketcap, Coingecko, Nansen, DefiLlama, Etherscan, etc. Below, we provide a step-by-step guide on what an investor needs to know about the finances and economics of the project:

1. Token economics (Tokenomics)

Tokenomics are the set rules governing the token supply, including minting and burning tokens. Additionally, a project’s tokenomics also provides a clear view of the distribution of tokens and their overall circulation model.

Some projects offer a small number of tokens, while others offer a large number (or unlimited supply of tokens. Each factor, with its pros and cons, helps investors understand demand and supply dynamics.

Finally, the distribution model can also be key to determining the health of a crypto project. Typically, projects with a high allocation of the tokens to founders could be a cause for concern. In this case, the investors should probably investigate further.

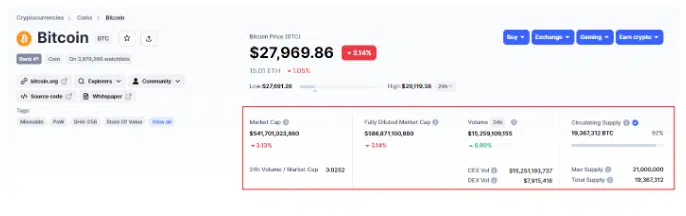

2. Check the token valuation stats

Secondly, you need to check the current market valuations and token velocity. The current market cap shows the total valuation of all tokens in circulation. While the velocity indicates the volume and average frequency with which token holders exchange (trade) a token.

A higher market cap probably shows that the upside potential of the token is squeezed. That means the asset may not see multiple-digit growth. On the other hand, a low market cap could show a potentially undervalued asset. However, it is important to research other aspects of the project. These are the trading volume and do not rely on the market cap alone.

The velocity could be critical to show how the market feels about the project. As velocity increases, the initial market capitalization may drop. However, some projects counter this by offering token burns, effectively reducing the tokens in circulation, which could positively impact the token’s price.

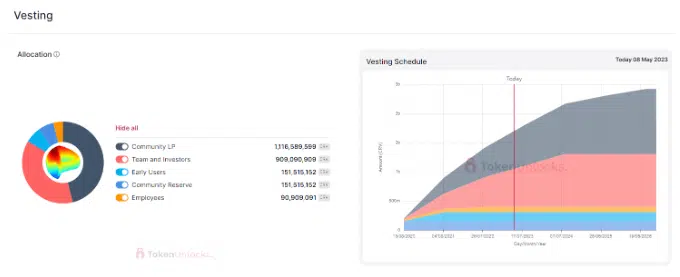

3. Check the token release schedule

Token release schedules specify when and how new tokens will be issued or unlocked for a crypto token. They are important to understand because they can affect the supply and demand of the tokens and, thus, their price and value.

There are several ways an investor can track these token release schedules. Some projects provide these token release schedules on official websites or white papers. There are also aggregator tools such as Token Unlocks that provide users with the planned release dates and may also allow users to create alerts or notifications for upcoming token releases.

4. The trading volume

It is also important to check the project’s trading history, volume, and the markets it is listed on. This gives a clear picture of the token’s liquidity in the market. The more trading volume a token has, the more liquid the market is.

Low trading volume might signal a poorly performing token, warranting caution before investing. Conversely, a high yearly trading history could indicate robust capital support from established and well-known firms, suggesting the token’s functionality.

Extra information on evaluating crypto projects

Above, the step-by-step guide provides investors with a due diligence path. It’s useful for evaluating any crypto project, launched or new. However, there are several other key pieces of information investors and enthusiasts need to ensure they do not lose their money to crypto scams in the market:

- Always countercheck the reputation of the project.

- Ensure the team members are very transparent, providing as much information as possible and openly sharing details of their projects with their investors.

- Check whether the crypto project is offering securities or digital assets.

- Also, check the legality of cryptocurrencies within the applicable jurisdiction.

- Do not FOMO into coins without conducting the proper research. Always do your own research.

Final words

Evaluating a cryptocurrency is a complex and multifaceted process that requires careful research and analysis. While there’s no one-size-fits-all formula or checklist for assessing a crypto project’s quality and potential, the step-by-step guide outlines some general factors. Key considerations like the team, the technology, the tokenomics, the governance, the market conditions, development activity, etc., are vital. Evaluating these elements could significantly contribute to successfully appraising a crypto project.

Finally, DYOR (Do your own research) before investing in any digital asset is important!

Supply and Demand Factors in Crypto:

High token availability may hinder demand increase and consequently, price rise. The best cryptocurrencies maintain sound economic principles while ensuring ease of use for consumers.

Essential Crypto Research Tools for Investors:

1. Messari

2. Glassnode

3. LunarCrush

4. Coin Metrics

5. Santiment

6. CoinGecko

7. CoinMarketCal

8. Coin Dance

Methodology for Evaluating Crypto Projects through Fundamental Analysis:

Review the white paper

Critically assess the white paper's claims

Analyze competitors

Examine the project team

Consider on-chain metrics

Study the tokenomics

Check market cap, trading volume, and liquidity

Assess community involvement