IDEX Review 2024: A Deeper Look at the Decentralized Exchange

TLDR

Delve into our IDEX review to discover the features, security, and advantages of this Ethereum-based decentralized exchange, granting users complete control over their assets.

With its innovative approach, IDEX is the pioneering hybrid liquidity decentralized exchange, blending elements from centralized and decentralized exchanges. Remarkably, it maintains a pristine track record with zero transaction failures.

IDEX is versatile and available in almost all countries of the world. Its features include a governance token, a CEX feature, and perpetual swaps. A staking option is also available on IDEX.

A major advantage of IDEX is its foolproof security against hacks. It also offers quality staking services and excellent rewards to its token holders. The major drawback is that the IDEX exchange does not support Bitcoin trading on its platform and has limited trading options.

Overview of IDEX

What is IDEX Exchange?

IDEX is a decentralized exchange that was founded in 2012. At its inception, it was first known as AuroraDAO (Aura) before rebranding to IDEX in 2019. After the company rebranded, they actively conducted a token swap, replacing Aura tokens with new IDEX tokens.

IDEX’s headquarters in Panama is the first hybrid liquidity DEX site that combines the traditional order book style with the liquidity pools of an Automated Market Maker (AMM). IDEX was deliberately designed utilizing the features and capabilities of both the Ethereum and Binance Smart Chain networks.

Unlike other more centralized and decentralized trading exchanges, IDEX is a crypto-to-crypto exchange; it allows for trading over 30 pairs of crypto assets but does not support fiat transactions.

IDEX uses an order-book system to place transactions, thus, retaining some standard features of centralized exchanges, including the Know Your Customer (KYC) and stop loss order features. It supports ERC-20 tokens and uses smart contracts to manage users’ private keys, thus, ensuring the safe trading of assets.

The exchange also provides a comprehensive and advanced trading platform for crypto enthusiasts, standing out among other decentralized exchanges because of its low trading fees and security.

In 2020, IDEX relaunched its platform to IDEX 2.0 and has improved its offline infrastructure and user experience, making its off-chain intelligent contracts more scalable. It is currently in its V4 version.

For New Users

New users will appreciate IDEX’s interface and wide range of trading pairs. Its UI is simple to understand, requiring minimal prior knowledge of crypto trading. In addition, it supports several ERC-20 tokens and stablecoins, including DAI, USDC, TUSD, and PAX.

Furthermore, through its referral system, liquidity mining, and staking features, new users can begin to earn on IDEX without actively trading their assets.

What Countries Are Supported?

IDEX is a versatile exchange available across almost all countries worldwide, including hotspot countries like the United States and India, where crypto trading is popular.

However, due to some sanctions, regulations, and anti-money laundering policies, it is not available to these countries:

- Iran

- Cuba

- North Korea

- Crimea

- Syria

Furthermore, residents of New York and Washington States in the United States are also subject to restrictions and are unable to utilize the IDEX exchange.

Biggest Drawbacks

IDEX decentralized exchange does not support fiat currencies or accept payments directly from bank accounts or cards. To fund your IDEX account, you must first fund a compatible crypto wallet and then transfer funds into your account from the wallet.

Furthermore, IDEX does not have a high daily trading volume. Compared to other exchanges, the transaction liquidity on the platform is lower.

What Makes IDEX a Good Choice?

No Failed Trades

IDEX holds a record for having zero failed transactions since it was launched. The exchange’s smart contracts control users’ transactions, and its DEX structure protects users from the challenges found when using other exchange platforms.

Some of these challenges include long wait times for trade execution and transaction completion, which often leads to trade failures and front running.

IDEX prevents these by ensuring that its smart contracts control order matching and off-chain execution of trades, thereby ensuring successful transactions. Additionally, the processing of users’ trades occurs exclusively upon authorization by their private keys, ensuring a secure and controlled trading environment.

Passive Market-Making

In crypto, passive market-making allows traders to generate income from their crypto assets without actively trading them. It provides liquidity by limiting orders, ensuring that buy and sell orders are available for traders to execute trades.

IDEX incentivizes passive market making through its staking program allowing traders to earn rewards for increasing the liquidity pool.

Secure Trading Platform

Because IDEX exchange combines the characteristics of centralized and decentralized exchanges, it can offer fast, user-friendly service while remaining secure from hacking, theft, and fraud.

As a result, IDEX is highly secure and cost-effective; it is one of the safest options for trading cryptocurrencies. The exchange platform runs as a node on the Ethereum network, effectively leveraging all of the perks of the Ethereum platform, including its encrypted trading technology.

Moreover, IDEX implements HTTPS technology, enabling users to securely access their accounts using a private key. Thus, eliminating the need for a third-party security intervention.

Higher Liquidity and Annual Percentage Yield

Liquidity refers to the ease of buying and selling a crypto asset without impacting its price on the market. With higher liquidity, traders get better selling and buying prices, boosting trading activities and reducing spread.

On the other hand, the Annual Percentage Yield (APY) measures interest earned on investments in a year. With higher APY, users can earn more passive income.

IDEX achieves higher liquidity and APY using its hybrid architecture, which consists of an off-chain order book and an on-chain settlement layer. These allow IDEX to quickly handle thousands of transactions every second while ensuring the security and finality of transactions.

IDEX allows its users to earn APY through liquidity mining and staking, contributing to its high liquidity. High liquidity attracts advanced traders and market participants, enhancing the network’s growth.

Low Gas Fees

Gas fees are charged on transactions executed on the IDEX platform. Compared to other platforms, IDEX charges lower gas fees on transactions. The exchange can achieve this due to its off-chain order book and hybrid liquidity model.

Due to these features, users are solely responsible for paying the fees associated with depositing, withdrawing funds, and executing orders on the platform. Users can actively place and cancel orders on IDEX without incurring any charges, as these actions are executed off-chain, providing a cost-free trading experience.

How to Trade on IDEX

Step 1: Visit IDEX’s Sign-up Page

To begin trading on IDEX, visit its sign-up page.

More details

IDEX is a leading decentralized exchange based on the ERC-20 blockchain. A significant perk of using IDEX is its low trading and gas fees; it charges as low as 0.10% on maker market orders. The only drawbacks to IDEX features are its limited trading pair and lack of a Bitcoin trading service. Otherwise, the exchange is versatile and has wide geographical availability.

-

Fast crypto-to-crypto transactions.

-

No failed trades.

-

Staking rewards.

-

Intuitive interface.

-

Dedicated customer support team.

-

Limited trading pairs.

-

No Bitcoin trading.

-

No mobile app.

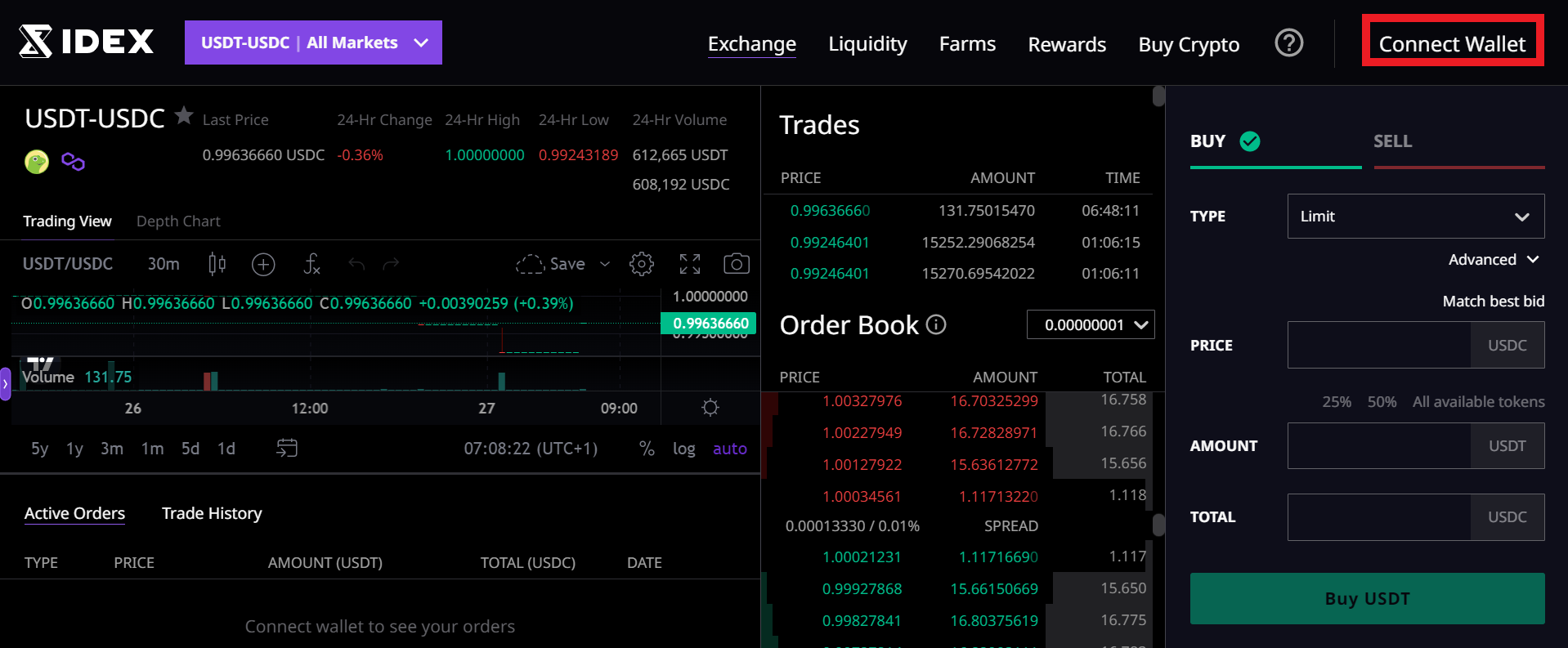

Step 2: Connect Wallet

You need to link your wallet to IDEX.

Click on the [Connect Wallet] button on the top right corner of the page to link your wallet.

IDEX supports a host of crypto wallets. Depending on the wallet, you may connect by entering a private key, scanning a QR code, or connecting directly to the installed wallet on your PC.

We recommend you connect with Metamask.

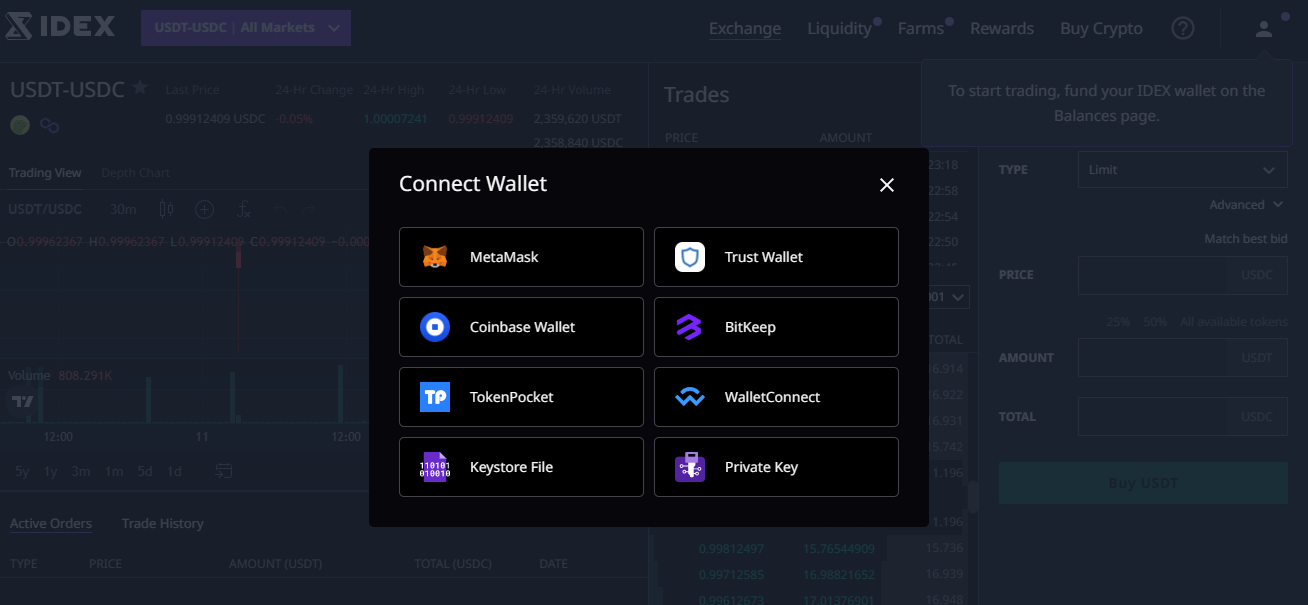

Step 3: Confirm wallet address

Once you select a wallet, you will be prompted to confirm your wallet address and details.

After confirming the wallet address, click the [Connect] button to link your selected wallet.

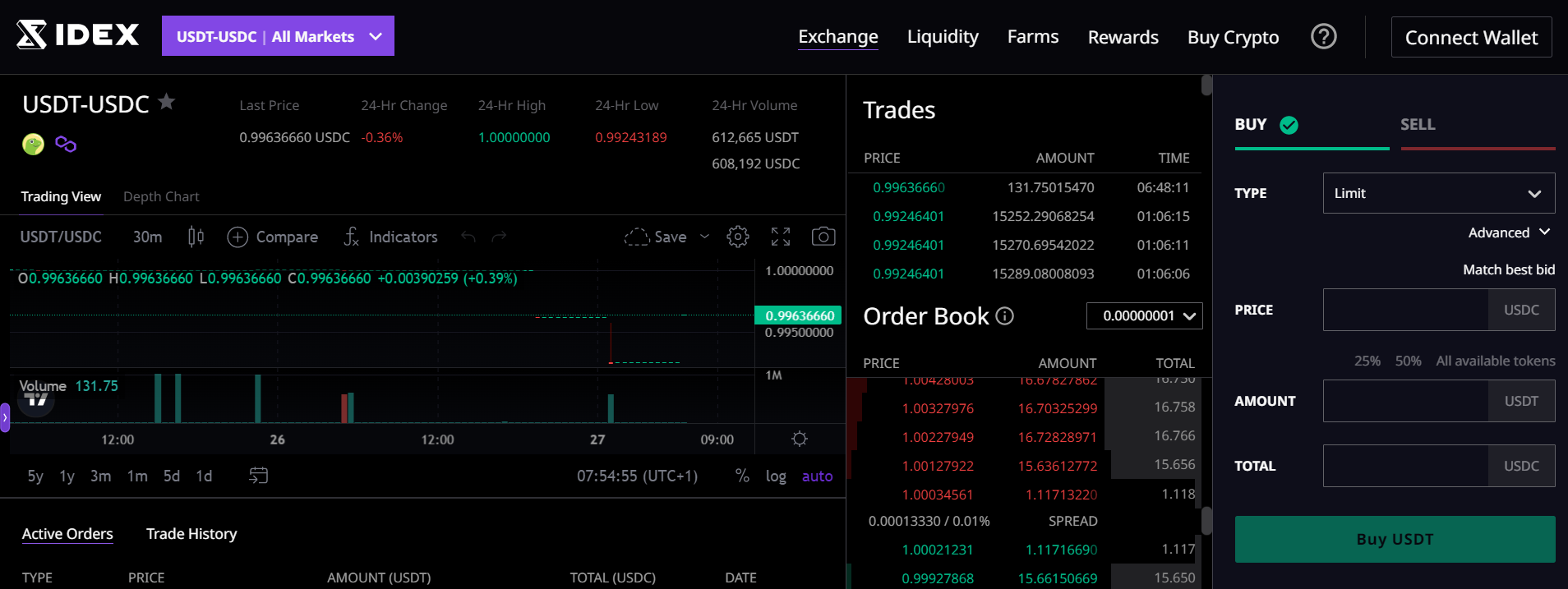

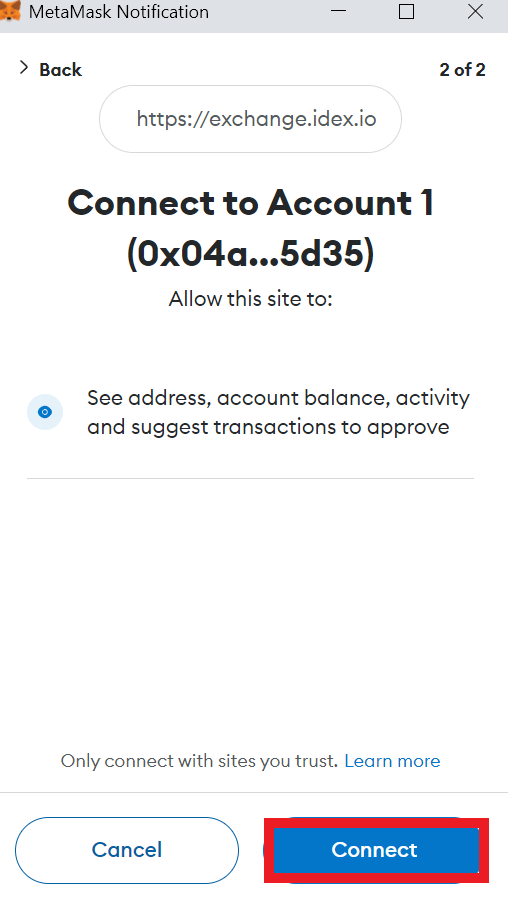

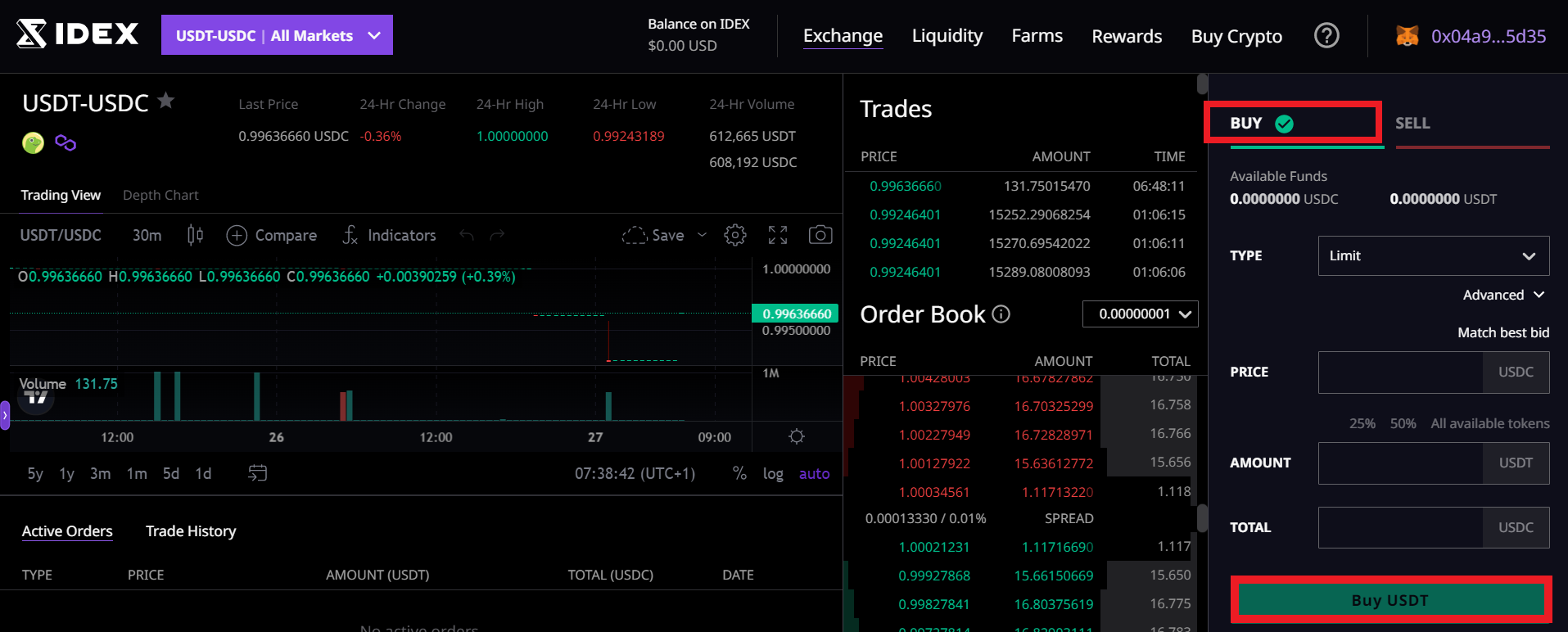

Step 4: Start Trading

After successfully linking a wallet, the wallet interface will actively display your trading funds. From the IDEX trading view screen, you can actively initiate trades.

To buy a token, use the [Buy] button on the right side of the page.

Enter the type of token you want to buy, your preferred buying price, and the number of tokens.

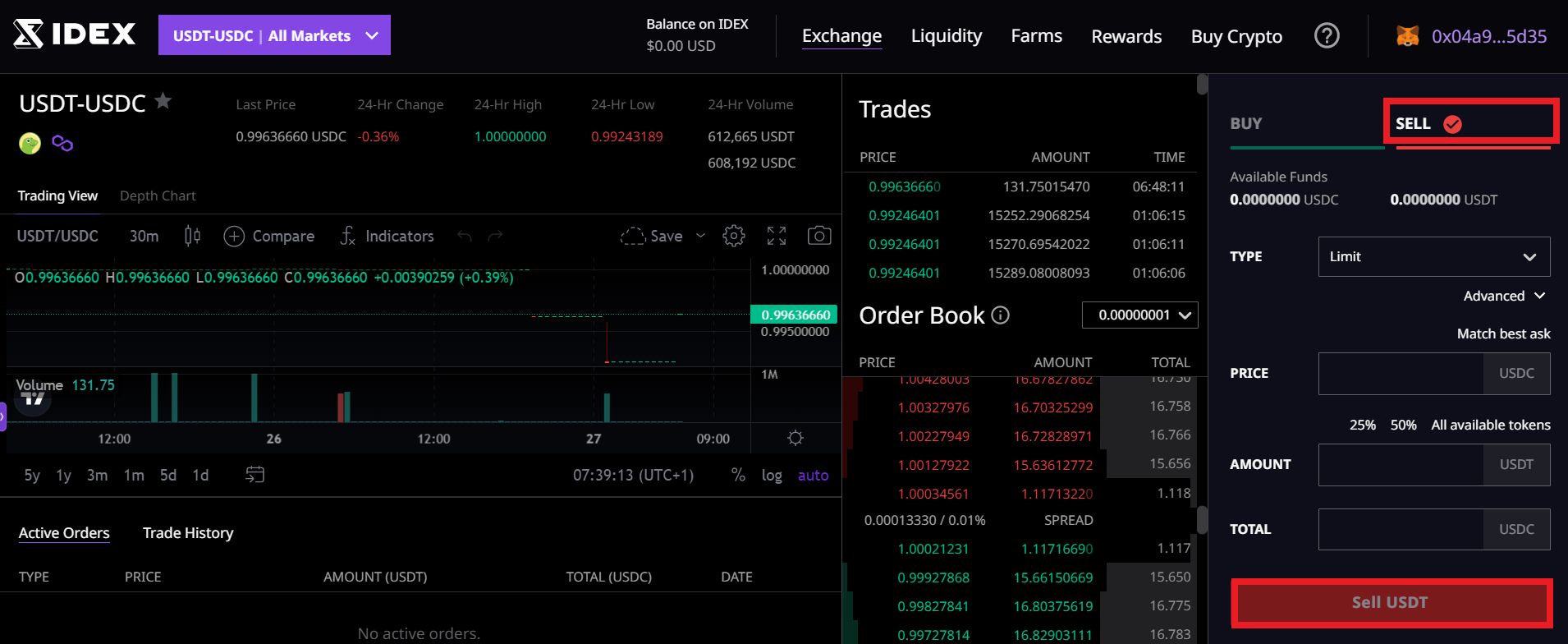

To sell tokens, use the [Sell] button on the right side of the trading homepage.

Enter the type of token, your preferred selling price, and the number of tokens you want to sell.

IDEX Review: Top Features & Perks

1. Governance Tokens

The IDEX token, the platform’s governance token, is an ERC-20 token. It allows users to operate a node and stake assets on the platforms. The tokens can also be traded on DigiFinex, Binance, and BiTrue.

Furthermore, IDEX token holders actively possess the authority to govern activities on the exchange platform, which includes participating in voting processes for upgrades and proposals.

2. CEX Features

IDEX differs from other decentralized exchanges because of its similarities to a centralized exchange. Its design combines the best features of a centralized exchange while eliminating the drawbacks commonly associated with decentralized exchanges.

High-frequency traders can seamlessly trade on IDEX without the extensive waiting periods for transactions to mine. In addition, IDEX allows orders to be placed or canceled as fast as they would be done on a CEX.

3. Perpetual Swaps

Perpetual swaps are a new feature on the IDEX platform that allows users to speculate on the price of a crypto asset without having to buy or sell the asset.

Unlike futures contracts, perpetual contracts do not have a settlement or expiration date. Traders actively engage in continuous trading and funding of perpetual contracts to maintain their price near the actual price of the underlying crypto asset.

IDEX can acquire a significant portion of the market share by including the perpetual swaps feature on its platform, allowing it to become a leading exchange offering the feature in the crypto industry.

4. Off-Chain Trading Engine

In the crypto world, off-chain trading engines actively process transactions outside the blockchain while ensuring a preserved connection to the blockchain. Off-chain trading allows for quicker, cheaper transactions and higher scalability.

IDEX’s off-chain trading engine executes trade live before dispatching the transactions to the network to settle them. This feature allows for a fast and easy trading experience for IDEX’s users while ensuring that all transactions are secured.

5. Hybrid Liquidity

IDEX’s hybrid liquidity model refers to its capacity to combine the benefits of an order book with those of an automated market maker. While order books actively match buy and sell orders based on price, automated market makers employ smart contracts to generate liquidity for tradable tokens.

IDEX leverages an off-chain trading system and an on-chain settlement layer to power its order book actively, providing users with fast, cost-effective trading and robust security measures. IDEX’s automated market maker prevents slippage while ensuring increased passive income opportunities and high capital efficiency.

By offering hybrid liquidity, IDEX ensures users a more efficient and profitable trading experience.

IDEX Review: Products and Services

IDEX Staking

In staking, crypto holders contribute their assets to validating transactions on a blockchain, improving the efficiency and security of the supported blockchain while also earning rewards on their staked tokens. IDEX began supporting staking in 2019, allowing users to earn up to 8.31% annually on staked assets.

Staking in IDEX is done using IDEXd, a staking software that allows users to operate a node on the IDEX platform. Node process and validate transactions. It operates part of IDEX’s infrastructure and contributes to its decentralization.

IDEX holders can participate in its staking program via two channels: operating a personal staking node or delegating to an existing node.

Token holders with a minimum of 5000 IDEX can host a personal or public staking node. They are granted rewards when people delegate their nodes and the freedom to set the price for using their nodes. Delegating an existing node remains most common among IDEX holders because it does not require a minimum number of IDEX tokens to participate in staking.

IDEX Launchpad

The IDEX Launchpad service assists new projects in growing on the IDEX platform. New and existing crypto developers using Launchpad can launch their tokens and raise funds on the exchange.

With Launchpad, developers can leverage IDEX’s wide user base to gain access to advanced traders and market players. In addition, the IDEX Launchpad offers new projects with marketing and community support to boost its visibility.

Furthermore, Launchpad assists with creating liquidity pools of tokens on IDEX’s automated market maker, allowing project developers to kickstart their projects. The service also ensures that new projects launched on its platform comply with all the relevant standards. Thus, ensuring that the best practices for security and transparency are followed.

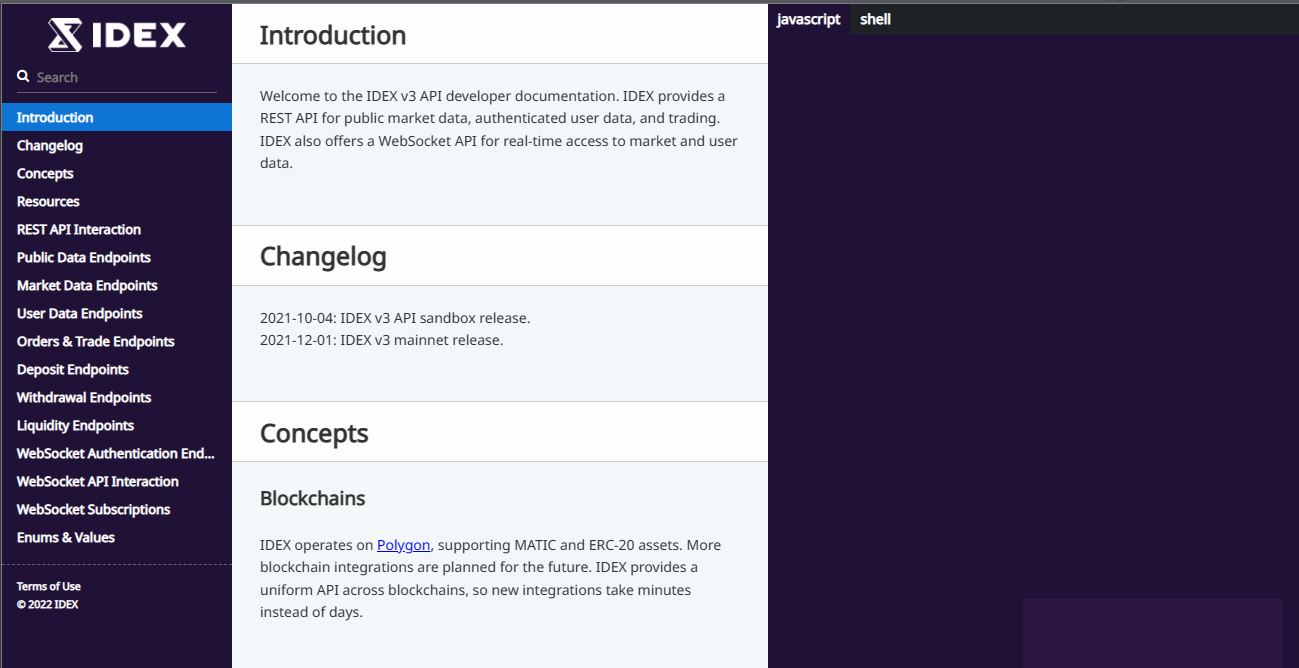

IDEX API

An API (Application Programming Interface) is a set of protocols defining the communication mechanism of software components. It allows software developers to access and interact with a platform’s data.

IDEX offers a flexible API enabling developers to interact with several applications and integrations using computer programming languages. The exchange offers two kinds of APIs: WebSocket and REST.

REST API allows the transfer of requests and responses through HTTP; WebSocket, on the other hand, allows the bidirectional transfer of signals over a single connection.

IDEX APIs allow for creating and canceling orders, acquiring important markets, accounts, staking information, and subscriptions to various events and updates on the exchange.

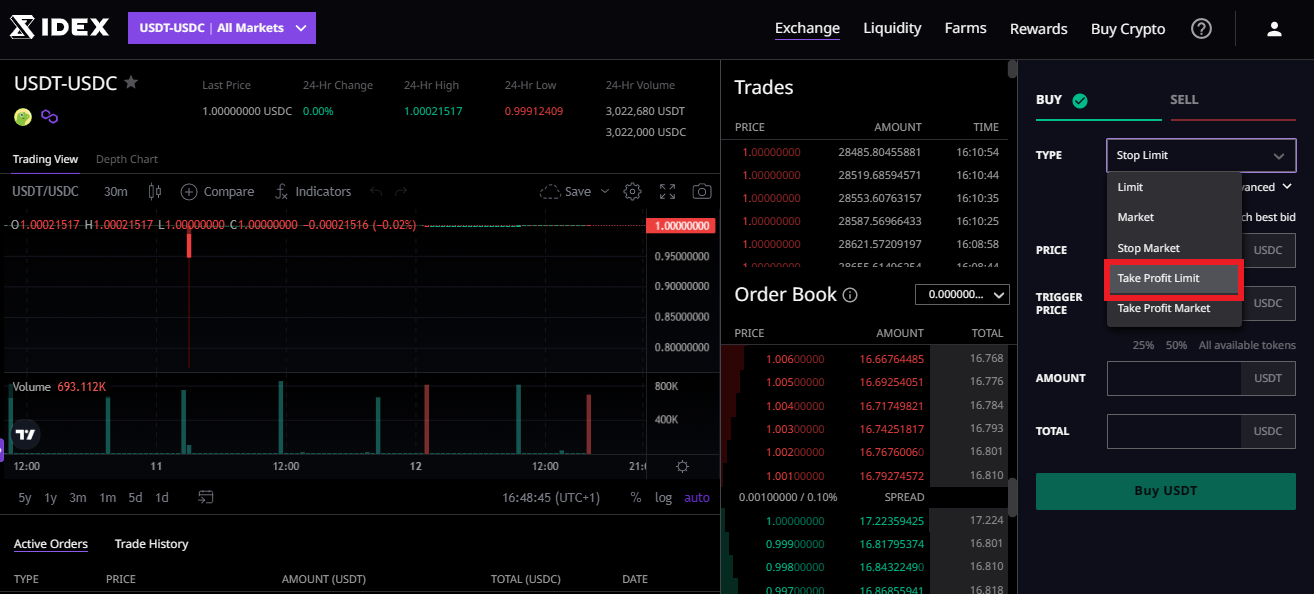

IDEX Review: Order Types

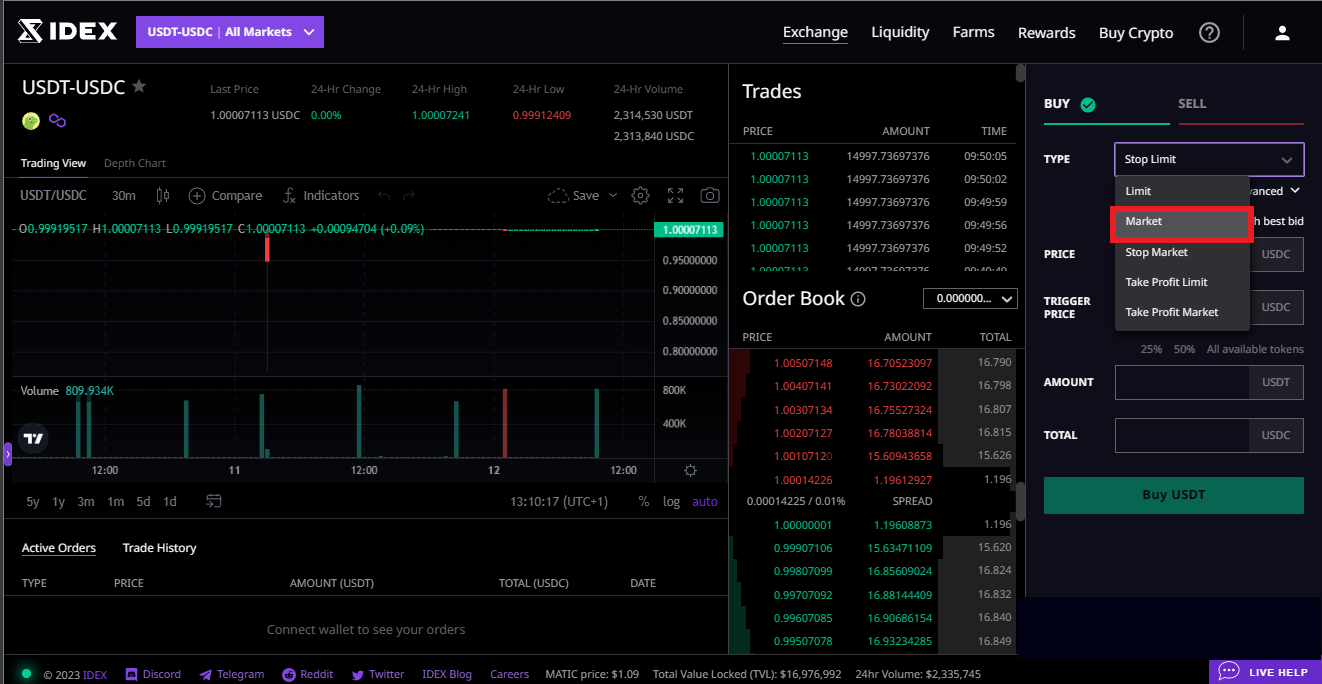

Market Order

On IDEX, a market order is executed at the best available price on the platform. It is the easiest and fastest order to execute, thus remaining the best option for traders looking to buy or sell assets instantly. Market orders, however, rely on liquidity for execution and can experience slippage in volatile or illiquid markets.

To place a market order on the IDEX platform, at the ‘Buy’ or ‘Sell’ IDEX tab, click [Market] under the type of order. Next, enter the number of tokens you want to purchase or sell.

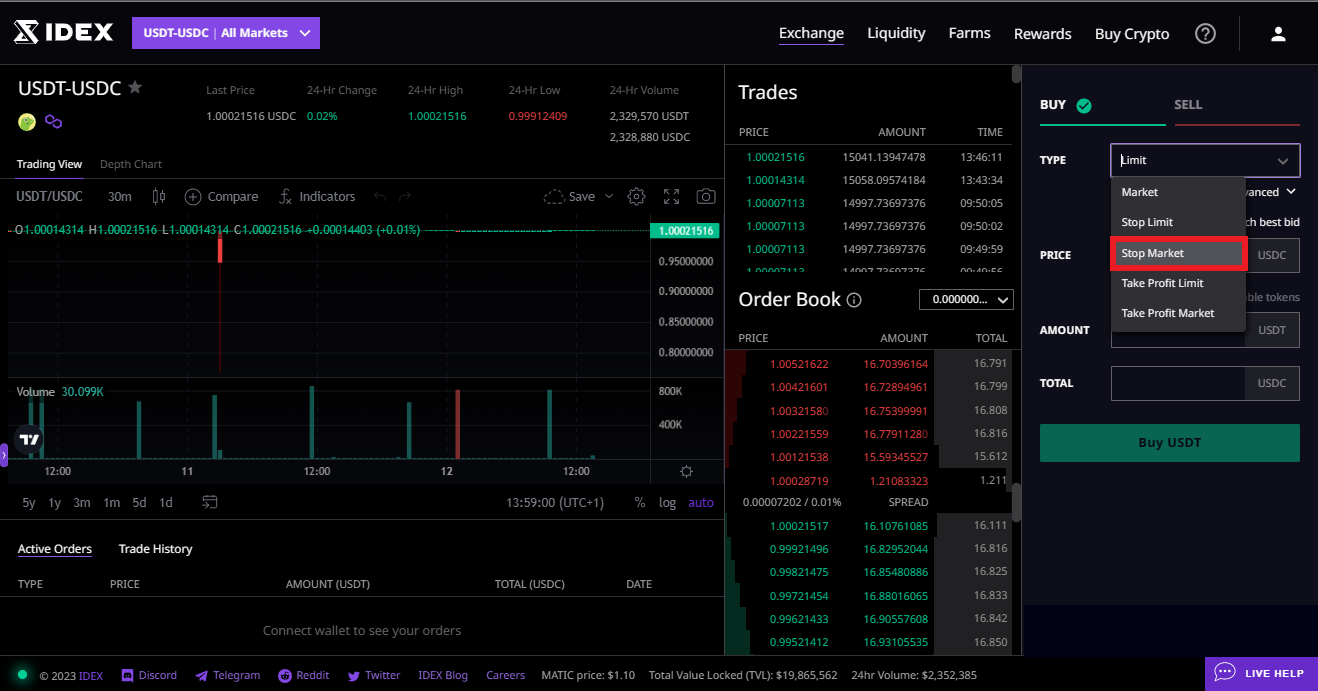

Stop Market Order

A stop market order allows traders to buy or sell tokens at the market price once their price reaches a predefined level called the ‘trigger price.’ These benefit traders who want to maximize profits and limit losses in a volatile market.

To place a stop market order on IDEX, navigate to the ‘Buy’ or ‘Sell’ tab and click [Stop Market] under the type of order. Next, enter your preferred trigger price and the total number of tokens you want to buy or sell. Place the order.

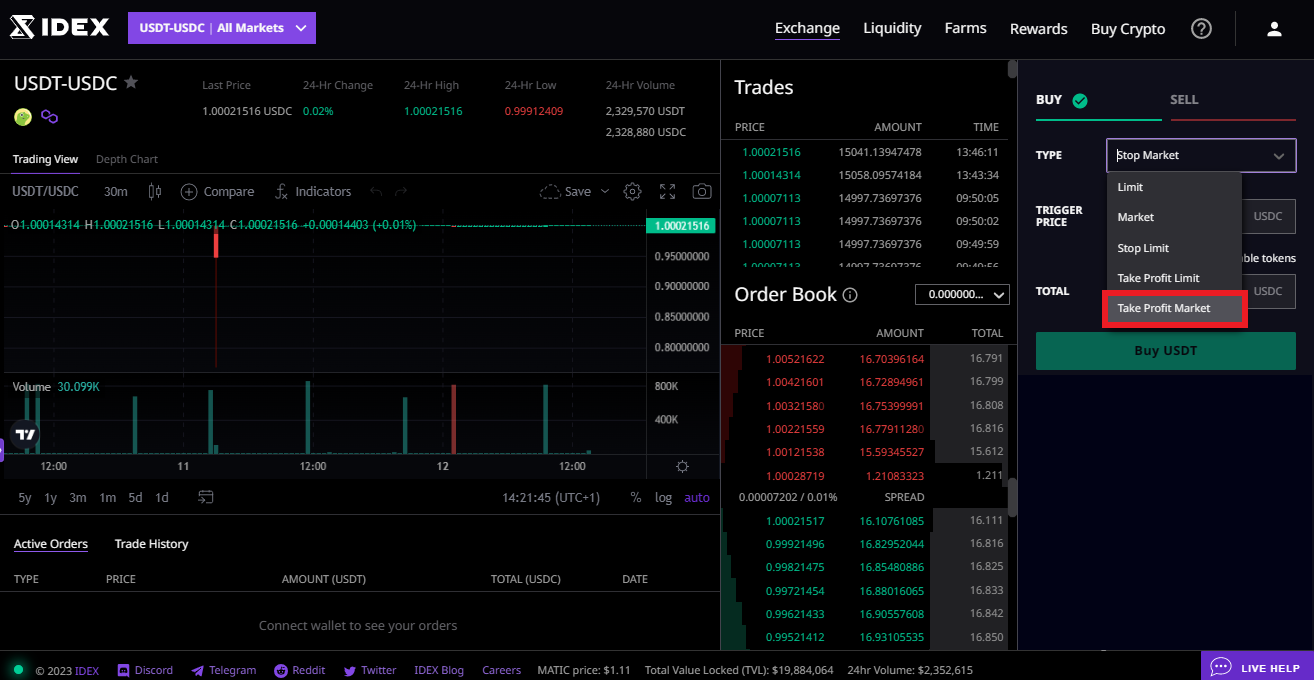

Take Profit Market Order

Take profit market order closes an order at the market price once a specific profit level is achieved. This order allows traders to lock their gains and avoid losses to market volatility.

To place a take profit market order on IDEX, click [Take Profit Market] order type from the trade tab. Next, set your trigger price and the number of tokens you want to buy or sell.

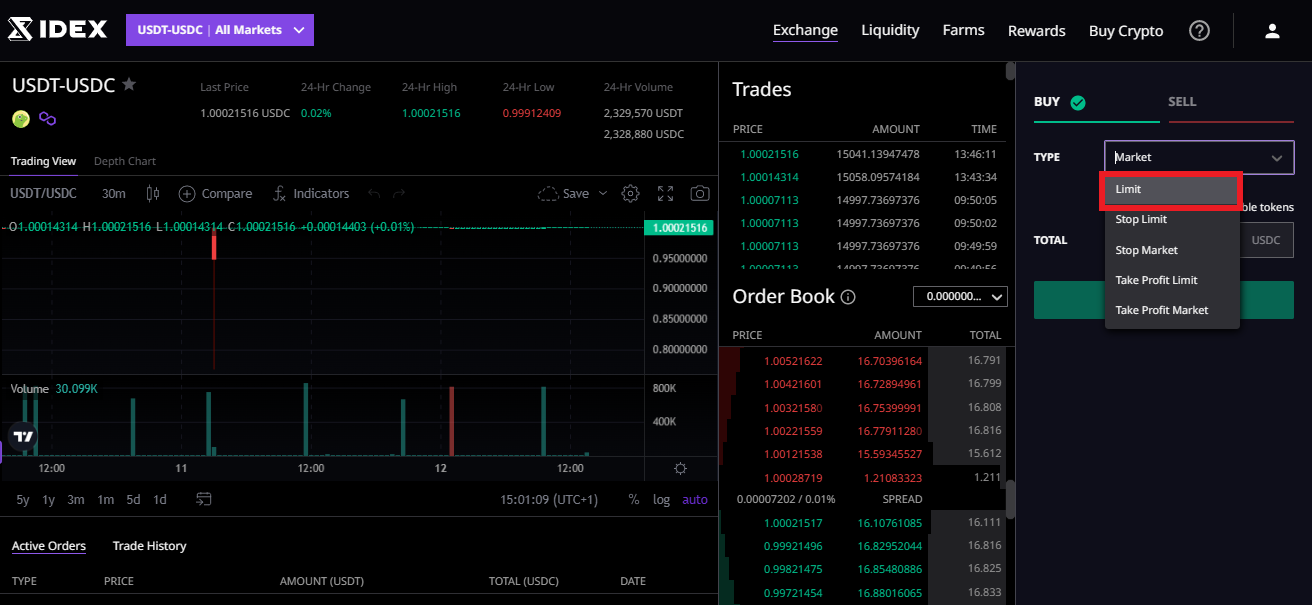

Limit Order

A limit order requests that an asset be bought or sold at a specific price or higher. It helps traders to control the price paid or received for an asset. However, there is no assurance of order fulfillment as tokens sometimes fail to reach the set trigger price, leading to unfilled orders until the user cancels them or the market closes.

To place a limit order on IDEX, click on the [Limit] order type from the ‘Buy’ or ‘Sell’ tab. Next, enter your preferred limit price and the number of tokens bought or sold.

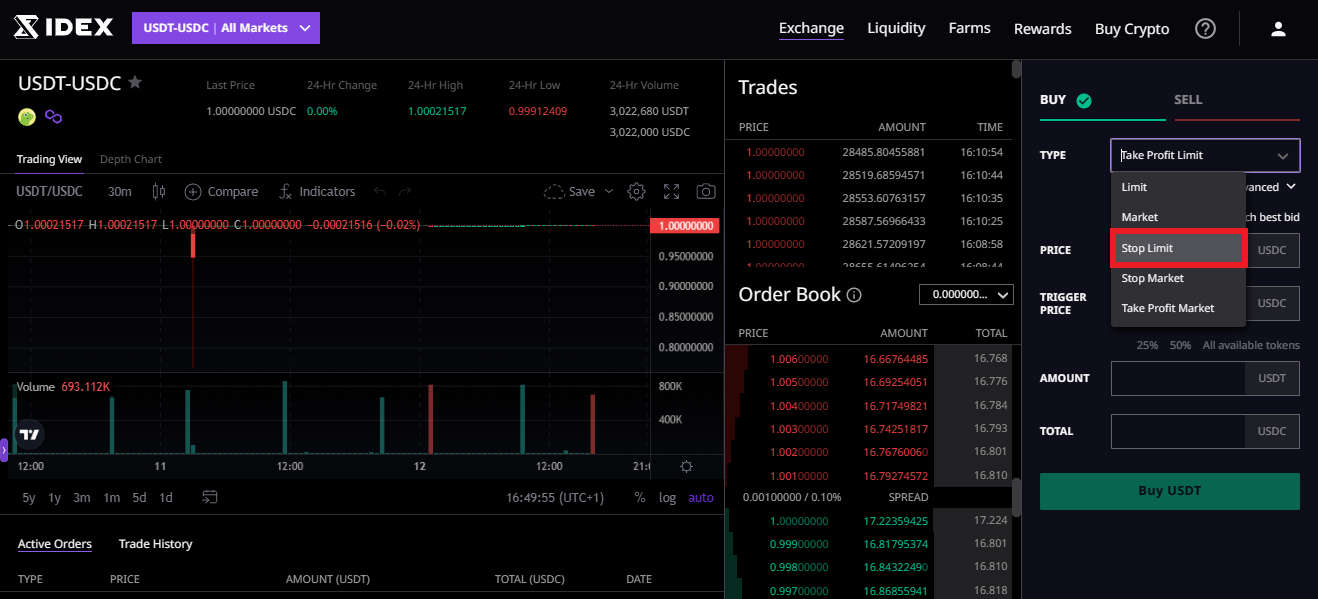

Stop Limit Order

Stop limit orders combine the characteristics of stop market orders and limit orders. When utilizing this type of order, two prices are set: the trigger price and the limit price. The stop market order actively fills at the trigger price, after which the limit order is executed. It helps to prevent unwanted execution of orders in a volatile market and avoid slippage.

To place a stop limit order on IDEX, click on the [Stop limit] order type from the ‘Buy’ or ‘Sell’ tab. Next, enter your preferred limit price, trigger price, and the number of tokens bought or sold.

Take Profit Limit Order

The take-profit limit order combines the characteristics of a take-profit market order and a limit order. After the profit level is reached, the order becomes a limit order. It helps to prevent losses due to market volatility.

To place a take profit limit order on IDEX, click on the [Take profit limit] order type from the ‘Buy’ or ‘Sell’ tab. Next, enter your preferred limit price, market price, and the number of tokens bought or sold.

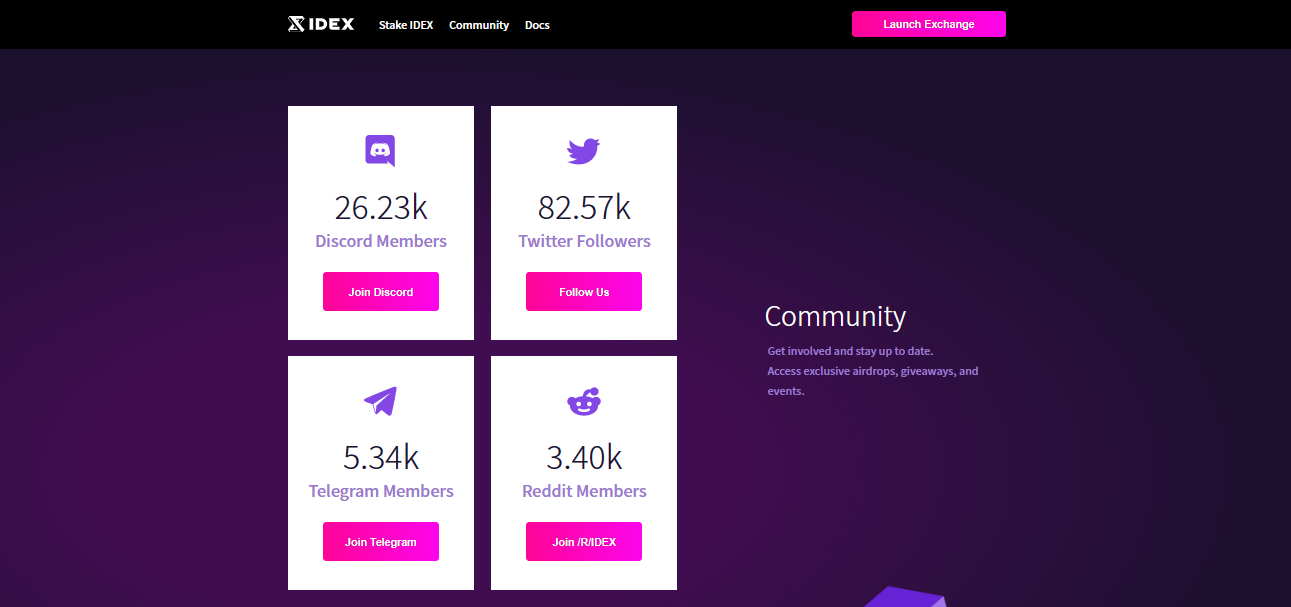

IDEX Review: Customer Support

The platform offers reliable customer support to its users. The support team provides information on wallet management, problems with private keys, token buying, funds deposit, and withdrawal. The exchange offers customer support through several channels, including e-mails, Discord, Twitter, Reddit, and Telegram.

IDEX’s e-mail channel remains the most common way of contacting customer support. To reach the exchange via e-mail, you can e-mail the IDEX help desk at [email protected], using screenshots to provide details of your problem. Expect a response within 24 hours!

IDEX’s channel on Discord allows users to communicate with each other and IDEX’s support team in real time. Join the Discord channel to access various topics and updates about the IDEX exchange.

IDEX also offers users support on Twitter, Reddit, and Telegram platforms.

IDEX Review: Fees

Gas fees

The Hybrid Liquidity (HL) of the IDEX exchange actively manages the gas fees charged on the platform. Hybrid liquidity (HL) automatically reduces the cost of gas fees and eliminates failed transactions and trades.

The gas fees for moving user funds into IDEX smart contracts are direct. To offset the settlement costs, the user’s funds actively cover the subsequent gas fees incurred on transactions carried out in the blockchain. These settlement gas costs are very similar to trading fees.

IDEX Trading Fees

Trading transactions always involve two parties: the makers and the takers. A market maker creates a market order on the order book before the execution of the trade. On the other hand, a market taker places the trade that matches the order made by the market makers.

IDEX decentralized exchange charges trading fees differently for these different parties. IDEX charges a maximum of 0.25% on trades executed by a taker. This value is competitive with the average spot trading taker fee, around 0.005% of the IDEX fee.

Meanwhile, IDEX charges a reduced trading fee of 0.10% for market makers. These benefits traders who prefer to make their orders rather than pick up existing orders from the order book. Also, the taker pays for the gas fees in this kind of trade.

Deposit and Withdrawal fees

The IDEX exchange utilizes smart contracts to accept fees into the IDEX chain. The trades are carried out with instant execution. IDEX does not charge any fee on deposit or withdrawal.

Peer-to-peer trading fees actively vary based on the category of market orders: market makers or market takers. Generally, IDEX gas, deposit, trading, and withdrawal fees are among the least expensive in the crypto space.

Drawbacks of IDEX

No Bitcoin Trading

Bitcoin remains the first and the most famous cryptocurrency across the globe. This fame can be attributed to its decentralization, scarcity, portability, divisibility, and programmability. Exchanges, as a result, support Bitcoin to allow its users to access its benefits.

In addition, exchanges that support Bitcoin can attract more users and boost their revenues. IDEX’s lack of support for Bitcoin remains one of its major drawbacks and a source of many negative reviews.

No Fiat Support

IDEX exchange is built to be a crypto-to-crypto exchange. This differs from common centralized and decentralized exchanges, which allow crypto and funding. A major drawback of IDEX is its lack of direct funding options from fiat currency through bank accounts or credit cards.

This makes the IDEX exchange a bit cumbersome for new crypto users who may not own crypto wallets. To connect funds to the IDEX exchange, it is necessary to fund through a wallet that permits fiat funding actively.

No mobile app

Mobile platforms offer several advantages for users and owners of websites. Some of these include improved accessibility, visibility, branding, and functionality.

Thus, IDEX’s lack of a mobile application to back up its website is one of its major drawbacks. Mobile apps are a fast way to access crypto services such as trading or customer support when desktops are unavailable.

The exchange platform can therefore benefit from developing a mobile platform to provide its users with a better experience with trading.

Idex Review: Our Verdict

IDEX exchange is a leading DEX that has successfully merged the strength of centralized and decentralized exchanges. It is one of the most secure platforms to trade on the internet, and its website is one of the most intuitive interfaces in the crypto space. Idex holds the record for having zero failed transactions.

It supports crypto trading and offers a variety of trading options. IDEX offers several market orders, including limit, market, and take-profit orders.

IDEX charges no fees on its clients’ funds when they deposit or withdraw their digital assets. Its trading fees are one of the lowest found around. It charges a meager 0.25% on taker orders, while trade makers get a lower 0.10% trading fee. It charges a nominal gas fee on the transaction on the chain.

Regardless, IDEX does not support fiat funding. It only allows crypto-to-crypto funding on its exchange. As a result, users will need to connect a crypto wallet that accommodates fiat funding before transferring to IDEX wallets.

Additionally, IDEX does not support Bitcoin trading and does not have a mobile app, making it difficult to access on the go.

IDEX exchange is a secure platform with high-end encryption to secure users' digital assets.

For transactions lesser than $5000, traders do not need to complete the KYC to carry out the transactions. Users who want to transact above $5000 will be required to upload a selfie to complete the transaction.

IDEX exchange's token, IDEX, can be purchased on the platform and Binance exchange. It is also available in Gate.io, Uniswap V2, and Balancer.

Currently, IDEX does not offer margin trading services to its users.