TL;DR

- Coinbase does report to the IRS. They do so by issuing tax forms called Form 1099-MISC for their customers who have exceeded $600 as crypto income within the financial year.

- Over time, Coinbase will report all capital gains and losses through Form 1099-DA, which is designed for cryptocurrencies and NFTs.

Do you wonder if Coinbase reports to the IRS?

Lacking insight into how taxes work for cryptocurrency can lead to unnecessary penalties in the US and, in some cases, even a felony! With many complexities in filing taxes, it’s easy to feel overwhelmed, too.

This article helps to understand how Coinbase reports to the IRS, the different types of tax forms, and how it affects crypto traders.

Does Coinbase Report To The IRS?

Yes. The short answer is that Coinbase issues Form 1099-MISC, one of the essential Coinbase tax documents.

They send it to the customer and the IRS if they exceed the threshold of $600 in crypto income. The document helps the IRS to verify their reported income and calculate the right tax liability.

Since crypto is treated as property in the US, it is subject to capital gains and income tax. As a result, citizens need to disclose their crypto transaction activities.

Coinbase Report to IRS: Taxes Transaction

Cryptocurrency is subject to both capital gains and ordinary income tax in the US.

In the case of capital gains, when you sell or trade crypto, profit may be subject to crypto taxes.

Furthermore, cryptocurrency income may be earned through mining, staking rewards, or referral rewards. These are subject to ordinary income tax based on the tax bracket the citizen falls under.

What information does Coinbase send to the IRS?

As of the time this article was written, Coinbase only reports Form 1099-MISC for customers who exceed $600 in crypto income.

The form provides the IRS and the taxpayer information about the user’s total income in the financial year.

How Does The IRS Use Information Provided by Coinbase?

The 1099 forms that Coinbase reports to the IRS have been used to assess the accuracy of the tax the Coinbase user is liable to pay.

Furthermore, the IRS also has the authority to ask for its customers’ Coinbase transaction history to identify taxpayers suspected of tax evasion.

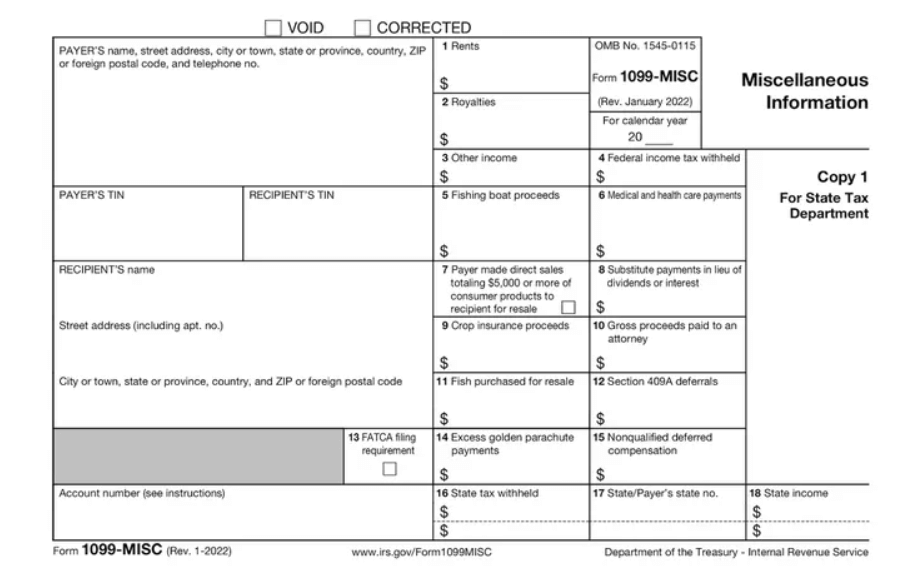

1099 Forms & Its Types

1099 Forms, also known as information returns, help the IRS classify income from non-employment sources.

Its main purpose is to accurately track a taxpayer’s income for the year so that the precise amount of taxes is paid.

Rental income, interest income, and gambling profits are some examples of it. Since there are various ways that income is earned, there are four major types of 1099 forms:

Form 1099-MISC

Earnings categorized as miscellaneous income fall under this tax form. For example, property income or services paid to independent contractors are within this category.

In the crypto context, these include miscellaneous income streams such as referrals, mining, and staking.

Form 1099-K

Credit/ debit networks and payment settlement networks use it. They show the transaction volume from the processed payments.

Before Coinbase only sent Form 1099-MISC, they used to send this form. It was meant for crypto traders with 200 sales transactions and over $20,000 in gross proceeds within a financial year.

Form 1099-B

This form shares information about security and property transactions through a broker. These are usually stock exchanges.

There was a debate on issuing 1099-B forms among the Coinbase tax forms, but this has failed to materialize and remains out of the question.

Form 1099-DA

This new form is designed to report capital gains and losses from digital assets, including crypto and NFTs.

What If You Didn’t Receive a 1099 Form from Coinbase?

You may not have received a 1099 form if you didn’t meet the necessary criteria.

Yet, it’s important to remember that reporting any taxable income from cryptocurrency is legally important. Not doing so is considered as tax evasion.

To calculate the total tax liability, it is first important to understand your situation.

Imagine you are a self-employed person who also transacts with crypto. You would need to report Coinbase income on Schedule C.

On the other hand, those who aren’t self-employed would need to report it as [Other Income] on Schedule 1.

Why Coinbase Switched from Form 1099-K to Form 1099-MISC?

Long-time Coinbase users might remember that Coinbase previously issued Form 1099-K to the IRS.

But this is stopped since it created much confusion.

This was because Form 1099-K reported the trading volume of a user rather than actual gains and losses.

To illustrate the problem, if a crypto trader bought Bitcoin worth $1000 and sold it for only $800, it is actually a $200 loss. Yet, the 1099-K calculations would report $1800 as the trade volume.

To further amplify the issue, some IRS agents viewed this volume as the profit amount subject to necessary Coinbase taxes.

How Will the Issuance of 1099-DA By Coinbase Affect Investors such as Myself?

Form 1099-DA, specifically designed for digital assets, will be introduced mandatorily in 2025.

Crypto investors tend to move their coins from different exchanges and crypto wallets. Cryptocurrency transactions across multiple platforms can confuse the calculation of accurate tax amounts.

Such concerns are probably why further work is currently being done on this type of 1099 before it gets adopted across the US.

Does Coinbase Share Information on Small Cryptocurrency Traders with the IRS?

As per the current policies of Coinbase, they only send a Form 1099-MISC if the minimum threshold of $600 is crossed for the year.

But planning has already been made to issue future tax forms called Form 1099-DA. This will require Coinbase to report all of the gains and losses from US-based users.

Furthermore, the federal court in the U.S. has issued permission to the IRS for a John Doe Summons to various crypto firms, including Coinbase.

It implies that Coinbase transaction history about unidentified taxpayers was given to the IRS.

Will Coinbase Send Me a 1099 Form For 2024?

Coinbase would send a Form 1099-MISC to you and the IRS if you meet the following criteria:

- You trade through a registered Coinbase account

- You are a US citizen or based in the US for tax purposes

- You have crossed the minimum crypto income threshold of $600 through miscellaneous income such as rewards or fees

When will Coinbase Send Me a 1099 Form?

Coinbase users who meet the necessary Form 1099-MISC thresholds should receive it by the end of February of the following year.

These forms are either emailed by Coinbase or can be downloaded via Coinbase itself.

How To Download My Coinbase Tax Documents?

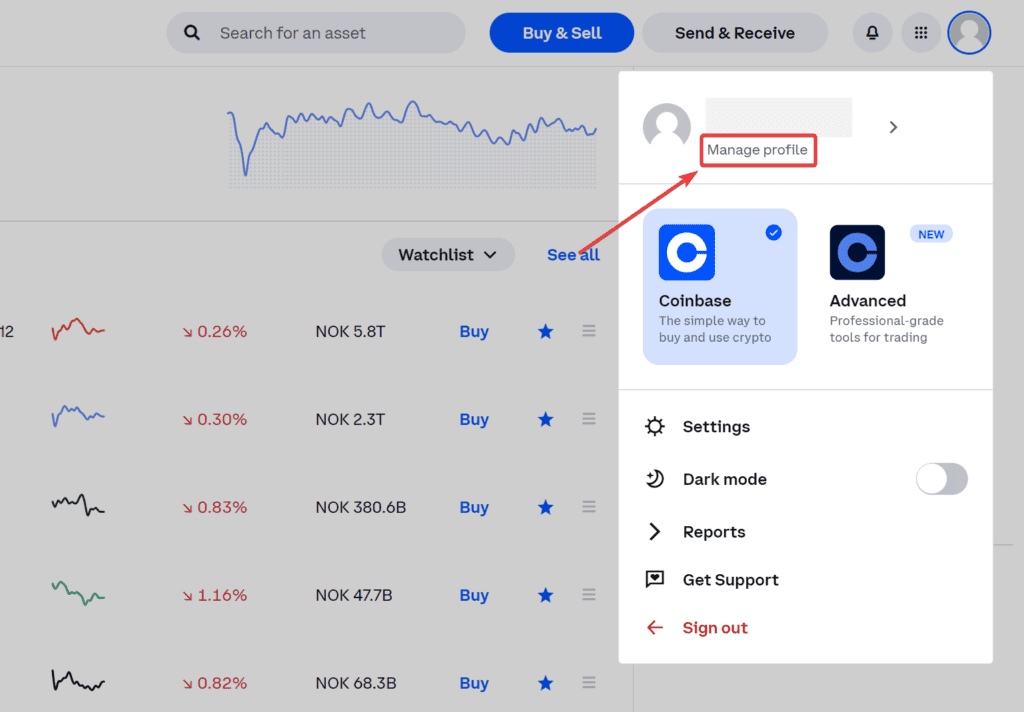

- Once logged into Coinbase, select your profile.

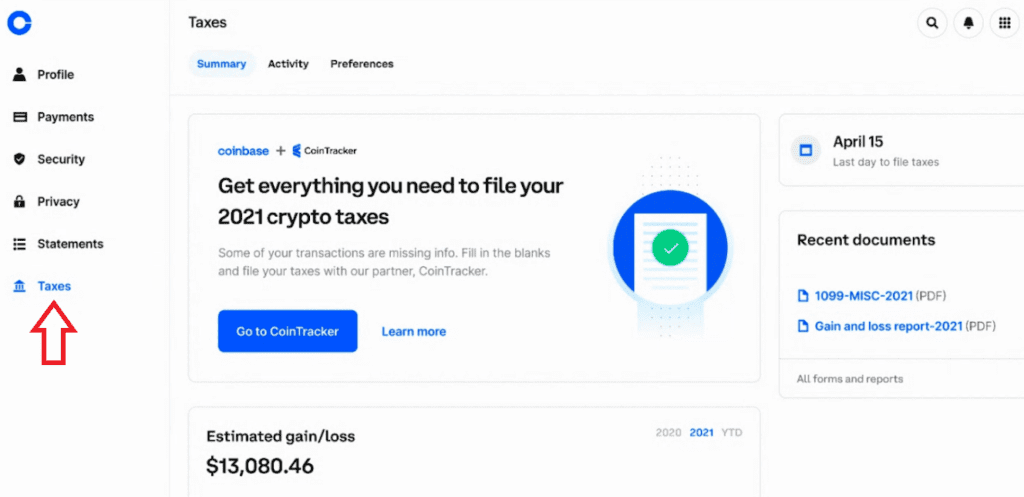

- Click the Coinbase Taxes section.

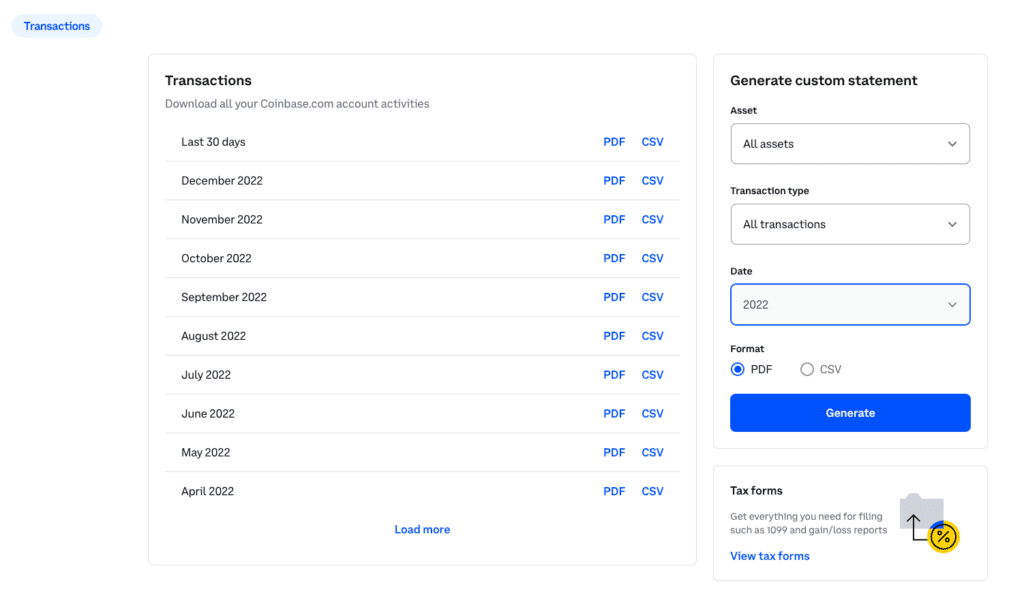

Next, click the [Statements] tab.

- You can now input the date range and download the record of all transactions in PDF or CSV to clarify Coinbase tax data.

This report will provide complete data on the type of transactions and total amount based on date and time.

Why Use a Crypto Tax Calculator?

Filing for crypto taxes can seem complex for newcomers. This is because users may have conducted transactions across multiple cryptocurrency exchanges and wallets.

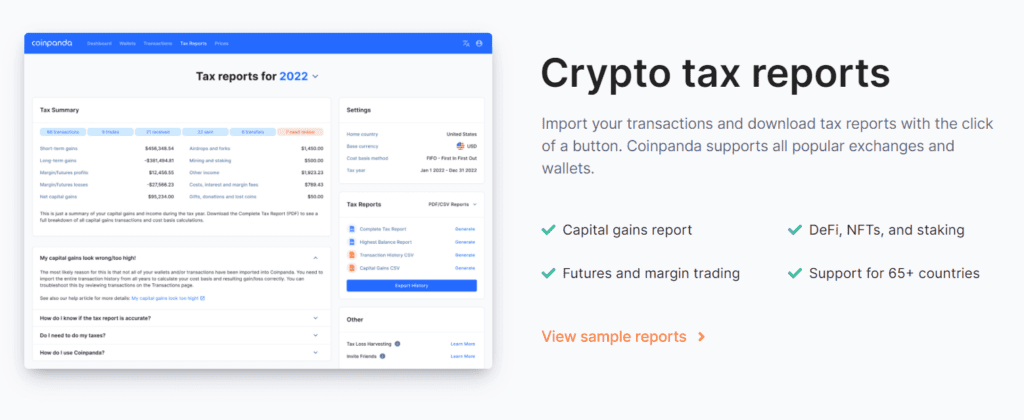

To solve this pain point, there are crypto tax software available such as Coinpanda and Koinly that help to generate the complete tax report.

They assist in paying taxes by importing the accurate data of transactions from multiple exchanges.

Consider a scenario where you have conducted transactions across Coinbase, eToro, and Binance.

This platform will help to synthesize all the transactions and generate the tax report to pay taxes.

You can also consider consulting a Tax professional. They can clarify IRS forms, tax returns, and tax implications based on your crypto transactions.

Yes, Coinbase transactions are applicable to either capital gains or ordinary income tax.

Taxpayers can put in place strategies such as holding their digital assets long-term and selling assets during a low-income year. Additionally, they can consider donating to charity and balancing gains with losses to cut tax liabilities.

Any Coinbase user who has crypto income above $600 within a financial year based in the US can expect a 1099-MISC form for their tax return.

It's important to file taxes since failing to report Coinbase tax obligations and providing a tax return is subject to various penalties. For instance, penalties begin at 5% of unpaid taxes each month which is not to exceed 25% of the unpaid taxes.

Crypto exchanges based in the US need to report to the IRS.