TLDR

Coinbase staking is one of the best ways to earn passive income with cryptocurrency.

Furthermore, staking operates on a system of getting rewards for holding a specific token to confirm transactions and secure the network.

Coinbase is a safe and secure platform where you can earn rewards on your coin through staking or DeFi yields.

How To Stake On Your Coinbase Account

This is a step-by-step process to start staking with Ethereum on Coinbase.

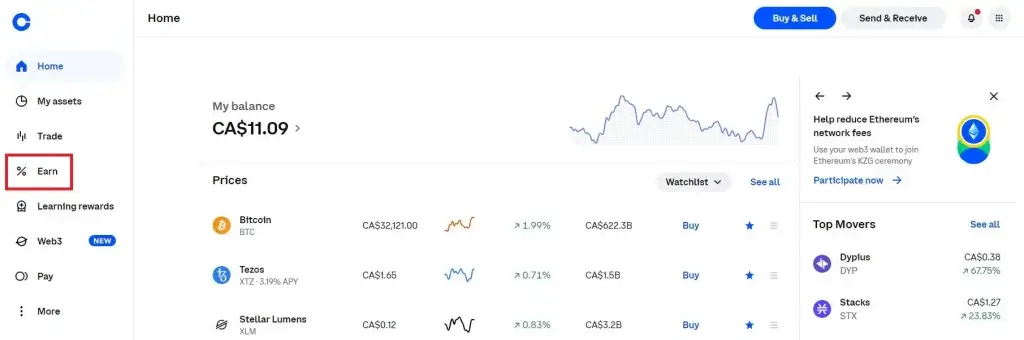

Step 1: Log into your account

Log into your Coinbase account and find the [Earn] tab on each page’s right side. Click on [Earn].

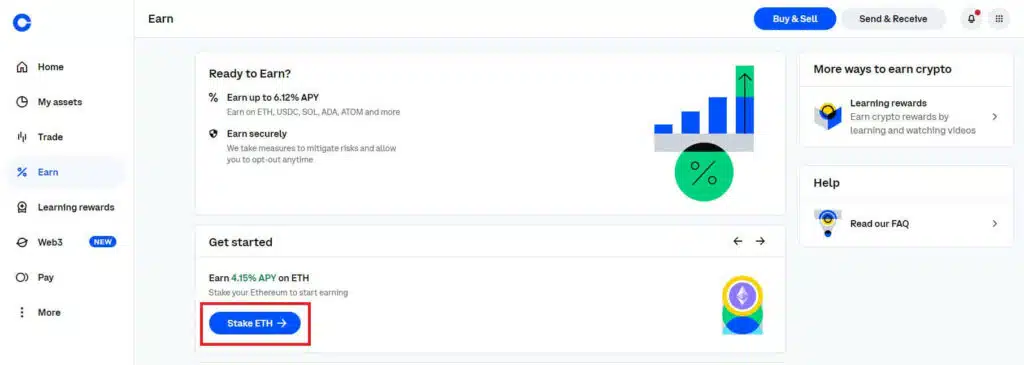

Step 2: Start staking

On the Coinbase Earn page, see the assets available to stake in the [Get Started] box.

Click [Stake ETH]. If you don’t have any staking assets, it’ll show you what you can buy and their staking APY.

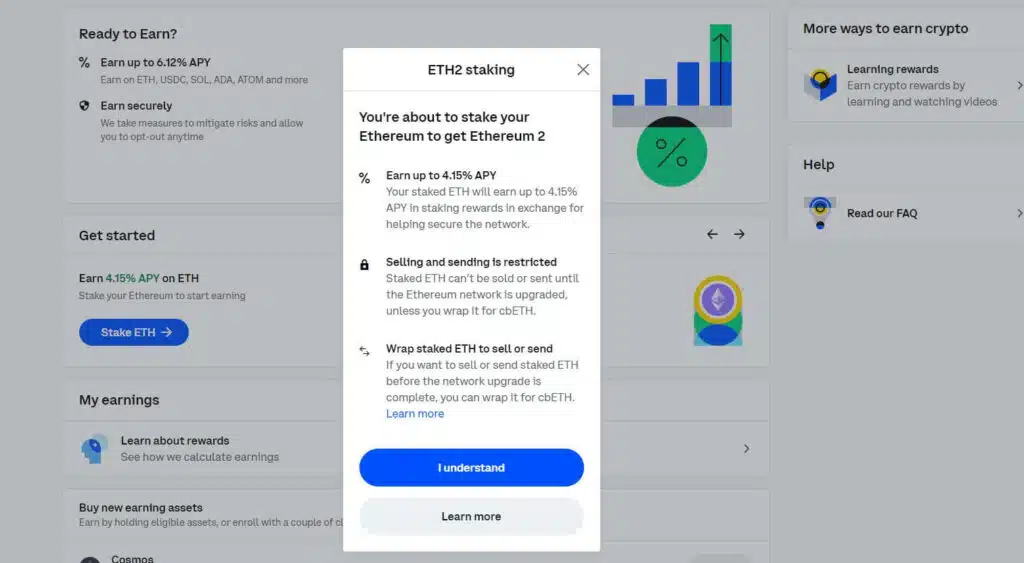

Step 3: Click [I understand]

You’ll see a prompt after clicking [Stake ETH] or another asset. Click [I Understand].

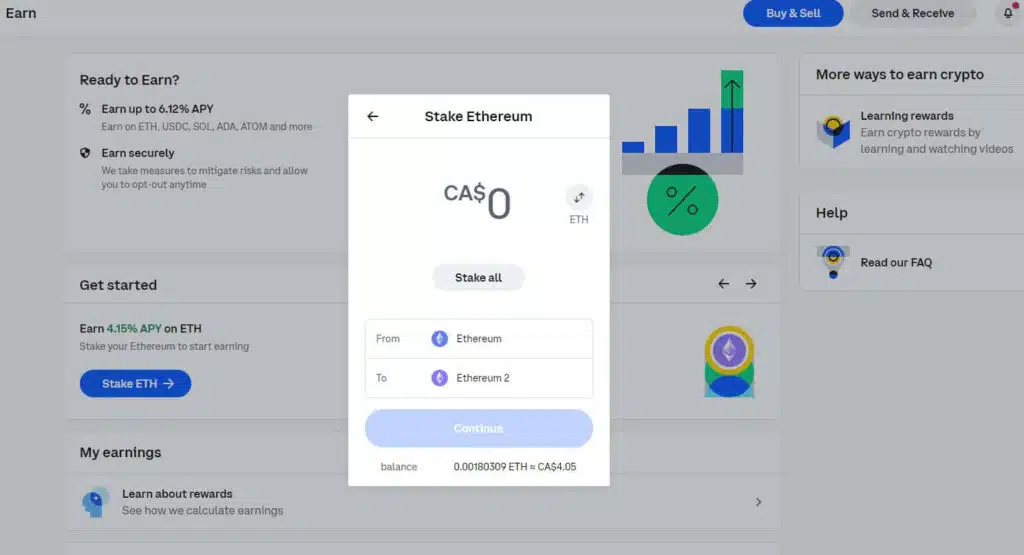

Step 4: Enter the staking amount

Enter how much ETH to stake or click [Stake All] for the full amount.

The process is the same for other assets. Click [Continue] when ready.

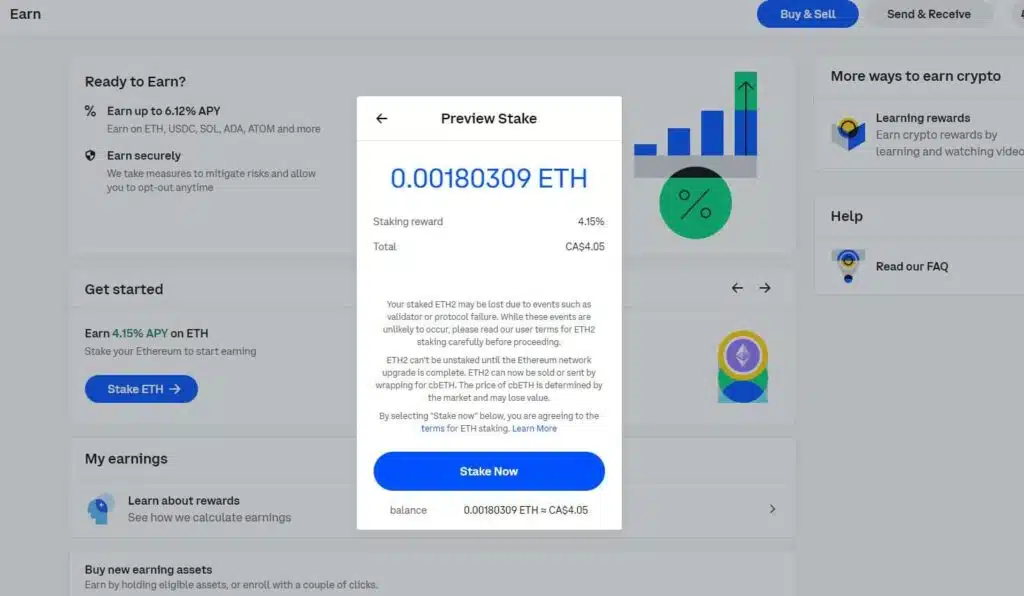

Step 5: Review and stake

Review the staking amount, reward, and terms. Click [Stake Now] when ready.

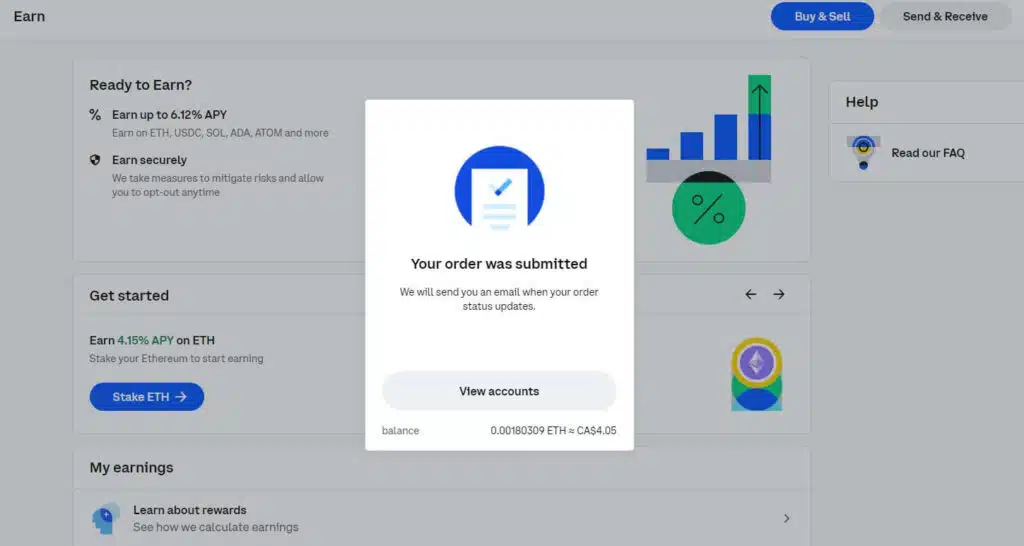

A confirmation appears showing your staking order was submitted to [Coinbase Earn].

Check your earnings on the [Earn] page.

And that’s it! You’re now staking ETH, helping keep its network secure and earning rewards.

At their current rate, you outpace what you’d earn if you held onto cash.

Wrapping Your Staked Eth Assets

Once you’re done staking your eth asset, it is locked in the Ethereum protocol. After that, Coinbase lets you wrap your staked assets in Eth and give you (both).

The cbETH gives you a more flexible range of exchange for your staked assets.

You can sell your cbETH anytime on the Uniswap platform.

However, the market’s volatility of ETH determines the prices for the cbETH., as they are pegget together. Additionally, please note that the cbETH tokens have limitations to specific regions – so make sure your region is eligible.

Wrapping your staked assets in eth assets doesn’t require extra charges on Coinbase. Instead, you are rewarded for simply holding tokens in your Coinbase account.

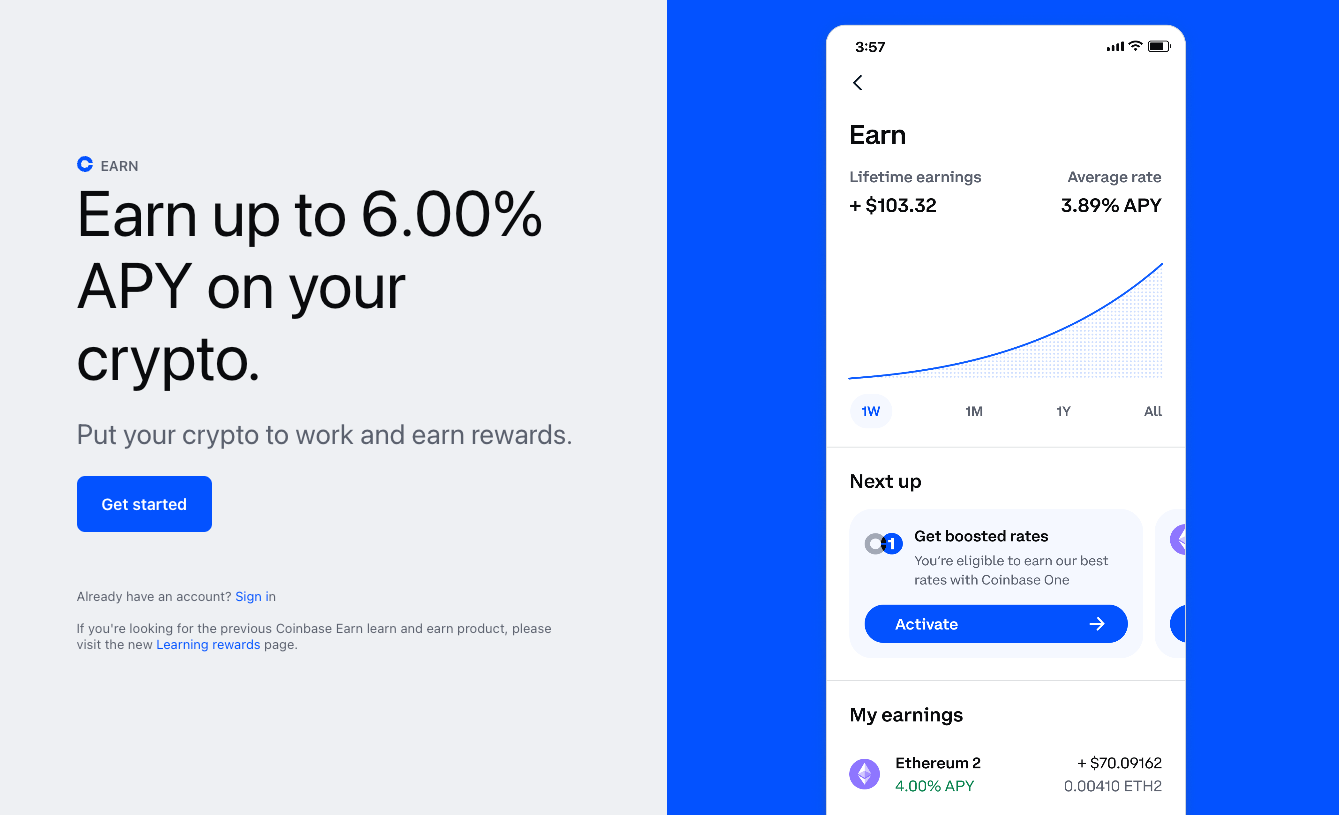

Coinbase Staking Rewards

The two primary reward systems for staking on the Coinbase platform are Staking and DeFi Yields.

Staking rewards on Coinbase

Rewards on the Coinbase platform are for users who leave some tokens in their wallets. The platform uses these tokens to validate transactions without requiring extra effort from the user. This process is easy, simple, and very straightforward.

First Time Staking Rewards

First-time stakers can earn a $10 staking reward on their first $100 Ethereum stake and can earn up to $30 staking rewards.

To earn staking rewards on Coinbase, you must:

- Be a legal resident in any of the 50 states in the US, excluding Hawaii and New York.

- Be new to Staking for rewards on Coinbase.

- Stake at least $100 Ethereum. Anything less than this will not earn staking rewards. Also, users who stake ETH2 are ineligible for staking rewards.

DeFi Yields

DeFi Yield lets eligible Coinbase customers earn Yield by lending their crypto to customers using third-party DeFi protocols. Holders are offered APY according to the market rates and conditions.

However, performing both earning processes can require complex protocols that might be challenging for customers to follow.

However, Coinbase has made it easy that you can gain access to both your staking and DeFi yields with a few clicks on your Coinbase account.

What Cryptocurrencies Can You Stake?

You can stake 104 assets on Coinbase. However, the list is subject to change as SEC sued Coinbase for offering unregistered securities in June 2023.

The list of the most popular assets that can be staked for rewards includes:

| Asset | Est. Reward Rate | How To Earn |

|---|---|---|

| USD Coin | 4.00% APY | N/A |

| Ethereum | 6.00% APY | Staking |

| Solana | 2.40% APY | Staking |

| Cardano | 2.00% APY | Staking |

| Polkadot | 9.77% APY | Staking |

| Cosmos | 17.66% APY | Staking |

| Tezos | 4.82% APY | Staking |

| Avalanche | 7.43% APY | Staking |

| TRON | 3.48% APY | Staking |

One factor determining if you can or cannot participate in the staking rewards process is the kind of coin you hold. Staking is not a system allowed for every coin because of the varying systems each coin operates.

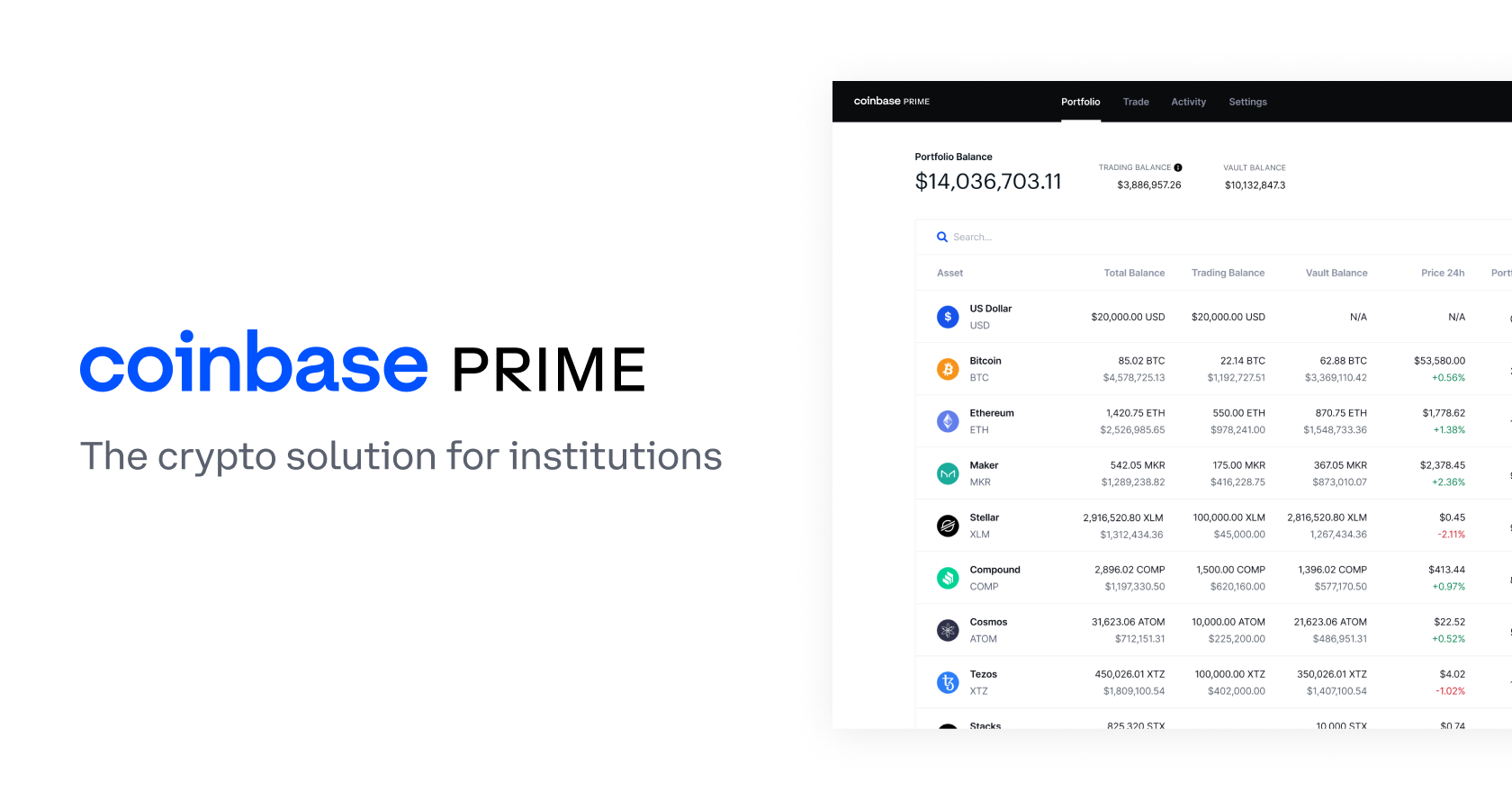

Coinbase Prime

Coinbase Prime is an account service reserved for full-time traders, businesses, brokerages, charity institutions, and investors.

Some of the assets that you can stake and earn payout rewards on include Kusama (KSM), Tezos (XTZ), Cosmos (ATOM), Solana (SOL), Celo (CGLD), Polygon (MATIC), Polkadot (DOT), Ethereum (ETH), and Near protocol (NEAR).

There are also options to stake assets that aren’t on Coinbase on your Coinbase Prime account; you can check this support page for more information on how the processes.

Is Coinbase Prime Worth Trying

Coinbase Prime is a dedicated platform created with several great tools to give you more efficient and better trading results.

Additionally, your crypto assets are kept safe in the Coinbase compound, with highly secure ways to earn rewards.

Every asset stored on Coinbase Prime also enjoys full insurance in case of an unprecedented security breach. As a community manager, business owner, or financial or charity institution, the Coinbase Prime platform helps manage and personalize your transactions with low-risk events. It’s a worthy investment to consider for your business.

It is crucial to recognize the potential risk of losing your staked assets due to slashing, which is a penalty imposed at the protocol level as a consequence of network or validator failure. However, Coinbase has implemented precautions to mitigate this risk.

Staking your ETH on Coinbase is generally considered safe. However, it is important to note the potential risk of slashing, which is a penalty imposed on a validator who fails to fulfill their duties. If you have delegated your stake to such a validator, your delegated ETH may also be subject to slashing.

Staking and unstaking on Coinbase is free of charge, but the platform charges a commission based on the rewards you earn from the network.