Coinrule Review 2024: Is It The Best Crypto Trading Bot?

TLDR

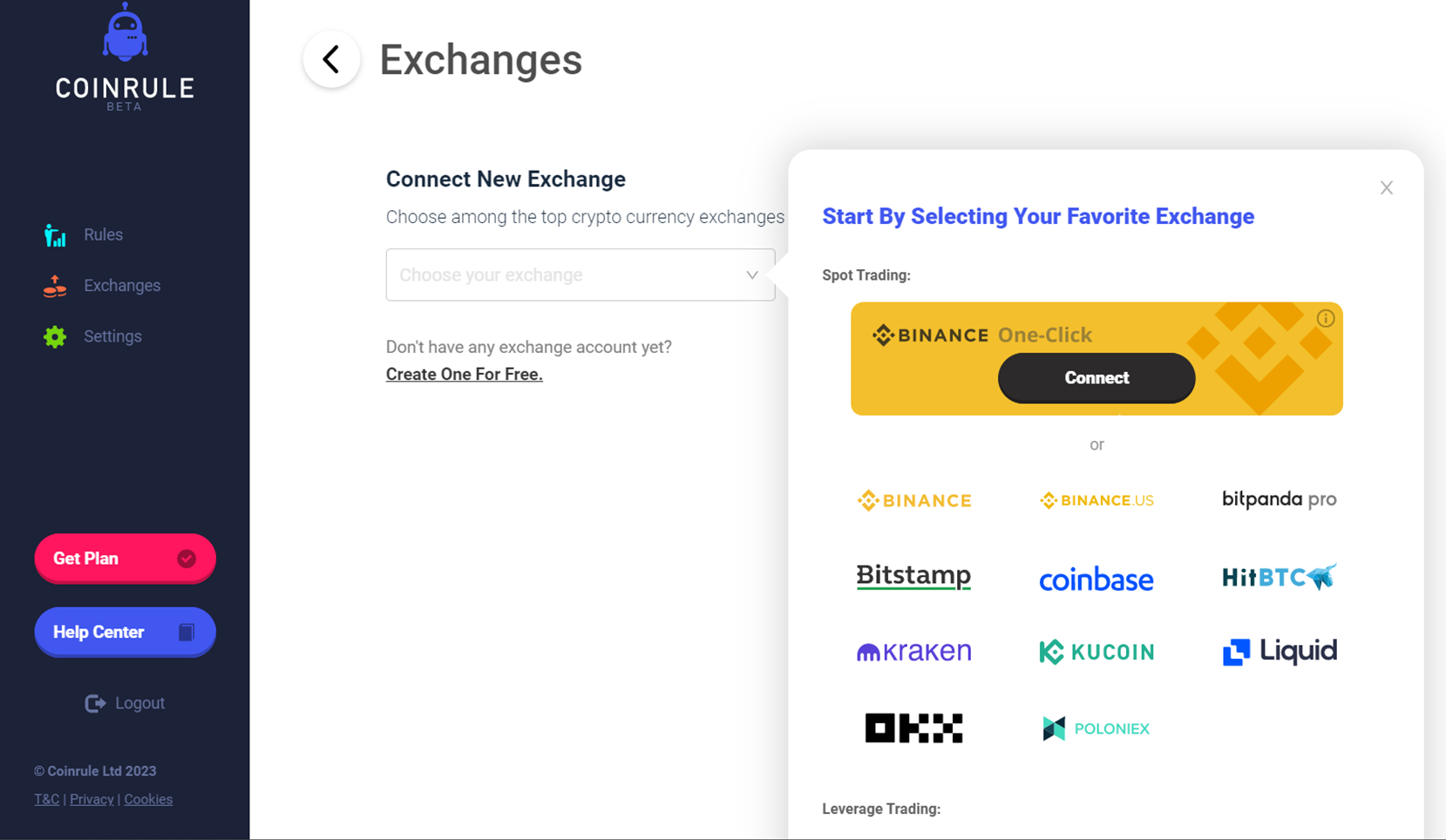

This review will look closely at Coinrule and its features, including supported exchanges such as Binance, Coinbase Pro, Kraken, and Poloniex.

We’ll explore the pre-built automatic rules and show you how to create demo rules without coding expertise. Designed for novice and experienced traders, Coinrule allows users to trade 24/7 without missing a price surge.

Its user-friendly interface makes it an attractive option for anyone looking to enter the world of automated cryptocurrency trading. We have tested it and giving you our experience to learn about one of the most innovative trading tools available today. Let’s dig in.

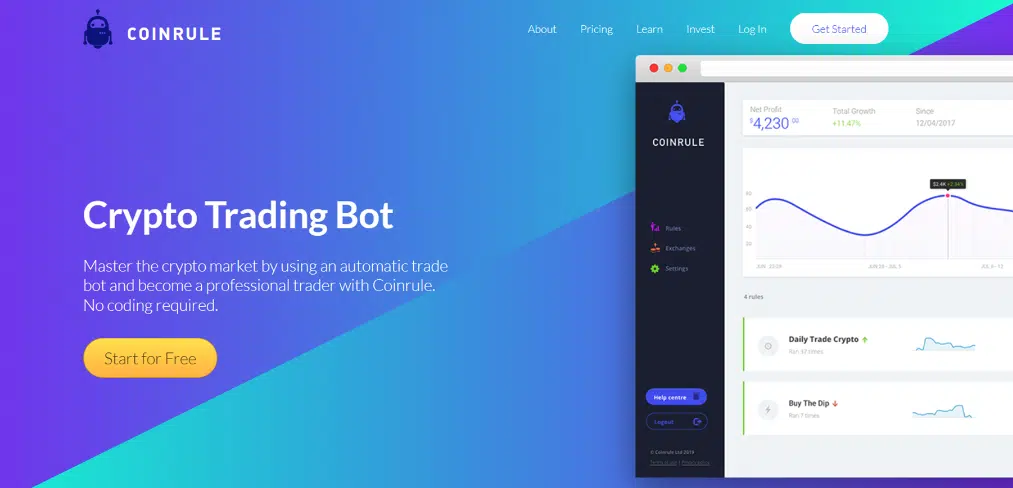

How Does Coinrule Work?

Coinrule is one of the most popular trading bot platforms allowing less technical and experienced traders to execute their preferred strategy. Users can easily create their own using simple If/then prompts if a pre-existing set of rules doesn’t fit their strategy.

Once the setup is complete, transactions will commence on the user’s exchange of choice – Coinrule supports a range of well-known international exchanges.

Additionally, the platform provides the flexibility to customize the execution speed of the rules and trading fees, and traders can take advantage of the weekly updates that include new indicators for more informed trading decisions.

Is Coinrule Safe?

To ensure the system’s security, Coinrule uses multiple encryption methods. Each user’s API key is encrypted in Coinrule with 256-bit AES using a private key generated specifically for them. When the keys are stored on an external device, they are encrypted again using AES-256.

All database/cache node-to-node communications in the web app are conducted using TLS 1.2 or above. Integration of Cloudflare’s content delivery network strengthens the platform’s defenses against distributed denial of service attacks and other types of cyberattacks (CDN).

Coinrule trading bots do not hold, trade, or swap your Bitcoin for any fee. Instead, it links to a curated network of exchanges for digital currencies. Your trades will be carried out in the API interface between their bots and the Bitcoin exchange.

Quick Overview of Coinrule Feature

- Functionality: Coinrule has a user-friendly design with a simple interface. Cryptocurrency traders can deploy rules without coding.

- Technology: Coinrule uses API integrations with over 15 exchanges for fast order execution. The platform uses SMS notifications and encryption for security.

- Range of Tools: Coinrule has a simple rule configuration and offers stop-loss, take-profit, and buy-the-dip/breakout tactics.

- Plans: Coinrule offers a free Starter plan, paid subscriptions Hobbyist plan for $29.99/month, and a Pro plan for $249.99/month.

- Customer Support: Coinrule provides a help center and official blog, with support available through live chat, e-mail, Facebook, or Twitter. FAQs are also available.

How to Get Started on Coinrule?

Adding your account to the Coinrule trading bot is simple; follow the steps below.

More details

Coinrule is an excellent platform with more than 250 automated trading rules and advanced algorithms. One of the significant advantages of Coinrule is that its users don't require coding expertise; thus making it easy to use and highly customizable. However, the absence of a mobile app and the limited number of exchange APIs supported are disadvantages.

-

Minimal fee with no locked commissions.

-

Access to exchanges and marketplaces.

-

Auto trading rule implementation strategies.

-

Access to the 34 best crypto trading bots.

-

Simulated market for testing trading strategies.

-

Decentralized exchanges are not supported.

-

Only supports 40 cryptocurrencies.

-

API integration with only 15 exchanges is available.

-

No mobile app.

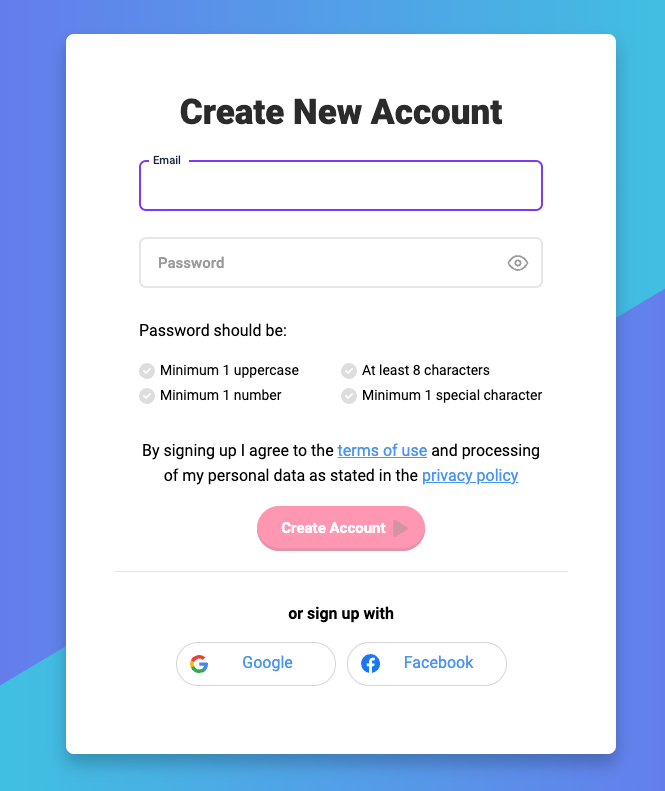

Step 1: Create an Account

Visit the official Coinrule website to sign up.

To join the site, go to the homepage, and select the [Get Started] button in the top right corner. A Google or Facebook account will also suffice for registration.

- A verification e-mail with a code number that must be entered to complete registration will be sent to you after you have submitted your information.

- As part of the procedure, they must Know Your Customer information. Please keep documentation handy.

- The CoinRule staff will check your information and refuse to let you have multiple accounts. Don’t waste time opening a second account if you already have one for foreign currency trading. Try contacting customer service if the old account doesn’t function.

Step 2: Connect an Exchange

If you don’t have an exchange account, our experts recommend Binance. To create an account, click the [Get started] button.

More details

Binance is a great combination of low fees, deep liquidity and multiple cryptocurrencies and trading pairs. We have tested every aspect of it and it STILL holds its reign as the top exchange in the world. In our view, it is the perfect crypto exchange for both newbies and advanced traders alike.

-

Biggest exchange in the world.

-

Industry's lowest trading fees.

-

Advance trading options like leverage trading.

-

600+ crypto options, 150+ for the US.

-

Lucrative on-site staking options.

-

Hiccups in account verification.

-

Less regulated than some competitors.

-

The corporate structure is not transparently.

Once done, click the [Add Exchange] button to connect to your preferred exchange. When selecting Binance, you must provide your personal information and API keys.

Log in to Binance and go to [API Management], then [Create API] to retrieve the keys. After naming your API key and confirming its creation, you can tighten security by modifying the key restrictions.

Finally, return to the Coinrule Dashboard and add the necessary information to complete the API integration process.

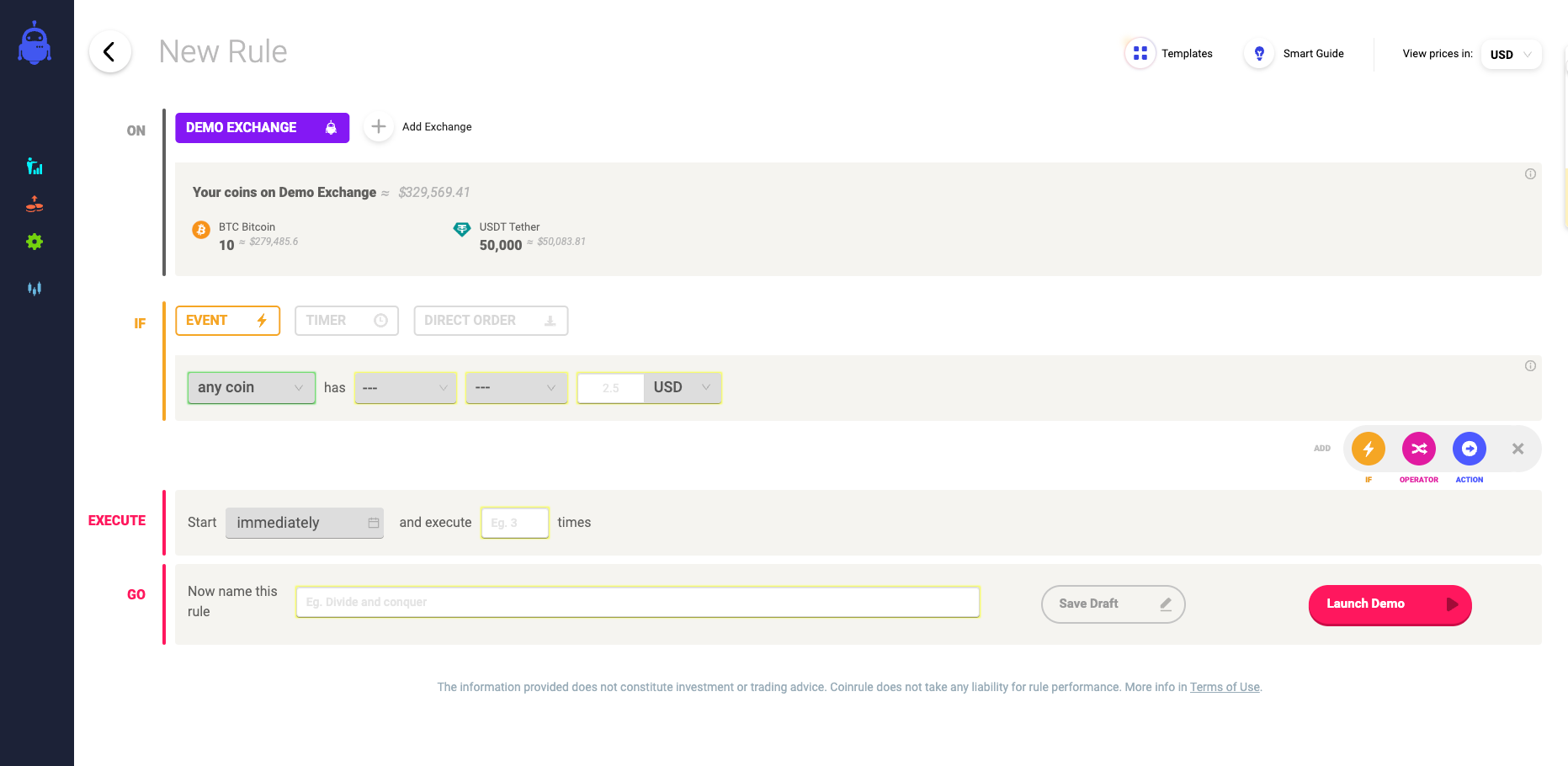

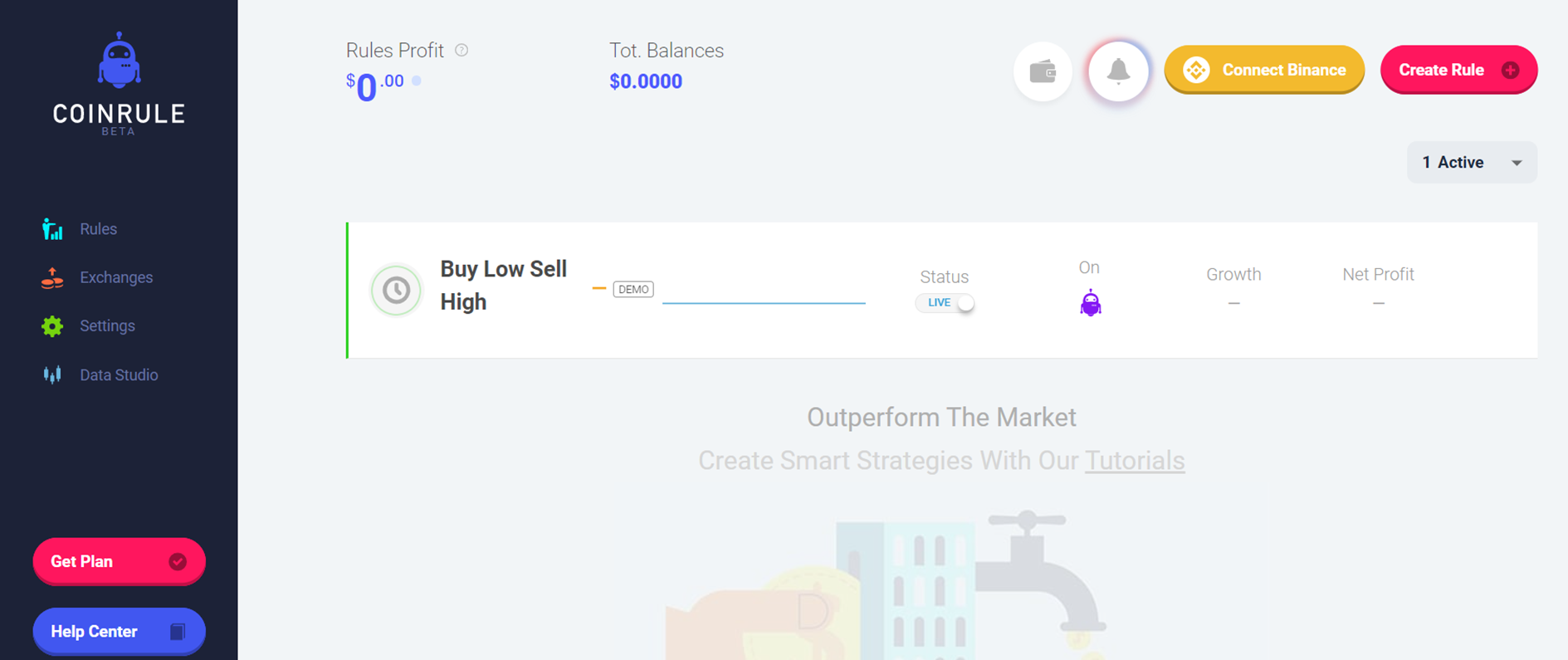

Step 3: Create Your Rule

Strategy development on Coinrule is fun and straightforward. Go to the Dashboard and select the [Create Rule] button on the right side to initiate the process.

Simple [If/Then] conditions can be used for creating trading strategies and own rules that take advantage of market fluctuations with lightning speed.

Before settling on a strategy to trade crypto here, you might want to test several free trading signals to get a feel for the market. Trading bitcoins successfully requires its own trading rules.

For instance, if the price of Bitcoin drops by 15%, you can first select an exchange and then set your buy/sell order.

You can customize the timing for your trades on the [Timer] page.

Before hitting the [Launch] button, ensure that all the conditions of the rule are satisfied by reviewing the tab on the top right of the screen.

Alternatively, you can choose a pre-made plan from the library of trading templates, which will automatically fill in the required information, allowing you to focus on adjusting the settings to your preference.

Coinrule Review: Supported Exchanges

Coinrule allows direct interaction with multiple exchanges using API keys. Over 15 different exchanges are compatible with the automated trading bot platform. These range from the five major A-list exchanges to more niche markets.

The currently supported exchanges are Binance, Coinbase Pro, OKX, KuCoin, Kraken, Poloniex, BitMEX, HitBTC, Bitpanda, Bitstamp, and Liquid.

Some notable outliers exist, including the American exchanges Gemini and Huobi Global. One drawback is that Coinrule doesn’t work with other popular crypto margin trading platforms like ByBit and Deribit.

The Coinrule platform does not support decentralized cryptocurrency exchanges and automated market makers like UniSwap and SushiSwap.

Coinrule Review: Conditions/Triggers

When establishing a crypto trading bot, you must provide the conditions/triggers to launch an activity. Following is a breakdown of these three categories:

- These orders will be dispatched at predetermined intervals.

- If a certain condition holds, then the order will be sent. To enter extra criteria, select the [Add Condition] button.

- By clicking the [Launch] button, you can easily send commanding instructions to the system straightforwardly.

Coinrule Trading Strategies Operators

Operators signify a logical relationship between distinct pieces of the same rule. A total of four dedicated private keys of “operators” exist.

1. THEN Operator

One can define a trading community with at least one action when a predetermined condition activates the strategy. Users can create multiple trading strategies on the platform by combining an initial condition, an action, and a sequential condition and action.

To put it simply, the pattern is BUY-SELL-BUY-SELL, and so on. When establishing such guidelines, you have some leeway in adjusting the parameters.

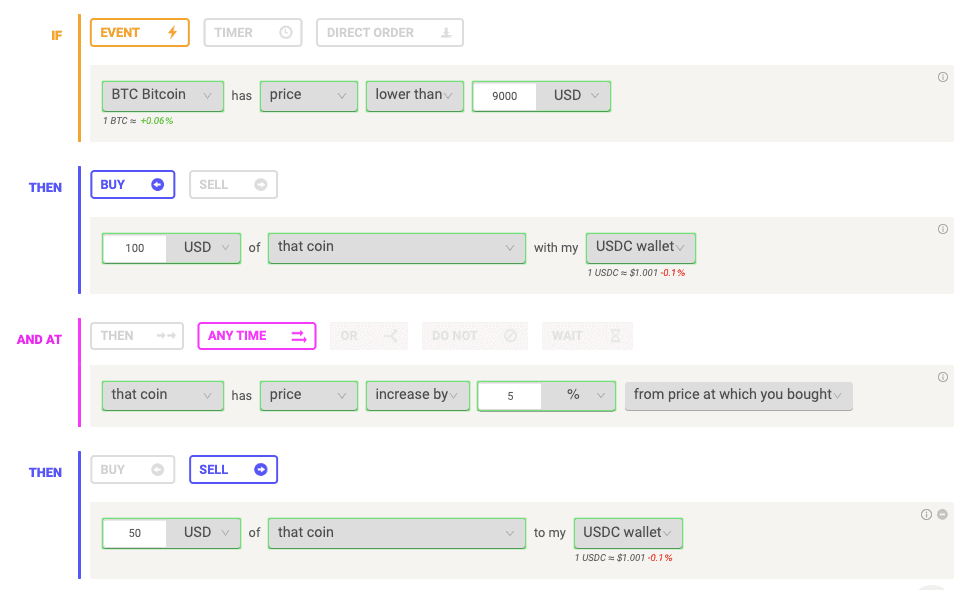

2. ANY TIME Operator

You can develop several approaches for a single rule using the any-time operator. It helps while planning an approach to wealth accumulation. You can limit your time commitment with some savings and a stop-loss order.

The platform executes the first and second parts of a rule concurrently. The first condition does not wait for the second action to run again; instead, it is verified as soon as the first action finishes.

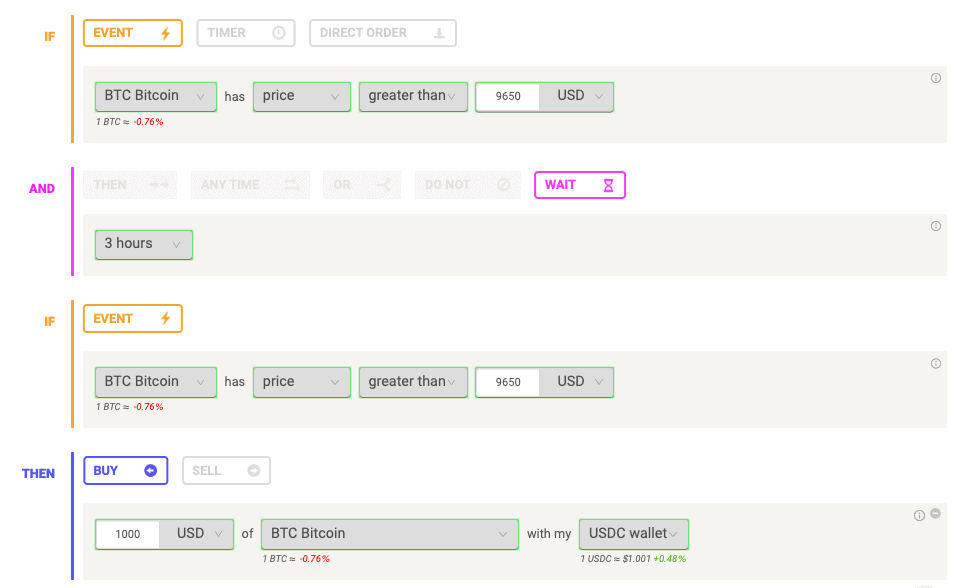

3. WAIT Operator

A false breakout can be avoided with the help of the [WAIT] Operator. Trading in cryptocurrencies is a high-risk endeavor. Waiting for the breakout time to make a purchase or sale could result in a loss if the trend suddenly reverses.

You can prevent this by waiting for the price to meet specific criteria before triggering the rule. Thus, you can monitor the changing market conditions and limit your financial loss.

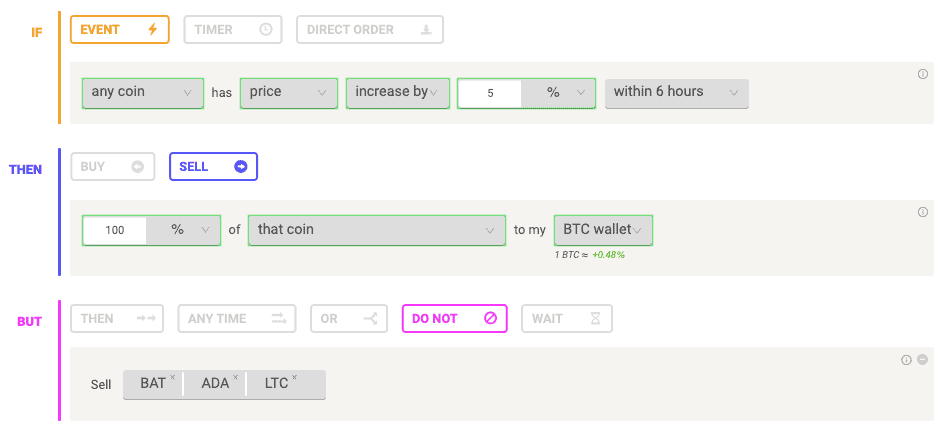

4. DO NOT Operator

With CoinRule, you may isolate your coins used for long-term evaluation from the rest of your hedge funds and trading bots. CoinRule has a [DO NOT] operator to help you avoid trading in unwanted cryptocurrencies. In this transaction, you can opt out of exchanging up to three different coins if you so want.

You can exercise even more command over your monthly trading and monthly trade volume by omitting coins you have no interest in buying with the [DO NOT] operator.

Coinrule Review: Technical Indicators

Technical indicators are mathematical calculations and technical analyses that provide valuable insight into a specific asset’s market trend or condition. Trading strategies can be used to predict an event’s probability and adjusted to produce the desired outcomes.

For example, indicators can determine an asset’s expected price at the end of a designated time frame.

One widely used technical indicator is the Relative Strength Index (RSI). This metric calculates the duration and strength of a price trend by considering the ratio of price increases to decreases.

The RSI measures the strength of an uptrend by evaluating the extent to which upward price momentum surpasses downward momentum.

Coinrule Review: Security for Trading Strategy

To keep its platform and its users safe, Coinrule employs the following security measures:

The Coinrule app encrypts all data transferred between the database, cache nodes, and backend using TLS 1.2 or higher.

A state-of-the-art security technique is used to encrypt the API keys.

The platform associates one private key with one user and utilizes separate data storage for all private keys. In addition, AES-256 encryption has been implemented to secure private keys.

They have joined forces with Cloudflare to shield themselves from distributed denial of service and other forms of cyber attack.

Through your Coinrule account, you can only connect to the exchange wallet with API keys that do not have withdrawal capabilities.

They employ Ukey1 as a trusted authentication gateway partner and don’t save user credentials. Ukey1 employs robust methods to secure users’ private data, including passwords.

Stripe handles all of your monetary transactions and labels them as MITs (Merchant Initiated Transactions). Neither Coinrule nor Stripe will have access to your private payment information under any circumstances.

Coinrule Review: Pricing

Here is a pricing overview:

| Plan | Price Monthly | Price Yearly | Additional Features | Connected Exchanges | Demo/Live Rules |

|---|---|---|---|---|---|

| Starter | Free | N/A | N/A | 1 | 2 |

| Hobbyist | $29.99 | $359 | Advanced Indicators, Trader Community | 2 | 7 |

| Trader/Pro | $249.99 | $2,999 | Ultra-fast data sockets, One-on-one training | Unlimited | 50 |

Starter and Hobbyist

The Starter account allows 1 Connected Exchange, 2 Demo/Live Rules, and 7 Template Strategies and is free for an unspecified time.

The Hobbyist plan includes 2 Connected Exchanges, 7 Demo/Live Rules, and 30 Template Strategies for $29.99 monthly (paid $359 yearly). Each premium plan includes Advanced Indicators and the Trader Community.

Trader and Pro

The Trader and Pro packages offer extra capabilities, including Unlimited Connected Exchanges, 50 Demo/Live Rules, and Unlimited Template Strategies for active traders.

It costs $249.99 a month, or $2,999 annually, and includes ultra-fast data sockets and one-on-one training.

To make a one-time purchase of a year’s worth of service, you must provide your credit card information, and Stripe processes payments.

Coinrule Review: Final Verdict

By establishing or selecting from rules, Coinrule facilitates the automation of trading strategies. A standard trading method used by them is the “if-then” statement. You can practice your trading tactics on their demo platform before committing to them. There is also the option of a no-cost initial free account to familiarise yourself with the interface. In this way, the trading templates facilitate newcomers’ use of crypto bots.

Many trading techniques can be backtested on TradingView with the help of Coinrule. The other steps are to choose the coin to trade, the trading time frame, and the trading technique. Afterward, TradingView will display the total number of transactions opened and closed by experienced traders using the strategy and the expected net profit.

Coinrule lets users trade using rules. They can develop automatic trading rules if no template matches their trading strategy. Your exchange places trades after configuration. Rules can then execute trades as fast as the user desires. New trading options are added regularly to the platform.

Coinrule is a powerful tool that enables traders to follow their crypto strategy without the need to constantly monitor their computer screens. With Coinrule, coding skills are not necessary to benefit from its features, setting it apart from many other trading bots.