What is ISO 20022, and why does it matter for crypto investments? We’ve put our decade of expertise in crypto and legal knowledge to tackle these questions in this guide.

ISO 20022 is a globally accepted rulebook for how financial institutions communicate. By adopting this standard, cryptocurrencies can become a part of global financial systems.

We’ve also done in-depth research to compile the list of ISO 20022-compliant coins in 2024.

What is ISO 20022?

ISO 20022 is a global standard for information exchange that is currently being adopted in the financial sector. Financial institutions may use different messaging formats, such as Swift MT 101 and IFX, as well as proprietary formats.

These variations may hinder transaction processing speed and present challenges along the way.

ISO 20022 offers a universal language for financial messaging. Adhering to ISO standards for electronic payment data helps avoid ambiguity and misunderstandings.

Banks can identify fiat currencies like U.S. dollars and euros with the currency code when processing payments. The Business Application Header field discloses transaction details, including purpose, sender, and receiver.

In today’s financial landscape, there are no ISO codes for cryptocurrencies, and banks cannot differentiate token transactions. By getting Digital Token Identifiers, cryptos could integrate with existing financial systems.

What are the Top 9 ISO 20022 Compliant Cryptos?

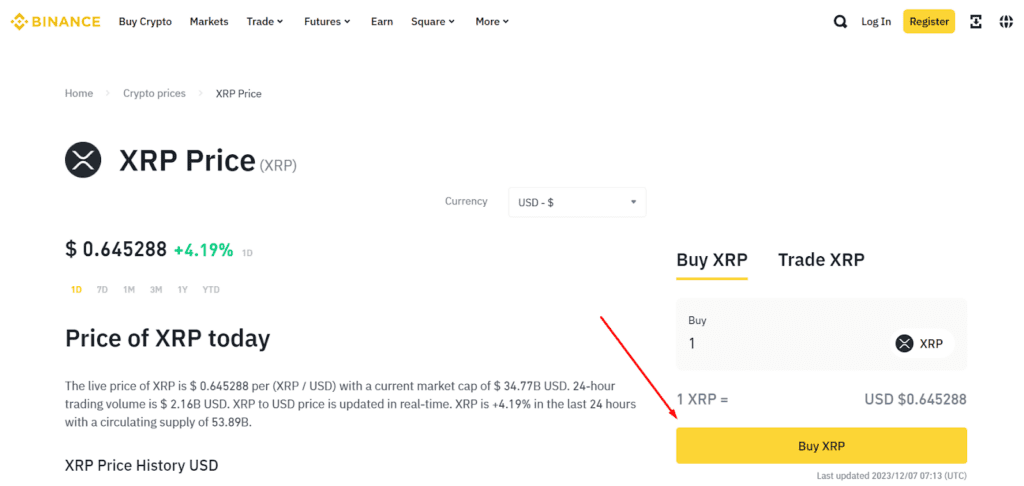

1. XRP (XRP)

Let’s begin our exploration with Ripple, a protocol for efficient cross-border transactions. XRP, its native digital token, is a bridge currency for seamless fiat exchange. It works on the Ripple Protocol Consensus Algorithm (RPCA) which is energy-efficient.

By using the Interledger Protocol (ILP), Ripple cuts settlement times and transaction costs.

As Ripple’s vice president claims, XRP is already ISO-compliant. Centralized financial institutions and payment networks adopt XRP to improve international money transfers. Furthermore, Ripple has recently become an ISO 20022 Standards Body member.

With Ripple making waves in the circles of the largest fintech firms, the community feels bullish about XRP.

Standout Features:

- Ripple’s consensus algorithm helps to avoid energy-intensive mining.

- Ripple’s global transactions are fast and low-cost.

- Ripple.Net streamlines cross-border payments for many financial institutions.

- Ripple partners with the world’s largest financial players to build solutions on XRP Ledger.

2. Cardano (ADA)

Next comes Cardano, a blockchain platform renowned for its scientific approach. As this ecosystem evolves, it relies on evidence-based methods and peer reviews. Cardano runs on Ouroboros, a provably secure blockchain protocol.

To reward network participants, Cardano has incentive mechanisms in place. You can stake your tokens and participate in governance as an ADA holder.

ADA has all the potential to become a part of the global financial system. Given Cardano’s research-driven approach, it’s no wonder that it’s ISO-compliant. Its robust ecosystem tackles blockchain limitations like scalability and connectivity.

Standout Features:

- The Cardano ecosystem thrives on academic collaboration and peer-reviewed research.

- Cardano’s protocol uses mathematically verified mechanisms to guarantee security.

- Cardano’s energy efficiency is 4 million times greater than Bitcoin’s.

- ADA holders can stake their tokens or operate stake pools to earn rewards.

3. Stellar (XLM)

Moving on to Stellar, a platform for quicker and cheaper cross-border payments. It connects a decentralized blockchain with a global ecosystem of innovators. Its native digital currency, Stellar Lumens (XLM), has low costs and near-instant settlement times.

Stellar stands out for its focus on financial inclusion. With Stellar, you can create, issue, and manage digital assets. Furthermore, you can trade cryptos on its decentralized exchange. Stellar’s connectivity and speed of cross-border transactions make it ISO 20022-ready.

Standout Features:

- The Stellar Consensus Protocol enables swift and low-cost cross-border payments.

- Stellar Lumens (XLM) is a bridge currency for efficient value exchange.

- The platform allows for creating and managing digital assets.

- The network’s DEX offers seamless cryptocurrency trading.

4. Algorand (ALGO)

Our next pick is Algorand, a blockchain designed to speed up transactions. Unlike Bitcoin’s energy-intensive mining processes, Algorand is notable for its eco-friendly approach. ALGO, Algorand’s native token, enables transactions and participation in governance.

The platform opts for the Pure Proof of Stake (PPoS) consensus algorithm, which is accessible to everyone. This approach simplifies block creation by relying on validators’ agreement for content inclusion.

Being well-suited for handling global payments, Algorand is all set to embrace ISO 20022.

Standout Features:

- ALGO’s settlement finality is 3.3 seconds, and its processing speed is 10,000 TPS.

- Algorand features minimal energy consumption and a carbon-neutral footprint.

- The security measures include Pure Proof of Stake (PPoS) consensus with VRF technology.

- Algorand ensures transparent decision-making through decentralization and governance.

5. Hedera HashGraph (HBAR)

Now, we are focusing on Hedera, an enterprise-grade public network built with scalability in mind. Hashgraph, its consensus algorithm, ensures quick and affordable transactions. It has become possible through fast consensus and low energy consumption.

As an HBAR token holder, you can participate in staking and earn rewards. For developers, Hedera provides an open-source codebase and ecosystem standards.

Hedera’s fast transactions and the network’s scalability conform to ISO standards.

Standout Features:

- Hedera stands out for its high throughput and finality of up to 3.48 seconds.

- A Hedera transaction will cost you as little as $0.0001 on average.

- Hedera’s governing body comprises corporations, universities, and Web3 projects.

- Hedera’s open-source codebase promotes dApps and smart contract development.

6. Quant (QNT)

Moving on to Quant, a crypto project designed to link different blockchains efficiently. To achieve it, Quant introduced the Overledger Network, the world’s first blockchain operating system. Overledger is a kind of connector that helps networks interact with each other.

QNT is the utility token within the ecosystem used to pay transaction fees and access services. It’s also a governance tool giving holders a say in the project’s future.

Quant’s ISO compliance lies in its interoperability, enabling seamless data exchange across networks.

Standout Features:

- Overledger, an operating system by Quant, connects and interacts seamlessly with blockchains.

- Integrations within the same blockchain environment promote cross-project collaboration.

- In Quant, deploying new tokens, moving them across chains, and adjusting smart contracts as needed is easy.

- You don’t have to be tech-savvy to use Overledger.

7. XDC Network (XDC)

Now, let’s explore XDC Network, a hybrid blockchain solution tailored for trade finance. It merges the best of the two worlds: the openness of public chains and the security of private domains.

XDC Network offers fast global and domestic payments, low costs, and an infrastructure for dApp development. It supports ISO 20022 with smart contracts, speed, scalability, low fees, and high security.

The blockchain features interoperable smart contracts and seamlessly integrates with other networks. The XDC token enables you to access the project’s services and participate in staking and governance. With real-world use cases such as global trade, XDC holds growth potential.

Standout Features:

- XDC Network is a layer 1 blockchain compatible with Ethereum Virtual Machine (EVM).

- The blockchain unites the advantages of both public and private states.

- XDC Network can process transactions in 2 seconds, with over 2,000 TPS handled

- It runs on the XinFin delegated Proof-of-Stake consensus algorithm and ensures fast confirmations.

8. IOTA (IOTA)

Let’s focus on IOTA, a crypto project tailored to the Internet of Things (IoT). It employs Tangle, a directed acyclic graph (DAG) structure for speedy and scalable transactions. Unlike sequential blockchains, Tangle allows for parallel transaction processing.

Furthermore, IOTA’s transaction validation system doesn’t need blocks and miners. Within this network, microtransactions happen super-fast. What’s more, all IOTA transactions are feeless.

With smooth data transfers and secure interactions between IoT devices, IOTA is ISO 20022-ready.

Standout Features:

- IOTA is a low-energy network designed specifically for IoT devices.

- It doesn’t need miners or blocks to validate transactions.

- Through parallel transaction processing, IOTA’s Tangle ensures fast confirmations.

- IOTA transactions incur zero fees, regardless of the sum you’re sending.

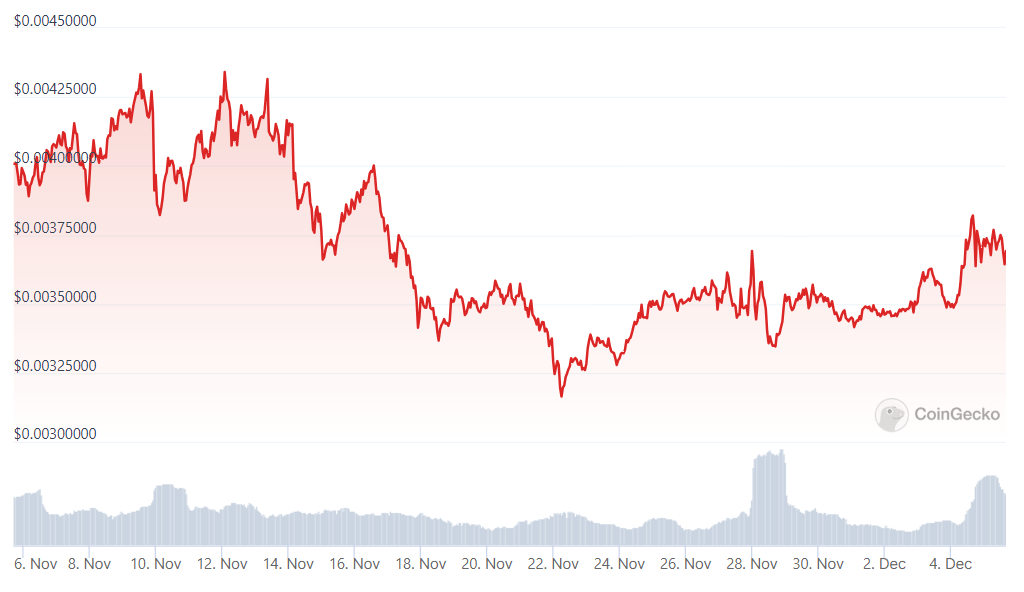

9. Verge (XVG)

Lastly, let’s delve into Verge, a cryptocurrency created for everyday payments. You can send and receive digital funds through easy-to-use vPay apps. vergePay wallets are compatible with various platforms, both desktop and mobile.

As an open-source project, Verge benefits from the community of developers across the globe. It runs on advanced privacy protocols, so nothing will reveal your sensitive data when transacting.

With cross-platform support, fast transactions, and low fees, XVG could see global mainstream adoption. Accessibility and user-centricity have made Verge ISO-compliant.

Standout Features:

- Verge emerged as a virtual currency for your everyday transactions.

- It’s an open-source project that thrives from the input of the global community.

- Verge offers user-friendly wallets compatible with iOS, Android, MacOS, Windows, Linux, and more.

- Verge ensures privacy through Tor and I2P protocols.

What are The Benefits of ISO 20022 Compliance?

Regulatory Compliance

First, compliant cryptos have a better chance of getting the regulatory green light. Ultimately, it would help build trust with government bodies and the community.

Adoption by Financial Institutions

Next, ISO-compliant tokens can step into the traditional finance scene. With ISO codes, virtually all financial institutions would identify them when handling payments.

After tapping into centralized bank services, digital coins could go big worldwide. Expect crypto payments from top financial services like Mastercard or Visa.

What’s more, compliant cryptos could become digital reserve currencies. Or, these tokens could join the payment systems run by central banks.

Transparency and Interoperability

ISO 20022 simplifies financial messaging by giving everyone a universal standard. This approach leaves no room for mistakes in payment processing. After its adoption, moving funds across networks and systems could become a breeze.

Efficient Cross-Border Transactions

ISO 2022-compliant coins can boast lightning-fast transactions. Banks and other financial institutions could smoothly process crypto payments using a global financial standard.

By fostering cross-border payments, ISO 2022 can further replace SWIFT, a protocol many payment processors use.

Customer and Investor Credibility

Integrating cryptos into traditional financial systems would drive their popularity. Greater adoption means greater trust in these digital currencies. With a positive market sentiment, such assets could add value to your portfolio.

Cost-Efficiency

With ISO-compliant tokens, transaction processing would become cheaper. Why is that?

Both the cryptocurrency and payment processors speak the same financial language. No need to spend resources on decoding sophisticated formats anymore.

What Makes a Coin ISO 20022 Compliant?

What does it take for a crypto project to become ISO 20022 compliant?

There is a compliance checklist by the ISO 20022 Registration Authority and Technical Support Group. To get an approval, coins must tick the following boxes:

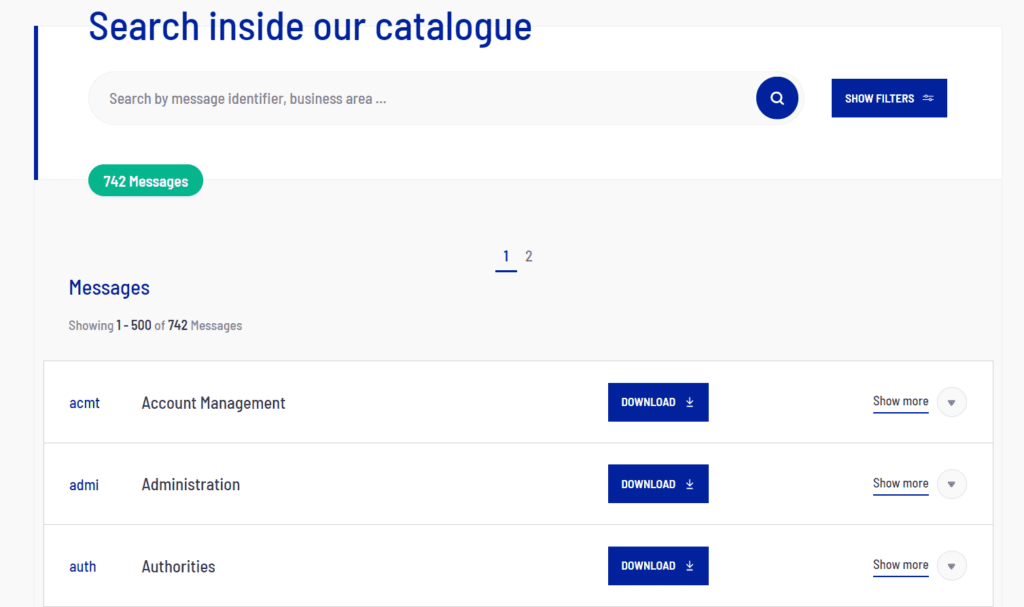

- Message Definitions: All financial messages must adhere to ISO 20022 message definitions. You can find these standards in the catalog of messages on the ISO 20022 website.

- Business Transactions: ISO defines them clearly when it comes to business transactions. To ensure ISO 20022 compliance, payment communication should align with these definitions.

- Message Structure and Content: Next are the structure and content rules for financial messaging. ISO 20022 compliance contenders must tailor their messages to these standards.

- ISO 20022 Constraints: ISO limits the data types used, maximum message length, and values allowed. Compliant coins must respect these constraints.

- Code Values: ISO has a list of codes registered and kept up-to-date. For ISO 20022 compliance, all messages in transactions must use these codes.

- Business Application Header: ISO 20022 messages must use a special Business Application Header. It has a predefined structure and reflects the message type, sender, and receiver.

- Supplementary Data Extensions: Need to include extra data not governed by ISO 20022? Supplementary Data Extensions will come in handy. This additional information should align with the ISO rules.

What are ISO Standards?

ISO standards are the guidelines set by the International Organization for Standardization (ISO). ISO develops international standards for various industries, including the financial sector.

Here are the key reasons for businesses and organizations to adopt these standards:

- Quality Assurance: ISO standards help companies showcase compliance with crucial criteria. For instance, ISO 9001 signifies a company’s commitment to ensuring quality.

- Environmental Responsibility: With a global sustainability focus, ISO 14001 standards come into play. These standards outline criteria for organizations to reduce environmental impact. Following ISO 14001 can give your company an edge.

- Handling Industry-Specific Standards: Certain industries rely on ISO standards tailored to their specifics. Such standards include ISO/IEC 27001 for information security and ISO 26000 for social responsibility.

- Global Compatibility: ISO standards make many markets compatible, which is crucial for sectors like IT. Following the same guidelines, projects can interact effectively since everyone is on the same page.

- Fostering Global Trade: ISO standards provide a common language in global trade. Using universal messaging simplifies international transactions and partnerships.

A Checklist for Seamless ISO 20022 Transition

When migrating from existing protocols to ISO 20022, crypto projects need to consider the following key aspects:

- Payment Infrastructure Readiness: Ensure the readiness of the existing financial infrastructure. Check software, hardware, and the ability to handle messages in the correct format.

- Regulatory Compliance: Ensure legal compliance. Check if your financial systems adhere to laws and regulations.

- Data Security: Prioritize data security to protect customer data during financial transactions.

- Implementation Costs: Evaluate the cost of migration to ISO 20022. Account for all the nuances to see if it fits into the company’s budget.

- Program Governance and Support: Establish a plan for managing the ISO 2022 adoption program. Assign a dedicated team, set up tracking and reporting processes, and train your staff.

- Strategic Benefits: Assess the strategic benefits of ISO 20022 implementation. Break down the expected cost savings, increased efficiency, and other KPIs.

- ISO 20022 Crypto List Benefits: Getting into the ISO 20022 Crypto List would help build trust among investors. The ISO-compliant status would showcase adherence to specific standards.

- Training and Resources: Ensure your team uses the ISO 20022 protocol effectively. Provide easy access to resources like manuals and FAQs for successful implementation.

- Client Education: Inform your clients about the upcoming changes to the payment infrastructure. Highlight the potential risks associated with ISO 20022, if any.

- Managing New Data: Be ready to manage new data or data fields required by ISO 20022. Organize processes and prepare systems for handling this information in advance.

How Will ISO 20022 Implementation Impact Different Industries?

Financial Entities

ISO 20022 could simplify the operations of banks and payment networks. With a global standard, financial institutions can reduce manual work and eliminate human errors.

The transition to this format may bring regulatory demands on certain transaction types. Furthermore, adopting ISO 20022 may involve costly tech upgrades and staff training.

Businesses

If you’re in business, ISO 20022 could bring you speedy transactions and access to rich data. Enriched data makes it easier to check your company’s financial health.

Note that tech investments and workforce training are part of the ISO 20022 adoption journey.

Infrastructure Providers

Now, what about infrastructure players like Stock exchanges and payment providers? Moving to ISO 20022 would speed up the transactions and make interactions more efficient.

What’s more, the unified format could help in risk management. With things being transparent, it’s easier to see what’s going on in the market.

Tech Solution Providers

With massive ISO 20022 adoption, tech providers will enrich their offerings. Financial entities could outsource custom ISO-focused solutions development to software pros.

Financial innovations will come as the industries are waiting for the new format. We can expect to see powerful apps and services tailored to ISO 20022.

Regulators

For those who set the rules, ISO 20022 offers a better view of the financial infrastructure. With a universal standard in place, regulators can oversee the industry effortlessly.

Since ISO 20022 is their favorite, regulators may push for standardization in some areas.

Where to Buy ISO 20022 Coins?

You can buy ISO 20022 coins through centralized and decentralized exchanges (dexes).

Some of the top-rated centralized exchanges include Binance, and OKX.

More details

Binance is a great combination of low fees, deep liquidity and multiple cryptocurrencies and trading pairs. We have tested every aspect of it and it STILL holds its reign as the top exchange in the world. In our view, it is the perfect crypto exchange for both newbies and advanced traders alike.

-

Biggest exchange in the world.

-

Industry's lowest trading fees.

-

Advance trading options like leverage trading.

-

600+ crypto options, 150+ for the US.

-

Lucrative on-site staking options.

-

Hiccups in account verification.

-

Less regulated than some competitors.

-

The corporate structure is not transparently.

For decentralized exchanges, consider dYdX, Kine, or Uniswap.

On platforms like Binance, you can buy digital coins with fiat money and crypto. Dexes, in turn, support only crypto-to-crypto exchange.

Not sure which type of platform suits you best? Check out this guide on centralized vs decentralized exchanges to make an informed choice.

ISO 20022 sets the universal messaging standards within the existing financial systems. By using globally accepted language, it simplifies communication between participants. With ISO 20022 adoption, cryptocurrencies can pave their way into centralized banking.

As a rule, crypto projects announce their compliance with ISO 20022 on their corporate resources. Check the project’s website and social media channels to stay updated.

The community and investors generally consider ISO 20022-compliant coins as more reliable. Note that security is a matter of technology and protocols used. An audited smart contract speaks of the project’s safety better.

Coins that follow ISO 20022 rules tend to have lower fees. With standardized data exchange, there is no need for decoding complex messages. Thus, financial transactions become faster and cheaper.

ISO compliance alone doesn’t guarantee you substantial returns on your investments. The cryptocurrency market is volatile, and many factors may impact the coin’s value. Keep an eye on the project’s roadmap, market sentiment, news, and government regulations.