TLDR

With the rising costs and challenges of cryptocurrency mining, staking coins has emerged as a new and popular way to grow your crypto assets. By staking your tokens, you can earn a return on investment (more crypto), help secure networks, and support new projects.

You’re in luck if you’re interested in staking and want to learn more about the process. This guide will provide a comprehensive guide to staking on Kraken, covering everything you need to know from start to finish. And if you have any questions along the way, we’ll answer them. So, keep reading to discover how staking can help you grow your cryptocurrency holdings.

Staking at Kraken

Staking has become one of the most popular activities among crypto enthusiasts, second only to trading. While staking is not a new concept in decentralized finance (DeFi), it has gained popularity and accessibility in recent years due to the maturation of Proof-of-Stake technology and the rise of staking cryptocurrency exchanges.

Kraken staking is no exception, allowing users to participate in this exciting and lucrative activity.

Kraken Staking: On-Chain VS Off-Chain Staking

For Kraken, there are two types of staking — on-chain and off-chain Kraken.

On-chain staking refers to holding and locking up coins directly on the blockchain (Kraken crypto exchange in this case) to participate in the network’s consensus mechanism and earn yearly rewards.

The staked coins are stored in a wallet directly connected to the blockchain (Kraken), and the staking process is managed directly on the blockchain.

On the other hand, off-chain staking refers to delegating staking your crypto assets to a third-party service. In this approach, the user transfers their coins to the service, which performs the staking on their behalf.

The user still earns rewards, but they do not need to manage the staking process directly.

Kraken’s off-chain feature is geo-restricted. You have to be from a non-restricted country to qualify for this service.

It’s also worth noting that Kraken’s interest rates and rewards for off-chain staking are often far lower than those for on-chain participation. Off-chain staking has several advantages, including more liquidity and the ability to stake various conventional and digital assets, including Bitcoin, USD, and EUR.

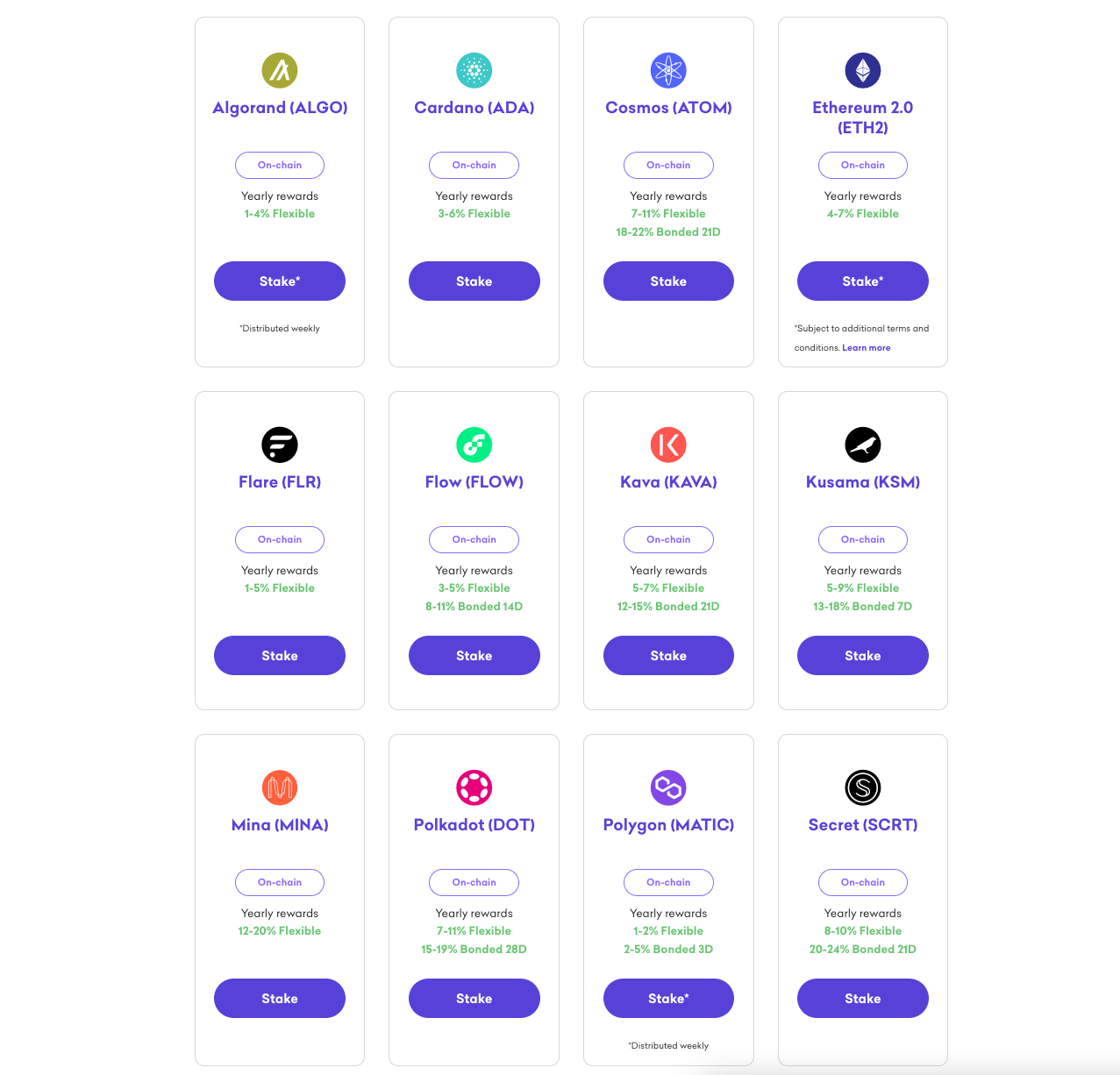

Which Coins Can I Stake on Kraken?

On Kraken, you can stake a variety of tokens, most of which include;

- Kusama (KSM)

- Flow (FLOW)

- Polkadot (DOT)

- Tezos (XTZ)

- Cosmos (ATOM)

- Kava (KAVA)

- Polygon (MATIC)

- Secret (SCRT)

- Solana (SOL)

- The Graph (GRT)

You can buy these tokens directly on the Kraken website using deposited fiat dollars or exchanging already-owned cryptocurrency.

You can also stake Bitcoin, Euros, and Dollars off-chain if you qualify for off-chain staking services.

How to Stake Crypto on Kraken

Here’s a step-by-step guide on investing in cryptocurrencies on the Kraken platform.

To begin staking coins, you must create an account on the Kraken Crypto exchange.

More details

Kraken Exchange offers a robust platform for serious crypto traders. It stands out with its diverse coin selection, advanced trading features, and competitive fees. However, its complex interface may prove challenging for beginners. Strong security measures further reinforce its reliability.

-

Margin trading and staking.

-

Support/chat is one of the best.

-

Low trading fees to withdraw Bitcoin (BTC).

-

Provides tons of resources for learning.

-

Only a few fiat currencies.

-

Doesn't accept debit cards or Paypal.

-

Has three apps.

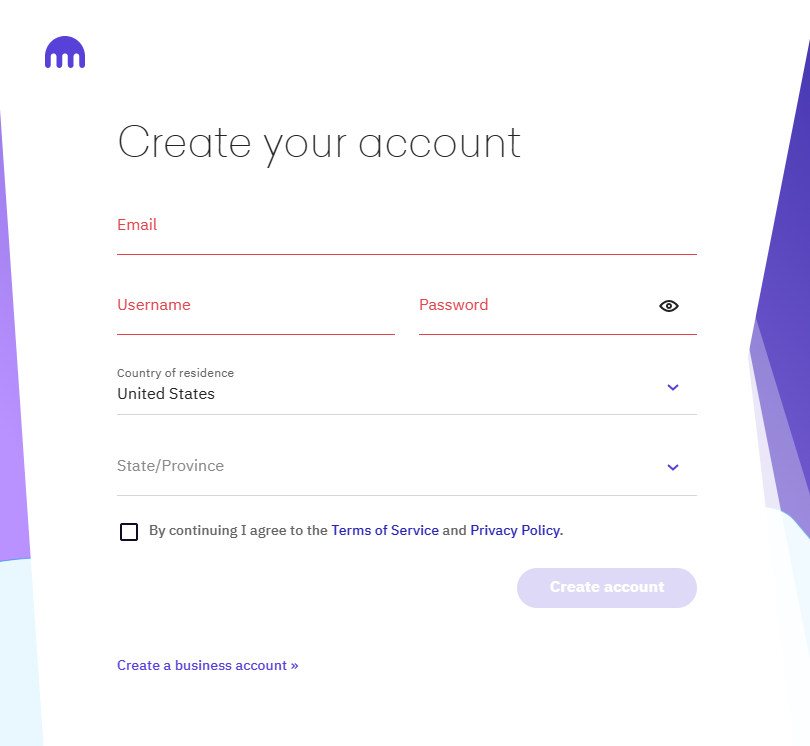

Step 1: Visit the Kraken website

Go to the Kraken website and click the [Sign in] button in the top right corner.

Step 2: Provide your personal information

Fill out the sign-up form with your personal information, including your full name, e-mail address, and a secure password. You must also agree to Kraken’s terms of service and privacy policy. Click “Create account.”

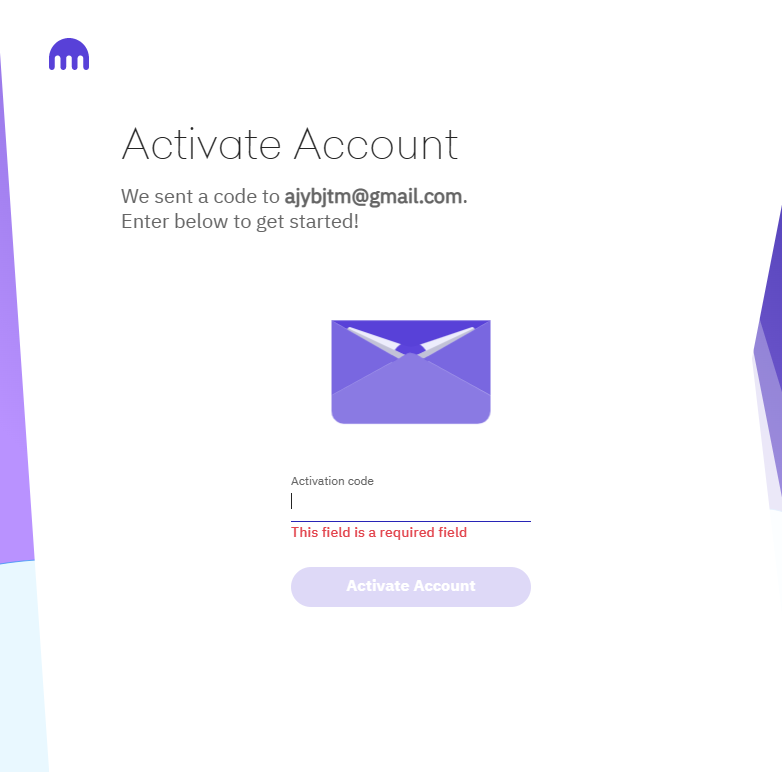

Step 3: Verify your email address

Kraken will send a verification e-mail to the address you provided. Follow the instructions in the e-mail to verify your account.

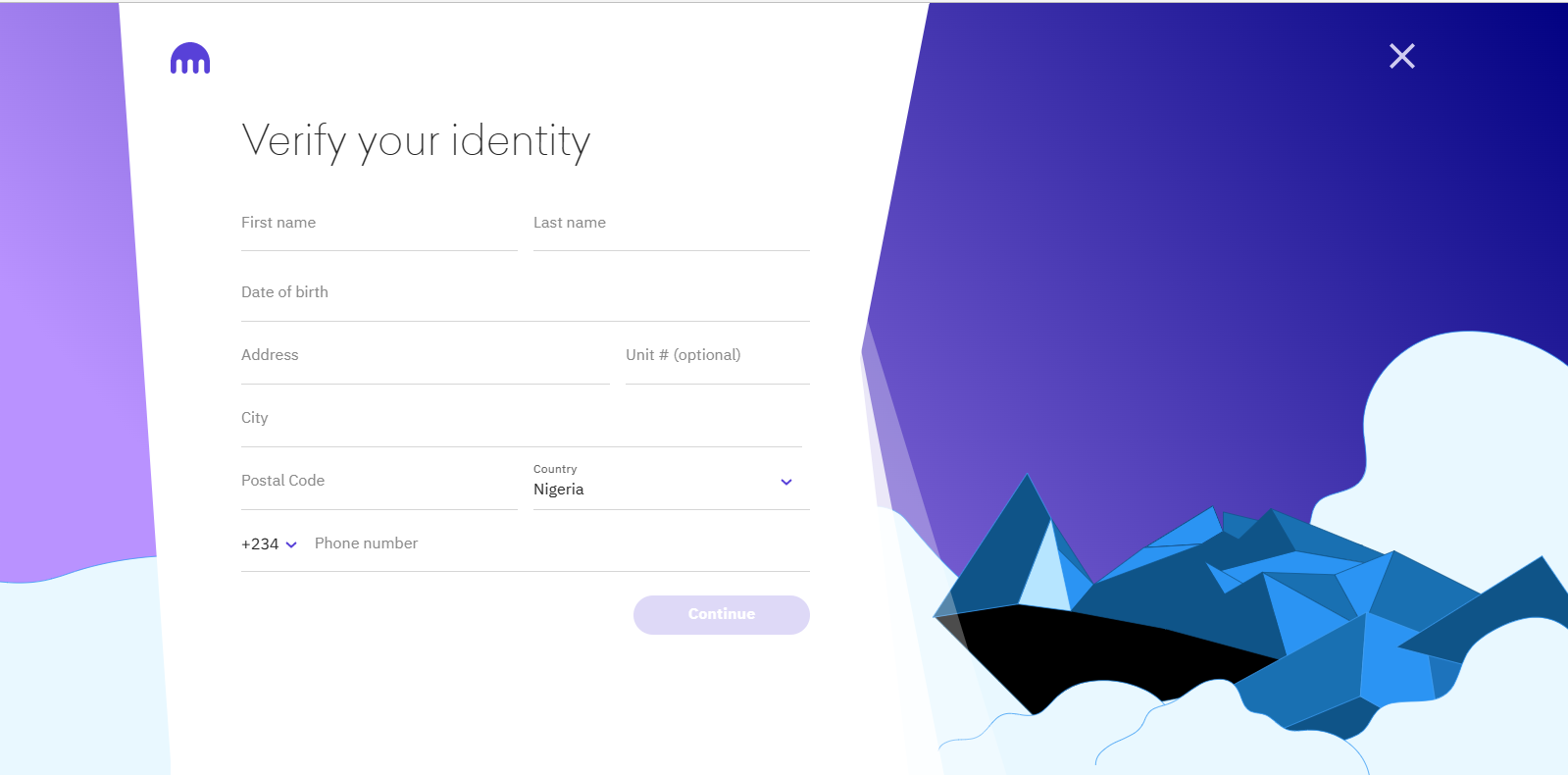

Step 4: Complete the KYC verification process

To complete the verification process, you must provide additional information, including your address and a government-issued ID.

Kraken will use your information to verify your identity and comply with anti-money laundering regulations.

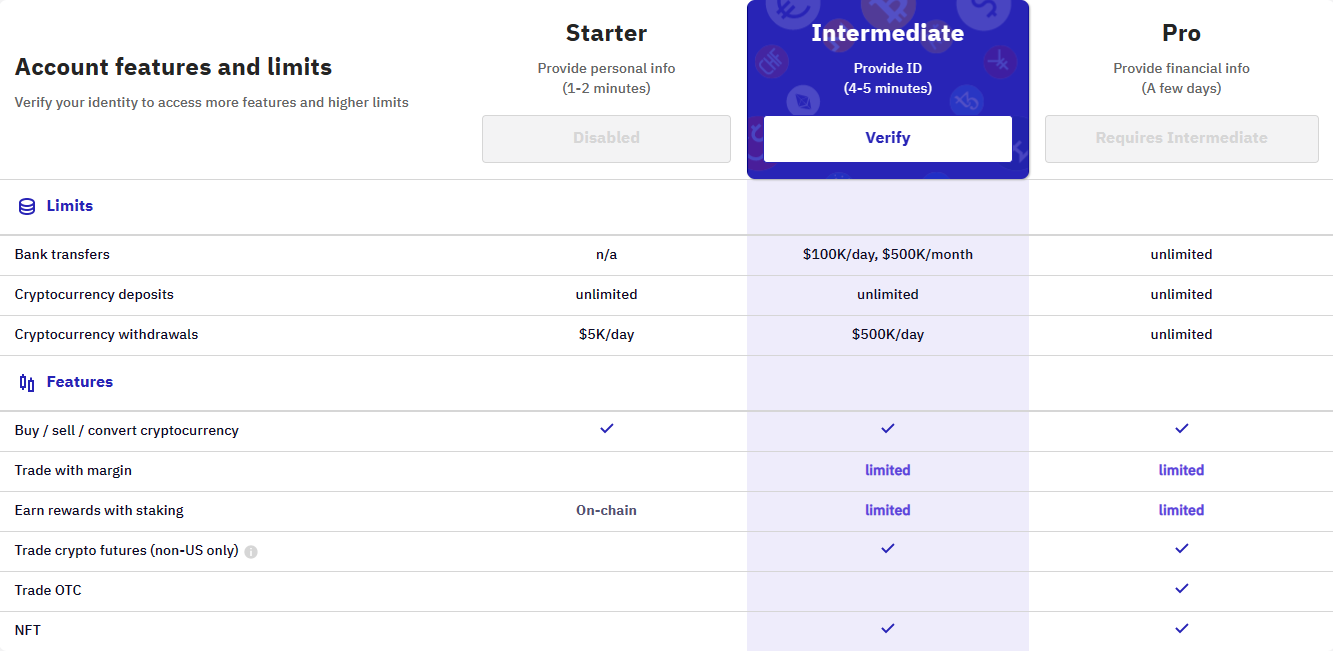

It’s worth noting that Kraken offers several distinct levels of KYC verification checks, each of which progressively offers more advantages as you comply.

To begin coins staking in Kraken, at the very least, the “Starter” KYC level will be required.

Step 5: Buy or Deposit coins

After you’ve created your account, you’ll need to deposit the coins you want to stake into your exchange wallet.

On the Kraken website, you can buy crypto with fiat currencies like the US dollar (

USD), GBP, or the euro (EUR).

Alternatively, you can deposit Bitcoin or another crypto straight into your Kraken account.

Here, the level of your KYC determines the range of flexibility and user-friendly features you can unlock. For instance, intermediate members can transfer other fiat currencies directly to their Kraken account, but a starter cannot.

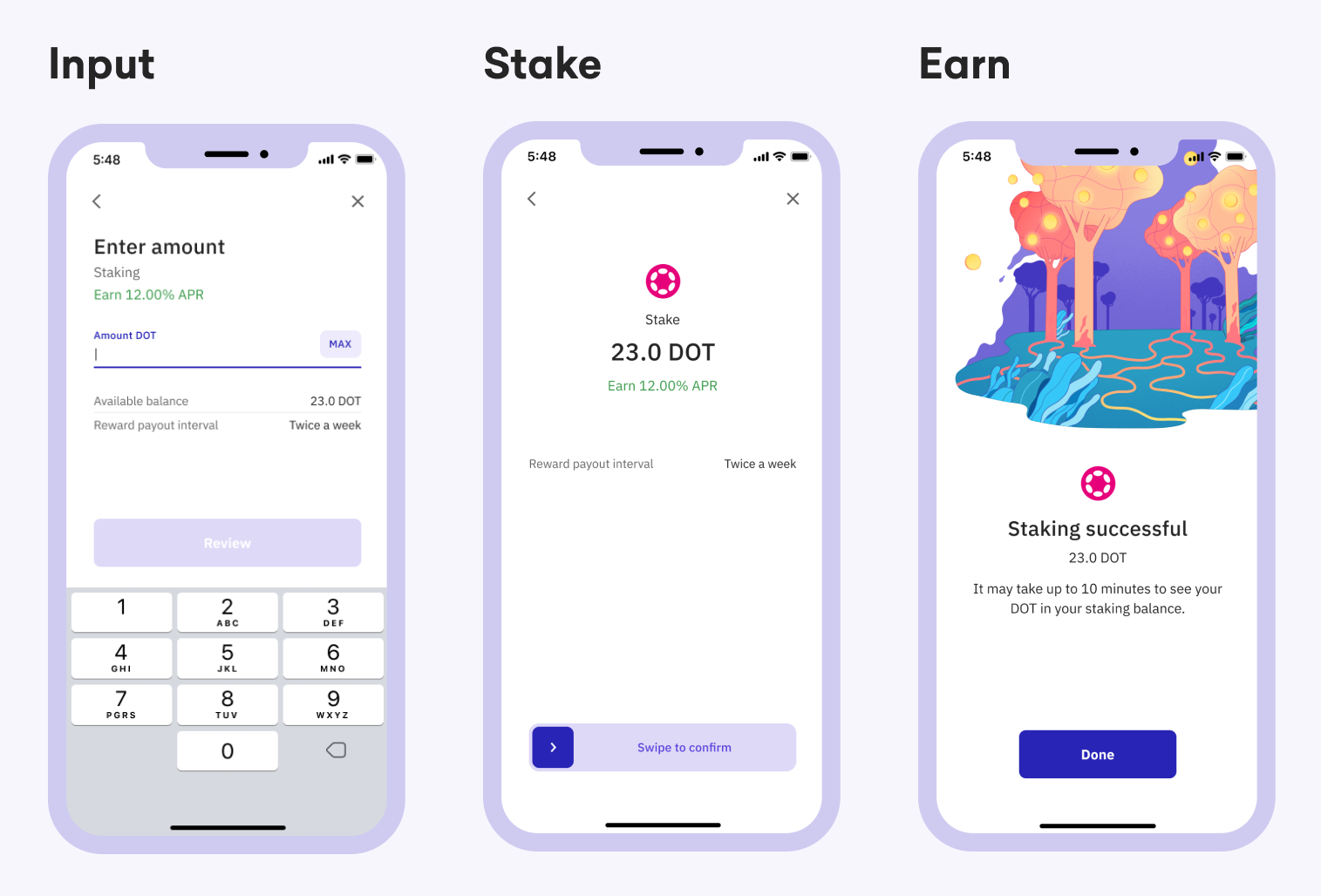

Step 6: Stake Your tokens

Follow the following steps to stake your tokens:

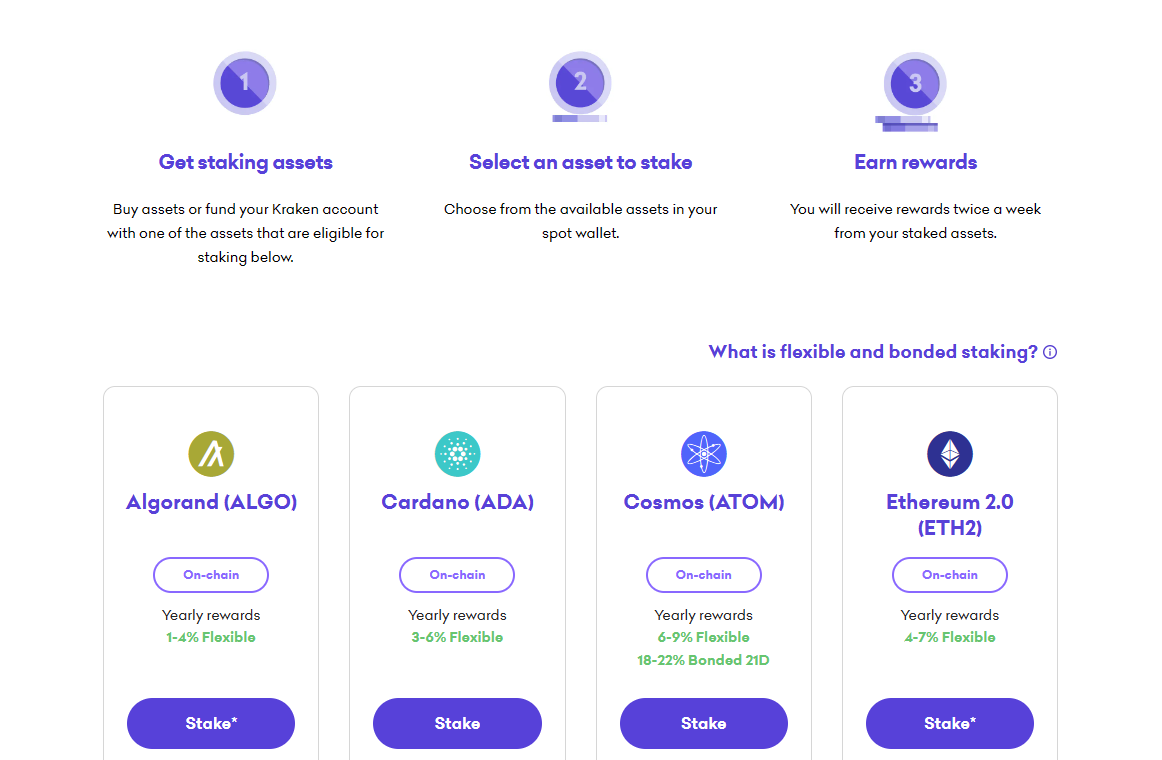

- Navigate to Kraken’s staking webpage and choose the token you want to stake.

- To open the staking window, click the staking symbol on the right side of the screen.

- Enter how many tokens (or what portion of your total supply) you wish to stake.

- Your tokens will be “bonded” after you click the “Stake” button, and you will then start to receive incentives.

- You can undo your stake by clicking the ‘Unstake’ option.

Once you’ve completed the three steps outlined above, you can sit back and watch your ROI grow.

Staking Rewards on Kraken Pro

You will receive rewards from your staked assets twice a week.

All payouts from Kraken are subject to a 15% fee. However, there is no price for the staking or unstaking procedure.

At press time, the quoted yearly rewards are as follows:

| Cryptocurrency | Flexible APY Range | Bonded APY Range | Bonded Period |

|---|---|---|---|

| Algorand (ALGO) | 1-4% | – | – |

| Cardano (ADA) | 3-6% | – | – |

| Cosmos (ATOM) | 6-9% | 18-22% | 21D |

| Ethereum 2.0 (ETH2) | 4-7% | – | – |

| Flare (FLR) | 4-8% | – | – |

| Flow (FLOW) | 6-9% | – | – |

| Kava (KAVA) | 5-7% | – | – |

| Secret (SCRT) | 8-10% | 20-24% | 21D |

| Polygon (MATIC) | 5-9% | – | – |

| Polkadot (DOT) | 6-8% | 15-19% | 28D |

| Mina (MINA) | 12-20% | – | – |

| Kusama (KSM) | 7-11% | – | – |

| Solana (SOL) | 5-8% | – | – |

| ETH 2.0 (ETH2) | 5-17% | – | – |

Please note that for some cryptocurrencies, only the Flexible APY range is provided, while for others, both Flexible and Bonded APY ranges are specified along with the Bonded Period (e.g., 21D or 28D, indicating the number of days the tokens need to be bonded to receive the APY).

What Is Staking and How Does It Work?

Three words — putting your cryptocurrency to “work for you” — this is the essence of staking. They “work” by participating in a network’s proof of stake mechanism, confirming transactions on the blockchain, and creating new blocks — in exchange, you get rewarded for doing so.

From a more technical point of view, staking is a way to support the security and stability of a blockchain network by holding onto a specific cryptocurrency.

By “staking” your coins, you can earn staking rewards, such as newly minted coins or a portion of transaction fees, in return for helping validate transactions on the network.

When you stake your crypto, your coins appreciate as the project’s network grows, and you earn ROI through an ‘interest rate’.

It’s worth noting that compared to traditional interest rates averaging a few hundred percent per annum, the returns from staking your crypto tokens in digital assets are often substantially higher, yielding between 1-200%.

Staking is considered a more energy-efficient alternative to typical proof-of-work methods. Users typically transfer their coins into a compatible wallet and lock them up for a specified period to move funds to participate in staking.

Here’s how it works in more detail:

- Wallet setup

To start staking, users must set up a wallet compatible with the cryptocurrency they wish to stake. The user then transfers their coins into the wallet and locks them up for a specified period. Kraken automatically gives you a wallet when creating an account.

- Validating transactions

The user’s wallet then participates in the network’s consensus mechanism, validating and adding transactions to the blockchain. The network completes this step by randomly selecting a user to validate a block of transactions and earn the associated rewards.

- Earning rewards

For each block validated, the user receives incentives from newly minted coins or a portion of the transaction fees. The size of the yearly rewards is proportional to the number of coins staked.

- Unlocking coins

After the specified period has passed, the user’s coins are automatically unlocked. Users can transfer them from their wallets or continue to stake coins for additional rewards.

Final Thoughts

Staking on Kraken is a great way to gain passive income while holding a long-term position in cryptocurrency. With competitive staking rewards and an easy-to-use interface, Kraken is the perfect platform for maximizing its crypto holdings.

Kraken’s staking features cater to everyone, from institutional investors seeking increased security to individual traders seeking higher rewards.

From institutional investors looking to stake cryptocurrencies for added security to individual traders seeking greater yields, Kraken’s staking features offer something for everyone. When determining where to stake your money in on-chain assets, Kraken is undoubtedly worth considering, thanks to its user-friendly design and comprehensive customer support.

Staking is the process of holding and securing coins in a wallet to support a blockchain network, helping validate transactions and earning rewards. It has become popular on Kraken due to its competitive rewards, user-friendly interface, and various supported tokens.

On-chain staking involves holding and locking coins directly on the blockchain, participating in the network's consensus mechanism. Off-chain staking delegates crypto assets to a third-party service, which performs staking on the user's behalf, often with lower rewards but more liquidity.

You can stake a variety of tokens on Kraken, including Kusama (KSM), Flow (FLOW), Polkadot (DOT), Tezos (XTZ), Cosmos (ATOM), Kava (KAVA), Polygon (MATIC), Secret (SCRT), Solana (SOL), and The Graph (GRT). Off-chain staking services allow for staking Bitcoin, Euros, and Dollars.

To stake crypto on Kraken, create an account, complete the KYC verification process, deposit coins into your wallet, navigate to Kraken's staking webpage, choose the token you want to stake, and follow the on-screen instructions to bond your tokens and start receiving rewards.