TL;DR

This extensive guide will take you through how to get your Webull tax documents. Whether using a desktop or the Webull mobile app, follow these simple steps to get your tax forms on Webull.

- Log in to the Webull website.

- Select your profile icon.

- Choose the taxes option.

- Select download to get your paperwork.

Webull’s simple interface makes it easy for active traders to file taxes.

Introduction

Webull is one of the world’s leading cryptocurrency exchanges. It is famous for its trading APIs that provide secure trading bots and a web socket that gives users access to actual live feeds. It is for investors looking to enter the financial markets with no minimum account sizes and commission-free trading.

Since it does not offer comprehensive brokerage services, its clients must independently make some portfolio management decisions. Customers at Webull tend to be younger than those at other brokerage firms. The broker’s no-cost business strategy also attracts active traders.

Active options traders, in particular, will be attracted to Webull’s free options trading. Because other brokers, even those like Schwab, have switched to free stock and ETF trades.

How to get Webull Tax Document

Investment portfolios are changing just as time is. Webull is a different online broker that debuted in 2017 and released its mobile application a year later in 2018. This is in sync with the rise of blockchain, cryptocurrency, and metaverse.

It has served millennials through a wide range of services and is developing strategies to support active traders directly.

Complimentary services include commission-free share trading, among others.

Suppose you want to save and import the Webull tax file. In that case, you must first log in from the online website or save and import the file from the mobile application.

Getting Your Webull Tax Document With Desktop

Follow these steps to access your tax forms on the Webull website:

More details

Webull is a dependable crypto exchange platform with low fees, suitable for both novice and seasoned investors. Its sleek desktop and mobile interface makes it attractive to all traders. However, its educational resources are limited, possibly making it less ideal for beginners.

-

Smooth account-opening process.

-

No fees on cryptocurrencies, stocks/ETFs, options.

-

Offers extended hours and pre-market trading.

-

Research tools

-

Flimsy educational support.

-

Backward portfolio options.

-

No live chat.

Step 1: Visit Webull Official Site

Visit Webull’s official website on your desktop browser.

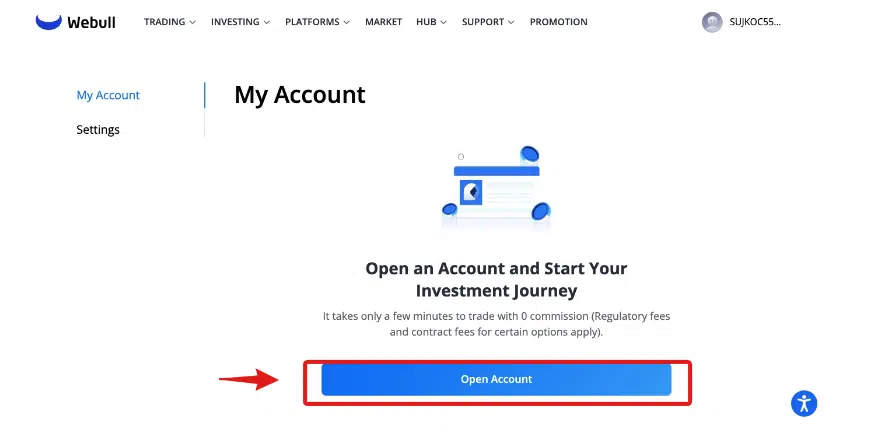

Step 2: Log in to Your Account

Login or verify your identity if your Webull trading account is closed.

Step 3: Verify Passwords

Verify your trading passwords after logging in.

Step 4: Save the Paperwork

Tap on the [Download] option.

Getting your Webull Tax Document with Mobile app

Follow these steps to access your tax documents on the mobile app:

Step 1: Tap on the Webull Icon

Tap the [Webull icon] in the bottom center.

Step 2: Go to Documents

Swipe to the Documents tab.

Step 3: Locate Documents Section

Scroll down to the Tax Documents section.

Step 4: Save PDF or CSV

Select the tax document you want to download and choose between the PDF or CSV file options.

How To Download Webull Statement?

You can only get Monthly Account Statements on months that you have been active, such as making trades and transfers.

There will be no account statement if there is no account activity within a month. You will receive trade confirmation for every exchange you make on your account.

This is to let you know that your transaction was successful.

Steps to Get Webull Statement

Step 1: Log in to Webull Website

If you have logged in on the mobile app, open it or visit the official website.

Step 2: Select Trading Option

Click on the [Trading] section among the list of dropdown items.

Step 3: Choose Account

After clicking on trade, click on the [Account] section.

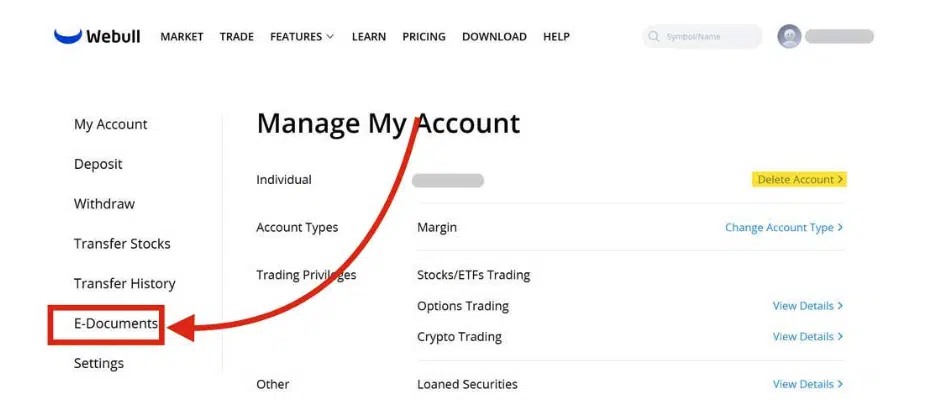

Step 4: Select E-Documents

Tap on [E-documents] to view your cash flow, balance, and income statements.

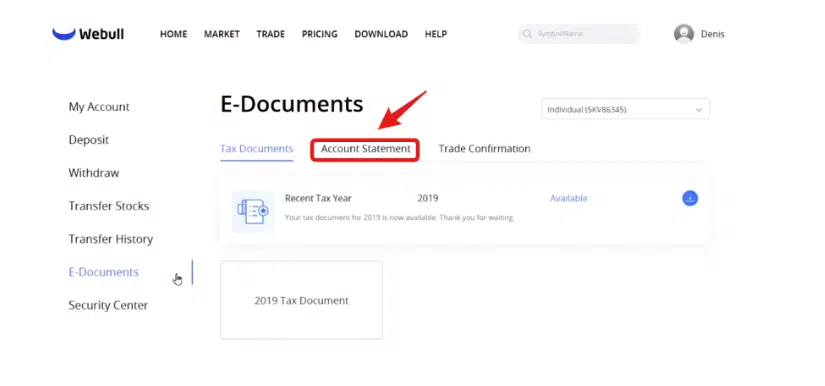

Step 5: Choose Account Statement

Choose [Account statement] from the available options on the list.

The account statement is available for viewing every quarter.

When Does Webull Send Tax Forms?

Your tax paperwork will be ready and available to view one day before Webull emails you. The forms will then be attached to that email, and a follow-up email they sent you the following day. Your tax and other forms will arrive at a specific time, depending on your account type(s).

Other forms you receive include:

- 1099-R: This tax form is for if you received a distribution of $10 or more from a retirement account.

- Consolidated 1099: This form helps in filing your income tax return. It will provide 1099-B from broker transactions, 1099-DIV for dividends, and 1099-INT for interest.

- Form 5498: You are required to give this form to your IRA trustee for signing with the IRS stating contributions or conversions within your retirement accounts. You will not need Form 5498 to file your taxes, but having the forms in your records is very important.

You can save and submit the forms directly as soon as they are ready.

Webull Tax Reporting

It can be helpful to connect your Webull account to CoinLedger. This allows you to create reports on your gains, losses, and income taxes based on your account and investing activity. Importing your data via the procedure described below will allow you to connect your accounts:

- Go to your account for the download option for your entire transaction history.

- By mapping the data into the desired CSV file format, you can instantly import your transaction history into CoinLedger.

- Based on this information, CoinLedger automatically creates your gains, losses, and income tax returns.

You can file these cryptocurrency tax forms independently, send a copy of them to a tax expert, or import them into your chosen tax preparation program.

How Do I Read A Webull 1099 Form?

Webull provides you with a tax form called 1099 that helps you report your taxable income. The paperwork offers your general details, including your name and address.

The summary follows your details, collecting data from all 1099 Forms.

Then, there is the Dividends and Distributions section. This part provides payments you could have received as a shareholder of the same equities. It is often known as Form 1099-DIV. There are two types of dividends, Ordinary dividends and qualified dividends.

Ordinary dividends are subject to taxation, while qualified dividends come with specific guidelines and requirements and are taxed on long-term capital gains and at a lower rate. Non-dividend distributions, the return of capital payments, are included on the 1099-DIV form.

The 1099-MISC contains the shares you lend, which may get replacement payments instead of dividends. Check Section 1256 CONTRACTS in Broad-based index options.

This is a review of Form 1099-B and your transactions summary in the Summary of Proceeds Gains and Losses Adjustments and Withholdings.

How to See Capital Gains on Webull

Capital gains are the profits you get from buying and selling your investments.

The actual 1099-B Form, titled Proceeds from Broker and Barter Exchange Transactions, aids in keeping track of your capital gains and losses and displays information going to the IRS.

Gains are typically taxable, but you can frequently deduct capital losses from the taxes required on your profits. You can find capital gains on Form 1099 B, a taxable file.

You can see the section on Webull Website, and you will receive a mail once your report becomes ready.

Steps to find your Capital Gains on Webull

Let us look at how to find the capital gains in your Webull app.

Step 1: Choose P&L

Tap P&L on the Webull App.

Step 2: Select ALL

Next, tap the [All] knob on the right.

Step 3: Fill in the Details

Input the duration to see your required capital gains tax forms file.

How do Webull Taxes work?

Webull charges taxes for investments, not gains. You will pay reduced tax rates if you hold investments longer. That is why many investors use long-term approaches.

Any money that you lose by investing will not be subject to taxes. Instead, you can use this to reduce ordinary income or capital gains up to $3,000 annually. You may roll over excess gains or losses into later years if they are more than this.

Conclusion

For active traders, Webull is a fantastic site. The platform doesn’t charge additional fees, making it a fantastic chance for anyone who wishes to experience trading but is unfamiliar with the industry.

Additionally, one receives a professionally created and managed desktop website and a mobile application that offers beneficial trading tools at no additional expense.

To get your tax files from Webull accounts, you must first log in to your account via the app or the online website. You will need to verify your identity, after which you can get your tax forms.

Yes, it does. You can access your yearly tax form directly from your mobile app. Tap on [Document] on the help center page.

Suppose you sell stocks, bonds, derivatives, or other securities through a broker. In that case, you can expect to receive one or more copies of Form 1099-B.

You may report the free stock received directly through Webull on 1099-MISC forms as miscellaneous income at the acquired securities fair market value.