Understand the dynamics of cryptocurrency search patterns for 2023-2024. We dive into crypto terms and their correlation with price action.

As the 4-year crypto cycle nears a close with a valuation above $1T, a sense of hopium is in the air. This report will share the 7 biggest crypto trends for the next bull market 2024.

For the upcoming cycle, a new set of narratives will fuel the next bull market, particularly after the anticipated halving of BTC in April/May 2024. When we say the “market,” we refer to BTC and ETH.

ETH will most likely outperform BTC (since it’s 2.5X smaller, offers a solid low-risk yield, and is the underlying infrastructure). BTC is still king and comes second in our long-term bags.

1. The New L1 Blue Chip Assets

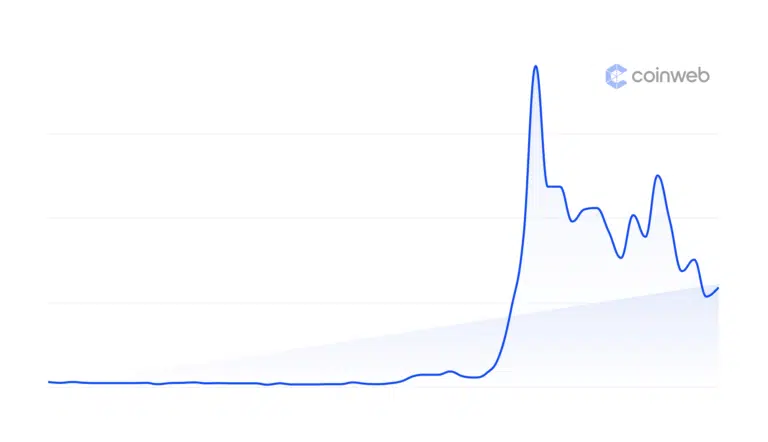

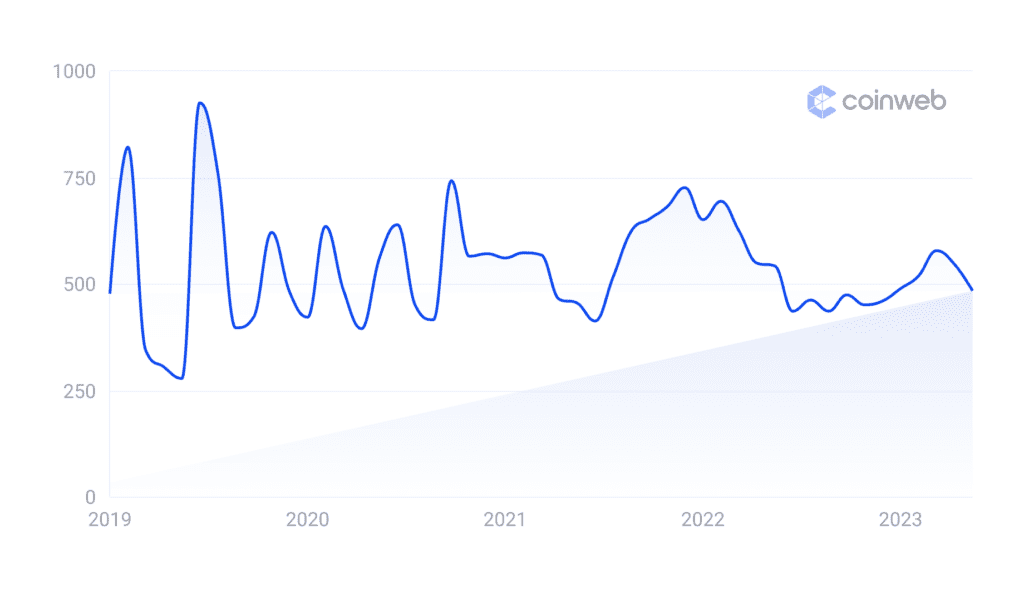

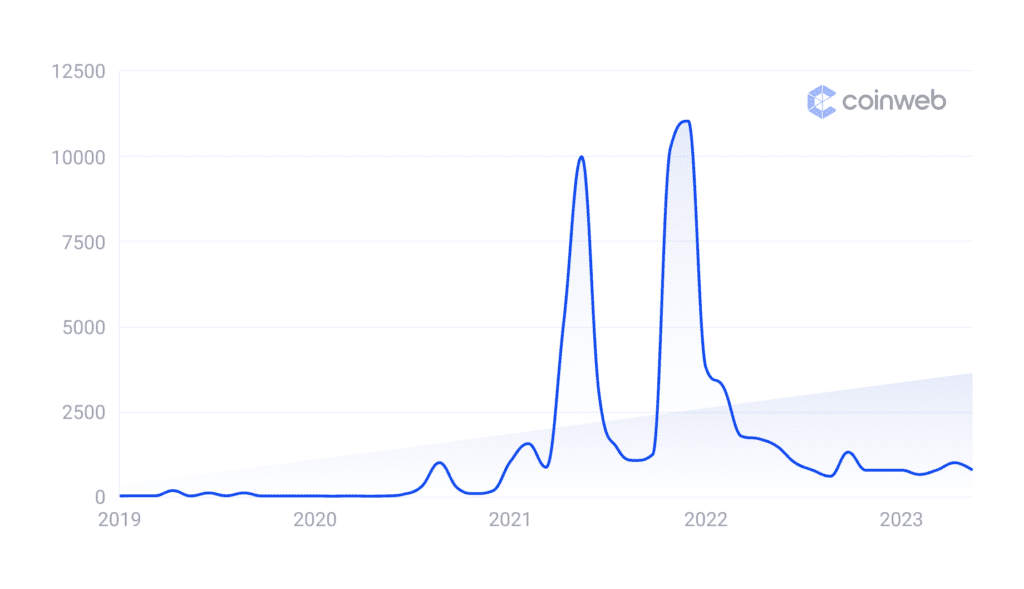

L1 protocols indicate sentiment building up for a new bull run.

The L1 survivors of the 2022 market wipeout are rebuilding liquidity, building bridges to Ethereum, and strong signs of product development.

The tokens in focus are the new batch of Layer 1 protocols. The most widely adopted blockchains with a growing user base include Binance Smart Chain (BSC, BNB), Solana (SOL) and Avalanche (AVAX).

Solana still has more than 88K daily active users and is still attractive to NFT communities and games. Avalanches community is growing and has developers to deploy multiple mini-games and DeFi tools.

Solana’s big challenge is rebuilding its total value locked (TVL), with an astonishing $9.1B during the peak bull market, with the current TVL of $299M.

L1 protocols are a must-have in your portfolio. These tokens are the first to rally after Bitcoin cools off.

L1 Tokens Under Our Microscope

The rising tide of a bull market will lift all ships, so there is hope for half-forgotten tokens.

We’ve added 2022’s overpromising, underdelivering projects to our bags – Tezos (XTZ), EOS (EOS), and Cardano (ADA).

We are also watching a group of projects that switched to L1 functions and pivoted to become platforms for Web3 developers. Those include Bitcoin Cash (BCH), pivoting from a BTC competitor, but also VeChain (VET) and eCash (XEC), Hedera (HBAR) and Algorand (ALGO).

The next notable group of tokens includes networks with high levels of developer activity. Binance Coin (BNB) is still a leader among L1 protocols, but rising stars include Polkadot (DOT), Fantom, Flow (FLOW), Kadena (KDA), Sui (SUI) and Fuse (FUSE).

L1 platforms will benefit from renewed interest in Web3, gaming, metaverses, and ownership. The 2023-2024 search trends suggest a new bull market will revive the lost L1 tokens.

2. Scalable rollups: Optimism, Arbitrum, Polygon

Layer 2 keeps improving, riding on the back of Ethereum. The purpose of L2 is to scale ETH transactions while offering near-zero gas fees.

L2 tokens may see the initial boost after the Ethereum Cancun upgrade, offering a new sharding technology for cheaper and faster transactions.

EIP-4844 has no set date but may become an active narrative toward the end of 2023. If delayed, the Ethereum upgrade will still be in play into 2024.

Platforms like Polygon (MATIC) and ImmutableX (IMX) will extend their success from the bull market’s peak in 2021. Beyond Polygon and ImmutableX, new arrivals will add to this trend. Arbitrum aims to make it big after several airdrops in the past months.

There will be increased demand for transactions for DEX trading, NFT sniping, and Web3 games. Consequently, L2 tokens will benefit from heightened user activity on these networks.

L2 Tokens Under Our Microscope

During a new bull run, Polygon (MATIC) will solidify its position as the go-to L2 platform.

Polygon has multiple use cases, among them a DeFi hub. The network carries Aave and UniSwap V3 versions for a low-fee alternative to Ethereum.

Arbitrum (ARB) is another token to watch closely. ARB is a late arrival with a short history and has had low fluctuation since April 2023. ARB is still a token with a market cap above $2B in April 2023.

Optimism (OP) is another L2 similar to ARB, with a market cap of $1B as of September 2023. OP is one of the few tokens with a rising trend, reaching a market cap record of $1.2B in August 2023.

3. Ethereum Ecosystem Liquidity and Staking

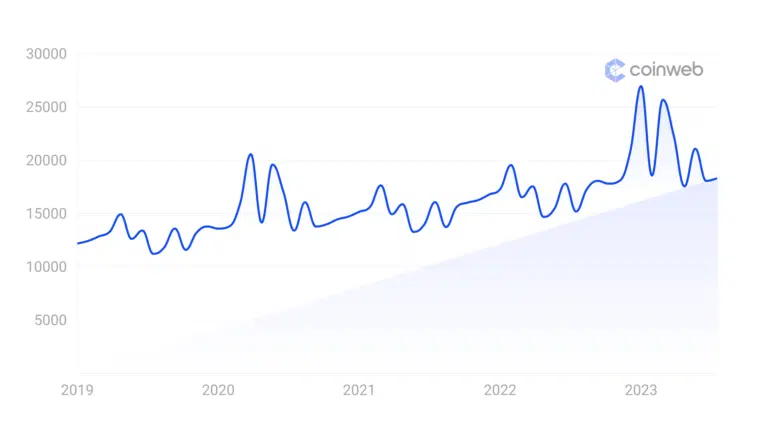

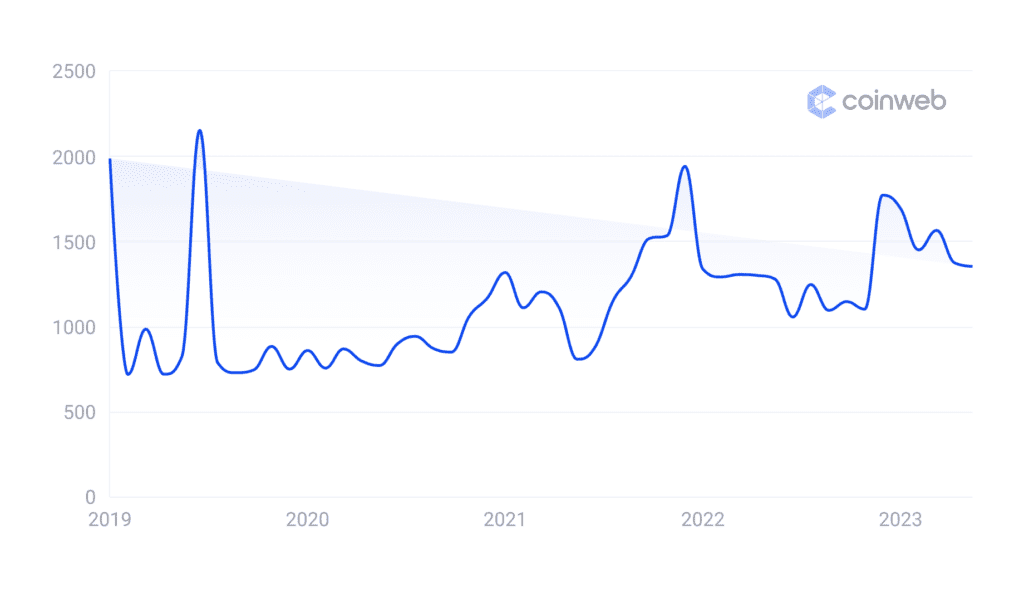

Investors are still staking 32 ETH to run a node. The higher the amount locked in smart contracts, the lower the amount of ETH in circulation.

More than 25M ETH are staked, offsetting the current circulating supply of 120M ETH. Staking and burning ETH is helping toward price stability, keeping ETH above $1,500.

Ethereum staking accelerated in 2022 and has been growing in 2023. One of the reasons is the 3.8% APY.

Deposits to the staking contract are not slowing down (currently at 30 million ETH), and the trend will continue into 2024.

Staking Tokens under Our Microscope

Deposited ETH also serves as collateral in a liquidity hub. Protocols like LIDO DAO (Lido) offer staking income and a new token. ETH holders can have a stake in the network and a Liquid Staked Token (LST).

A new economy of trading and risk is emerging with LST as its basis. Protocols can use stETH by Lido, cbETH (from staking through Coinbase), rETH from Rocket Protocol, and sETH2 from Stakewise.

The various LSTs offer arbitrage opportunities for trading. They have a price differential between ETH and themselves. Lido is also building a liquidity hub centered around the LDO token.

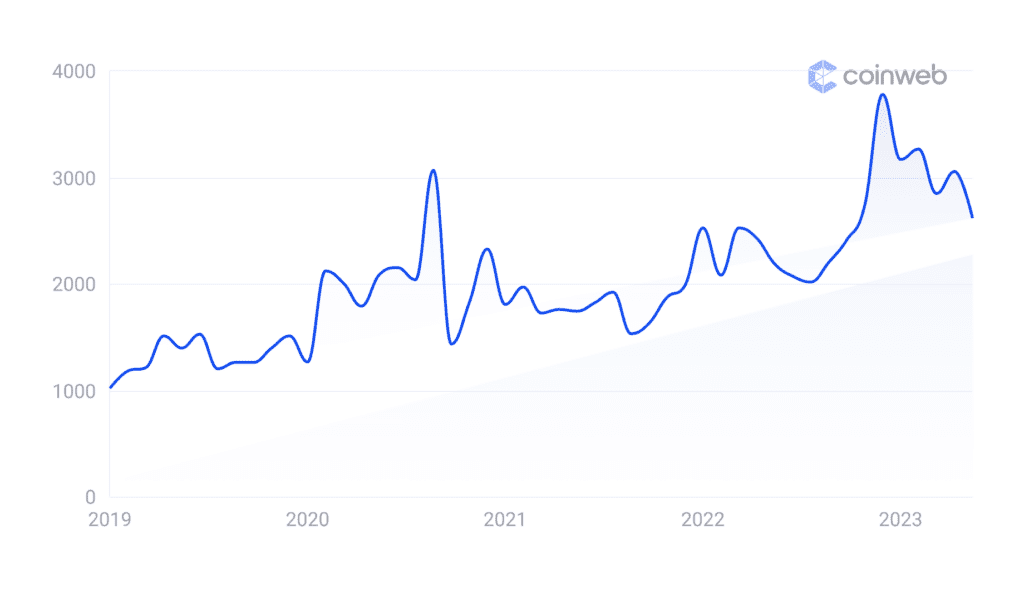

“Ethereum staking” searches are also at a higher baseline, matching the trend of token deposits in the smart contract.

4. Cash Cow Protocols

After the market massacre in May 2022, crypto investors prioritized security. Rather than risking liquidation through leveraged trading, the trend has shifted to low-risk passive income strategies.

“Cash cow” protocols provide this opportunity by distributing the fees and revenue from decentralized exchanges.

With a weekly reported trading volume of up to $9B, DEX activity is an endless source of fees. In 2023 and 2024, we expect a gold rush to buy tokens that offer DEX-based passive income.

We expect riskier decentralized pairs to get little liquidity, hitting the brakes, while DEX profit sharing takes off as trading volumes recover from their current lows.

Cash Cow Protocols Under Our Microscope

In the summer of 2023, GMX (GMX) rose to prominence, riding on the back of Arbitrum and Avalanche protocols. GMX tokens offer buyers a direct way to tap into trading fees by staking the asset.

GMX tokens show a history of quickly reacting to the hype. The total value locked on the exchange is stable, awaiting a potential breakout during the bull market.

Our attention is also on Gains Network (GNS), up 300% even after the 2022 bear market.

Top DEX tokens also include ThorChain (RUNE), Loopring (LRC), PancakeSwap (CAKE), and other projects that thrived in 2021. During a market recovery, these are in our long-term bags.

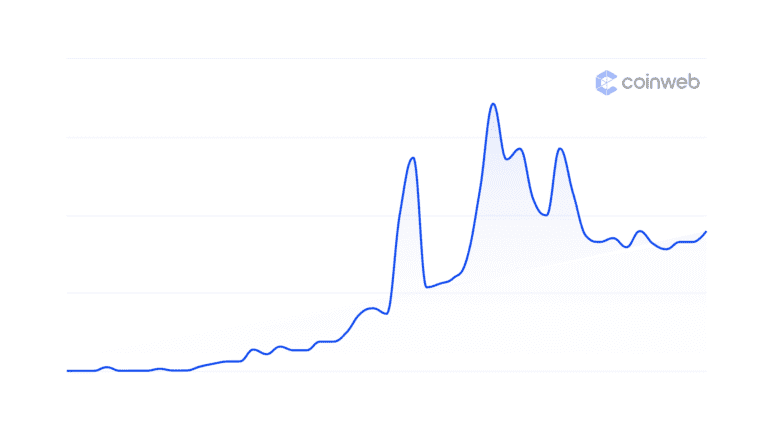

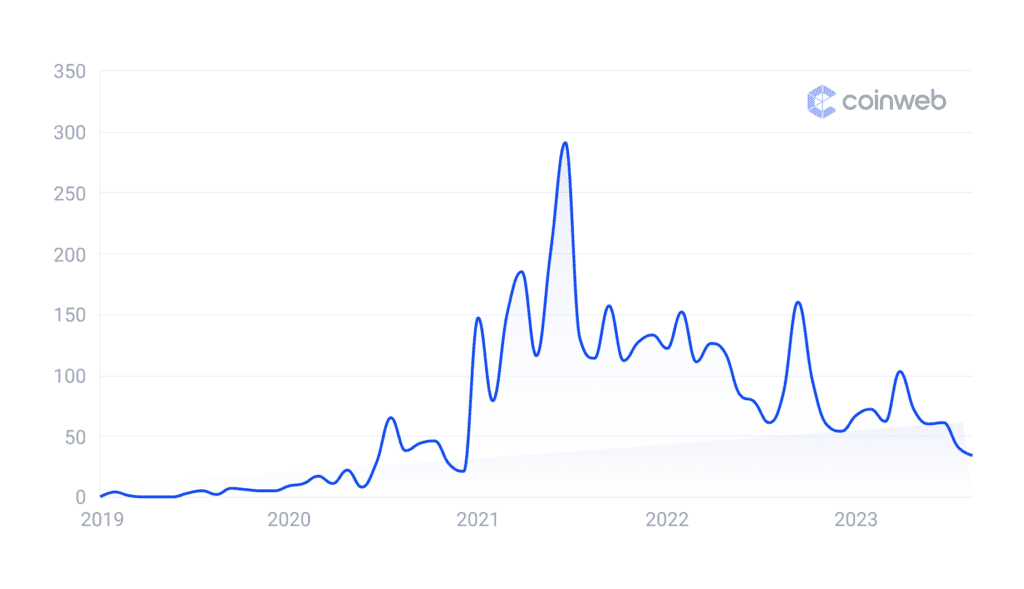

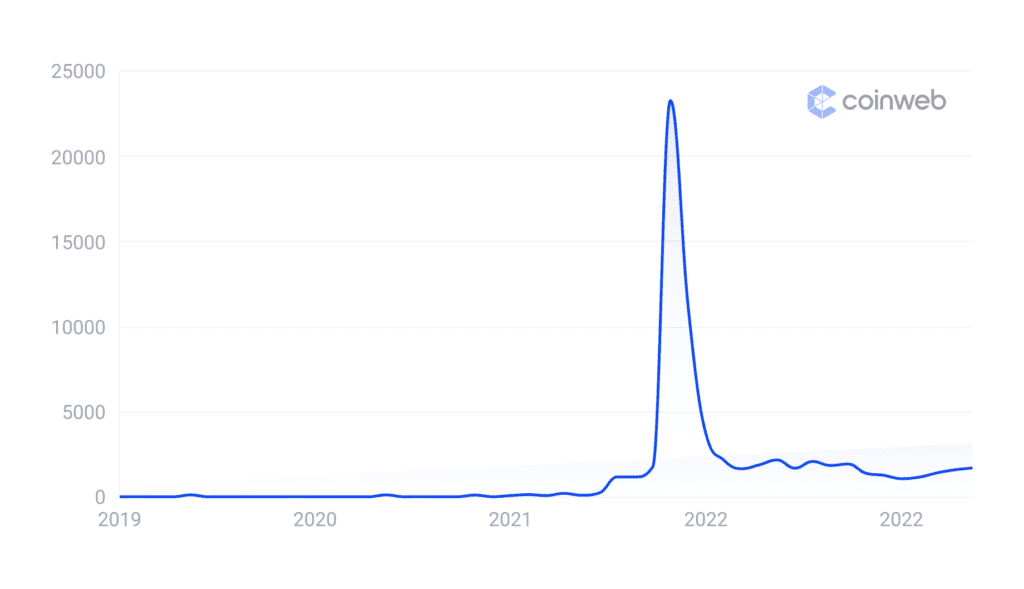

5. Meme Coins Return as Jesus

Meme coins and tokens reflect the pure, irrational risk-taking in crypto. The force to go full degen will remain strong in 2023 and 2024. Meme coins may react illogically, even during a bear market.

The king of meme coins is still Dogecoin ($DOGE). A decade after its launch (2013), DOGE still looks sexy compared to the new batch of meme tokens.

What binds these assets is the irrational expectation of gains exceeding 10,000%.

Meme Coins Under Our Microscope

In 2023, the high-profile Pepe coin ($PEPE) airdrop set off a new demand for more degen tokens. A 10x price move is nothing for PEPE, which peaked at $0.000002 in May 2023.

Another meme coin that is on our radar is the Jesus coin (JESUS). We expect this coin to grow fast and hard throughout 2024.

Older meme coins like Shiba Inu (SHIB) may repeat similar feats, growing by a factor of 1,000 quickly. Meme coins remain a purely irrational bet with potentially unlimited upside.

In 2023, a total of 1,227 meme coins competed for attention. Meme tokens include multiple DOGE clones, often tied to NFT and gaming. LADYS, or Milady Meme Coin, tracks the social media community of Milady NFT owners.

There is no rational way to predict which one will break out, so meme coin buyers often resort to buying the type of meme and hoping it reaches peak hype levels.

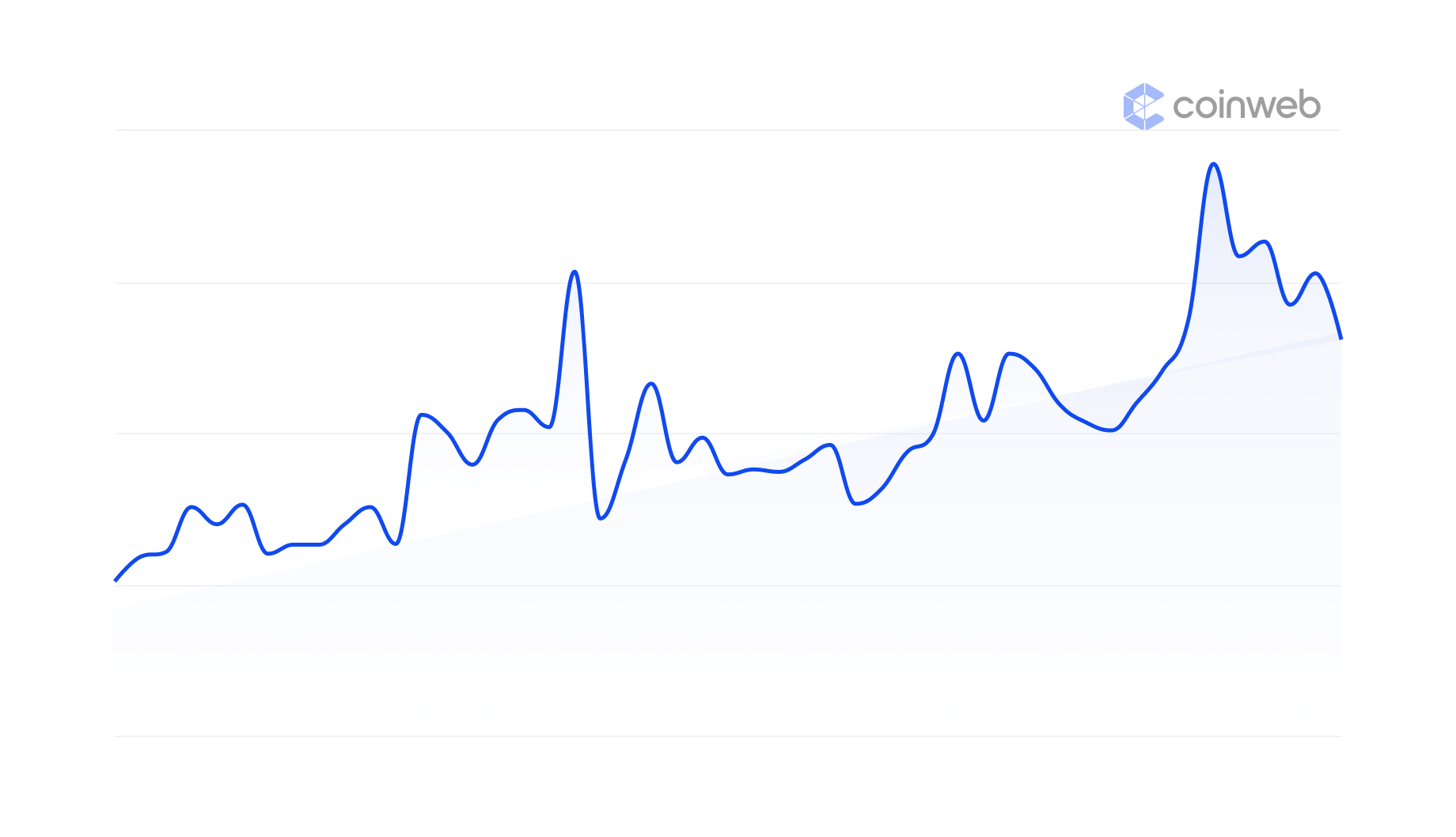

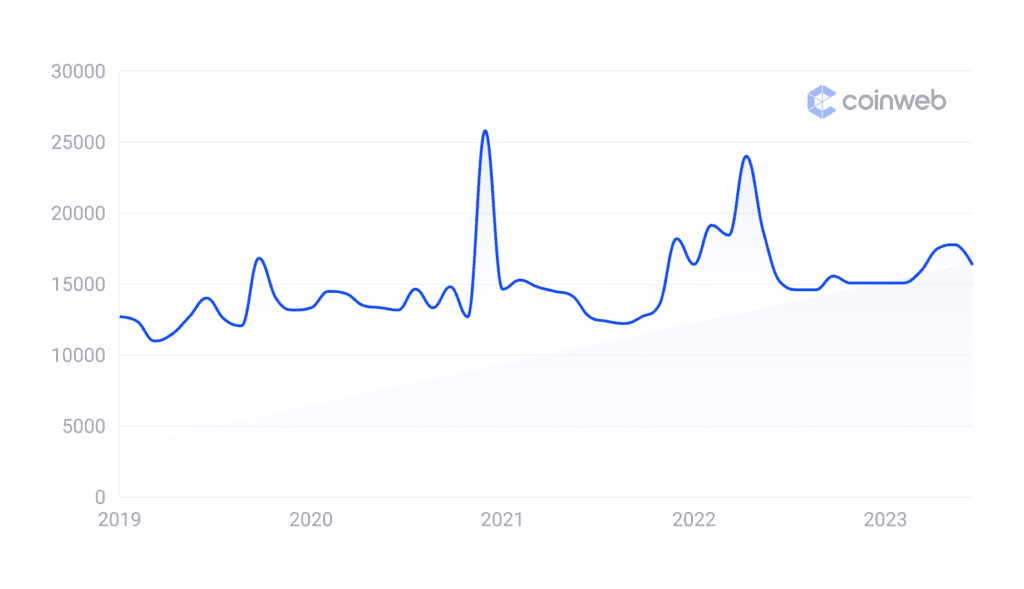

6. Unibot Trading, Sniping and Automation

Thanks to Unibot (UNIBOT) and other Telegram bots, automated sniping is now open to anyone.

DEX trading is fast and competitive, requiring automated strategies to snipe the best trades. That is why Telegram bot tokens will boom early in the next bull run. The trend will be driven by demand for new tokens, airdrops, sniping, copy-trading, and other short-term speculative activities.

In 2023, it started with the UNIBOT token, created on June 12. Besides using alerts and automation, holding UNIBOT gave revenue share from all transaction fees.

Telegram bot tokens are an emerging trend in 2023. So far, the list of Telegram bot tokens features only 67 tokens.

Some tokens are going through early price discovery, with low volume and higher risk. The Telegram bot trend shows there is still demand for risk.

TG Bots Under Our Microscope

A clear lead is Unibot (UNIBOT), the leader of the Telegram bot tokens and will most likely control the direction of less prominent assets. Most Telegram bot tokens are still under a daily volume of $1M.

A few stand out because of their social media profile – Moon Bot (MBOT) and MEVFree (MEV).

Other Telegram bot tokens include Wagie Bot (WAGIEBOT) and ChainGPT (CGPT), which look poised for short-term rallies.

Most Telegram bot tokens are below the top 1,000 tokens by market cap. We expect the tokens mentioned to be out among mainstream assets in 2023/2024.

7. DeFi and GameFi

DeFi and GameFi are rekt, with the market cap of gaming tokens down 99% from the peak.

Axie Infinity (AXS) traded above $157 in July 2021 and is down to $4.91 in September 2023.

Games are one of the most successful use cases for blockchain technology. Web 3 wallets are gaming accounts that can collect in-game assets and flex on other players.

Gaming projects overlap with decentralized finance (DeFi). We anticipate that top-tier games will rejuvenate trading volumes in DeFi, subsequently increasing activity for GameFi.

Gaming Tokens We Are Looking At

Projects like Aavegotchi (GHST) continue to build new in-game terrains with unique features such as “cyan grass” and other collectible NFT items.

DeFi is also consolidating, with a total value locked at $38.73B in the past year following the crash at the end of 2022.

DeFi has existed for only one bull cycle; it will return once we achieve higher ETH prices and BTC rallies.

GameFi is getting a boost from a thriving list of gaming tokens with a market cap above $7B. Those gaming projects move beyond simple play-to-earn into sustainable token-based earnings.

Takeaway

The next bull market will arrive with new tech we didn’t expect. Holders of Layer 1 and Layer 2 projects will be the earliest to detect the market’s pivot.

Expectations for 2023/2024 include a spectrum from wildly speculative meme coins to precision AI trading tools and bot sniping.

Decentralized exchanges and Telegram bots will continue to make risk-taking accessible to all. The Ethereum ecosystem still carries the most important tokens.

Ethereum remains the epicenter for pivotal tokens, with ETH’s price solidifying thanks to a rising staking trend.

And as always, King Bitcoin will remain the king.

The anticipated resurgence of NFTs is a notable trend, with search interest for "non-fungible tokens" soaring by over 1,000% in the past 5 years.

Given its origins from a successful Ethereum NFT project and an enticing presale entry, Wall Street Memes' $WSM, with a 2 billion token supply cap, emerges as 2023's most promising crypto.

Bitcoin: The pioneering crypto, boasting the largest market cap.

Ethereum: The first platform for smart contract development and the heart of DeFi.

Pikamoon: A trending play-to-earn NFT game.

Ethereum (ETH): Topping the list as the potential breakout cryptocurrency of 2023.

Ripple (XRP): Showcasing explosive growth potential, possibly 10x in 2023.

ApeCoin (APE): Standing out as the altcoin with immense promise.

Binance Coin (BNB): A strong contender among exchange-based coins.

Sam Farao

Sam Farao

Shawn Munir

Shawn Munir