Sometimes, you just need some cash on hand. But if you believe in HODL-ing, why would you need to cash out? Well, sometimes you just have bills to pay. You might also just want to take some juicy profits while you can.

So, how do you cash out on the Coinbase app and into your bank account?

- Sell all crypto and convert to fiat balance

- Click “Withdraw” in your portfolio

- Choose how much you want to cash out

- Choose which linked bank account or alternative payment method you want to withdraw to

- Double-check all transfer details and cash out

For a more in-depth guide on how to instantly cash out your Coinbase fiat currency, read on below, where we give you some screenshots and additional info.

What Do You Need Before Cashing Out on Coinbase?

If you want to sell your crypto assets and instantly cash out, there are a few things you need to understand. There’s a lot that goes on when you withdraw money from Coinbase, and it’s not as simple as dealing with regular bank accounts and fiat currency.

It’s important to take into account the following:

- Coinbase fees

- Tax implications of your transaction

- Required Coinbase identity verification levels

- Potential holding periods for specific cryptocurrencies.

Fees and Tax Implications

First and foremost, let’s discuss dreaded fees.

| Method | Deposit Fee | Withdrawal Fee |

|---|---|---|

| ACH* | Free | Free |

| Wire (USD) | 10 USD | 25 USD |

| SEPA (EUR) | 0.15 EUR | Free |

| Swift (GBP) | Free | 1 GBP |

Whenever you withdraw your crypto via Coinbase, there are network fees involved. This fee varies depending on your chosen withdrawal method and transaction size and can impact the total amount you receive.

In addition to fees, withdrawing funds from Coinbase can also have tax implications.

Different jurisdictions have different tax laws regarding cryptocurrency transfers, so keep that in mind before you cash out fiat currency into one of your bank accounts. If you don’t, the taxman might get ‘ya.

Coinbase Verification Levels for Withdrawals

Aside from fees and taxes, you have to consider the verification levels that Coinbase requires before you cash out.

When you sign up for a Coinbase account, you’re required to verify your identity. This verification level determines your withdrawal capabilities.

The amount of crypto you can sell and convert to cash balance is unlimited. However, withdrawal limits are determined by the payment method used and can vary greatly.

You can increase your withdrawal limits by elevating your account verification level. This involves completing additional verification steps as stated in your account settings.

Cryptocurrency Holding Periods

Lastly, before you cash out, be aware of the holding period for certain cryptocurrencies.

This is also known as ‘funds on hold,’ and it restricts the immediate cash out of recent transactions. During this period, you can’t cash out your local currency balance to a linked bank account and won’t have your funds immediately, unlike regular transactions.

While this may seem restrictive, any increases in cryptocurrency value during the holding period do not affect the availability of those funds for cash out.

The hold on withdrawals typically lifts at 4 pm PST on the date specified within your Coinbase account.

How to Withdraw Funds to Your Bank Account? Step-by-Step Guide

Now that you know the basic requirements, let’s move on to the specifics.

We’ll begin with the process of withdrawing funds from your Coinbase account to your bank account.

Before initiating a withdrawal to your bank account, ensure you have a verified bank account linked and have exchanged your crypto into your local currency in Coinbase.

Some pointers to keep in mind before you cash out on Coinbase:

- Make sure the Coinbase app is up-to-date (if on mobile)

- Exchange crypto to GBP if using a UK bank

- Make sure your card has Visa Fast Funds enabled

- Add cash to your local currency balance via SEPA transfers

Then, to begin the withdrawal process on Coinbase, follow these steps:

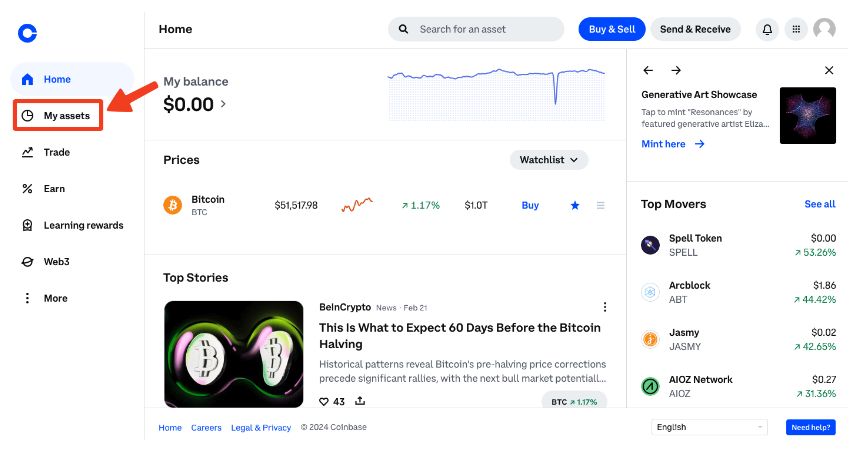

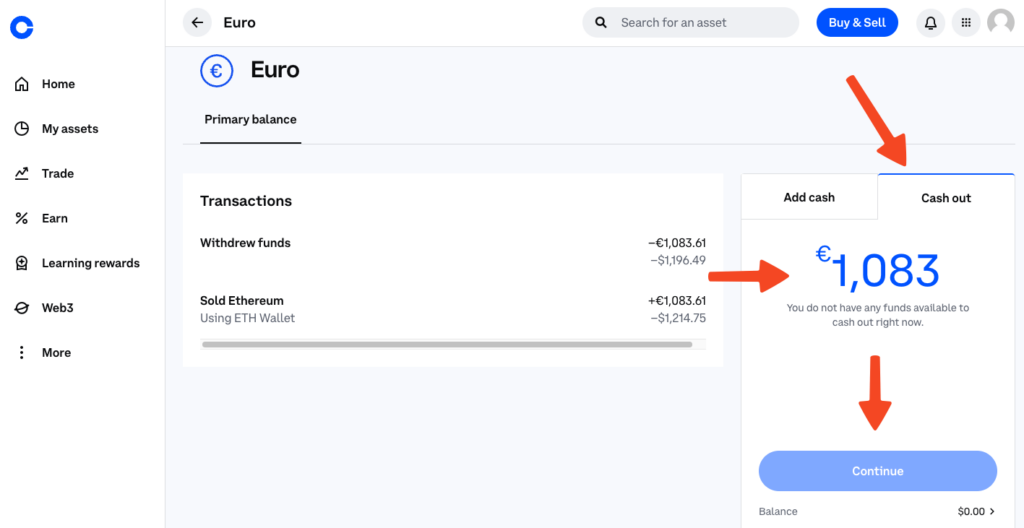

1. Navigate to “My Assets” in the navigation bar, where you’ll see all of your cryptocurrency holdings and fiat balance.

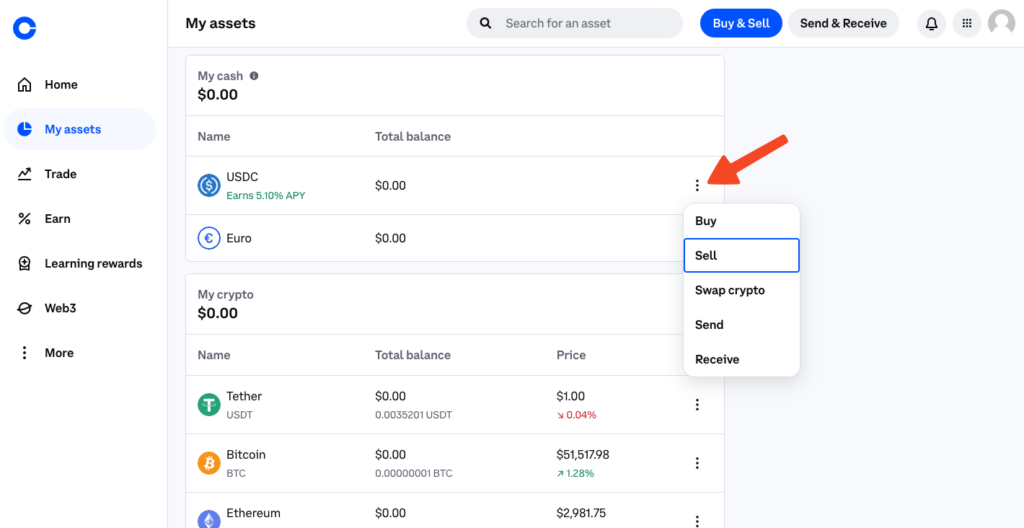

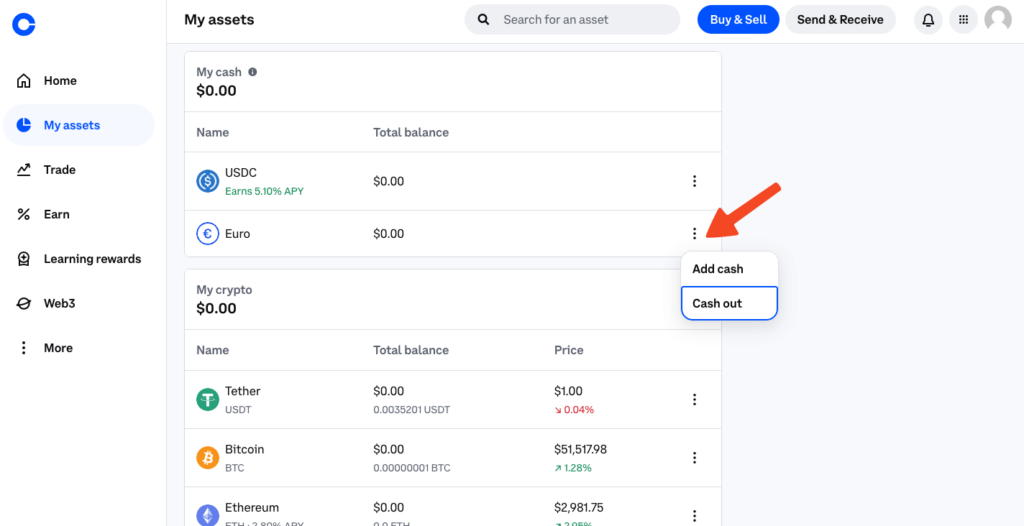

2. Click on the three dots icon next to the currency you want to withdraw and choose how much you want to transfer from your available balance into your bank account.

3. Select “Cash out” to withdraw all remaining money in your Coinbase account.

4. Choose your linked bank account.

5. Double-check all transaction details in the transaction preview screen to ensure you’re withdrawing into the right bank account with the proper transaction size.

6. Complete any additional security verifications if prompted. This might happen if your account has no existing transaction history.

The time it takes for the funds to appear in your bank account varies depending on local banking procedures.

Coinbase is the most mainstream way to cash out your crypto. If you don’t have an account already, sign up for free now!

How to Cash Out on Coinbase: Withdraw to PayPal Account

Coinbase also lets you withdraw to PayPal, which many people prefer due to the instant cash-outs and real-time payments.

- Firstly, complete all necessary identity verification documentation. Make sure your country of residence is correct (especially important).

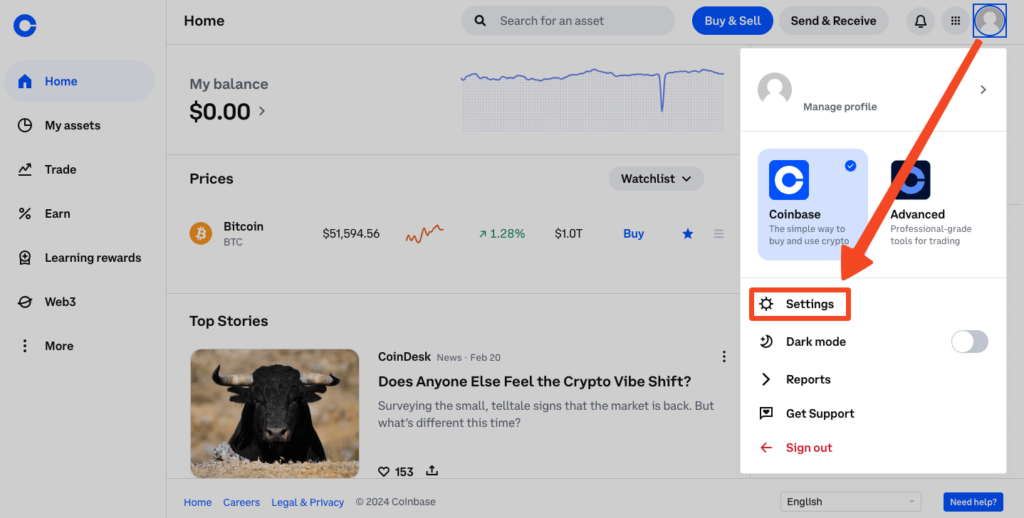

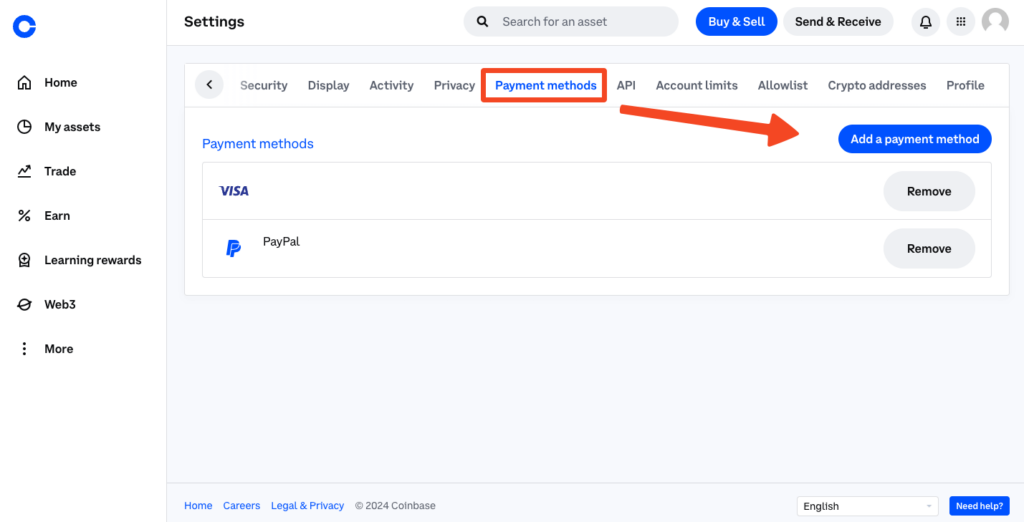

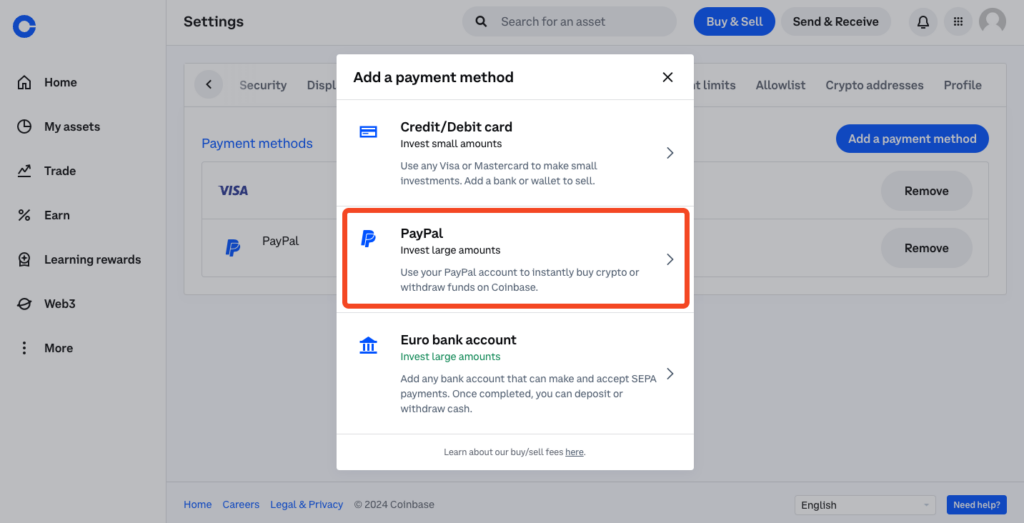

- Then we link our PayPal by heading over to Settings > click on “Payment Methods” > then “Add a Payment Method”.

- Select “PayPal” and log into your PayPal account.

- If your PayPal and Coinbase emails don’t match, you’ll need to complete two-factor authentication. For security reasons, of course.

U.S. customers need a valid payment method linked to their PayPal in order to buy cryptocurrency or transfer funds from Coinbase.

Conveniently, the Coinbase cash-out process to PayPal is exactly the same as when you initiate a bank transfer. Just make sure you select the PayPal withdrawal option, of course.

If you want your sweet crypto profits in seconds, PayPal is your withdrawal method. Transactions get processed in real-time payments, and you can enjoy your earnings instantly.

Troubleshooting Common Withdrawal Problems

Despite Coinbase’s efforts to streamline the withdrawal process, users may occasionally face challenges. These can range from difficulties due to account verification to specific limitations on withdrawals.

Here are a few common problems you might have when you withdraw.

Can’t Access the Coinbase App?

If your Coinbase app doesn’t work on your phone, don’t worry. It’s a simple fix. Most of the time you just need to perform a few updates or do some minor tweaks. Here are some steps you can take to troubleshoot any smartphone-related Coinbase issues:

- Restart your device

- Update your smartphone operating system

- Update Coinbase

- Clear your mobile app cache. Settings > Coinbase > Clear cache on the next launch

- Reinstall Coinbase

- Log into Coinbase on a web browser to make sure it’s not an account issue

Can’t Access Coinbase on the Web?

Similarly to the section above, there are a few things you can consider doing if you have problems with Coinbase on a web browser.

- Update your computer

- Clear your web browser cache and cookies. Navigate to your browser’s settings and privacy/security tab to do this.

- Make sure to have your web browser updated

- Switch to Incognito mode

- Use a different browser

Lost Access to Coinbase Wallet?

Losing access to your Coinbase Wallet app (which is an external wallet that holds both your mainstream crypto assets and fiat) can seem daunting. Not all is lost, of course. Here’s what you can do to regain access in this specific situation:

- Make sure you have your 12-word recovery phrase handy (you should have saved this when making an account)

- Open the Coinbase Wallet app and select “I already have a wallet” (assuming you’ve been signed out)

- Choose “Restore with recovery phrase”

- Enter your phrase and follow the on-screen instructions. Should be super simple!

Other Issues to Troubleshoot

There are some other issues and restrictions you might face when trying to sell your crypto and cash-out assets.

For example, a declined PayPal transaction can be due to insufficient funds. You might be trying to withdraw too much, so double-check how much you’re trying to transfer.

Also, a transaction might take some time to register. If you’re trying to sell your crypto into fiat currency but don’t see your funds right away, refresh the page or wait a couple of minutes. Once you see it in your balance, you can transfer your assets.

Setting Up Limit Orders for Control and Withdrawals

Setting up limit orders on Coinbase could be an ideal strategy if you want greater control over your selling prices.

Limit orders allow you to set defined prices for your trades, so you can withdraw crypto at the exact price you want automatically.

A bid, or buy limit order, is when you think the price of a crypto is too high and want to buy at a lower point. For example, if BTC at $40,000 is too high for you, you might initiate a bid when it drops down to $38,000. Once it reaches this price, your order will be initiated automatically.

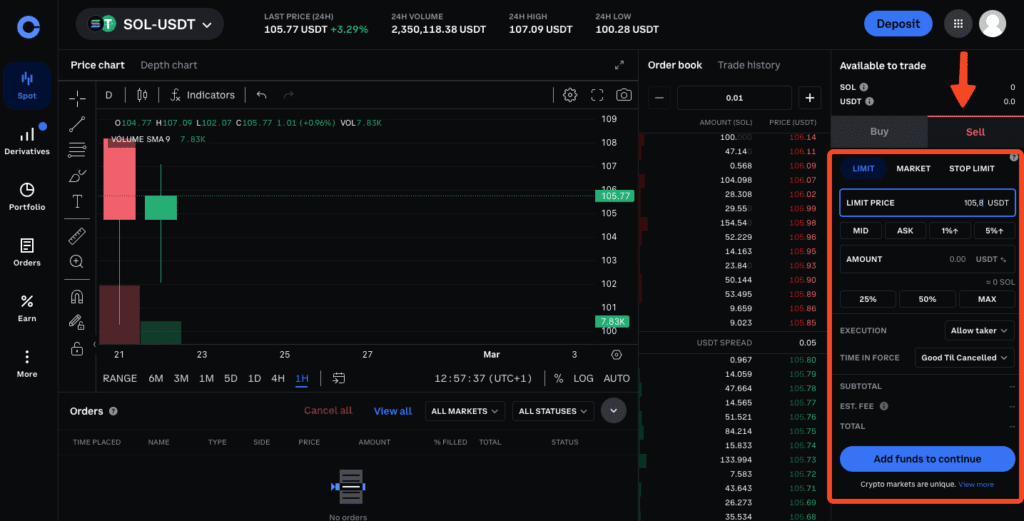

An ask, or sell limit order, is the opposite of that concept.

The MID is for mid-market price, which is the average between the bid and ask price. Coinbase also gives you the option to customize your limit orders by 1%, 5%, or 10%, meaning you control the exact price you want to enter a crypto.

Here’s how we can set up a limit order:

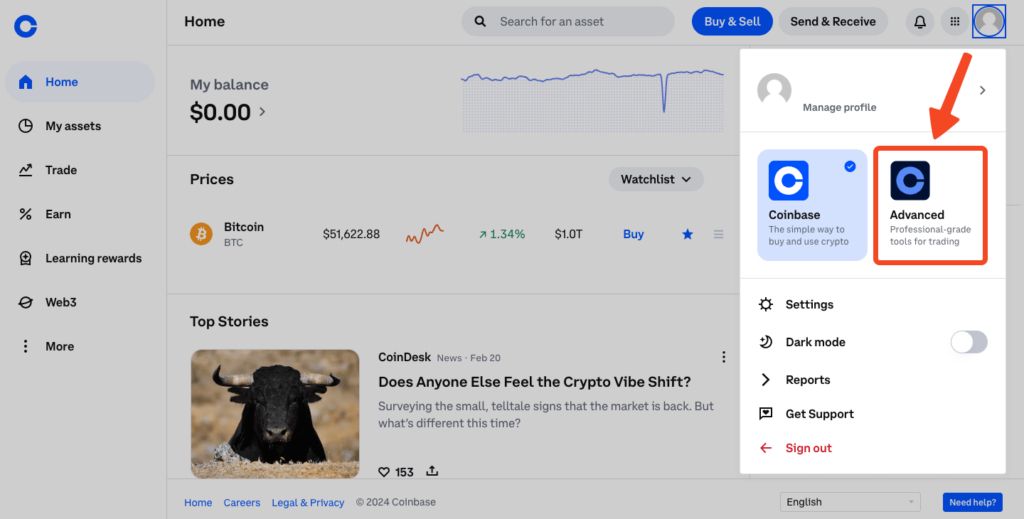

- In the Trade tab, click on the dropdown and select “Advanced Trade”.

2. Select a coin pairing you want to trade.

3. You’ll see the asset pairing chart and a module to the right where you can initiate limit orders.

4. Select Buy (bid) or Sell (ask).

5. Once you choose whether to buy or sell, choose the Limit option.

6. Either enter the price you want to enter manually or choose from one of the options below the price box. These options are MID, BID/ASK, 1%, 5%, 10%.

7. Choose how much you want to invest in this limit order. Deposit funds if you don’t have any.

8. Choose how long you’d like the order to stay open, good ‘til canceled or good ‘til time.

9. Initiate your limit order!

Securing Your Coinbase Account

Security is everything when it comes to your precious coins.

Coinbase recommends the following steps to enhance the security of your account:

- Set up 2-step verification.

- Choose from various types of 2-step verification, such as Security Key, Authenticator apps, and SMS.

- Consider using hardware security keys, as they’re the most secure method.

Use strong and unique passwords for your accounts to prevent unauthorized access. Regularly manage your account’s device access. Never share your details or password with ANYONE (even Coinbase Support). Change your password regularly.

These are all steps you should take to keep your account super secure and up to date.

Tax Reporting Obligations for Cryptocurrency Transactions

Yes, you need to pay taxes on your crypto withdrawals. Sucks, but it’s true.

As required by the IRS, Coinbase reports certain cryptocurrency transactions over $600 using Form 1099-MISC. All relevant activities, including sales, rewards, and staking income, are documented for tax purposes.

Taxable cryptocurrency transactions include:

- Cashing out cryptocurrencies for fiat

- Staking rewards

- Interest

- Payments received for goods and services

- Other miscellaneous income such as rewards for signing up or referrals.

The IRS may impose a Failure to File penalty for not reporting Coinbase taxes, which could increase your tax liabilities.

When you add cryptocurrency income to your regular income, you might even shift into higher tax brackets. Technically a good thing, but you also have to pay more tax. There are a few ways to minimize or avoid crypto tax so that you pay less.

Just the mention of taxes might deter you. But our helpful guides walk you through each step. Our crypto tax guidelines give you the full rundown of what you need to know. However, if you feel like you need to study the crypto-tax topic more, you can look at our whole directory on it.

Alternative Withdrawal Methods: Sending Crypto to Other Wallets or Exchanges

For some, Coinbase might not be the best option to cash out funds.

In this case, you’ll want to sign up for an exchange like Binance. Having an account at an exchange like Binance is beneficial for those who want to trade altcoins not supported on Coinbase.

More details

Binance is a great combination of low fees, deep liquidity and multiple cryptocurrencies and trading pairs. We have tested every aspect of it and it STILL holds its reign as the top exchange in the world. In our view, it is the perfect crypto exchange for both newbies and advanced traders alike.

-

Biggest exchange in the world.

-

Industry's lowest trading fees.

-

Advance trading options like leverage trading.

-

600+ crypto options, 150+ for the US.

-

Lucrative on-site staking options.

-

Hiccups in account verification.

-

Less regulated than some competitors.

-

The corporate structure is not transparently.

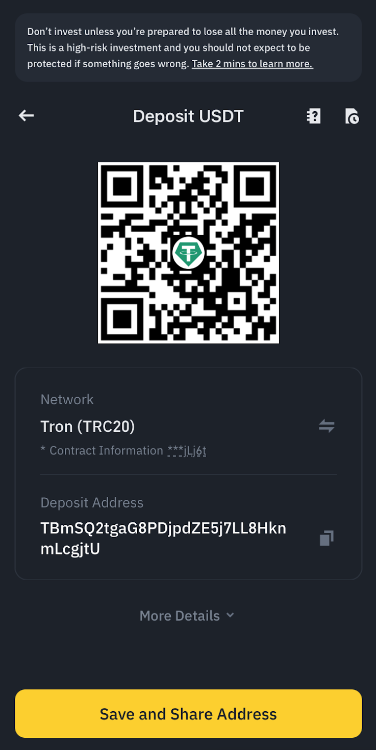

Make sure you have your Binance and Coinbase wallet address ready when transferring funds between them. Here’s a step-by-step guide to help:

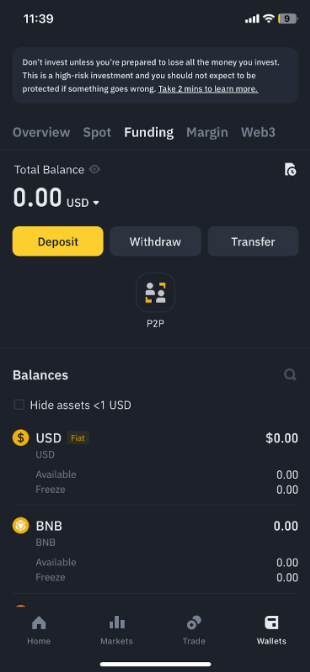

1. Head over to your Binance wallet, and go to the Funding tab.

2. Select Deposit if you want to transfer Coinbase funds to Binance.

3. Choose the asset you want to transfer. We recommend USD, but USDT is honestly easier to do. Copy your wallet address.

4. On Coinbase, tap on “Send/Receive”.

5. Paste your Binance key in the “To” field.

6. Follow through with the steps on your screen.

Want to exchange your altcoins into your local currency? Sign up with Binance and access your crypto profits.

Summary

Cashing out on Coinbase is easy. It’s not like the old crypto days when you would have to enter the Matrix for some complicated keys and avoid scams left and right.

When you cash out to your bank account, most of the time, you’ll receive your local currency balance instantly. There are network fees, taxes, and other aspects to consider, but the same goes for any type of money transfer.

If you want to enjoy the fruits of your assets and withdraw money quickly, follow the steps above so you can familiarize yourself with the process.

You can convert crypto into cash in Coinbase. Simply “sell” the crypto you’re holding to your local currency (or USD). Obscure altcoins might not have this option available, in which case, you’ll need to use an exchange.

You can cash out up to $100,000 per transaction from your Coinbase Exchange account. Instant Card Cashouts on Coinbase do not have specific limits, but your card provider may have restrictions in place.

Your account may be on hold due to security or verification reasons. Wait a little for Coinbase to complete its security check. Contact Coinbase customer support if the issue persists.

Before cashing out from Coinbase, consider the fees, taxes, verification levels, and holding periods for certain cryptocurrencies.

When cashing out from Coinbase, it’s important to be aware that the transaction is taxable, and the IRS may penalize you if you fail to report it.