EDX Markets Review 2024: The Best Exchange for Institutions?

TLDR

EDX Markets is a newly launched cryptocurrency trading marketplace backed by major financial firms. It aims to establish itself as a trusted trading platform for the digital asset market with several unique advantages. These include high liquidity, competitive quotes, and a non-custodial model launch trading that reduces conflicts of interest.

Also, the involvement of prestigious investors adds to its credibility. It prioritizes security and incorporates best practices from the traditional financial sector into the crypto market. Notably, it offers a dedicated listing for the retail market, ensuring better prices for retail orders.

The platform operates based on clear and transparent rules to ensure efficiency. Membership is open to registered and licensed firms and institutions that meet financial and credit requirements.

Introduction

EDX Markets emerged as a digital assets marketplace to cater to the needs of native cryptocurrency companies. Backed by Charles Schwab (SCHW), Fidelity Digital Assets, and Ken Griffin’s Citadel Securities, it holds a credible position in the market. Recently, it concluded its latest funding round and commenced trading on June 20th, 2023.

Initially, the platform only trades four crypto assets, including Bitcoin, Ethereum, LiteCoin, and Bitcoin Cash. However, the company envisions expanding its asset offerings over time to establish itself as a reliable crypto marketplace.

Although EDX Markets may appear similar to other crypto trading platforms, it possesses distinct competitive advantages.

It strives to enhance liquidity in the digital asset market and deliver more competitive price quotes. Plus, it aims to implement a trading model that minimizes conflicts of interest through a non-custodial system.

They also plan to develop EDX Clearing. This decentralized clearing system validates and reconciles the transfer of digital assets between buyers and sellers.

Who is behind EDX Markets?

Jamil Nazarali, the visionary behind EDX Markets, is revolutionizing digital asset trading. With support from Sequoia Capital and esteemed industry leaders like Citadel Securities, Virtu Financial, and Fidelity Digital Assets, EDX Markets is poised to redefine safety, speed, and efficiency in the market.

Before his groundbreaking venture, Nazarali held influential positions at Citadel Securities, where he shaped the firm’s equities, options, and FX market-making businesses. As Members Exchange’s (MEMX) chairman, he championed fairness and transparency in U.S. equities trading.

With a stellar track record, including global electronic trading leadership at Knight Capital Group, Nazarali brings unrivaled expertise to EDX Markets. His strategic insights from consulting at Ernst & Young and Bain & Company further amplify his visionary approach to trading innovation.

Who’s it for?

EDX Market Exchange is uniquely positioned to cater to the needs of various institutional entities interested in crypto trading. Plus, they must be registered with the SEC and FINRA and have an account with a digital custodian integrated with EDX Market Exchange. It is designed to cater to the needs of:

Institutional investors

EDX Markets focuses on meeting the needs of major financial institutions that seek exposure to cryptocurrencies but may have concerns about centralized service providers.

Additionally, EDX Markets caters to retail and institutional investors who prefer trading crypto through trusted intermediaries.

By providing a platform that specifically caters to the requirements of institutional investors, EDX Markets offers safe and compliant trading in the market.

Market Makers and custodians

Within the EDX Market Exchange ecosystem, market makers contribute to liquidity and ensure competitive spreads. By participating as market makers, these entities enhance trading opportunities for investors and promote a highly liquid and efficient marketplace.

EDX Market Exchange collaborates with custodians to safeguard customer assets and facilitate blockchain-based settlements. Custodians ensure the security and integrity of digital assets, providing peace of mind for investors and institutions using the platform.

Broker and dealers

EDX Market Exchange provides a regulated and secure digital asset marketplace that enables broker-dealers to offer their customers access to a reliable and compliant trading platform.

This allows broker-dealers to expand their services into crypto markets and meet the growing demand for digital asset trading among their clientele.

What are the major benefits of using EDX markets?

Let’s explore some major advantages of EDX Market exchange:

Backed by credible institutions

EDX Markets benefits from the support of renowned financial institutions and equity partners, including Citadel Securities, Fidelity Investments, Miami International Holdings, Charles Schwab, and additional strategic investors and equity partners.

This backing enhances EDX Markets’s credibility, providing access to substantial capital, expertise, and a wide customer base. Furthermore, it signifies the increasing interest and acceptance of cryptocurrencies within traditional finance circles.

Faster and cheaper settlements

EDX Markets operates as a non-custodial exchange, which makes it stand out from its customers. It effectively eliminates concerns of fund misappropriation by not holding customer crypto.

Instead, it collaborates with select digital custodians, allowing customers to choose their preferred safeguarding option. This method enables faster and cheaper settlement through blockchain-based netting, avoiding costly bilateral settlements.

Trusted Partners

Fully independent entity

EDX Markets functions as a fully independent entity, distinguishing the roles of crypto exchange operators from entities trading on the platform.

This separation eliminates significant conflicts of interest in existing cryptocurrency exchanges, where the same entity may serve as an operator, market maker, custodian, and broker. EDX Markets aims to establish a fair and level playing field for all participants, ensuring no entity holds undue influence or access to privileged information.

It also enjoys a market leadership position and strong backing from industry leaders like Paradigm, Sequoia Capital, and Virtu Financial. This industry backing enhances the overall strength and competitive advantage of EDX Markets in the cryptocurrency trading landscape.

Regulatory compliance

EDX Markets operates as a fully independent entity, separating the exchange’s responsibilities from those engaged in trading strategies and activities.

This approach eliminates significant conflicts of interest commonly encountered in existing cryptocurrency exchanges. EDX Markets provides users with a trustworthy and compliant trading environment by upholding high customer security and ensuring a compliant cryptocurrency market.

This commitment to regulatory compliance enhances user confidence and ensures legal and regulatory requirements adherence.

Getting started with EDX markets

More details

EDX Markets is a digital assets marketplace catering to native cryptocurrency companies and top crypto institutions. It offers liquidity, competitive prices, and a non-custodial trading model. It plans include expanding asset options and introducing EDX Clearing for decentralized transaction settlement with 24/7 trading.

-

Backed by the world’s biggest financial institutions.

-

Regulated by a trusted financial body.

-

Offer higher liquidity than other crypto exchanges.

-

Provides competitive quotes for digital assets.

-

Offers only four crypto assets for trading.

-

The platform is still being developed.

-

Largely untested for now.

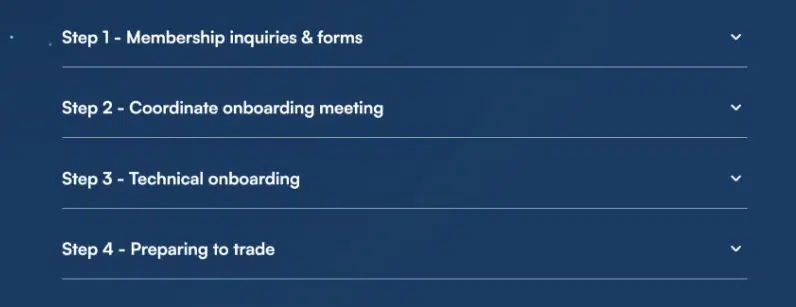

If you’re interested in joining EDX Market Exchange, here’s a step-by-step guide:

- Determine Your Category: Identify whether you fall into the category of a broker-dealer, market maker, custodian, or investor. This will help you understand the specific requirements and processes involved in joining.

- Visit the Website: Visit the official EDX Market Exchange website. There, you’ll find more information about the platform and its offerings.

- Contact Form: Fill out the contact form on the website, providing your details and specifying your category. This will initiate the process of joining the EDX Market Exchange.

- Await Communication: Wait for the EDX Market Exchange team to contact you. They will contact you to provide you with the information and KYC requirements for registration.

- Registration Process: Follow the EDX Market Exchange team’s instructions to complete the registration process. This may involve setting up an account with EDX Market Exchange and selecting a digital custodian that aligns with your needs and preferences.

- Account Setup: Once your registration is complete, set up your account with EDX Market Exchange and integrate it with your chosen digital custodian. This will allow you to access the platform and its services.

- Start Trading: Begin trading digital assets on EDX Market Exchange through your preferred broker-dealer. Use the platform’s features and benefits to engage in secure and efficient cryptocurrency trading.

Key features

Here are some key features of the EDX Markets exchange:

Non-custodial model

One of the significant advantages of EDX Markets is its non-custodial model. Unlike traditional exchanges, EDX Markets does not hold customer crypto assets. Instead, it relies on a network of select digital custodians to safeguard these assets.

This approach ensures increased security and allows customers to choose their preferred custodian. Moreover, the non-custodial model enables faster and more cost-effective settlement as trades are directly settled on the blockchain, eliminating the need for expensive bilateral settlement processes.

Technology from MEMX

EDX Markets benefits from using the proven and scalable exchange architecture provided by MEMX. As an innovative and customer-centric market operator that operates a successful U.S. equities exchange, MEMX offers a secure, fast, and efficient trading environment for digital assets across a diverse range of markets.

By adopting this technology, EDX Markets ensures its users a reliable crypto trading experience. It ensures that EDX Markets benefits from a scalable and secure exchange architecture.

MEMX’s expertise extends to serving the largest financial institutions and retail investors in crypto markets, providing operational support and market experts to EDX Markets.

The highly liquid cryptocurrency ecosystem

EDX Markets stands out in terms of liquidity and price discovery. EDX Markets aggregates liquidity from multiple market makers through its platform, creating unparalleled operational efficiency.

This unique approach fosters a highly liquid trading environment and enables investors to benefit from better prices than existing cryptocurrency exchanges.

Moreover, the improved liquidity and enhanced price competition mechanisms make EDX Markets an attractive choice for traders seeking optimal trading conditions.

Clearinghouse business

The platform plans to launch the EDX Clearing business and other critical institutional best practices. It will further enhance its value proposition as a comprehensive cryptocurrency trading platform.

Its responsibilities include ensuring proper execution of trades and transfer of funds according to agreed terms. The EDX clearing will also provide risk management and regulatory compliance services, reducing settlement risks.

With this additional service, EDX Markets aims to become a one-stop destination for cryptocurrency trading, offering users a convenient and comprehensive trading experience.

Security measures

EDX Market Exchange prioritizes the security of its customers and their digital assets. Not holding crypto assets directly relies on a network of carefully chosen digital custodians to protect them. The platform adheres to rigorous standards of security and regulatory compliance.

Furthermore, EDX Market Exchange operates independently, ensuring a clear separation between the exchange’s operation and the entities engaged in trading. This approach mitigates significant conflicts of interest in other cryptocurrency markets and exchanges.

Transparent fee structure

While specific details about the fee structure are not provided on the EDX Market Exchange website, the platform aims to offer better pricing for investors than existing cryptocurrency exchanges.

It achieves this by aggregating liquidity from multiple market makers, reducing spreads, and enhancing transparency. Additionally, EDX Market Exchange eliminates the need for costly bilateral settlement by netting and settling trades on the blockchain.

Effective risk management

EDX Market Exchange proactively manages various risks associated with its operations, including market, operational, legal, reputational, and crypto scams. It employs robust risk management practices to ensure its viability and profitability.

Compliance with regulatory requirements set by the SEC, FINRA, and other authorities is paramount. EDX Market Exchange remains vigilant about potential legal challenges and regulatory changes that may impact its operations or viability.

Moreover, the platform faces competition from other cryptocurrency exchanges like Binance and traditional financial institutions that may offer superior features, lower fees, or enhanced user experiences.

Drawbacks of EDX markets

While EDX Market Exchange offers numerous advantages, it’s essential to consider the potential drawbacks associated with the platform. Here are some limitations to be aware of:

- Limited token selection: Currently, EDX Market Exchange only supports four tokens: Bitcoin, Ethereum, Litecoin, and Bitcoin Cash. If you wish to trade other digital assets, you must utilize an alternative platform.

- Institutional-only access: EDX Market Exchange caters exclusively to institutional investors and is not accessible to retail investors or traders. To use the platform, you must be an institutional investor with an account linked to a broker-dealer connected to EDX Market Exchange. This means that direct access and utilization of its features are restricted.

- Regulatory uncertainty: Operating within a highly regulated and evolving industry, EDX Market Exchange is subject to oversight and rules imposed by regulatory bodies such as the SEC and FINRA. The platform may face legal challenges or regulatory changes that could impact its operations and viability.

- Competitive pressure: EDX Market Exchange faces competition from other players in the space, including centralized and decentralized exchanges. These competitors may offer enhanced features, lower fees, or a superior user experience. Additionally, traditional financial institutions may enter the crypto space or provide solutions, intensifying the competitive landscape.

Final verdict

EDX Market Exchange is an innovative cryptocurrency platform offering secure trading through trusted intermediaries. It provides non-custodial storage, regulatory compliance, and access via API for seamless integration with trading systems.

The platform leverages proven technology and liquidity aggregation to offer better prices for Bitcoin, Ethereum, Litecoin, and Bitcoin Cash. However, it is limited to institutional investors, excluding retail traders.

Regulatory uncertainty and competition from other exchanges and traditional financial institutions pose challenges. In a nutshell, EDX Market Exchange presents a compelling option for the major financial institutions seeking secure and efficient cryptocurrency trading backed by industry leaders and advanced technology.

EDX Market is a newly launched cryptocurrency marketplace that aims to provide a trusted platform for trading digital assets. It offers several distinct advantages, including high liquidity, competitive quotes, and a non-custodial model that reduces conflicts of interest.

Crypto Exchange EDX Market is a regulatory-compliant cryptocurrency market with high liquidity and competitive quotes. It follows a non-custodial model to reduce conflicts of interest, ensuring a secure and efficient trading environment.

EDX Market aims to establish itself as a trusted cryptocurrency trading marketplace, offering its users unique advantages. It has welcomed additional strategic investors like Miami International Holdings.