Key Takeaways

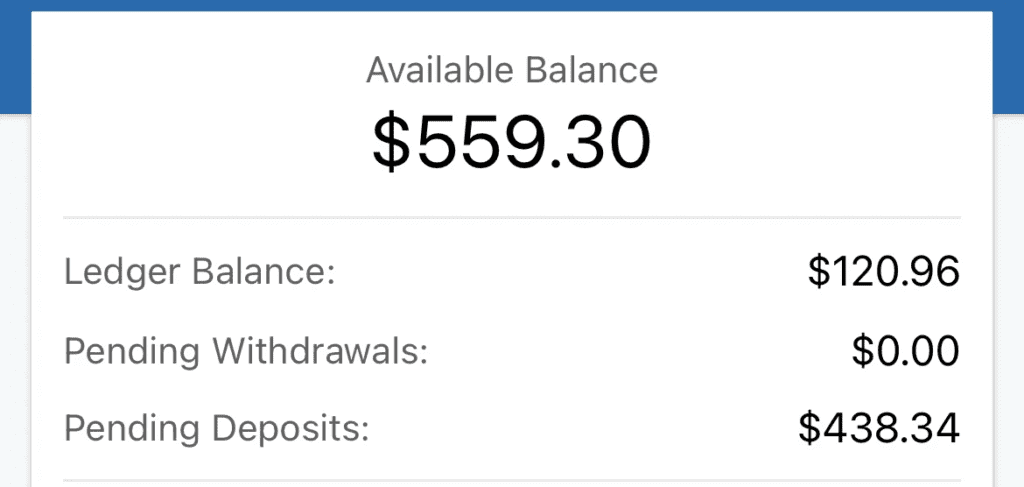

- Ledger Balance is the amount displayed at the start of each business day. It is subject to change on the next business day, influenced by all debit and credit transactions made.

- Available Balance is distinct from the Ledger Balance and represents your bank account’s real-time, actual balance, indicating the amount available for withdrawal.

Anyone dealing with finance might have heard about Ledger Balance and Available Balance. Even though these financial terminologies can be confusing, they are essential to managing your finances.

So, what exactly is Ledger Balance? How is it different from the Available Balance? And why does it matter? Let’s discover the answers!

What is Ledger Balance?

Ledger Balance refers to the opening balance at the start of the day. It remains constant for over 24 hours. This is because the bank processes pending transactions at the end of the business day. After this, the Ledger Balance gets updated for the subsequent period.

The bank considers all the withdrawals and deposits that are approved and processed. This includes any outgoing payments made or received, interest income, cleared checks, and error corrections.

This is why any pending transactions will not be considered in the Ledger Balance. Ledger Balance, also known as current balance, is used in accounting and banking for reconciling book balances.

It also helps to know if the bank account holder has maintained a minimum threshold in their bank account.

We maintain the Ledger Balance up to a specific date, and it won’t reflect any deposits made or outstanding checks cleared on or after that statement date.

What is the difference between Ledger Balance vs. Available Balance?

A Ledger Balance differs from an Available Balance in that the latter shows financial transactions that haven’t been processed.

| Ledger Balance | Available Balance |

| Provides the starting balance on transactions approved and processed the previous business day | Provides the real-time balance of a personal checking account |

| Doesn’t reflect any unprocessed transactions during the day | Changes during the day based on withdrawals and deposits made. Both complete or incomplete transactions are reflected on the account balance |

| Metric better for long-term financial planning | Metric better to be used for knowing money is immediately available |

| The current balance may not be ready to use, as some cheques or deposits may first need the bank’s approval | The Available Balance is ready for access immediately |

| It doesn’t change during the day, only updated at the beginning of the next day | Another main difference is that the available balance changes frequently throughout the day |

| Calculated as: Ledger Balance = Opening. balance + Credits – Debits | Calculated as either: Ledger Balance +/- any debit or credit till the moment you check your real-time balance or Ledger Balance +/- deposits or cheques that haven’t been processed yet |

As a business owner, knowing the difference between the two is crucial. This is because banks don’t transfer funds immediately after a transaction. Usually, the bill payments take time before they reach the account owner.

In such cases, businesses can consider the Available Balance for immediate financial decisions. On the other hand, they can look at the Ledger Balance for a comprehensive view of their financial health.

Imagine it is Wednesday morning, and you have $10,000 in the Ledger Balance of your checking account. You decide to treat yourself and buy a laptop for $1,500 with your debit card.

To your relief, a friend paid back the $2,500 they owed you. Now, checking your Ledger Balance during the day will still show $10,000.

The changes will only be reflected once the transactions are processed and approved. However, the Available Balance would show $11,000, reflecting all the real-time transactions.

How does a Ledger Balance work?

The Ledger Balance updates after we approve and process transactions by the end of the business day. Once we update it, you’ll see the new balance the following day.

Banks look into various transactions, including deposits, wire transfers, cleared cheques, interest income, cleared credit cards, debit transactions, and error corrections.

One reason for this processing time is the federal regulations governing financial institutions. They allow banks to hold deposited funds for some time before they become Available for use by the account holder.

Why Ledger Balances are Important?

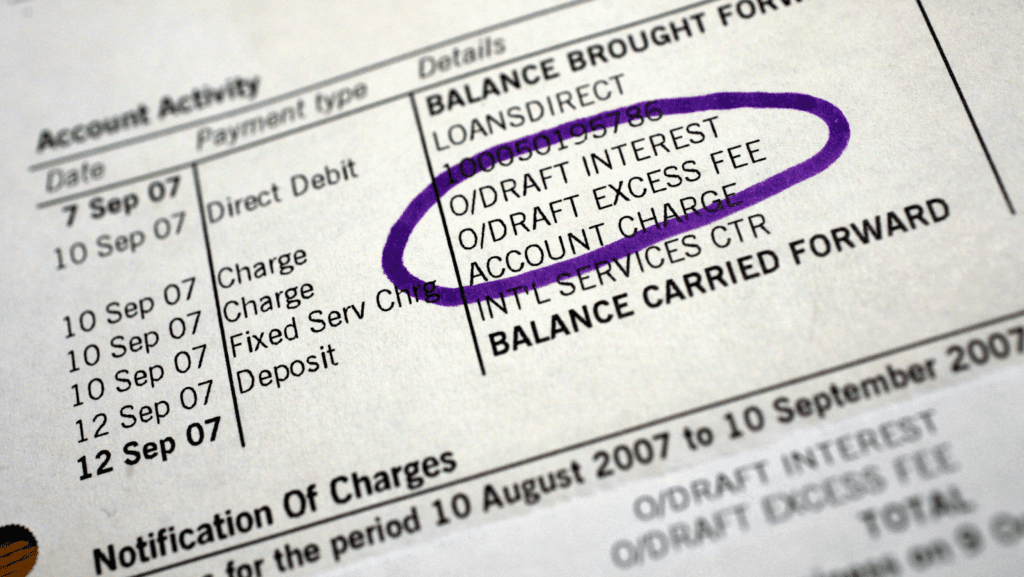

Ledger Balances are important as not knowing about them can lead to problems such as bounced cheques and insufficient funds when making payments.

For instance, if you make a large purchase but are unaware of the Ledger Balance, you may face unexpected overdraft fees.

Staying updated on your Ledger Balance helps with budgeting and avoiding unnecessary issues.

Factors that Affect Ledger and Available Balance

Some key factors affecting the Ledger and Available Balance are pending deposits/withdrawals, processing delays, and bank transfers.

Depending on the bank’s policies, some deposits or withdrawals take longer before they are accessible.

Processing delays can also occur based on different factors, including the day of the week. If you process a cheque on a Friday, you may have to wait till Monday before it gets processed and show up in the checking account.

Finally, some banks have a close working relationship, leading to faster processing times. But, if a transfer includes a foreign bank, it might take longer to succeed.

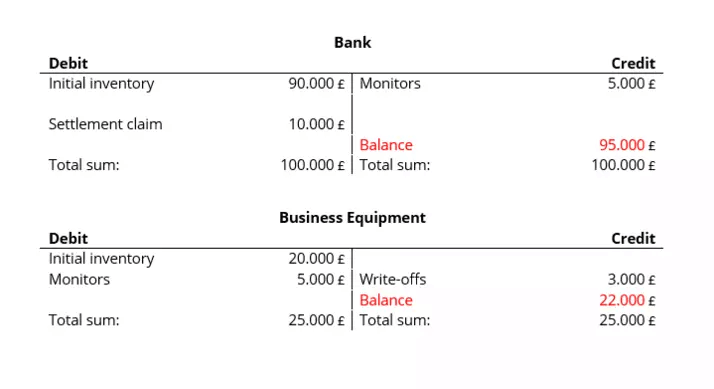

How to Calculate Your Ledger Balance

Follow these three steps to calculate your Ledger Balance

Find the opening balance

Look at your business’s bank account and identify the Ledger Balance at the beginning of the day, called opening balance.

Add all credits

Add up the actual amounts of all payments you’re confident will process, including deposits you made, income received from others, wire transfers, and earnings.

Subtract all debits

Now, subtract the debits you have made from your bank account, including paying off debt, interest, or expenses

In summary, Ledger Balance works with the formula below:

Ledger Balance = Opening balance + Credits – Debits

This ending balance represents the financial standing at the end of the business day, providing the current Ledger Balance.

How to Monitor Ledger and Available Balance?

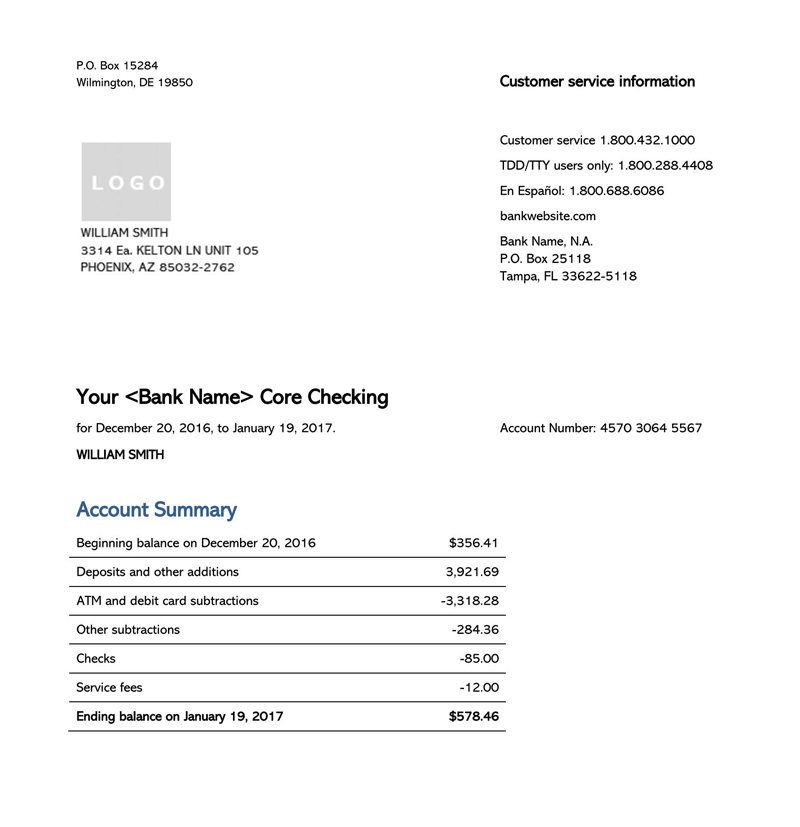

You can review your bank statement monthly or quarterly. This will ensure that all the deposits, withdrawals, and fees are recorded without any errors.

Also, consider utilizing the online application provided by your bank. It helps to get real-time updates on any transactions made immediately.

You can even set up notifications for large transactions or when the Available Balance falls below a certain minimum balance with enough funds.

Finally, having multiple active bank accounts is common today. Thus, you can explore financial management applications that consolidate information from various accounts.

This will help provide a complete view of the Ledger and Available Balance.

What about Bank Statements?

A Bank statement is a financial document that summarizes the transaction activity of an account holder. It includes all credits and debits made from various sources.

They are available either by visiting the bank or through the online platform provided by the financial institution. These statements can be received monthly, quarterly, or on demand.

Through these statements, you can figure out the Ledger Balance and the Available Balance.

You can take out money based on your Ledger Balance, but always check your Available Balance because that's the money you can use immediately. If you withdraw funds more than your Available Balance, you might face fees or returned transactions.

For real-time updates, the Available Balance provides the best insights. Yet, the “Ledger balance” helps get a complete picture of your finances.

The Ledger Balance shows the amount at the beginning of the day but only gets updated the next morning. Available Balance updates all debits and credits made throughout the day.

The Ledger Balance doesn’t get updated throughout the day, but the Available Balance does. Thus, if you have made withdrawals, you will notice the Ledger Balance is more than the Available Balance.

When a business writes a cheque for more than it has in its checking account, the Ledger Balance is negative.