TL;DR

- Day trading crypto aims to generate profits through the rapid buying and selling of digital assets. Still, it carries inherent risks that require informed strategies such as range trading, high-frequency trading, scalping, and more.

- Seasoned crypto day traders stay disciplined and unemotional, assessing factors like liquidity, volatility, and trading volume and employing technical indicators, chart patterns, and sentiment analysis to identify entry and exit points.

Introduction

Crypto-day trading, or intraday trading, enables investors to capitalize on short-term price movements in the cryptocurrency market. While potentially profitable, day trading crypto comes with high risk.

In this guide, we’ll equip you with the 15 best crypto day trading strategies to succeed in your journey. We’ll also break down the necessary steps to start day trading cryptocurrencies and explore common pitfalls to avoid along the way.

Keep reading to discover what it takes to become a crypto day trader and how to navigate the crypto markets effectively.

Top 15 Crypto Day Trading Strategies

1. Range Trading

The range trading strategy focuses on stable support and resistance levels in sideways or non-trending crypto markets. Crypto day traders use this strategy to buy assets when they’re oversold (at lower prices) and sell when they’re overbought (at higher prices).

Applicable not only in crypto but also in other financial markets, range trading offers clear entry and exit points, helping you minimize losses and secure small profits in a short timeframe. This approach is good for trading high-liquidity coins oscillating between two stable price levels.

2. High-Frequency Trading (HFT)

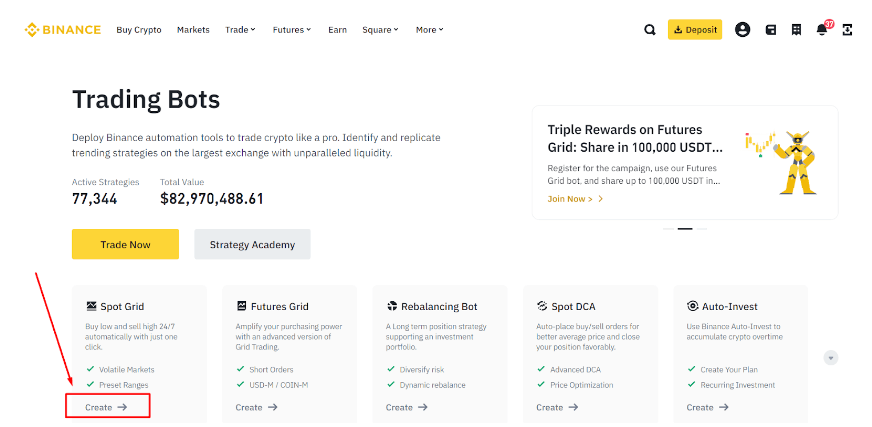

High-frequency trading, or HFT, relies on software tools to execute trades. Capable of processing hundreds of transactions per second, these automated algorithms and trading bots can help you capitalize on small price movements in the shortest time possible.

HFT involves a steeper learning curve compared to other day trading strategies. An opportunity to streamline the order execution makes this strategy a top pick among professional traders. Still, platforms like Binance offer simplified trading bots for everyday use.

3. Scalping

Scalping is another day trading strategy that aims to profit from small price movements. Adherents of this strategy buy and sell digital assets within relatively short timeframes, from minutes to a few hours at most.

Scalping calls for high asset liquidity and low spreads so that trading costs don’t affect your revenue. Since this trading strategy allows for small percentage gains, it requires the purchase of high asset volumes. As an advanced strategy, scalping may not be suitable for novice crypto day traders.

4. Long Straddle

The long straddle is a versatile trading strategy designed to help you profit from significant price swings. Day traders following this strategy purchase both a put and call contract for the same cryptocurrency. These orders have an identical strike price (the price for buying or selling the derivative contract upon its execution) and expiration date.

In this strategy, crypto price movements are critical, regardless of their direction. If the price remains fixed, a crypto day trader will incur losses.

5. Arbitrage

Crypto arbitrage assumes making profits on cryptocurrency price variations across different exchanges. Following this strategy, you will purchase an asset on one crypto trading platform and promptly sell it on another one for a higher price.

As a prime illustration, day trading Bitcoin to capitalize on price disparities (the phenomenon known as “Kimchi Premium”) brought crypto enthusiasts profits of 40% or more as they bought crypto in U.S. exchanges and sold it on Korean platforms. Arbitrageurs can also capitalize on price disparities between cryptocurrency pairs.

When day trading crypto through arbitrage, you need to act swiftly to seize opportunities for profits so that automated tools may be useful. Remember that you’ll need accounts on multiple platforms for arbitraging, which can be resource-intensive.

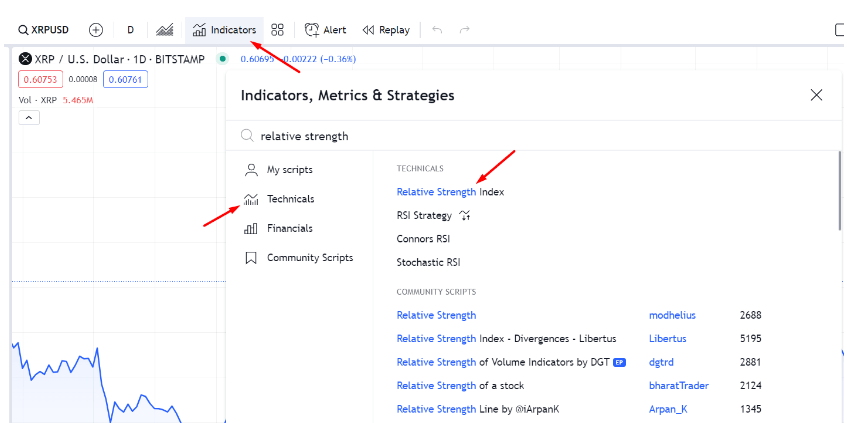

6. Technical Analysis

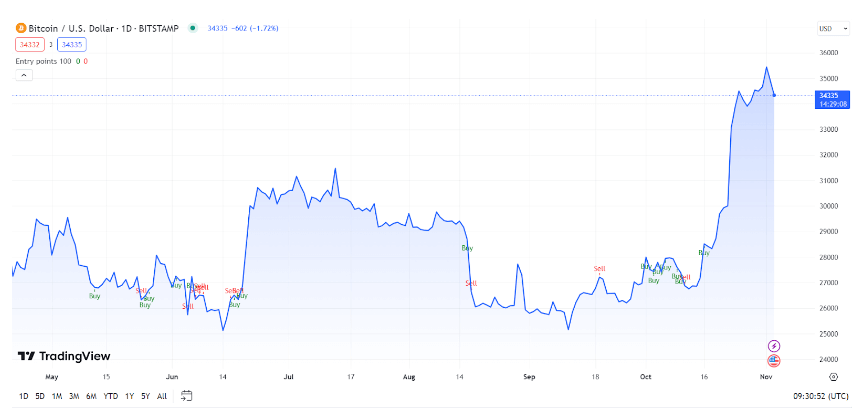

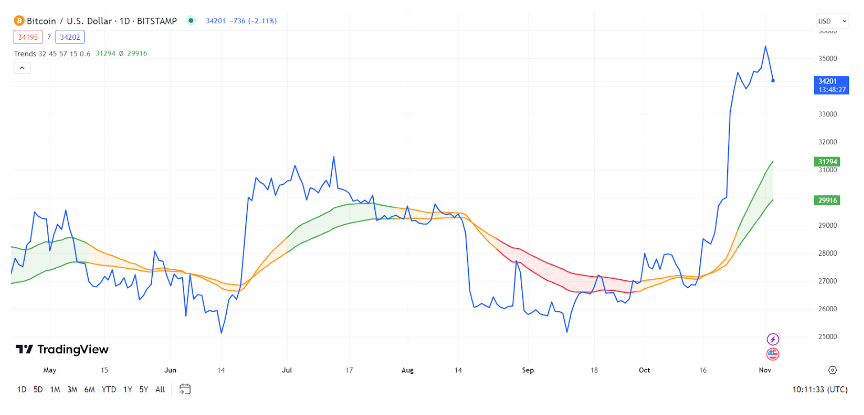

Technical analysis is a statistical approach to crypto trading. It involves studying historical trading data, such as prices and trading volume, to identify crypto market trends and uncover opportunities. On TradingView, you can find lots of data and tools to enhance your technical analysis.

To gauge crypto asset’s potential, day traders use indicators like the Relative Strength Index (RSI) and the Money Flow Index (MFI). These technical indicators can give you a hint about potential entry and exit points for successful day trading.

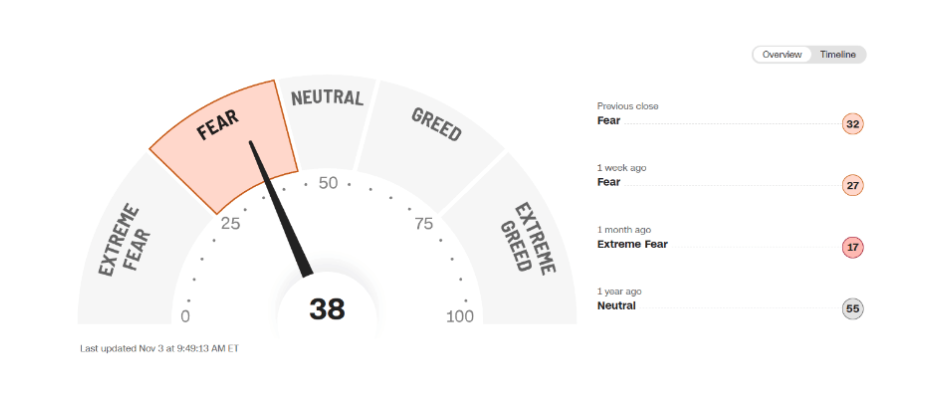

7. Sentiment Analysis

Sentiment analysis involves predicting crypto market movements based on human reactions and information sources, rather than price trends. Following this approach, crypto day traders assess public sentiment toward specific digital coins by monitoring news outlets and social media.

To perform sentiment analysis, monitor the Bitcoin dominance ratio, Fear & Greed Index, Google Trends, news aggregators, and other sources.

8. Momentum Trading

Momentum trading is a day trading strategy capitalizing on the prevailing market trends and price movements. By buying assets with an upward trajectory and selling those in decline, day traders aim to capture short- to medium-term price fluctuations.

Key indicators like Moving Averages and the Relative Strength Index (RSI) can help you identify assets with momentum and potential entry and exit points.

9. Order Flow Trading

Order flow trading focuses on analyzing the flow of buy and sell orders in the crypto market. By monitoring order book data, day traders look for imbalances or significant shifts in the order flow. Analyzing these dynamics can help you predict short-term price movements and enter trades accordingly.

10. Breakout Trading

With the breakout strategy, a day trader will enter positions when prices escape established levels. This strategy thrives on the expectation that prices will continue to move in the direction of the breakout, whether upward or downward.

Breakout trading strategies require substantial technical analysis and vigilant market monitoring.

11. Pullback Trading

The pullback trading strategy aims to benefit from impulsive price swings within highly volatile crypto markets. Since prices rarely follow a linear path, exhibiting either bullish (rising) or bearish (falling) trends, it makes sense to buy an asset after it has recently decreased in value.

At the core of this strategy lies the expectation that the asset will bounce back from its decline and return to its previous price level or even surpass it.

12. Reversal Trading

Reversal trading identifies key points where a cryptocurrency’s price trend will likely change direction. How does it differ from pullback trading, you ask?

Pullback strategies target assets temporarily dipping in value within an ongoing trend. Reversal trading, in turn, seeks assets poised to switch from a bearish to a bullish trend or vice versa.

To identify potential trend reversals, day traders rely on indicators such as the Moving Average Convergence Divergence (MACD), the Relative Strength Index (RSI), and candlestick patterns.

13. Mean Reversion Trading

Mean reversion trading assumes that prices tend to revert to their historical average over time. Adherents of this strategy spot coins that have recently undergone substantial price fluctuations, anticipating a return to their average price levels.

When a digital asset deviates substantially from its historical mean, a day trader takes positions, expecting a price correction.

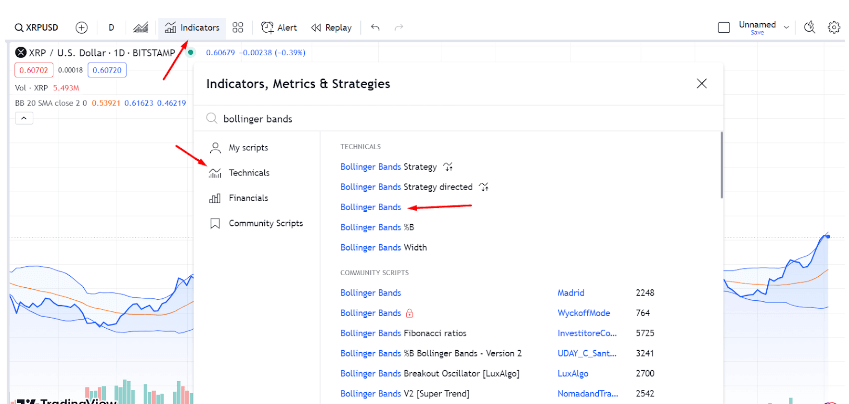

Key technical indicators for mean reversion trading include Bollinger Bands, moving averages, and the Relative Strength Index (RSI).

14. Trend Trading

Trend trading is about identifying the prevailing direction of price movements, whether it is upward or downward, within a single day. Crypto-day traders can use a combination of timeframes and technical indicators to make informed decisions.

When you spot a trend in the crypto market, you’ll want to trade in this direction, especially if clear trends are present.

15. Swing Trading

Swing trading aims to capitalize on crypto price movements within both intraday trading and more extended trading periods. This approach focuses on the price swings within larger trends, helping day traders achieve numerous small wins that accumulate into substantial returns.

Most swing traders utilize daily charts for entry and exit points, while others prefer 4-hour or hourly charts for greater precision.

How To Get Started with Crypto Day Trading: A Step-By-Step Guide

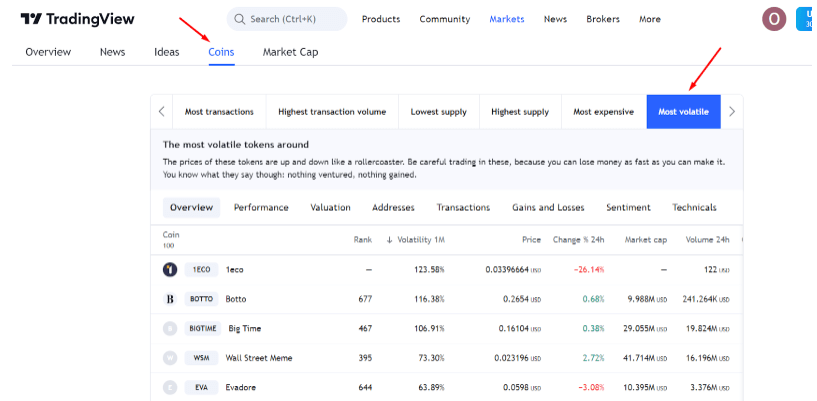

Step 1: Choose a Crypto to Day Trade

Just like with traditional financial markets, the first step in your crypto day trader journey is selecting the asset to day trade. Here are the key factors to consider when making your choice:

- Market Volatility: Assess the asset volatility. Price movements of highly volatile coins can pose significant risks yet open attractive day trading opportunities.

- Asset Liquidity: Liquidity refers to how easily you can buy and sell an asset. With highly liquid cryptocurrencies, it’s easier to find entry and exit points. Illiquid assets, in turn, make it difficult to execute trades.

- Trading Volume: Pay attention to the trading volume of the crypto tokens you’re considering. Cryptocurrencies with a high trading volume may offer better opportunities for trading as they are circulating in more active and competitive crypto markets.

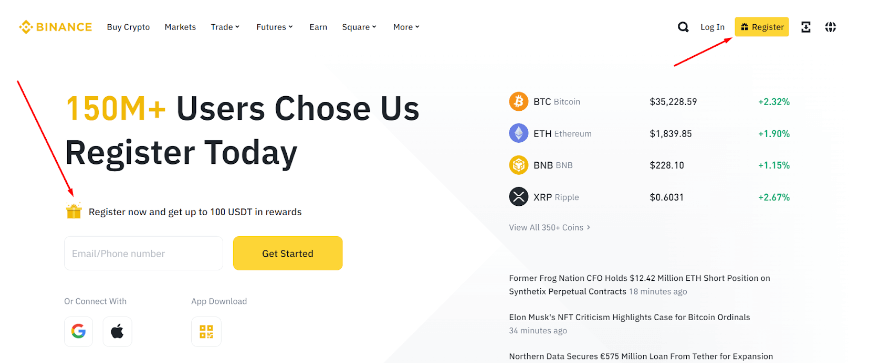

Step 2: Pick a Crypto Brokerage Platform

Next, you need to register with a reliable crypto brokerage platform. With so many options out there, how do you pick the best cryptocurrency exchange? Compare the alternatives by the following criteria:

- The reputation of the crypto exchange

- Security measures in place

- Supported crypto coins

- Available funding methods

- Trading fees involved

- User-friendly interface

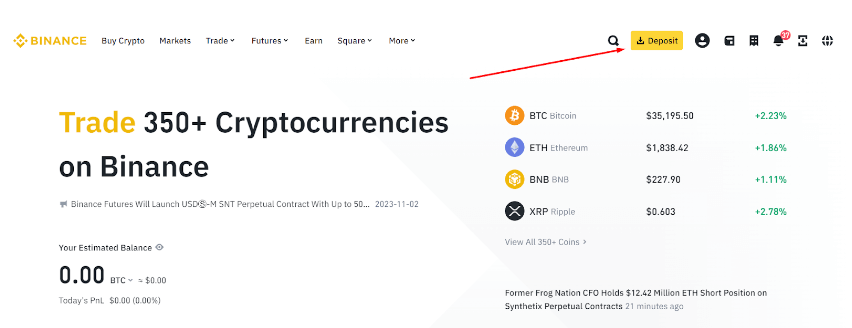

Popular crypto exchanges among day traders are Binance, KuCoin, Kraken, and Coinbase.

More details

Binance is a great combination of low fees, deep liquidity and multiple cryptocurrencies and trading pairs. We have tested every aspect of it and it STILL holds its reign as the top exchange in the world. In our view, it is the perfect crypto exchange for both newbies and advanced traders alike.

-

Biggest exchange in the world.

-

Industry's lowest trading fees.

-

Advance trading options like leverage trading.

-

600+ crypto options, 150+ for the US.

-

Lucrative on-site staking options.

-

Hiccups in account verification.

-

Less regulated than some competitors.

-

The corporate structure is not transparently.

Step 3: Create an Account with the Trading Platform

Once you’ve selected the right trading platform, complete the registration process. Then, link your bank account or wallet for funding.

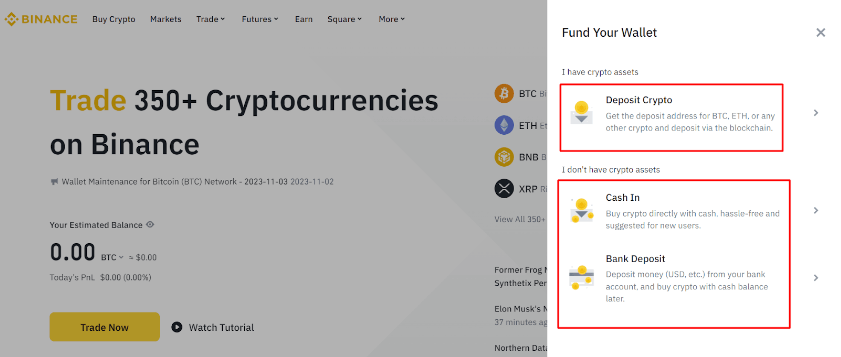

Step 4: Top Up Your Account

After setting up your account, deposit funds to start day trading crypto. Determine how much you’re willing to invest and transfer the desired amount into your trading account.

Depending on the crypto exchange platforms, you can fund your account using a credit card or a bank transfer. Make sure not to deposit more than what you can afford to lose.

Step 5: Come Up with a Trading Plan

Now that you’re prepared for day trading cryptocurrency assets, create a clear plan to guide your actions. Choose a trading strategy that aligns with your risk tolerance and objectives.

The most popular options include range trading, HFT, and scalping. We’ve covered the most popular trading strategies earlier in this guide, so check back to see what works for you best.

Next, identify your entry and exit criteria. Additionally, plan your risk management activities such as

- Position sizing, which determines the amount of capital allocated to each trade;

- Placing stop-loss orders to exit trades at the predetermined price automatically.

Step 6: Practice Day Trading in the Demo Mode

Before risking your initial investment capital, practice day trading cryptocurrencies in a demo mode offered by many crypto exchanges. This approach allows you to obtain basic trading skills, refine your approach, and find a winning strategy.

eToro, a platform with a unique social trading network, offers a free demo account to all members to practice trading skills and explore the strategies of seasoned investors.

Step 7: Consider Crypto Bot Trading

After you’ve started day trading crypto, you may want to automate the process to a certain extent. With today’s automated financial instruments, you can select a reliable trading bot that matches your trading strategy and risk management preferences. AI-powered trading bots can assist you in executing trades based on predetermined parameters.

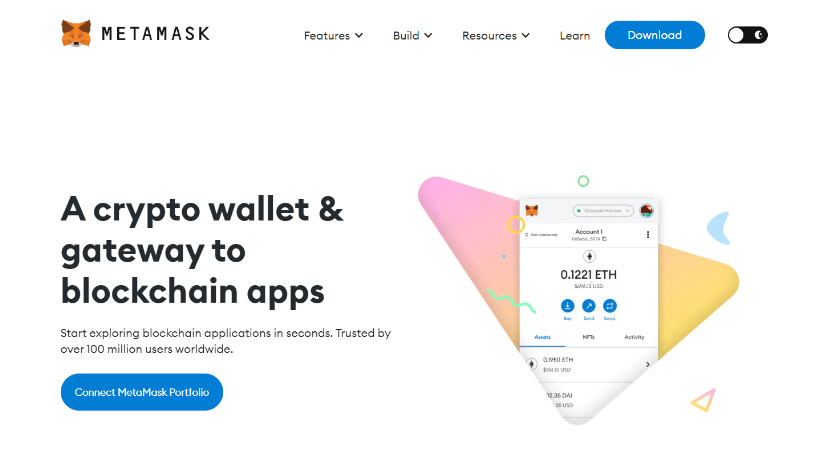

Step 8: Decide on Storage for Your Crypto Assets

In addition to the trading process itself, you need to take care of secure storage for your digital assets.

Choose between custodial wallets, linked to crypto exchanges like Binance and store your keys, and non-custodial wallets like MetaMask and Trust Wallet, which keep your keys without intermediaries.

Wallets can also be hot and cold — that is, online and offline. For your peace of mind, use hardware or software storage options with strong security features.

Consider Trezor and Ledger as prominent offline crypto storage solutions, with Ledger offering three types of wallets: Ledger Nano X, Ledger Nano S Plus, and Ledger Stax.

More details

The Ledger Nano X is a must-have, secure hardware wallet for cryptocurrency. It features easy mobile pairing, a sleek design, Bluetooth support, and robust security features like a safe chip and two-factor authentication.

-

Supports 5500 various cryptocurrencies.

-

Private keys are encrypted.

-

Desktop and mobile devices are supported.

-

Bluetooth enabled.

-

Allow 100 apps storage.

-

Fairly overpriced against the competition.

-

Only 100 apps are allowed.

-

Bluetooth works solely with mobile.

Common Mistakes Crypto Day Traders Make

Neglecting Market Research

Failure to conduct market research can hinder your ability to make informed decisions. To day trade crypto confidently, explore asset liquidity, its past performance, and growth potential.

Learn how to conduct fundamental and technical analysis and read essential indicators. Stay updated with the latest news and events that may impact your trades.

Overtrading

Once you’ve started day trading crypto, it’s important to stay in control in terms of both time and money. While executing numerous trades within a single day can be tempting, overtrading can cloud your judgment and lead to burnout. Additionally, frequent trades can lead to increased fees.

Trading Out Of FOMO

Fear of Missing Out (FOMO) often drives impulsive decisions, such as entering a trade too late or too early. As a result, you may face losses or missed trading opportunities.

Stick to your trading strategy, and don’t let emotions dictate your actions. Maintain discipline and patience, and only enter trades when they align with your predefined criteria.

Trading Beyond Your Means

In an attempt to achieve their financial goals quickly, some crypto enthusiasts put all their savings into trading. To prevent financial stress and losses, it’s essential to trade crypto within your means and only invest what you can afford to lose.

Wrapping Up

There you have it — the top 15 strategies and essential knowledge for crypto day trading in 2024. We hope that the insights we’ve shared in this guide will help you navigate the high volatility of crypto markets with confidence.

Remember, success in day trading crypto results from continuous learning, discipline, and effective risk management.

So, go ahead, select the strategy that aligns with your financial objectives and risk tolerance, and start day trading crypto like a pro!

Cryptocurrency day trading can be a potentially lucrative venture, but it involves high risk. Your success will depend on your skills, experience, and ability to interpret trading indicators. With the right approach, even small price movements can yield remarkable returns.

Trading success may vary from day to day due to factors such as market conditions, your chosen strategy, and external influences. On some days, you can achieve substantial gains, while on others, you may earn smaller returns or even incur losses. Seasoned traders aim to maximize profits from their trading efforts over the long run.

There are no strict requirements for the initial investment capital to start day trading crypto. You can begin with as little as $100 in your crypto exchange account and start trading.

The expected return rate, together with your investor appetite, can give you an idea about the optimal investment size.

There’s no one-size-fits-all answer to the best crypto trading strategy. Each one, from range trading techniques to swing trading, offers a unique approach. To determine the right day trading strategy for you, consider factors such as your financial goals, trading budget, and risk tolerance.