TL;DR

The term “HODL” originated from a Bitcoin forum post where a user typed “hodl” by mistake instead of “hold.” After that, it gained worldwide recognition as a term for investing in cryptocurrencies.

Hodl meaning represents the phrase “hold on for dear life.” This reflects the commitment of crypto investors to long-term investment. It also reflects their belief in the future potential of cryptocurrencies.

HODLing has emerged as a favored investment strategy and is a proven strategy that has made many millionaires. The strategy aims to capitalize on the long-term benefits of the investment.

Hodl Meaning For Crypto Investors

The term “HODL” has recently gained significant attention, particularly among those interested in Bitcoin.

“Hodling” means acquiring stocks or bitcoin and refraining from selling them for an extended duration. The intention is to buy when prices fall and keep them until their value increases.

Hodl, despite its peculiar sound, has a relatively recent origin and usage compared to other internet slang terms.

The rise in popularity of the term Hodl can be attributed to Bitcoin. It is a misspelling of ‘hold,’ referring to investing and holding onto Bitcoin or other cryptos as a true believer.

Hodl Evolved Into Hold On For Dear Life

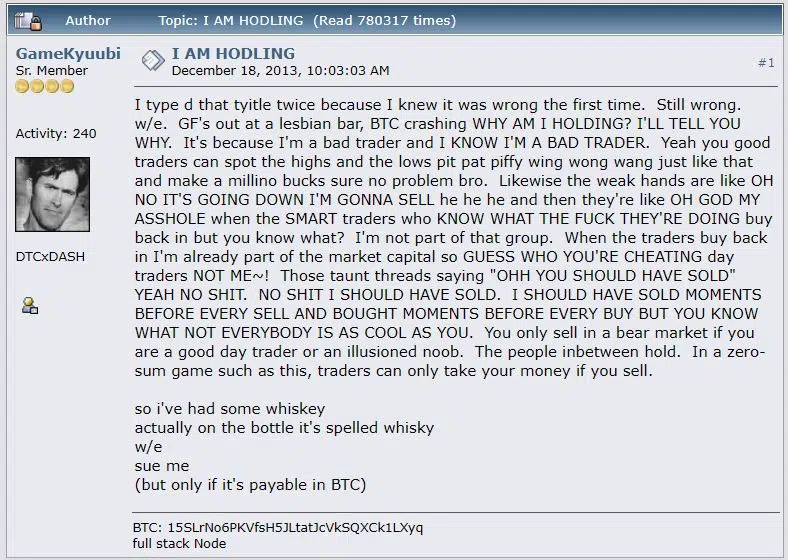

The term “hodl” originated in a 2013 Bitcoin forum post by the user “GameKyuubi,” who accidentally misspelled “hold.”

This typo sparked the creation of the term and gained recognition among the crypto community. Crypto forum-Bitcointalk members embraced “hodl” as a playful way to describe their investment strategy.

The term “hodl” evolved into an acronym, “hold on for dear life.”

It reflects the unwavering commitment of Bitcoin investors to holding their assets despite market fluctuations. This broader interpretation emphasizes their belief in the long-term potential of cryptocurrencies.

With the rise of social media and online communities, “hodl” spread rapidly. It became synonymous with cryptocurrency investment and permeated popular culture. It became a symbol of resilience, determination, and faith in the future of digital assets.

The concept of holding onto investments for a long period was not new. But, GameKyuubi’s original post coincided with the growing popularity of Bitcoin as a tradable asset that stormed for the “hodl” memes.

GameKyuubi explained that he is a bad trader and cannot predict crypto markets for other Bitcoin investors. The emerging space of the crypto market is notoriously volatile. Thus, he is using hodl as his investment strategy.

Today, the cryptocurrency community continues to use the term “hodl”. Thus, it embodies the enduring spirit of long-term investment in the crypto market.

Trusted Partners

Hodling as a Strategy in 2024

HODLing, as an investment strategy, has its roots in the stock market. It involves buying and keeping assets at significant price drops. Besides, it has become a culture in the Bitcoin world due to its notorious volatility.

All HODL memes aside, the HODL strategy has proven simple. It is also an excellent investing strategy for long-term gains.

Cryptocurrency investors believe in HODL to overcome emotions like FOMO and FUD. It represents a steadfast belief in the future of cryptocurrencies. Additionally, they envision these digital assets to navigate extreme fluctuations due to volatility.

Hodling strategy has yielded many gains for some. Yet, it is essential to acknowledge that not all investors have had a similar experience. Many investors have lost money by trading Bitcoin, often buying it at high prices and then hastily selling it after disappointing price drops.

For example, amateur investors or bad traders who bought Bitcoin at its all-time high during the crypto boom have seen sharp declines. It is a cautionary tale for hodlers, resulting in near-complete investor losses.

So, exercising caution and conducting thorough research is essential when implementing the HODL strategy. While hodling can lead to success, risks and volatility must also be evaluated carefully.

Hodl vs. Trading

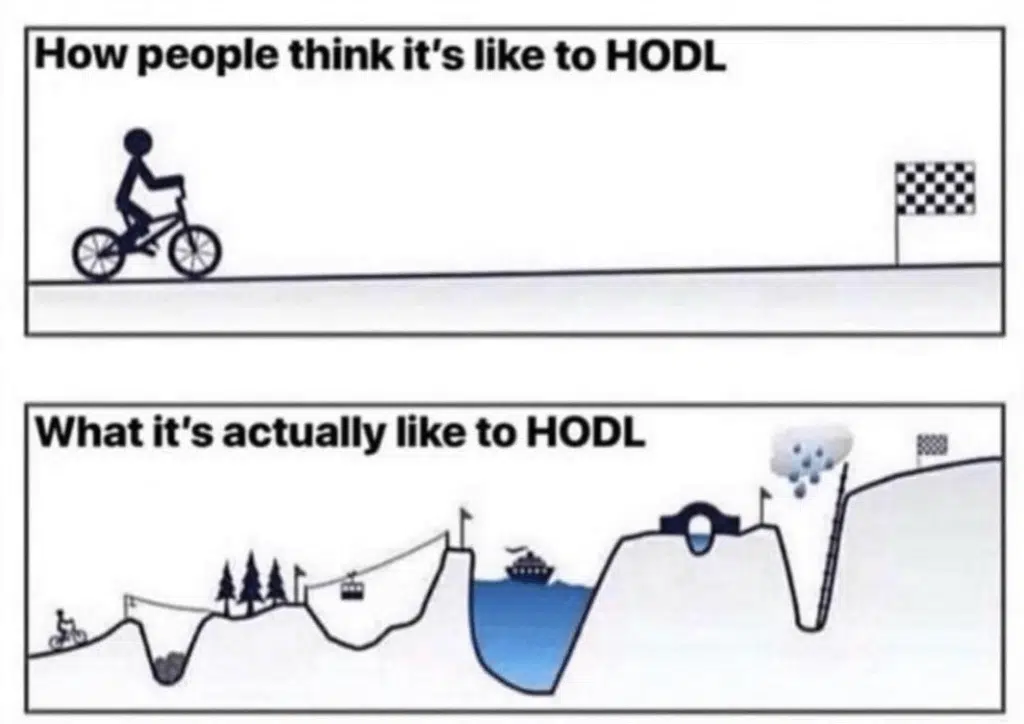

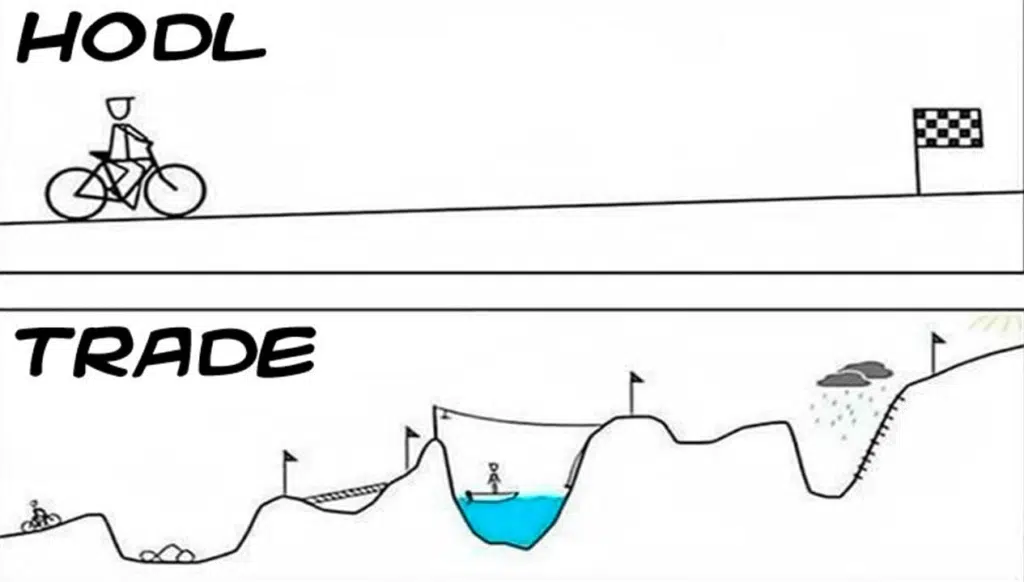

Hodling and trading represent two distinct investment strategies. When you opt for hodling, you buy assets and hold onto them for a long period, irrespective of short-term market fluctuations. It is a tactic that calls for perseverance and patience because it is based on a firm belief in an asset’s potential. Contrarily, trading entails aggressively buying and selling assets to profit from swift price changes.

Hodling provides simplicity and a long-term perspective. It helps you avoid emotional decision-making based on short-term fluctuations. It can be helpful if you believe in an asset’s fundamental value and are willing to await its long-term growth. Additionally, hodling minimizes transactions by reducing frequent buying and selling activities.

However, trading entails seizing opportunities presented by short-term price fluctuations. Traders track the market, use tools like technical analysis, and make swift decisions. Yet, it’s important to note that trading involves higher transaction costs. It can be demanding due to the need for constant market vigilance.

Choosing between hodling and trading hinges on your investment goals, risk tolerance, and time commitments. Some individuals prefer the stability and long-term potential of hodling. Some are enticed by the active and more lucrative nature of trading. It’s essential to test your financial situation, knowledge, and objectives. Then, you can determine which strategy aligns best with your circumstances.

The HODL Coin

The HODL Coin was introduced in May 2021. It is a DeFi token on the Binance Smart Chain (BSC). Also, it presents a comprehensive passive income ecosystem designed for cryptocurrency investors. The team behind the HODL token has planned strategic initiatives to offer sustainable income opportunities.

By holding HODL tokens, users can earn rewards through Binance Coin (BNB), distributed every three days. It is crucial to note that transactions involving HODL tokens carry a specific tax percentage. At last, the tax will be converted into BNB and distributed back to users.

But, it is worth acknowledging that the price of HODL tokens has unfortunately declined over time. That led to unsatisfactory returns for investors.

Is it good to HODL?

HODLing may be an intelligent strategy, depending on your risk tolerance and investment philosophy. There is no assurance that HODLing will be profitable. We already know that the cryptocurrency markets are so unpredictable.

Long-term investors who believe in the potential of a cryptocurrency can find hodling to be a promising strategy. Investors can hold their assets despite volatility. So they can reap the benefits of long-term growth. It will also steer clear of impulsive decisions driven by short-term price fluctuations.

However, investors must conduct comprehensive research. It will help to grasp the fundamentals of the cryptocurrency they are considering. Moreover, it is a must to diversify investments and check the strategy with consistency.

Summary

The term “Hodl” means both a misspelling of “hold” and the phrase “hold on for dear life.” It reflects the commitment of crypto investors to long-term investment.

Hodling meaning has emerged as a favored investment strategy. It is viewed by the cryptocurrency community from long-term prospects.

In conclusion, hodling refers to acquiring assets like stocks or cryptos for an extended duration. The intention is to buy at a low price and keep the assets until their value increases.

Hodling strategy is embraced by investors who believe in a specific digital currency’s potential growth and acceptance. It can be a means to endure short-term price fluctuations. It also prevents rash financial decisions influenced by industry trends. But, it comes with risks, and market conditions should always be considered.

A crypto hodler keeps their crypto assets for a long period without selling them. They have faith in the future value of their cryptocurrencies.

HODL is a term used in the world of cryptocurrencies, like Bitcoin. It means "Hold On for Dear Life" and it's all about not selling your digital money, even when its value goes up and down a lot. Think of it like holding tight to a rollercoaster ride!

The term "hodl" became well-known after a user of the Bitcoin forum wrote a post. The post was with the subject line "I AM HODLING" during a period of decline. Others noticed the misspelling of "hold" in the post. Over time, the term gained popularity and is used in the cryptosphere.

For investors with a long-term outlook and faith in a cryptocurrency's potential, hodling can be a good strategy. Investors should do an extensive study of the assets they hold before employing this approach. It is good to understand the market environment too.