Do you have a hard time choosing between Uphold or Coinbase? Our experts with 10 years of experience in testing exchanges know how hard it can be to pick the right exchange.

Coinbase is among the first players in the market and fits the needs of retail and institutional clients. On the other hand, Uphold has an “anything-to-anything” trading approach, allowing you to trade crypto assets for any other precious metals and currencies.

So, which exchange is best for you? Read on to find out.

More details

Uphold is a secure, transparent digital asset exchange, ideal for no-hassle transactions. With no-fee transactions for assets over $100, it sets itself apart. Furthermore, its debit card facilitates instant cryptocurrency conversions, adding user convenience. However, it's important to note that equity trading isn't available on Uphold in the US and Europe.

-

Cross-asset trading in one platform.

-

Good educational content.

-

Transparent fee structure.

-

Easy user interface.

-

No advanced trading features.

-

Weak security as it has been hacked.

-

A less appealing mobile app.

More details

Coinbase is one of the largest crypto exchanges in the world and a widely-used platform for buying, selling, and trading over 200 cryptocurrencies. It offers trading solutions for beginner, advanced, and institutional traders alike. Take a look at what makes it an excellent option for individual traders looking to trade in cryptocurrencies and beyond.

-

A wide-selection of coin offerings.

-

Most secure online crypto platforms.

-

Top-rated mobile app.

-

Easy interface and user-friendly.

-

Expensive and complex fee structure for beginners

-

Higher fees as compared to other cryptocurrency exchanges.

-

Slow customer support.

Main Platform Features

| Attributes | Coinbase Exchange | Uphold Exchange |

| Main Features | Deep liquidity and a good selection of cryptocurrencies | Anything-to-anything trading offering, as well as precious metals and FX |

| Fees | Trading fees start at 0.6% and decrease for higher-volume traders. Low fees for bank deposits and withdrawals but high fees for bank wires. | Spreads range from 0.8% to 1.2%, with the option to lock in the price. No-fee bank transfers, but in the U.S. Uphold charges 3.99% for debit card deposits and 1.75% to withdraw via card. |

| Number of Cryptocurrencies Listed | 238, with 400 trading pairs | 260+, ability to cross-trade multiple assets |

| Security Measures | Two-factor authentication, crime insurance on exchange assets, FDIC insurance on U.S. customer balances held in cash | 2FA, bug bounty program |

| Types of Transactions Supported | Buying, selling, Limit orders, Market orders, stop orders | Buying, selling, Limit orders, Market orders, stop orders |

Uphold vs. Coinbase: Features

- Global Reach: Coinbase operates in 100 countries with 238 cryptocurrencies. Uphold goes further, offering over 260 cryptocurrencies in 184 countries.

- Crypto Storage: Coinbase’s Wallet stores crypto and integrates with its trading platform. Uphold is lacking a similar app but operates as a custodian.

- Staking Rewards: Uphold offers competitive staking rewards, 0% trading commissions, and promising industry-leading APYs for up to 14%. Though Coinbase also offers staking for a similar set of digital assets, it offers up to 10% comparatively.

- Trading Options: Uphold offers more trading tools, including cross-trading digital assets, currencies, and metals. Coinbase, however, focuses primarily on crypto trading.

- Fee Structure: Coinbase benefits high-volume traders with decreasing fees. Uphold, with higher fees, emphasizes transparency in its pricing.

Uphold vs. Coinbase: Cryptocurrencies

Coinbase supports 238 cryptocurrencies and operates in 100 countries. Uphold goes further, offering over 250 cryptocurrencies in 184 countries.

Besides that, Uphold has the advantage for those who prefer multi-asset trading. It currently supports 25+ currencies, including japanese Yen and Swiss Franc, making it a good choice for global nomads.

The major difference between Coinbase and Uphold is that in addition to crypto and fiat, Uphold supports four precious metals, including silver and platinum. So, if you are someone who wants to diversify their investments, Uphold is a solid pick.

Here are some supported coins on both exchanges:

- Bitcoin (BTC)

- Ethereum (ETH)

- Ripple (XRP)

- Cardano (ADA)

- Solana (SOL)

- Dogecoin (DOGE)

- Polygon (MATIC)

Uphold vs. Coinbase: Security

Customer Funds on Coinbase are insured by the Federal Deposit Insurance Corporation (FDIC), holding 98% of crypto funds in cold storage.

Although Coinbase is SEC-compliant and trusts many institutional clients, the exchange fell victim to a hack in 2021 when at least 6,000 accounts were compromised.

Uphold says it has state-of-the-art security measures, including layered defenses and a 24/7 Security Operations Centre. But it also had its share of difficulties, including faulty 2FA.

Following the blow-up of FTX in late 2022, Uphold rushed to publish Proof of Reserves and claims that it has always been 100% backed with reserves. Coinbase hasn’t published its reserve status, but since going public in 2021, it has audited financials, including annual financial statements filed with the SEC.

Uphold vs. Coinbase: Fees

Coinbase follows the common maker-taker fee model, initially ranging from 0.40% to 0.60% but decreasing with higher monthly trading volumes.

Deposit and withdrawal fees vary on Coinbase, with Automated Clearing House (ACH) being free, SEPA costing 0.15€ for deposits (free for withdrawals), and wire transfers at $10 for deposits and $25 for withdrawals.

In contrast, Uphold employs a spread for each trade, offering simplicity and transparency, with free ACH deposits in the U.S. and varying fees for card deposits and withdrawals. In the E.E.A., SEPA, Debit and credit card transactions are free.

Uphold’s all-inclusive pricing model locks in pre-trade prices, ensuring transparency with no hidden fees. There’s a flat fee of $0.99 for trades under $500.

Meanwhile, Coinbase offers a premium subscription, Coinbase One, for $29.99/month, providing fee waivers, enhanced staking rewards, and simplified crypto tax filing.

| Fees | Uphold | Coinbase |

| Bank Account | Free | 1.49% |

| Debit/Credit Cards Deposits | 2.49% debit/3.99% credit | 3.99% |

| ACH Transfer | Free | Free |

| Crypto Conversion | Free | Up to 2% spread |

Uphold vs. Coinbase: Debit Cards

Coinbase’s Visa card is available to EU and US residents (excluding Hawaii), while the Uphold debit card is only available to residents of the U.K. However, the exchange says a new card will be launched for US residents “in the near future.”

Uphold’s card has 0% foreign transaction fees, a favorable exchange rate, and 0.8% cashback. With it, you can spend crypto worldwide hassle-free, with no setup or annual fees. Plus, the integration with Apple Pay and Google Pay adds extra convenience.

Meanwhile, the Coinbase Visa debit card has a cash-back reward of 4%, making it better for those who want to earn crypto while spending. It allows you to spend USD or 8+ crypto without fees (trading fees apply). Security features include two-factor authentication, card freezing, and pin change.

| Coinbase Card | Uphold Card | |

| Foreign Transaction Fees | 3% + 2.49 Liquidation Fee | |

| Cashback Crypto Rewards | Up to 4% | 1% (XRP 4%) |

| Available Countries | US & EU | EU |

| International ATM Withdrawal | 1% fee for domestic and 2% for international | $3.50 |

More details

Uphold partnership with Mastercard allows users to use the card for online and in-store purchases. Uphold offers a highly secured payment process, an excellent user interface and experience, and good cashback payment rewards. The significant drawbacks to this card are its geographical limitation to U.S. and U.K. and the poor customer support.

-

Supports over 250 assets.

-

They are accepted almost everywhere in the world.

-

Transparent fee structure.

-

Easy user interface and excellent user experience.

-

Cashback rewards on every payment.

-

High spread fees.

-

Relative new product.

-

Poor customer service.

More details

The Coinbase Card seamlessly integrates the crypto economy into our everyday transactions. Unlike typical Visa debit cards, it promotes zero transaction fees and an annual fee, providing the most cost-effective way to use your crypto. We recommend it as an ideal entry point for newcomers hesitant about volatile coins.

-

$0 annual fee.

-

Earn crypto back on every purchase.

-

Used everywhere Visa is accepted.

-

No ATM fees.

-

No credit check is required.

-

Monthly spending limits apply.

-

Tax implications.

-

Requires Coinbase account for eligibility.

-

No bonus spending categories.

Uphold vs. Coinbase: Regulatory Situation

Uphold is regulated in the United States by FinCen. In other markets, it complies with the FCA in the U.K. and FINTRAC in Canada, ensuring adherence to global Anti-Money Laundering (AML) controls.

Coinbase, recognized for its commitment to regulatory compliance, is a listed stock on the New York Stock Exchange (NYSE).

Despite ongoing legal proceedings with the SEC regarding alleged unregistered securities, the impact on users appears unlikely, ensuring both cryptocurrency exchanges maintain a strong regulatory position and are generally considered safe.

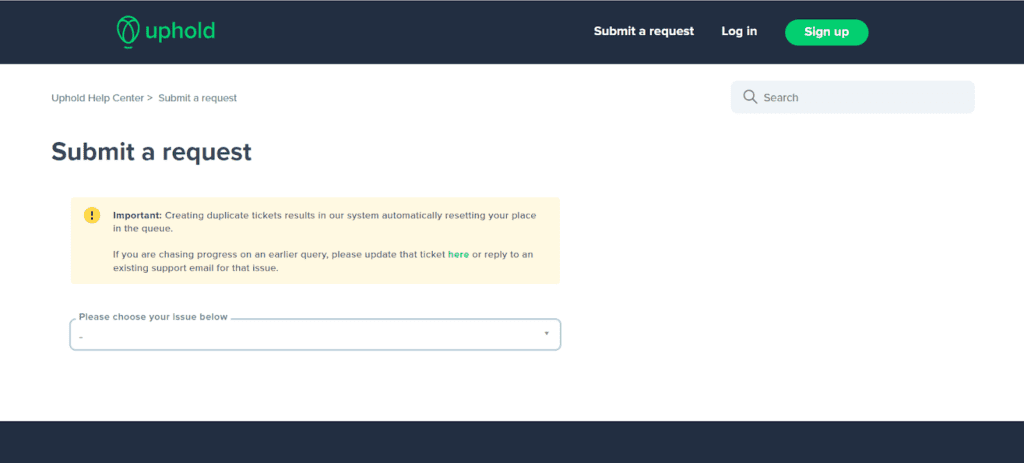

Uphold vs. Coinbase: Customer Support

Coinbase has tried to address its reputation of lousy customer support, including adding phone support options in certain markets (the U.S., U.K., Ireland, Germany, and Japan) and offering US retail customers live messaging to connect with customer service experts 24/7.

However, its current customer reviews on Trustpilot suggest that the exchange is struggling to respond to customer queries helpfully, with plenty of frustrated users leaving behind poor reviews.

Uphold’s customer service has also received its fair share of criticism, though it looks to have turned a corner more recently. Customer support is available via email, live chat, or logging a request directly on their website.

Uphold vs Coinbase: Mobile Application

Uphold and Coinbase offer their mobile app versions to their users, with both iOS and Android support.

These apps are good for experienced traders on the go and provide multiple benefits accessible through the web version. You can manage your wallet, cards, and staking from these apps. Both Coinbase and Uphold apps work smoothly and are lag-free.

However, neither the Coinbase nor Uphold apps offer advanced charting solutions.

In the context of which is better, Coinbase has a better app. The navigations here are simple. Plus, Coinbase offers two apps, Coinbase Pro and Coinbase Wallet, with more value with Coinbase.

Uphold vs Coinbase: Pros and Cons

Coinbase

| Pros for Coinbase | Cons for Coinbase |

| Conservative in listing new crypto assets. | Conservative in listing new crypto assets.. |

| Competitive fees for high-volume traders. | Limited support for national currencies. |

| User-friendly with extensive educational content. | Fewer trading pairs compared to other crypto exchanges. |

| Supports Non-Fungible Tokens (NFTs). |

Uphold

| Pros for Uphold | Cons for Uphold |

| Direct crypto trading without multiple transactions. | No debit card support for U.S. users. |

| Trade directly in both precious metals and cryptocurrencies. | Higher fees on low-liquidity coins if you compare Uphold to other exchanges. |

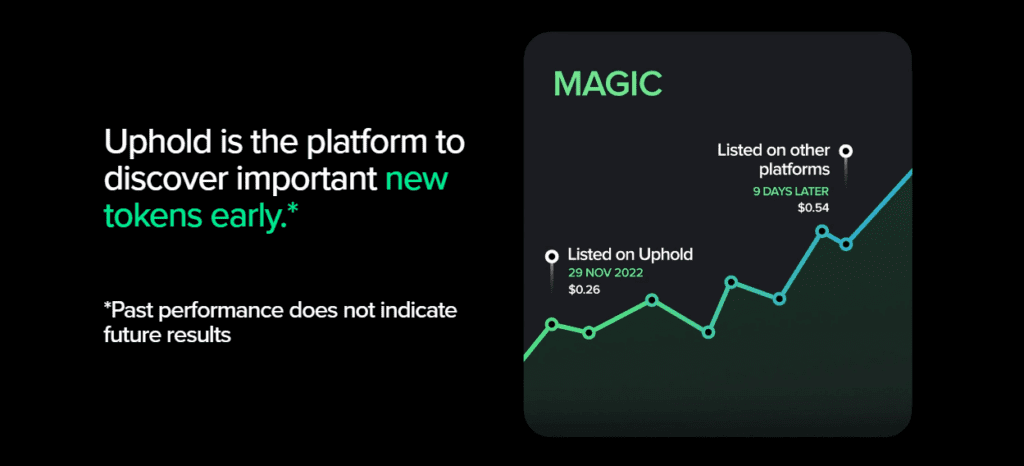

| Fast in listing new crypto projects. | |

| Supports many national currencies. |

Uphold vs. Coinbase: Final Rating

Here are some ratings from online sources, both user-generated and expert opinions.

Uphold Rating:

Trustpilot gives Uphold a rating of 3.3 stars (average) out of 5.

Uphold has a rating of 4.1 stars on G2.

Forbes gives Uphold a rating of 3.7 stars.

Coinbase Rating:

Trustpilot gives Coinbase a rating of 1.5 stars (bad) out of 5.

Investopedia gives Coinbase a rating of 4.8 stars out of 5.

NerdWallet gives Coinbase a rating of 4.8 stars.

Coinbase vs Uphold: Our Verdict

Having carefully weighed the pros and cons in our Uphold vs Coinbase comparison, we’re leaning toward Coinbase as the best choice for trading crypto.

A better fee structure, deep order book liquidity, and a widely available debit card will be attractive features for most people. Additional features such as an NFT platform, strong educational content, and the Coinbase wallet app help seal the deal.

If you still haven’t decided, we recommend checking out our best crypto exchange category for the extensive list.

Coinbase has criminal insurance if its crypto exchange is hacked and FDIC insurance on USD deposits. The business is also closely scrutinized by the SEC. Therefore, Coinbase holds assets in cold storage and seems to be a safe cryptocurrency exchange in the industry.

Like any on-chain transfer, transferring an asset like ETH will be subject to network fees that power the transaction. You can manually adjust various fees, but that will risk failed transactions.

When you stake your assets via a cryptocurrency exchange, the platform takes care of all technical issues, and for this service, it takes a margin, which varies between exchanges. Exchange stakings have benefits like being simpler; smaller amounts can be staked, and, in some cases, shorter lock-up periods.

Many exchanges allow you to spend crypto via their debit card in certain countries and may even advertise it as being zero fee. But, you will still incur trading fees if the exchanges sell it automatically to fund your purchase in fiat currencies like USD.

Uphold imposes a fee of $0.99 for transactions below $500. Credit and debit card deposits in the U.S. incur a 3.99% charge. Withdrawals to external crypto wallets may involve a network fee, but it's imposed by the cryptocurrency network, not by Uphold.