TLDR:

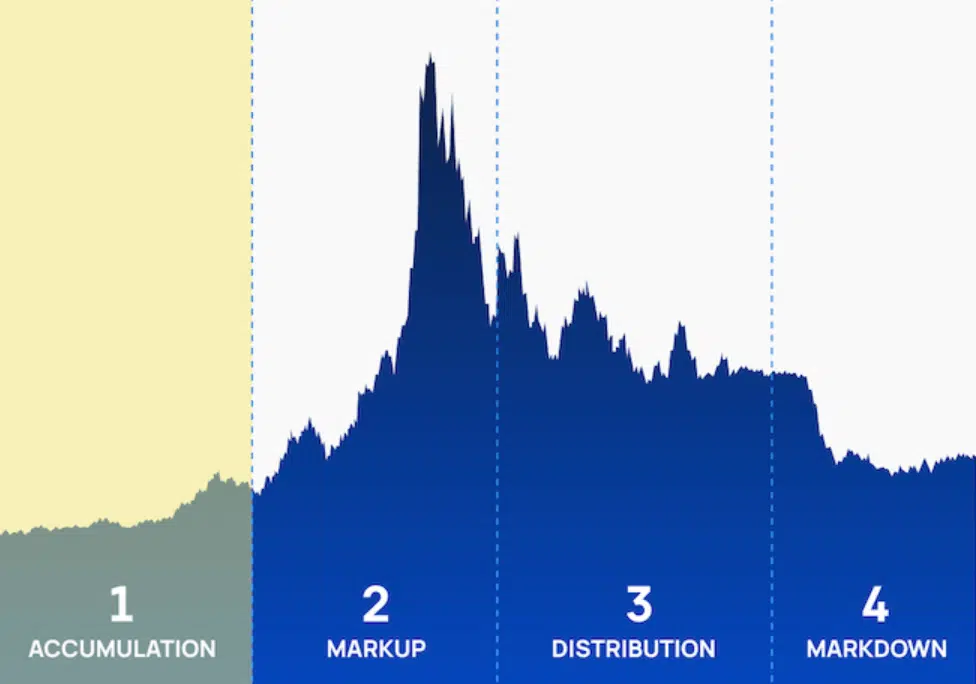

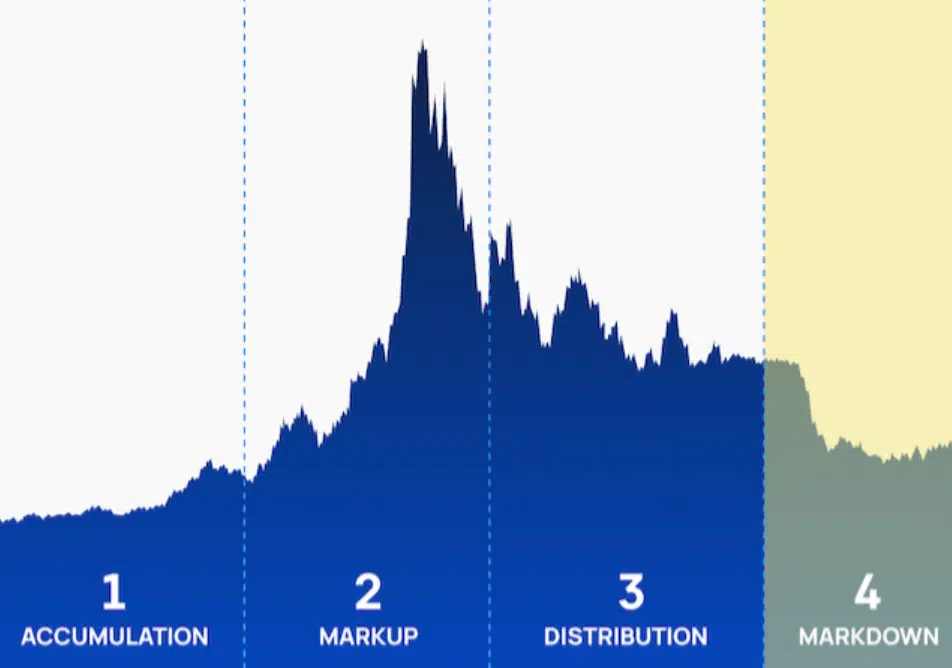

- Bull markets have 4 distinct phases: Accumulation, Early Bull Market, Peak Bull Market, and the mark-down phase.

- Each phase requires a specific strategy to maximize profits and avoid common traps.

The journey through a bull market is a dynamic process characterized by distinct phases that demand different strategies and mindsets.

To optimize your gains and avoid pitfalls, understanding these phases is essential.

In this guide, we’ll dive into the 4 phases of a bull market and outline strategies to guide your decisions at each juncture.

Phase 1: The Accumulation Phase

As we stand on the cusp of Phase 1, it’s vital to grasp the landscape ahead.

The market has weathered turbulence, with incidents such as Terra’s collapse and USDC’s depeg, but the worst seems to be over.

Volatility is subdued, and news has a limited impact on prices.

During this preparatory phase, planting the seeds for future gains is crucial.

Accumulating projects positioned for success, for example, Cosmos (ATOM) in the upcoming bull market, is a strategic move.

Prioritize projects with solid fundamentals, including product/market fit, strong teams, competitive advantages, and robust roadmaps.

To thrive in this phase:

- Strategically accumulate: Identify projects with potential and build your portfolio.

- Exercise restraint: Avoid overtrading or chasing after projects with weak prospects.

- Leverage learning: Enhance your knowledge base while liquidity is low.

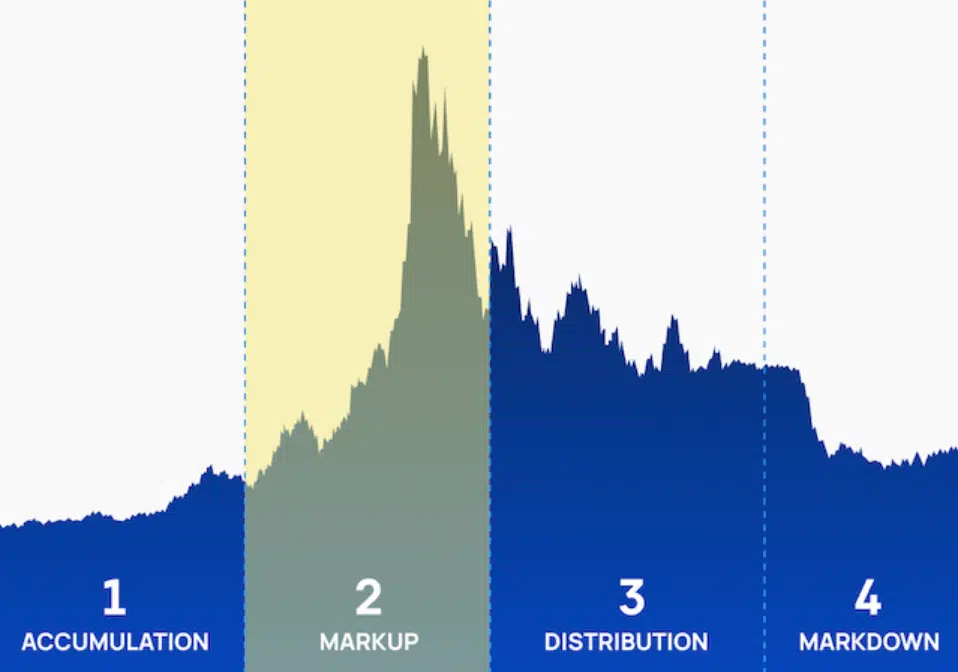

Phase 2: Early Bull Market

As prices rise and skepticism persists, the early bull market presents unique opportunities. Overcoming bear market, PTSD is essential; the earlier the cycle, the more calculated risk-taking is warranted.

Triggers for the bull market include major events like ETF approvals or countries adopting cryptocurrencies. Look out for emerging sectors such as Metaverse and NFTs, which have previously demonstrated their potential as bull market winners. Regulatory changes and improvements in onboarding processes will also play pivotal roles. Like all bull runs, new trends will emerge that you should look out for.

For success in the early bull market:

- Adapt and diversify: Adjust your portfolio and embrace calculated risks.

- Strategize profits: Set up a take-profit system to capitalize on upward trends.

- Stay informed: Monitor emerging sectors and macro changes.

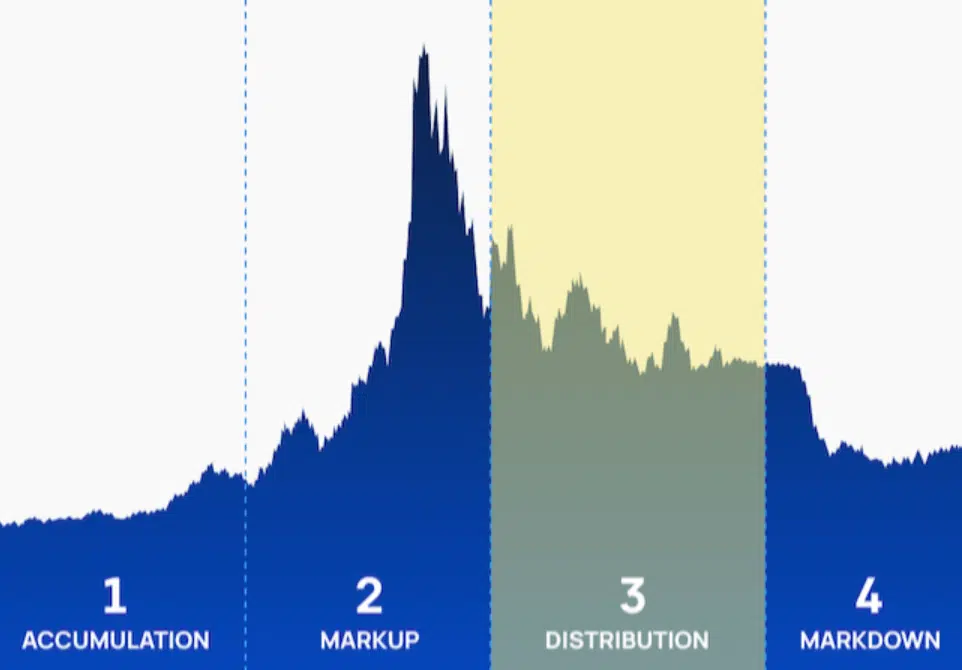

Phase 3: Peak Bull Market

Retail investment surges in the peak bull market, and coin prices tend to skyrocket.

A self-reinforcing loop of rising prices and FOMO dominates the scene.

Recognizing irrational exuberance signals and maintaining a clear exit strategy is vital.

Watch for mainstream media coverage, celebrity endorsements, and excessive bragging on social media as indicators of the peak. Amidst the frenzy, remain level-headed and secure profits.

To avoid being swept up in the euphoria:

- Evaluate signals: Identify signs of the peak, such as mainstream media attention.

- Stick to strategy: Don’t deviate from your well-planned exit strategy.

- Protect gains: Secure profits while maintaining a realistic outlook.

Phase 4: The Mark Down Phase

The inevitable downturn arrives, and the bear market looms.

Differentiating genuine trends from noise becomes critical. Chatter about a “super cycle” might arise, but rationality and caution are paramount during this phase.

As prices dip, it’s an opportune moment to capitalize by shorting declining cryptos, but these strategies are highly risky.

Also, beware of false narratives, and don’t succumb to FOMO and purchase cryptos that are in a so-called “free fall.”

Navigating the markdown phase requires a clear perspective and a disciplined approach.

Conviction for the Next Bull Market

The belief in another strong period of growth in the cryptocurrency market is based on more people becoming interested in cryptocurrencies.

This is happening because of the challenges in the regular economy and the desire to make money quickly. People see cryptocurrencies as a way to become financially successful.

Cryptocurrencies aren’t only about the systems for handling money; they also represent the chance to achieve personal dreams and goals.

Conclusion: Master the Four Stages of a Bull Run

To sum up, it’s important to understand the four different stages of a strong growth period in the cryptocurrency market.

Knowing these stages will help you take advantage of opportunities to build wealth over time.

Each stage requires a different approach, from gradually collecting cryptocurrencies to taking profits at the right times and recognizing signs in the market.

By following these suggestions and keeping up with how things are changing, you can confidently navigate the ups and downs of a strong growth period and make the most out of your investments.

A bull cycle refers to a significant price increase and upward buying pressure for Bitcoin and altcoins. Most coins gain huge growth during a bull run, surpassing previous all-time highs.

In a bull market, there are typically four stages: accumulation, markup, distribution, and markdown.

The crypto bull run occurs every 4 years due to the limited availability of Bitcoin in the market, caused by a halving event. This is when the rewards for mining Bitcoin are slashed in half, creating scarcity.

Based on previous data, we could expect the next cycle to begin in 2024. Usually, a new bull cycle begins after a Bitcoin halving event.