Search results for cryptocurrency showed a 91% correlation with price action in 2017.

For 2023 and 2024, search trends are key indicators of which investments are losing interest and which are gaining traction.

Search volume for Bitcoin is above the baseline set by the previous “crypto winter” during 2018 and 2021.

Research indicates that periods of trading volatility and outsized returns often increase Google search activity. The potential for gains is a primary driver of this web search traffic.

This list presents 13 search trends that are significantly correlated with price action.

Search growth status guide:

- Moon – general upward trend in search growth

- When Moon? – trend remains mostly flat or sideways

- Rekt – search growth has already peaked and is on the decline

1. Searches for ‘Cryptocurrency’ Show Flat Trends

The most encompassing term, “cryptocurrency,” is back to the flat interest levels of the 2018-2021 period.

The last spike in interest happened at the end of 2021, and web traffic for major blockchains and exchanges is declining.

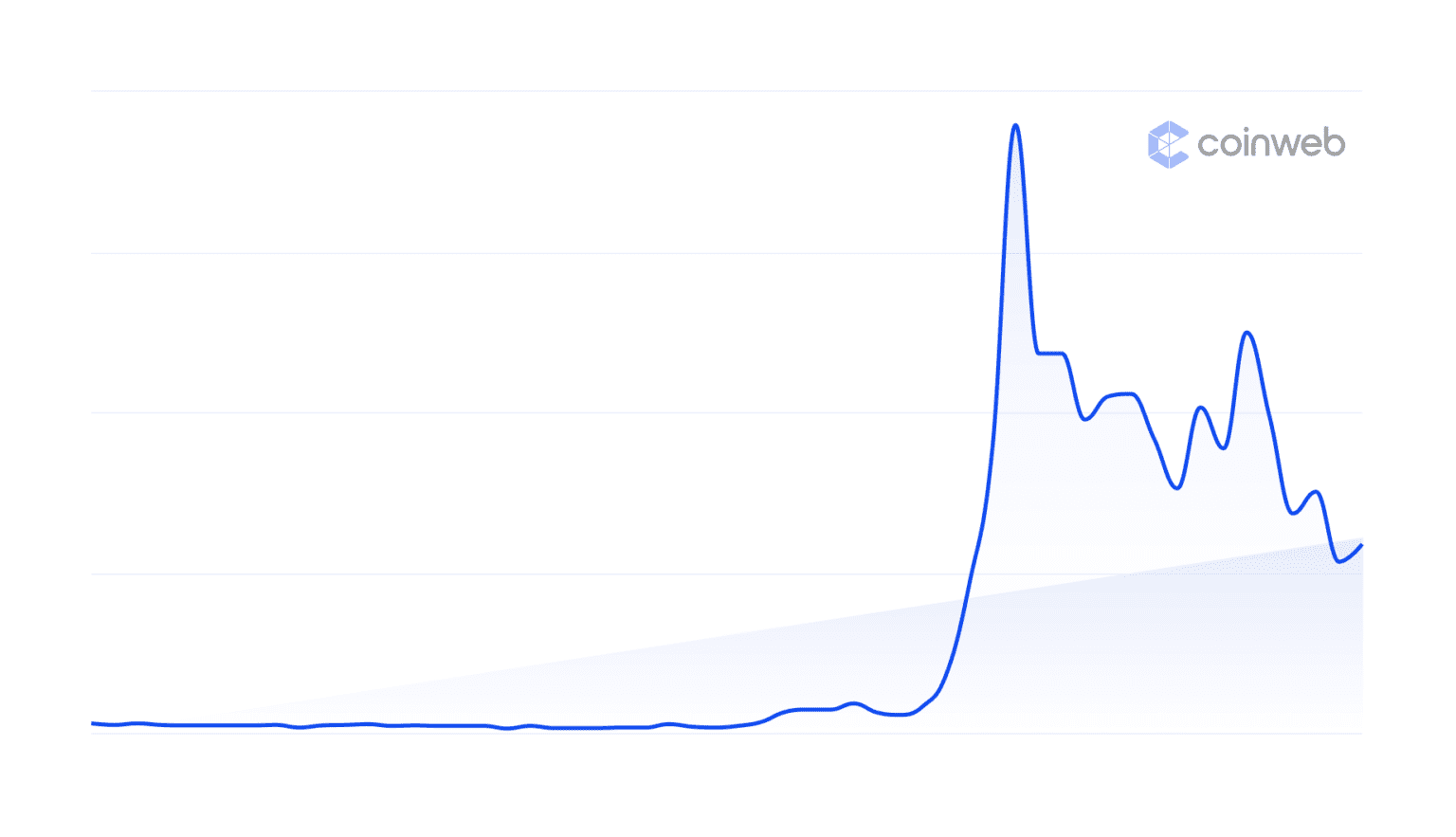

“Crypto” is the shorter, more intuitive term showing a strong correlation between peak market prices and user interest.

Searches for “crypto” peaked in May 2021, coinciding with one of the peaks in the BTC bull market. “Crypto” searches surpass “cryptocurrency” in frequency by about 300%.

5-year search growth: +1000%

Search growth status: Rekt

2. ‘Bitcoin’ Searches Miss the Summer Hype

Over the past five years, “Bitcoin” searches typically peaked during summer months. However, in 2023, this trend did not hold, and searches for the term “Bitcoin” remained flat.

The downward search trend reflected the price action, where BTC traded between $25,000 and $27,000 for most of Q2, 2023.

The search volume in Q4 2023 remains lower and flat even as the next halving of Bitcoin is expected in April 2024.

However, the search trend for Bitcoin doesn’t match the chart of active addresses. In 2023, a baseline of 800K to 1M wallets is active daily, showing that older owners are still around. Trading volumes match the search trend more closely. Daily activity is around 30% of the peak levels seen in the summer of 2021.

5-year search growth: +100%

Search growth status: Rekt

3. ‘CoinMarketCap’ Searches Wait for Next Bull Run

“CoinMarketCap” is a good indicator of mainstream interest. Search volumes mooned 500% during the 2021 bull market, compared to the low-interest period of 2018-2021.

CoinMarketCap is also closely watched for signs of crypto trading recovery and a new price direction.

Visits for May, June, and July 2023 hover between 89M and 93M, coinciding with a stagnant BTC market price at around $26,000.

5-year search growth: 100%

Search growth status: Rekt

4. ‘Ethereum’: Good Baseline Layer, but No Searches

Ethereums new searches are flat after many instances of hype over the past five years.

Searches for “ethereum” match the trend of Bitcoin searches. ETH prices peaked in November 2021 at above $4,810, but searches peaked in May, creating a weaker correlation.

Part of the searches for Ethereum were also linked to a network upgrade from August 2021, the London hard fork, which created additional hype.

Most searches are not due to price hype and pure trading but are related to the main use cases of Ethereum, especially DeFi, NFT, and passive income.

5-year search growth: 200%

Search growth status: Rekt

5. ‘Dogecoin’ – Largely Forgotten, but Not Gone

Dogecoin (DOGE) search activity moved between absolute frenzy and zero. Searches fell to rock bottom after DOGE buying interest peaked in May 2021.

DOGE was a low-priced meme coin known only to crypto insiders. Search traffic for DODGE increased once Robinhood added the coin to its portfolio.

DOGE only benefited a little from a brief stint as the Twitter/X logo from April 3, 2023. However, the meme power of DOGE spread through other crypto searches, creating a long list of DeFi projects. Meme tokens are also used for NFT collections and Web3 games.

DOGE also has a wider international search profile, reflecting its communities in Asia and South America. Despite promises that DOGE may become a tool for social media micropayments, general search interest matches the five-year slump trend.

DOGE prices peaked on May 7, 2021, coinciding with the highest Google search volume.

5-year search growth: 4500%

Search growth status: Rekt

6. ‘DeFi’ Searches Measure Risk Appetite

DeFi is an example of an insider term where the mainstream search spike was much smaller.

Despite the slow search volume, DeFi earnings are projected to reach more than $16B annualized in 2023, with about 50% of the earnings linked to US-based investors.

The DeFi tide turned after the crash of Terra (LUNA) that started on May 9, 2022. Interest waned further after the final collapse of FTX a month later.

Post-June 2022, DeFi search traffic slid more rapidly and showed no signs of rapid spikes for the rest of 2022 and most of 2023.

5-year search growth: +370% to peak, 70% net

Search growth status: Rekt

7. ‘NFT’ Survives on Creativity

NFT experienced a boom and bust cycle in 2021, correlated with the peak in search volumes. Yet the decline is better compared to other crypto-related terms.

NFT searches get a boost from the constant inflow of new collections, whether for sale or as free airdrops.

The search for NFT is also at a higher baseline after the launch of Ordinals collections. Ordinals offer a more involved NFT linked to a direct blockchain record using the Bitcoin or Ethereum networks.

NFT may be digital art but is closely linked to crypto trading. The loss of value and a slower market also translated into a weaker search trend.

5-year search growth: +9000% to peak, 700% net

Search growth status: When moon

8. Searches for ‘Metaverse’ Poised For New Breakout

“Metaverse,” an offshoot of Web3 games, also reflects the peak hype and crash after the end of the bull market in late 2022. Metaverse games with crypto earnings enticed users, selling digital land plots, characters, and skins and often offering passive returns.

As of 2023, metaverse projects report up to 400M active users. This includes all VR games and metaverses, of which blockchain metaverse games are a subset.

5-year search growth: +700%

Search growth status: When moon

9. ‘Web3’ Defies the Crypto Search Trend

“Web3” is the first big exception to the slump in crypto search volumes. The searches for Web 3 have reached a robust baseline, retaining 1000% growth compared to early 2021.

The term ‘Web3’ is considered one of the creative use cases for blockchains. The services included in Web3 go beyond trading and flipping NFT and include ownership, game passes, unique wallet-based identities, and exclusive communities.

Web3 search volume trends are now flat, resembling the charts for most Web3 tokens, waiting for an eventual breakout when the bull market returns.

5-year search growth: +4900%

Search growth status: When moon

10. ‘Play-to-earn’ Searches Run on Gaming Hype

“Play-to-earn” is showing signs of decoupling from the overall crypto trend. Still, as a relatively niche topic, this term saw overall low and uneven search volumes.

“Play-to-earn” reflects interest in an industry that reached $3.3B in size and is expected to triple in a decade.

Searches for play-to-earn picks up when a new game or tournament comes online. For instance, the early 2023 search in volumes coincided with the announcement of Axie Infinity: Homeland Season 1.

Play-to-earn searches peaked in January 2022, coinciding with near-peak prices for Bitcoin, Ethereum, and higher prices for most game tokens.

5-year search growth: +200%

Search growth status: When moon

11. ‘Binance’ Searches: Still a Trend Among Insiders

“Binance” searches diverge from the overall crypto trend despite Binance being the top exchange and liquidity hub for traders.

The world’s biggest exchange has over $54B in notional value and more than $5B in daily trades, even during a stagnant market.

In 2021, during the highly active bull market, Binance averaged 28.6M monthly visits. During a stagnant market in May, June, and July 2023, three-month visits reached 58.6M, a lower monthly average.

5-year search growth: +200% net

Search growth status: When moon

12. ‘Liquidity Mining’ Exposes Shorter Hype Cycles

The searches for Liquidity mining peaked in 2022 but had a significant slump in 2023.

Liquidity mining is highly fragmented and still in the discovery stage, even in liquidity hubs like UniSwap. New liquidity pools and incentives can affect the trends and lead to a new breakout.

Liquidity mining also shows a pattern similar to interest in DeFi and is related to the usage of decentralized exchanges such as UniSwap and PancakeSwap.

5-year search growth: +1000%

Search growth status: When moon

13. ‘Staking’ Shows Potential of Search Recovery

The search pattern for “staking” shows two distinct periods of outsized interest in crypto. The first search spike follows the age of ICOs or token sales. In 2017 and 2018, staking was often the only use case for those tokens.

Searches for “staking” are now sliding but also show the potential for breaking out during new project launches.

Search patterns for blockchain-related themes and crypto reveal the potential for exuberance and for quickly losing interest. Most search terms retain a correlation to the price action of Bitcoin.

5-year search growth: +900%

Search growth status: Moon

Key Takeaway

Crypto trends fluctuate based on the main driver, the risky and volatile price action.

In the past five years, multiple crypto topics cycled through peaks, crashes, and partial recoveries.

We previewed the potential search trends that may shape the market and retail interest in 2023 and 2024.

Uptrends occur when prices achieve successive higher highs and lows. These trends can be charted, with a typical approach being to connect the lows using an uptrend line. Some traders prefer using moving averages to determine the trend instead of manual trend lines.

Google Trends data reveals a significant decline in "crypto" searches, scoring a 17. This is the lowest point for such searches since December 2020, mirroring the 32-month low in exchange volumes this past May.

1. Bitcoin BTC: -2.6%

2. Ethereum ETH: -2.5%

3. Solana SOL: -3.0%

Bitcoin continues to dominate search queries. Coinweb reports that Bitcoin (BTC) was the most searched cryptocurrency in 2023, amassing 34.41 million monthly searches globally. Despite fluctuations, its prominence in searches remains notable as experts compare its value to other crypto counterparts.