TLDR

This guide will give you everything you need to know about Ethereum and how to invest in it.

- Step 1: Create a Binance account, and verify your account.

- Step 2: Deposit funds (bank, cards, crypto).

- Step 3: Navigate to the Ethereum market.

- Step 4: Choose the desired amount to buy.

- Step 5: Confirm and complete the purchase.

Still not convinced? Let us go over the details.

How to Invest in Ethereum

You can use centralized exchanges or a decentralized exchange to purchase Ethereum.

This article will use Binance, which has the market’s highest trading pair and lowest fees. To create an account, click the [Get started] button.

More details

Binance is a great combination of low fees, deep liquidity and multiple cryptocurrencies and trading pairs. We have tested every aspect of it and it STILL holds its reign as the top exchange in the world. In our view, it is the perfect crypto exchange for both newbies and advanced traders alike.

-

Biggest exchange in the world.

-

Industry's lowest trading fees.

-

Advance trading options like leverage trading.

-

600+ crypto options, 150+ for the US.

-

Lucrative on-site staking options.

-

Hiccups in account verification.

-

Less regulated than some competitors.

-

The corporate structure is not transparently.

Buying Ethereum (ETH) from Binance is simple. Here’s a step-by-step guide to help you through the process:

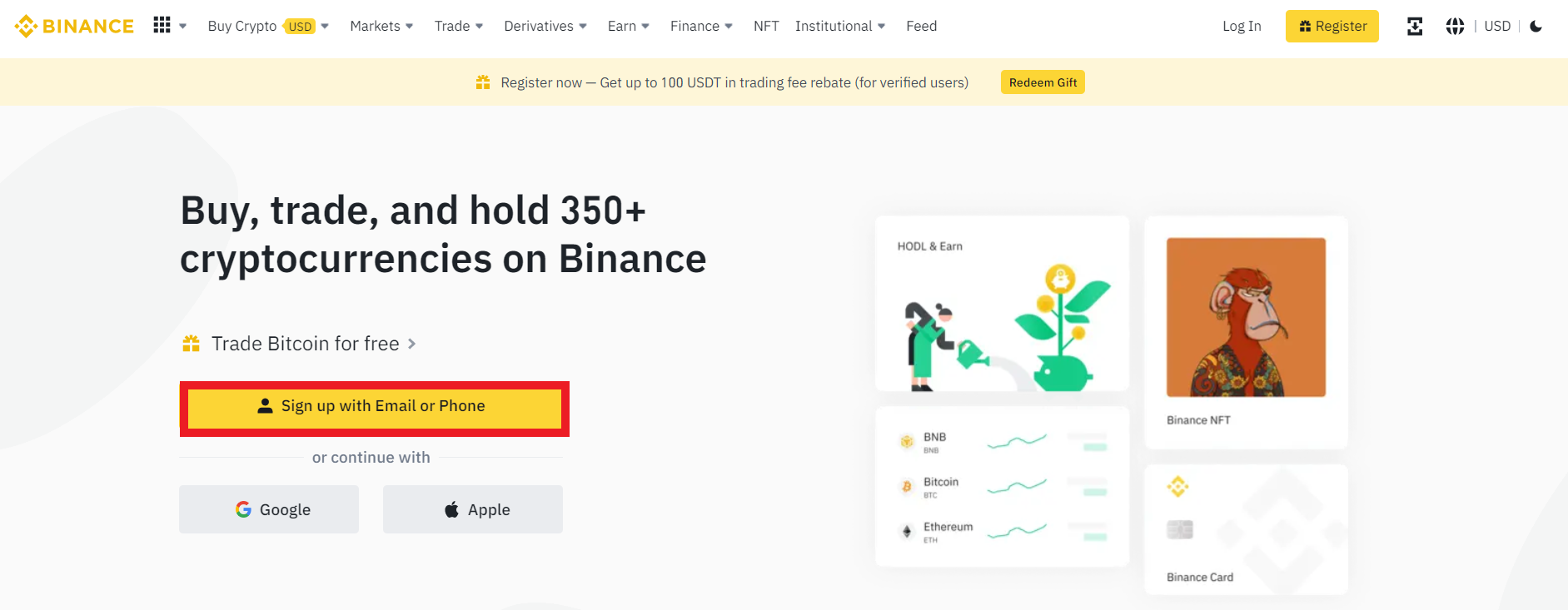

Step 1: Sign up for a Binance account

Go to binance.com and click on the [Sign up] button.

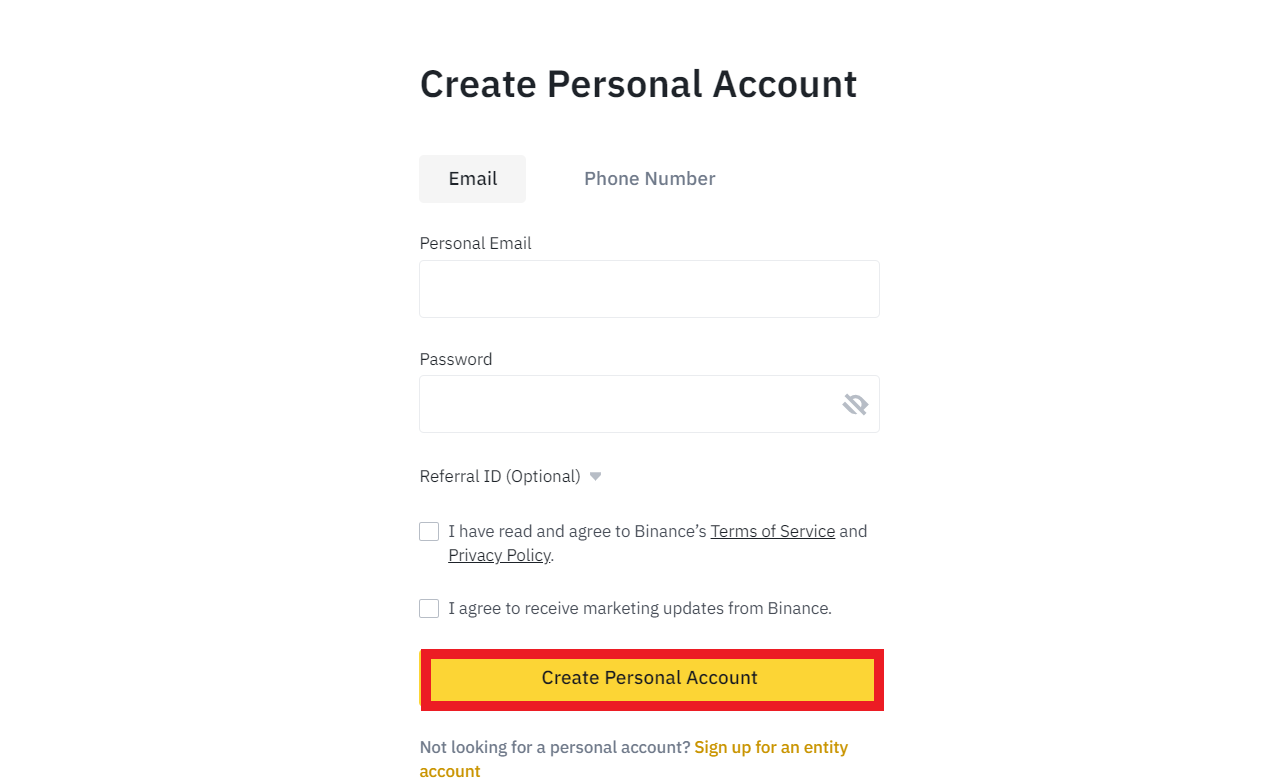

This leads you to a new page where you fill in your e-mail and password to create your account. Check off the Terms of Service and Privacy Policy box.

Select the [Create Personal Account] button once you are done.

Step 2: Verify your account

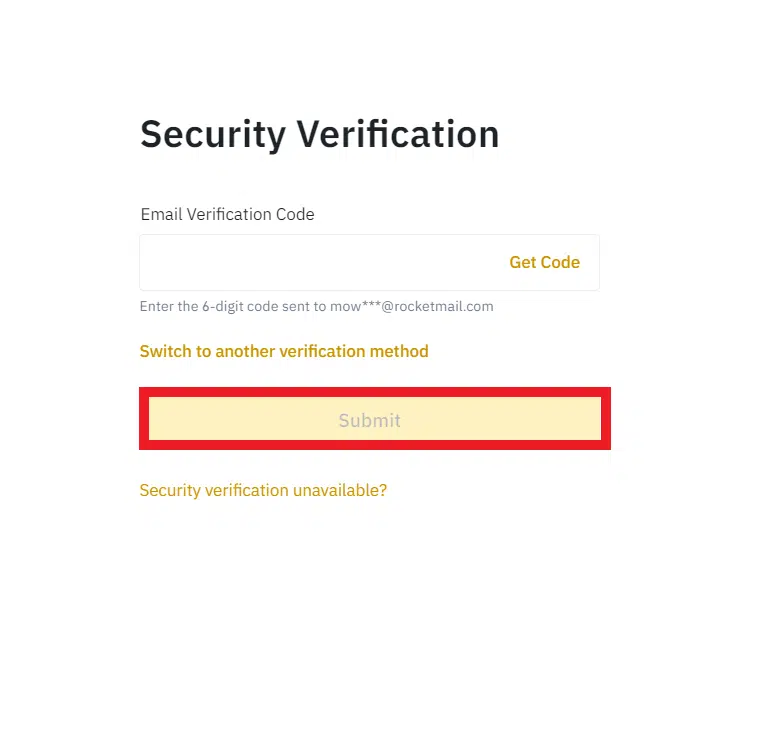

Binance will send you a verification e-mail. Type in your e-mail, and click [Submit].

When the e-mail is received, click the link to verify your account.

Step 3: Log in to your Binance Account

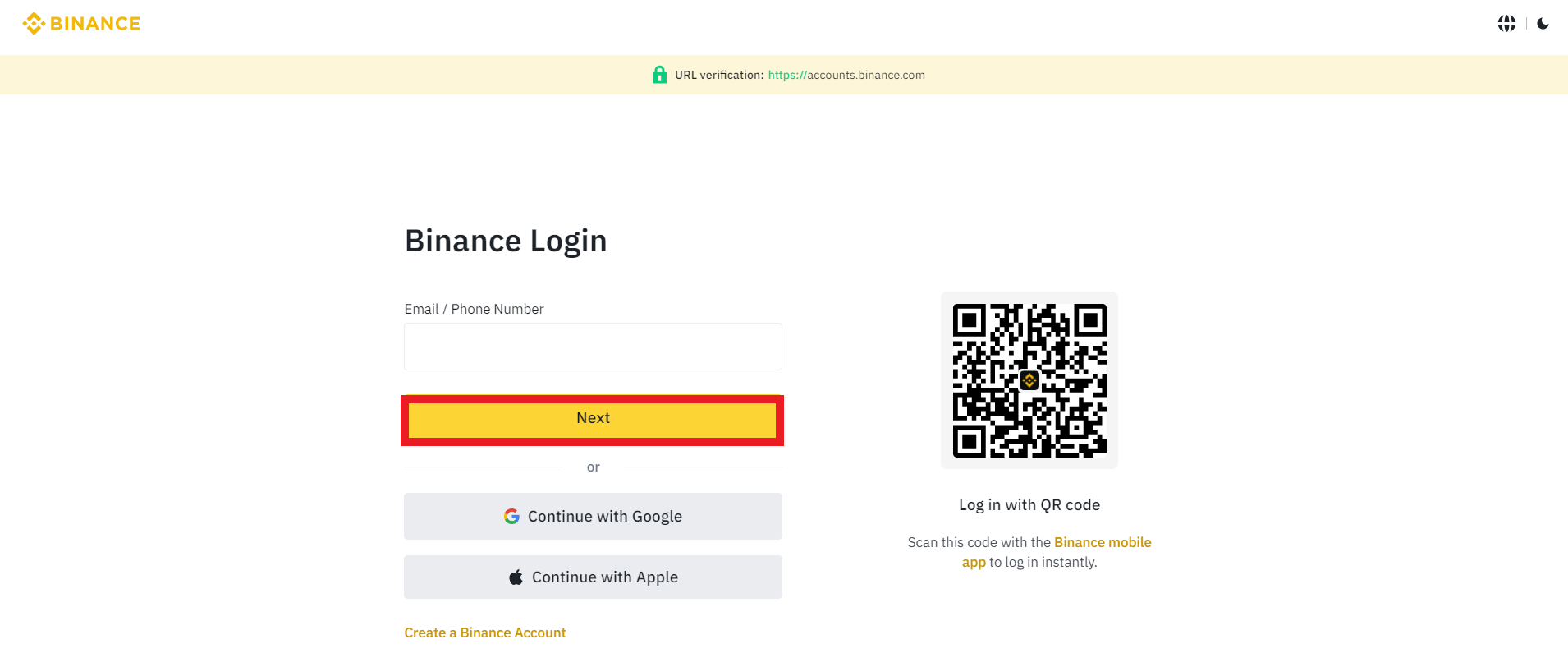

Log in using the e-mail and password created to access your Binance Account.

For added security, Binance requires you to set up 2-factor authentication (2FA) on your account. You can use the Google Authenticator app or a physical 2FA device.

Step 4: Deposit funds into your Binance account

Before buying Ethereum, you need to deposit funds into your Binance account.

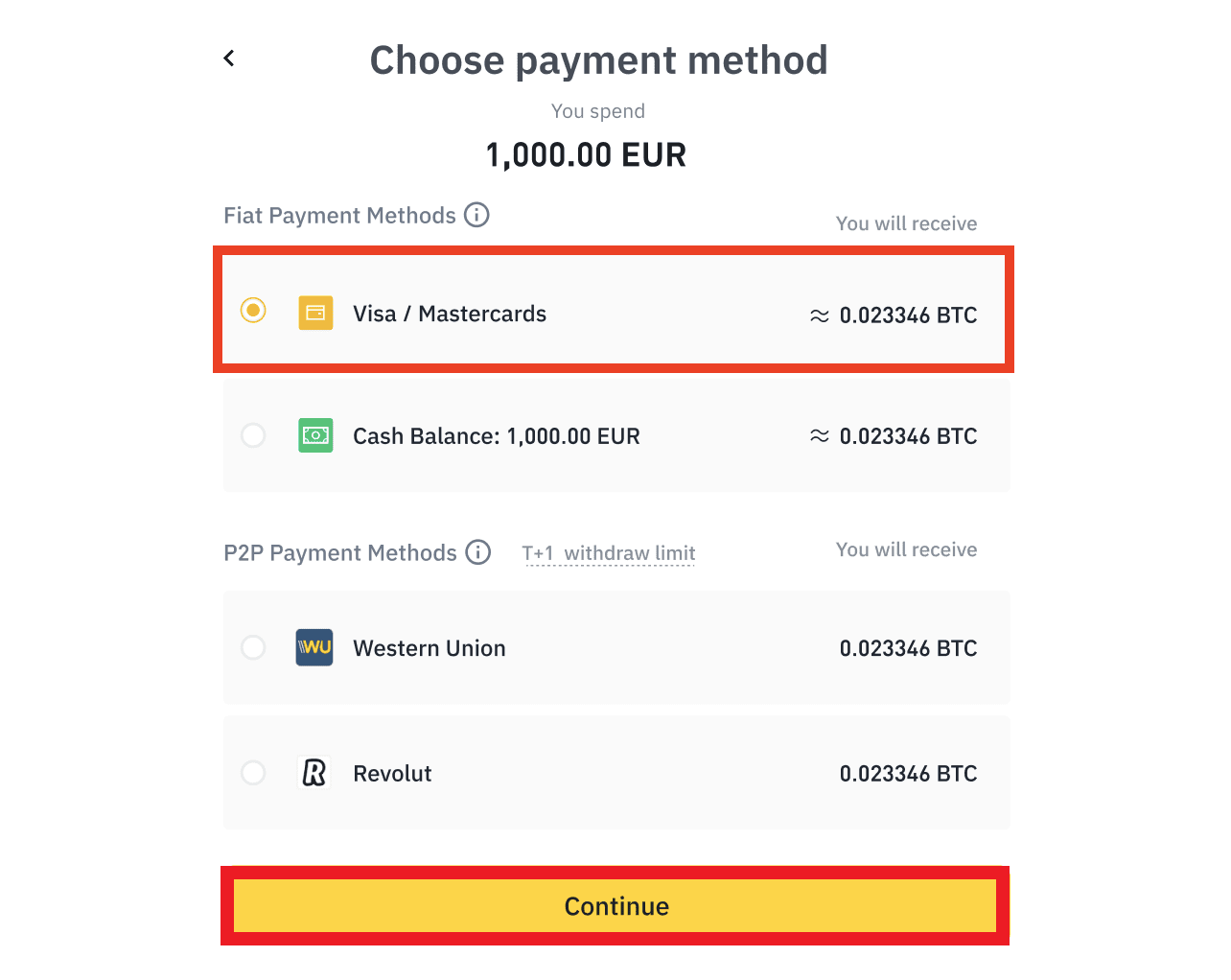

You can do this by clicking the [Deposit] button and choosing the currency you wish to deposit.

You can fund your wallet using your bank account, credit card, or debit card.

Step 5: Buy Ethereum

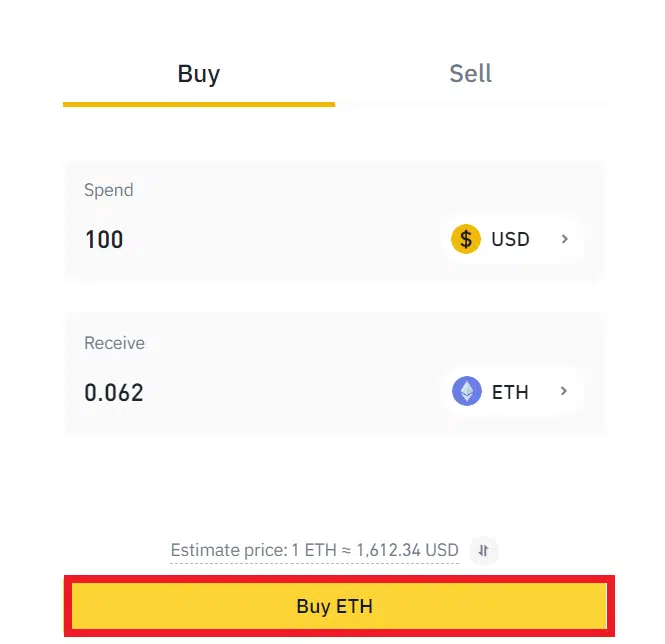

Once your funds have been deposited, you can buy Ethereum by going to the [ETH/BTC] trading pair (or the ETH/USDT trading pair if you deposited USDT).

Next, enter the amount of ETH you want and click the [Buy ETH] button. Depending on your pair, you will have to pay transaction fees. These are minimal on Binance.

Confirm the transaction. Binance will show you the details of the transaction.

Congratulations! That’s all you need to do to buy Ethereum.

Setting up a Wallet

Explanation of different types of wallets

Several wallets are available for storing and managing Ethereum, including software, cold wallets, ether tokens, and paper wallets.

Software wallets are digital currency wallets accessed through a computer or mobile device. In contrast, hardware wallets are physical devices that store your private keys offline.

Paper wallets are physical documents that contain your private key information.

How to choose the right wallet for your needs

When choosing a digital wallet, it’s essential to consider security, ease of use, and compatibility with different crypto exchanges.

For example, if you plan on trading frequently, a software wallet may be more convenient, while a hardware wallet may be a better option for long-term storage.

Trusted Partners

Storing and Securing Your Ethereum

Explanation of different storage options

After you buy Ethereum, storing it safely and securely is essential. Two main storage options are available: hot and cold storage.

Hot storage refers to online wallets, such as those offered by cryptocurrency exchanges or companies like Metamask or Exodus.

I recommend keeping your crypto safe on a hardware wallet like Ledger Nano S Plus or Trezor Model T.

More details

Ledger Nano S Plus is a fortress-like protection for your digital wealth, sporting an affordable price point. This crypto wallet supports many cryptocurrencies and blockchain networks, making them easily managed via the reputable Ledger Live app. Despite its significant advantages, some users have noted the lack of storage capacity.

-

Support for up to 5,500 cryptocurrencies.

-

Private keys are always offline.

-

Integration with other hot wallets.

-

Support for staking.

-

NFT support.

-

High fees for Ledger Live crypto purchases.

-

Limited app space.

-

Small display.

How to properly secure your Ethereum

Securing your Ethereum involves protecting your private keys, which are used to access and manage your Ethereum. This can be done by setting a strong password, backing up your private keys, and enabling two-factor authentication (2FA).

It’s also a good idea to keep your hardware wallet in a safe and secure location.

How to safely transfer your Ethereum to different wallets

You will need the recipient’s address and private key to transfer Ethereum from one wallet to another.

The process may vary depending on the type of account creation and wallet. It’s important to double-check the recipient’s address and ensure you send the correct amount before initiating the transfer.

Trading, Yield Farming, and Staking

Ethereum trading

Trading Ethereum involves purchasing and selling cryptocurrency on a crypto exchange to benefit from price fluctuations.

To trade Ethereum, you must create an account on a crypto exchange, fund it with fiat currency or another cryptocurrency exchange amount, and place buy and sell orders to trade cryptocurrencies based on your market analysis and price charts.

Yield Farming in Ethereum

Yield farming is a process in which investors lend their Ethereum to liquidity providers on decentralized finance (DeFi) platforms in crypto exchange for a return on investment. This can be done through various platforms, protocols, and pools.

Yield farming can be riskier than traditional trading, and investors should research carefully before participating in yield farming pools.

Staking ETH

Staking is the process of holding and validating transactions on a proof-of-stake blockchain. In Ethereum, staking is the process of holding Ether in a wallet and participating in the validation of blocks on the Ethereum network.

By staking, users can earn a return on their crypto investment and help secure the network.

Trading vs. Yield Farming vs. Staking — What’s the Best

Each option has its own set of risks and potential returns. Trading Ethereum is more suitable for short-term investments and requires a good understanding of the market and price charts. Yield farming can offer higher returns but carries a higher risk level.

Staking is a more passive form of investment suitable for long-term investments. It requires holding a certain amount of Ethereum in a wallet and participating in the validation of blocks on the network.

Evaluating your investment goals, risk tolerance, and the time you are willing to commit is important before choosing the best option. After all, your end goal should be to sell crypto at a profit.

How to Track and Manage Your Investment

How to track the value of your Ethereum

To track the value of your Ethereum investment, you can use cryptocurrency tracking tools such as Coinmarketcap or CoinGecko, which provide real-time market data, charts, and price alerts.

You can also use portfolio tracking apps such as Blockfolio or Delta to keep track of your cryptocurrency portfolio across multiple exchanges.

How to set up alerts for price changes

Most cryptocurrencies and exchanges offer tracking tools that allow you to set up price alerts that notify you when the price of Ethereum reaches a certain level.

This can help you stay informed and make timely decisions about buying Ether or selling Ethereum.

How to manage your investment

Managing your investment involves monitoring the market, analyzing price charts and indicators, and making decisions about buying and selling Ethereum based on your investment goals and risk tolerance.

Reviewing your portfolio regularly is important to ensure it is diversified and aligned with your investment strategy.

3 Ways to Invest Your ETH

1. Long-term holding

Long-term holding is a strategy of buying and holding an asset for an extended period, typically several years or more. The idea behind this strategy is that the asset’s value will increase over time and generate a profit for the investor.

With Ethereum, the long-term holding strategy is based on the belief that the Ethereum network will continue to grow and be adopted by more individuals, businesses, and organizations, leading to an increase in the value of Ethereum.

One of the main advantages of long-term holding is the potential for compound interest. As the value of Ethereum increases over time, the returns on the investment also increase, leading to a compounding effect.

Additionally, by investing and holding an asset for a long time, investors can ride out any short-term market fluctuations and not be swayed by temporary dips in the price.

To successfully implement a long-term holding strategy with Ethereum, it’s important to diversify investments by holding various crypto assets in addition to Ethereum. This can help spread the risk and reduce the impact of any potential crypto market fluctuations.

2. Dollar-Cost Averaging

Dollar-cost averaging is an investment strategy where an investor divides a more significant sum of money into smaller, regular purchases over a period of time rather than investing the entire sum at once.

This strategy can help reduce the risk of buying at a high price point, as the purchases are made over time, regardless of the price.

One of the main advantages of dollar-cost averaging is that it reduces the risk of buying at a high price point. By making regular purchases over time, investors are less likely to buy at the top of a market cycle.

Additionally, dollar-cost averaging can help smooth out market fluctuations, as the investor buys at different price points rather than all at once.

3. Trading

Trading is an investment strategy that involves buying and selling assets, such as Ethereum, in short, and long-term investments to make a profit. This strategy is based on the belief that the asset’s value will increase or decrease in the short and long-term investment, and the investor can take advantage of these fluctuations.

One of the main advantages of trading is the potential for short-term profits. By buying and selling assets in the short term, investors can take advantage of stock market fluctuations and make a profit.

A trading platform also allows investors to be more active and make decisions based on current market conditions.

Conclusion

Investing in Ethereum can be a great opportunity, but it’s essential to research and understand the risks involved.

This guide has provided a step-by-step overview of investing in Ethereum, including setting up a wallet, buying Ethereum, storing and securing it in a cold wallet, and tracking and managing your investment.

Ethereum has a growing ecosystem of decentralized applications and non-fungible tokens (NFTs) built on its blockchain. Its smart contract capabilities have attracted a wide range of industries and projects.

This has increased demand for Ether, the cryptocurrency used to pay for transactions and computational services on the Ethereum network.

While Ethereum has the potential to be a great long-term investment, investing in crypto is never a sure thing. Evaluating your risk tolerance can help you determine if it is a suitable investment for you.

There is no established limit or commonly accepted "good amount" to invest in Ethereum, similar to any other traditional or crypto investment. The decision of how much to invest in digital currency is entirely up to you and what you are comfortable with.

Holding ETH and other cryptocurrencies comes with inherent risks. Numerous crypto platforms used for buying or selling Ethereum and other coins have experienced crashes or been subject to hacking, resulting in users losing access to their funds.