The question for the topic is: how many people hold Bitcoin?

As of 2024, an estimated 106 million people globally hold Bitcoin.

In the United States alone, about 67 million residents own at least one type of cryptocurrency, and approximately 22% of the adult population in America owns Bitcoin.

Remarkably, over a million individual wallets hold one whole Bitcoin.

Today, we’ll explore the data behind this digital currency’s broad yet uneven distribution. Let’s dig in!

Top 5 Facts about Bitcoin hodlers

Here are the top 5 facts to know when it comes to Bitcoin and its surrounding world:

- Global Bitcoin Users: As of 2023, there are an estimated 106 million global Bitcoin users, with the US accounting for 67 million.

- Bitcoin has a finite supply: A maximum of 21 million Bitcoins will ever exist, creating scarcity and value. As of February 2023, over 19 million Bitcoins have been mined.

- Bitcoin’s creator remains unknown: Introduced in 2009 by an entity known as Satoshi Nakamoto, the true identity of Bitcoin’s creator is still a mystery.

- Lost Bitcoin: It’s estimated that around 20% of all Bitcoin has been irretrievably lost, further contributing to its scarcity.

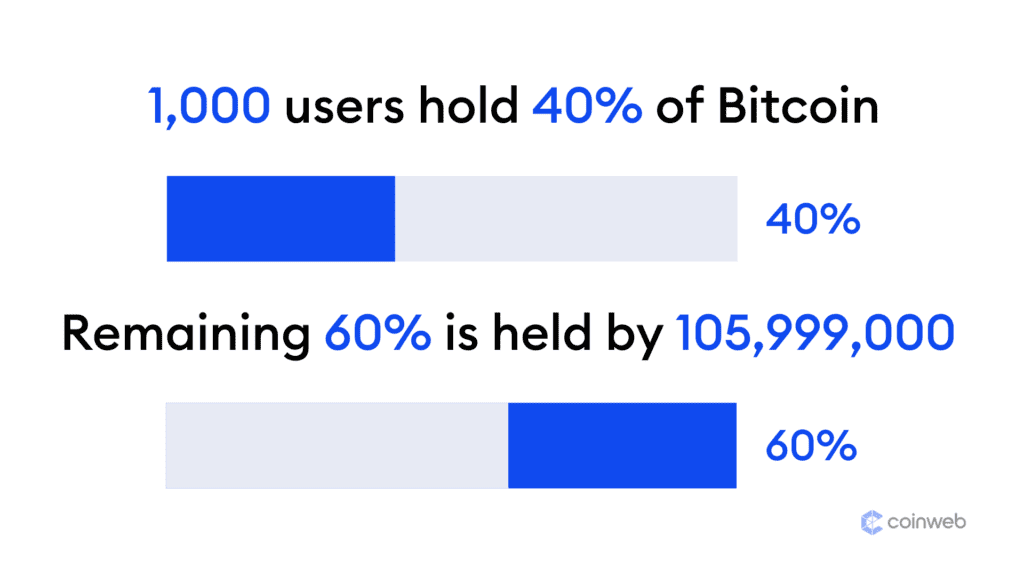

- Concentrated Ownership: A tiny fraction (0.01%) of Bitcoin owners control nearly one-third of the total Bitcoin supply.

Source: HartfordFunds, Simplilearn, Fool, Fortune, BuyBitcoinWorldwide

Trends in Bitcoin Ownership

Bitcoin ownership is rising, representing a trend driven predominantly by millennials. In this scenario, we found on average, most people hold a small amount of their working income in cryptocurrencies.

As of 2023, global crypto ownership rates are estimated at an average of 4.2%, equating to over 420 million crypto users worldwide.

Of these crypto users, an estimated 106 million people specifically own Bitcoin.

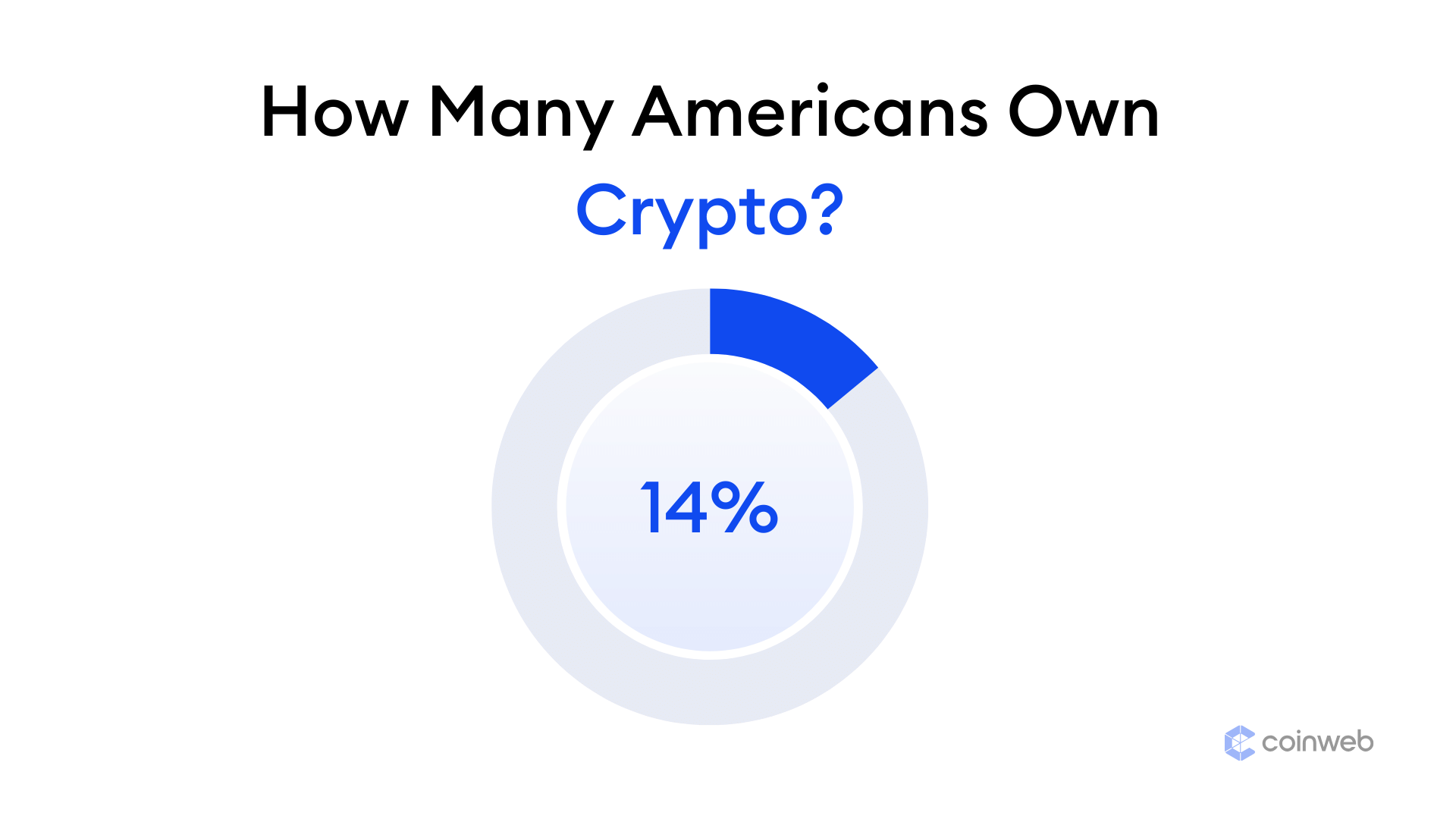

Digging deeper into demographics, younger generations are driving these statistics. A revealed that 26% of millennials owned Bitcoin as of July 2023, compared to 14% of all U.S. adults.

Interestingly, despite the growing popularity of Bitcoin, the distribution of holdings is skewed. Most individuals hold relatively small amounts of cryptocurrencies (approximately $620).

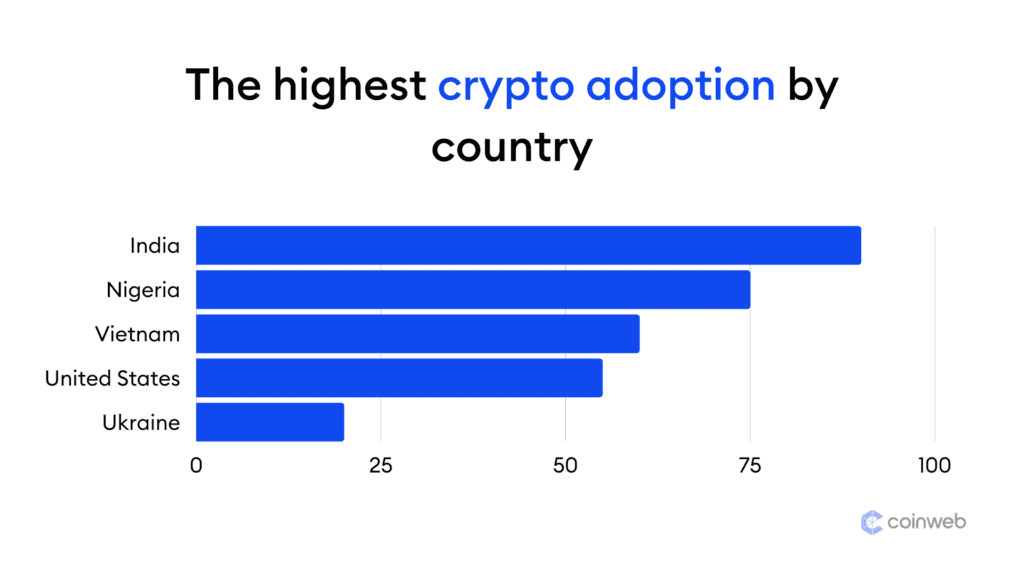

Geography also plays a role in Bitcoin ownership. In particular, consumers from countries in Africa, Asia, and South America were most likely to own cryptocurrencies such as Bitcoin in 2023.

Lastly, crypto adoption varies largely across different countries, as summarized by the ranking in the table below.

Source: Triple-A, BuyBitcoinWorldwide, Bankrate, JPMorgan, Statista, Chainanalysis

Table 1: Crypto adoption index by country (Chainanalysis)

| Country | Overall index ranking | Centralized service value received ranking | Retail centralized service value received ranking | P2P exchange trade volume ranking | DeFi value received ranking | Retail DeFi value received ranking |

| India | 1 | 1 | 1 | 5 | 1 | 1 |

| Nigeria | 2 | 3 | 2 | 1 | 4 | 4 |

| Vietnam | 3 | 4 | 4 | 2 | 3 | 3 |

| United States | 4 | 2 | 8 | 12 | 2 | 2 |

| Ukraine | 5 | 5 | 3 | 11 | 10 | 10 |

| Philippines | 6 | 6 | 6 | 19 | 7 | 7 |

| Indonesia | 7 | 13 | 13 | 14 | 5 | 5 |

| Pakistan | 8 | 7 | 7 | 9 | 20 | 20 |

| Brazil | 9 | 9 | 11 | 15 | 11 | 11 |

| Thailand | 10 | 8 | 15 | 44 | 6 | 6 |

| China | 11 | 10 | 5 | 13 | 23 | 23 |

| Turkey | 12 | 11 | 9 | 35 | 12 | 12 |

| Russia | 13 | 12 | 10 | 36 | 9 | 9 |

| United Kingdom | 14 | 15 | 20 | 38 | 8 | 8 |

| Argentina | 15 | 14 | 12 | 29 | 19 | 19 |

| Mexico | 16 | 17 | 18 | 30 | 16 | 16 |

| Bangladesh | 17 | 18 | 19 | 33 | 22 | 22 |

| Japan | 18 | 22 | 21 | 49 | 18 | 18 |

| Canada | 19 | 25 | 23 | 62 | 14 | 14 |

| Morocco | 20 | 27 | 25 | 21 | 26 | 26 |

Institutional vs. Individual Bitcoin Ownership

Not only are individuals investing in Bitcoin, but institutions have also joined the trend. In such a changing scenario, it is still surprising that very few people hold a relatively large amount of existing BTC.

As of June 2022, institutions held 6.47% of all Bitcoin that will ever exist. This category includes ETFs like VanEck in Canada.

In this context, a survey found that 52% of institutional investors hold Bitcoin, indicating an increased appetite for Bitcoin exposure.

On the other hand, 26% of millennials owned Bitcoin as of July 2023, according to a Morning Consult survey, compared to 14% of all U.S. adults.

Despite the widespread adoption, the market remains highly concentrated, with about 40 percent of Bitcoin held by 1,000 users.

Crypto ownership and use are only legally restricted in 3% of countries worldwide and fully illegal in another 3%, constituting a strong barrier to institutional adoption.

Source: Coindesk, Glassnode, Nasdaq, Bankrate, Finoa

Demographics of Bitcoin Investors in the US

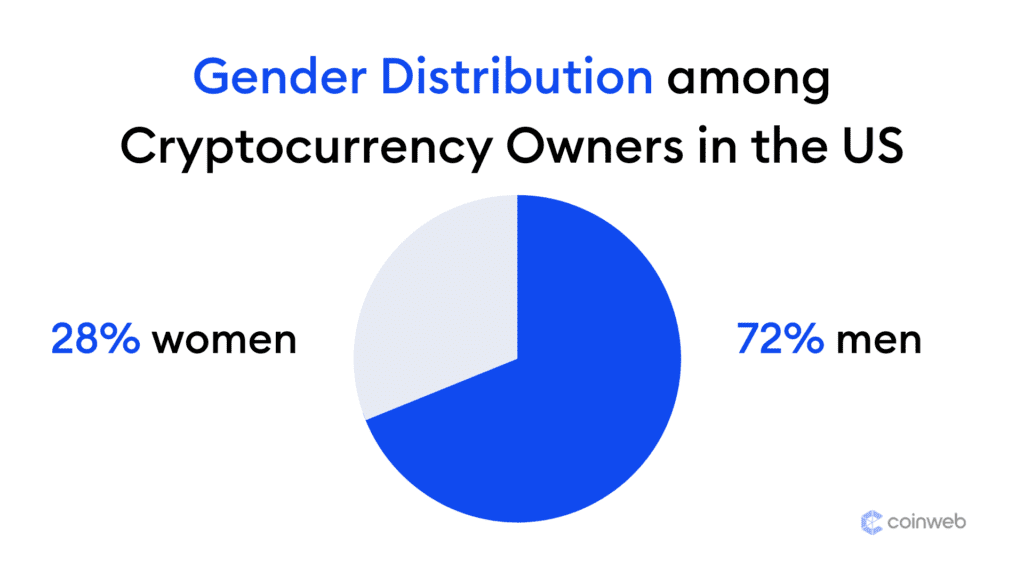

The demographic dimension of Bitcoin investors is a crucial aspect to analyze as it provides insights into the target audience and their behavior. Age remains the biggest demographic gap in the crypto market, with young adults being the most active users. However, there is also diversity in terms of race and gender among crypto owners.

The crypto user shares for Black and Hispanic individuals in the US were approximately equal at 21 percent, with White individuals slightly lower at 20 percent.

If we take one step back and look at the bigger picture, 41% of cryptocurrency owners identify as people of color.

The main demographic gap in crypto is related to age: adults under 50 (25%) are more likely than those 50 and older (7%) to be crypto users.

If we zoom in on these numbers, we can see that cryptocurrency is most popular with young adults: 31% of people ages 18 to 29 have used it, compared to 21% of people ages 30 to 49.

In 2022, just 28% of crypto owners in the U.S. were women, while 72% were men.

Some statistics are transversal to all demographic groups, such as that 75% of those who’ve heard of crypto aren’t confident in its safety and reliability.

Source: JPMorgan, Morning Consult, Forbes, Stash

Conclusion

Since its 2009 debut, Bitcoin has transformed global finance with its finite supply and the mystery surrounding its creator.

With 106 million users worldwide, it’s incredibly popular, especially among millennials, although ownership is unevenly distributed.

Institutional investors have joined the market despite a slight drop in Bitcoin ownership. Demographically, investors span various ages, races, and genders, with younger generations showing particular interest.

Latest Statistics:

- Top 7 Crypto Trends for the Next Bull Market (2023 & 2024)

- Cryptocurrency Search Traffic Trends (2023-2024)

The global crypto ownership rate is estimated at 4.2%, which translates to over 420 million crypto users worldwide.

As of July 2023, 26% of millennials owned Bitcoin.

Institutions held 6.47% of all Bitcoin that will ever exist as of June 2022.

Yes, as of 2022, only 28% of crypto owners in the US were women while 72% were men.

Despite its increasing popularity, 75% of those who've heard of crypto aren't confident in its safety and reliability.