The DeFi market has grown exponentially, reaching over $80 billion in locked value in 2023.

As we journey deeper into the digital age, Decentralized Finance (DeFi) startups are swiftly gaining traction, with the overall market set to hit a $231.19 billion valuation by 2030.

Among them, 13 have become the fastest-growing DeFi startups, including Uniswap, Aave, and SushiSwap, spearheading this revolution.

We will analyze their potential to set new industry standards by drawing insights from reputable sources. Welcome to a glimpse into the future of finance.

Search growth status guide

- Moon – strong and consistent upward trend in search growth

- When Moon? – relatively flat or sideways trend

- Rekt – declining search volume after a significant peak

1inch

5-year growth: +175%

Search growth status: Moon

Year founded: 2019

Valuation: $2.25 billion (Source: Forbes)

Funding: $175 million (Series A) (Source: TechCrunch, 1inch)

What they do: 1inch is a decentralized finance (DeFi) platform that gathers funds from various exchanges and divides a trade across multiple decentralized exchanges (DEXs). Consequently, this allows users to find the best prices. This helps users to optimize their trades and secure the best possible trading rates. The platform also features a governance token, 1INCH, which allows holders to vote on protocol settings.

Uniswap

5-year growth: +135%

Search growth status: Moon

Year founded: 2018

Valuation: $1.66 billion (Source: TechCrunch)

Funding: $165 million (Series B) (Source: Fortune)

What they do: Uniswap is your go-to for swapping crypto with no intermediaries involved. What’s the catch? Its secret sauce is an automated liquidity protocol. Thus, you get to trade right from your wallet without any detours. Furthermore, the platform is deeply committed to open-source and decentralization, with an extremely simple and user-friendly interface.

Compound Finance

5-year growth: 8%

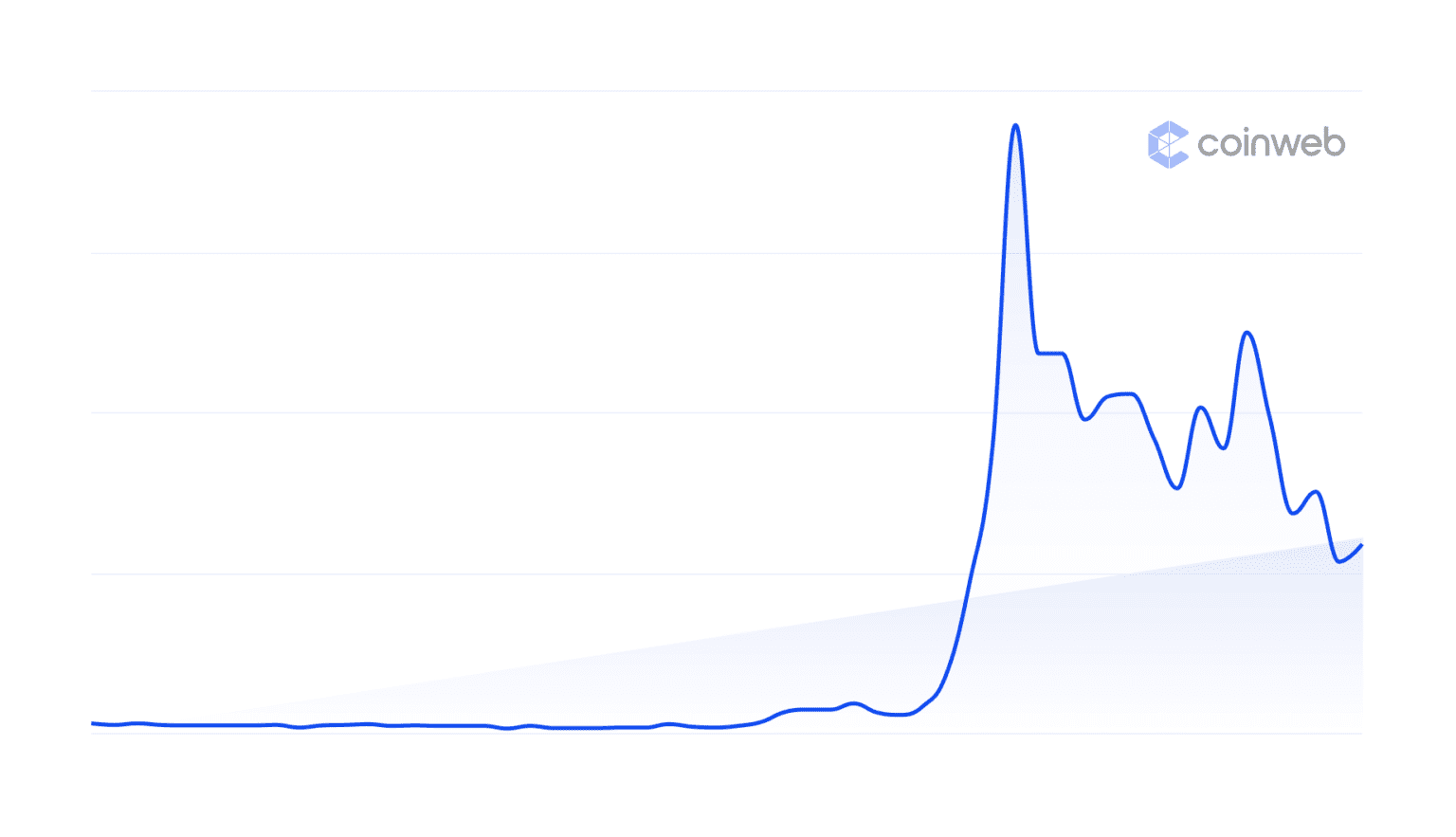

Search growth status: Rekt

Year founded: 2017

Valuation: $90 million (Source: CBInsights)

Funding: $24.4 million (Series A) (Source: Pitchbook)

What they do: Compound Finance is an open-source, autonomous interest rate protocol specifically designed for developers. To begin with, users deposit their crypto-denominated collateral to access loans, and subsequently, lenders can earn interest from their crypto holdings. Moreover, the platform securely holds approximately $103 million worth of cryptocurrency within its automated system.

Aave

5-year growth: +20%

Search growth status: When Moon?

Year founded: 2017

Valuation: $2.2 billion (Source: Vauld)

Funding: $15 million (Later Stage VC) (Source: Pitchbook)

What they do: Aave is an open-source, non-custodial protocol on Ethereum for decentralized lending and borrowing. Fundamentally, this transparent and open infrastructure promotes financial inclusivity and security. Furthermore, recent developments include the launch of a new algorithmic dollar-pegged stablecoin. In addition to this, governance votes by Aave token holders have been introduced. Lastly, the expansion of the ‘social layer’ of Web3 has been realized through the Aave-developed Lens Protocol.

MakerDAO

5-year growth: +220%

Search growth status: Moon

Year founded: 2014

Valuation: $500 million (Source: Forbes)

Funding: $15 million (Stage VC) (Source: Crunchbase, Coindesk)

What they do: MakerDAO is a decentralized organization dedicated to bringing stability to the crypto economy through its stablecoin, DAI. Unlike many cryptocurrencies known for their price volatility, DAI is pegged to the US dollar, meaning it maintains a consistent value. The MKR token acts as a pseudo-equity in the project, designed to appreciate as the Dai ecosystem grows. The protocol’s annual revenue has quadrupled to $185 million since the start of the year.

Yearn Finance

5-year growth: 1,200%

Search growth status: Moon

Year founded: 2020

Valuation: The current market cap of Yearn Finance is approximately $169.93 million (Source: Coinbase)

Funding: Unknown

What they do: Yearn Finance is a platform in the decentralized finance (DeFi) sector that provides automated yield farming strategies through its product offerings. Firstly, the platform offers several products, such as yVaults, automated yield farming tools that allow users to earn passive income on cryptocurrency deposits. Additionally, the native token of the platform, YFI, is used for governance decisions within the Yearn Finance ecosystem.

Curve Finance

5-year growth: +200%

Search growth status: Rekt

Year founded: 2019

Valuation: The project’s current fully diluted market cap is $1.46 billion (Source: CoinMarketCap)

Funding: $161 million (Series C) (Source: PRNewsWire)

What they do: Curve Finance is a decentralized exchange (DEX) that focuses on stablecoin liquidity pools. The protocol allows users to trade between stablecoins with a low slippage and low-fee algorithm specifically designed for stablecoins and earning fees. Despite recent security breaches which reduced the total value of assets locked on Curve, it still stands at around $1.7 billion.

SushiSwap

5-year growth: +550%

Search growth status: Moon

Year founded: 2020

Valuation: The current market cap of SushiSwap is $124.99 million (Source: Coinweb)

Funding: Unknown

What they do: SushiSwap is a decentralized exchange (DEX) built on the Ethereum blockchain that allows for the swapping of cryptocurrency tokens. SushiSwap also offers yield farming and staking opportunities to its users. Users can earn a portion of the exchange’s trading fees by staking their SUSHI tokens. SushiSwap has been successful in attracting a significant amount of liquidity since its launch despite being a fork of the popular Uniswap exchange.

Balancer.fi

5-year growth: +60%

Search growth status: Rekt

Year founded: 2018

Valuation: The fully diluted valuation stands at approximately $294.1 million (Source: DefiLlama)

Funding: $3 million (Seed) (Source: Crunchbase)

What they do: Balancer is a non-custodial portfolio manager, liquidity provider, and price sensor on the Ethereum blockchain. It allows anyone to create or add liquidity to customizable pools and earn fees. Instead of the typical constant product formula used by most AMMs, Balancer’s formula can accommodate any number of tokens in any weights or trading fees, making it a much more flexible protocol. The platform incentivizes users to provide liquidity by rewarding them with BAL tokens.

Synthetix

5-year growth: +135%

Search growth status: Rekt

Year founded: 2017

Valuation: The current market cap of Synthetix is approximately $230.32 million (Source: Coincodex)

Funding: Unknown

What they do: Synthetix is a decentralized synthetic asset issuance protocol built on Ethereum. These synthetic assets are collateralized by the Synthetix Network Token (SNX) and minted as ERC-20 tokens. Furthermore, the protocol offers on-chain exposure to various crypto and non-crypto assets and crucially enables the creation of any asset with a clear price feed. For those involved, SNX stakers earn two types of rewards – trading fees generated by Synth trades and, on the other hand, SNX inflationary rewards.

PancakeSwap

5-year growth: +10%

Search growth status: Rekt

Year founded: 2020

Valuation: The current market cap of PancakeSwap is approximately $268.65 million (Source: Coinweb)

Funding: Unknown

What they do: PancakeSwap is the largest decentralized application (dApp) that allows users to trade and swap BEP-20 tokens. Operating on Binance Smart Chain, it offers faster and cheaper transactions than its competitors on Ethereum. It provides features like farming, staking, lotteries, and NFTs. Users can earn rewards in CAKE tokens by providing liquidity on PancakeSwap.

Alchemix

5-year growth: +50%

Search growth status: Rekt

Year founded: 2021

Valuation: The fully diluted valuation of Alchemix is approximately $31.5 million (Source: CoinGecko)

Funding: Unknown

What they do: Alchemix is a future-yield-backed synthetic asset platform and community DAO. It lets users receive early profits from their yield farming through special loans that automatically pay themselves back over time. Users deposit DAI into the Alchemix protocol to mint alUSD, which can be used in various DeFi protocols, such as Yearn.Finance and Hyve. The deposited DAI is then deployed to Yearn.finance for yield, and the yield earned automatically repays the alUSD debt over time.

Bancor

5-year growth: -50%

Search growth status: Rekt

Year founded: 2016

Valuation: The Bancor Network is valued at a market cap of approximately $70.96 million (Source: Coinweb).

Funding: Unknown

What they do: Bancor is an on-chain liquidity protocol enabling automated, decentralized exchange on multiple blockchains, starting from Ethereum. The system uses multiple smart contracts to gather funds and carry out direct trades between individuals and contracts in each transaction, without needing a second party. It’s also possible for users to stake coins, provide liquidity, or swap tokens directly from their wallets. Bancor’s native token, BNT, serves as a hub connecting all tokens in the Bancor Network, allowing them to be converted for one another.

Conclusion

Search data and company profiles reveal a surge in the DeFi industry, with platforms like 1inch and Synthetix showing remarkable growth due to their innovative services.

Even platforms with declining search growth, like Alchemix, contribute unique offerings in this niche.

The industry’s expansion underscores the rising demand for decentralized finance and its potential to disrupt traditional finance.

While promising, this growth brings challenges like regulatory issues and scalability, which need addressing for continued success. Nonetheless, the future of DeFi appears bright.

DeFi offers financial services on blockchain, eliminating intermediaries. It's revolutionizing traditional finance with a potential $231.19 billion valuation by 2030.

Some of the rapidly growing DeFi startups include 1inch, Uniswap, Aave, SushiSwap, and Synthetix. These companies have demonstrated notable growth in terms of valuation, funding, and user engagement.

While many DeFi projects are Ethereum-based, platforms exist on other blockchains like Binance Smart Chain (e.g., PancakeSwap).

DeFi faces regulatory scrutiny, scalability issues, potential security vulnerabilities, and market volatility challenges.