TL;DR

- Bitcoin outshines Bank of America and Bank of China regarding total market capitalization.

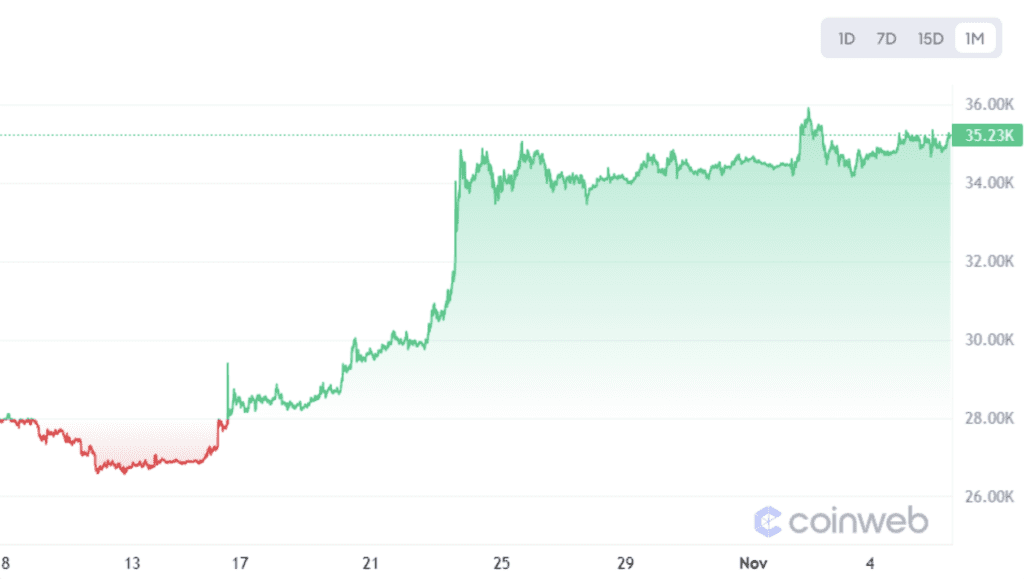

- The surge in market cap is caused by the price increase in the last two weeks. Bitcoin gained over 25% following rumors of a Bitcoin ETF acceptance from the SEC.

Bitcoin Beats Major Banks at Market Cap

Bitcoin’s remarkable growth has led to a market capitalization surpassing the combined values of two global financial giants, Bank of America and Bank of China.

This unprecedented achievement underscores the increasing prominence of cryptocurrencies in the global financial landscape.

Bitcoin’s decentralized nature and limited supply have driven investor enthusiasm and adoption, while traditional banks face evolving challenges.

The comparison symbolizes a shift in financial paradigms, with Bitcoin offering an alternative store of value and borderless transactions.

It’s a testament to blockchain technology’s disruptive potential, reshaping how people perceive and interact with money.

Bitcoin Price Growth Driven By Stablecoins Inflow

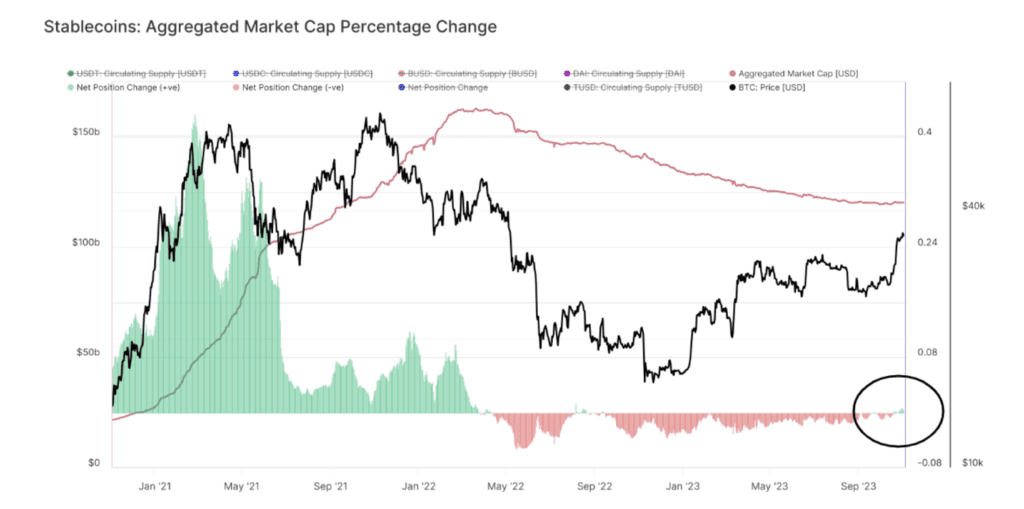

Recent data highlights a resurgence in the supply of the top five stablecoins – USDT, USDC, BUSD, TUSD, and DAI – following a period of contraction.

After the 2021 bull run, the total supply of these stablecoins surged from a modest 25 billion to an astonishing 162 billion by February 2022.

However, the tide reversed, mirroring Bitcoin’s downturn in 2022, resulting in the current combined supply of approximately 120 billion.

For the first time since April 2022, the supply of these leading stablecoins is expanding again, with the turning point occurring on October 19.

Notably, this growth coincided with a Bitcoin rally, suggesting a potential return of on-chain liquidity after a prolonged bear market, which could provide much-needed support to Bitcoin.

The influx of stablecoins into Bitcoin played a significant role in propelling Bitcoin past the $30,000 threshold in October 2023.

Thus, monitoring the trend of stablecoin supply growth becomes crucial for forecasting Bitcoin’s market dynamics.

Bitcoin Addresses With More than $1k Hit Record High

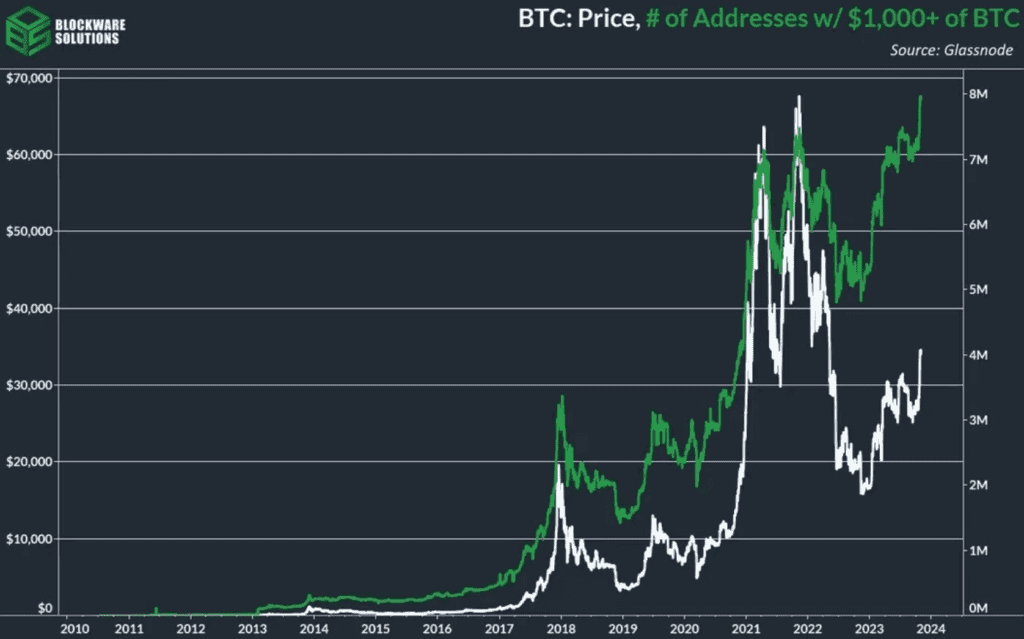

Data reveals that the number of Bitcoin addresses holding over $1,000 worth of BTC, equivalent to 0.028 BTC at the current price of $35,115, has reached a new peak at 8 million.

This figure could see exponential growth as Bitcoin monetizes, marking a positive long-term development for the cryptocurrency.

Monetization, in essence, involves generating income potential from an asset that previously did not yield revenue.

This milestone coincides with Bitcoin’s 25% gain over the past four weeks, fueled by anticipation of the SEC approval of spot Bitcoin exchange-traded funds.

The record-breaking number of Bitcoin addresses holding at least $1,000 worth of BTC showcases a growing interest in cryptocurrency ownership.

This trend offers greater financial inclusivity, allowing more individuals to participate in the digital asset market. This can potentially broaden the adoption of cryptocurrencies in daily transactions and investments.

Additionally, the expansion in the supply of stablecoins bolstered Bitcoin’s liquidity and overall market stability.

These developments underscore the evolving digital finance landscape, offering end users more choices, opportunities, and cryptocurrency accessibility.

Do you think this is the start of the bull run for Bitcoin?