TL;DR

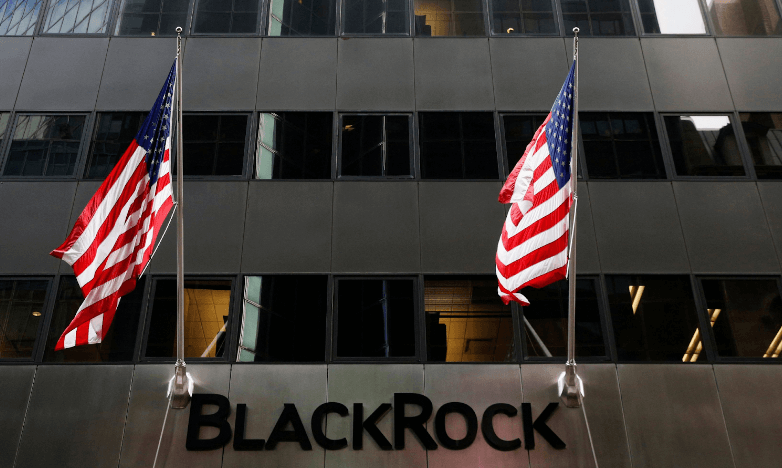

- In a groundbreaking development, BlackRock’s Bitcoin ETF has amassed over 100,000 BTC holdings under its administration.

- Amid BlackRock’s IBIT news, spot Bitcoin ETFs have made a momentous milestone by hitting a new record high of $613.3 million in daily net inflows.

BlackRock’s IBIT Amasses 105,280 BTC in Holdings

BlackRock iShares Bitcoin Trust (IBIT) has amassed 100,000 BTC under management in a remarkable milestone.

IBIT has garnered 105,280 BTC in holdings, making it a significant player in the crypto investment landscape.

Notably, the recent feat makes IBIT the first Bitcoin ETF in the U.S. to facilitate trading of such significant amounts.

It is the first among the nine spot Bitcoin exchange-traded funds, excluding Grayscale Bitcoin Trust ETF (GBTC).

Since its launch in Jan. 2024, IBIT has shown aggressive Bitcoin (BTC) buying behavior. Its holdings have grown by an astonishing 3,700%, with an initial holding of 2,621 BTC to 100,000 BTC in just a month.

As Bitcoin continues to gain market prominence, it may transform the structure of the worldwide economy.

Whether referring to it as a stable base of virtual currency or as a disruptive force, Bitcoin’s impact is far-reaching.

Spot ETFs Remarkable Milestone in Daily Net Inflows

BlackRock’s ishares Bitcoin Trust (IBIT) is among the nine spot Bitcoin ETFs actively expanding their holdings.

Fidelity Wise Origin Bitcoin Fund (FBTC) is also close behind, amassing 83,925 BTC. This collective effort highlights the growing interest in Bitcoin as an investment vehicle.

On the other hand, Grayscale Bitcoin Trust ETF (GBTC) is actively dumping BTC after Bitcoin ETF’s historic launch.

After trading with 619,220 BTC in managed assets, GBTC has been reducing its holdings. It currently stands at 463,475 BTC, roughly a 25% downturn.

In any case, IBIT’s Bitcoin holdings news follows another remarkable milestone in the ETF sector. Since its launch, spot Bitcoin ETFs have recorded another noteworthy milestone in daily net inflows.

Farside Investors data reports that the combined daily inflows of the ten-spot Bitcoin ETFs now stand at $631.3 million. And about $493 million from this total flows to the ishares Bitcoin ETF.

Market watchers believe BlackRock may struggle to meet high demand from these recent inflows.

Rapidly Growing Spot ETFs Fuel Bitcoin’s Rally

The new development comes amid Bitcoin’s record-breaking performance on the market. Bitcoin is green, surging to a record high of $50,000 for the first time since Nov. 2021.

Moreover, on Feb. 14th, 2024, it reclaimed another momentous milestone by reaching $1 trillion in asset status. This is the second time Bitcoin has got such market capitalization in history.

Several traditional financial players are buying more Bitcoin, removing selling pressure. This is among other reasons that have propelled the price to higher levels.

IBIT approval by the US SEC has fostered increasing confidence in Bitcoin as a legitimate asset class by institutional investors.

And BlackRock’s active involvement further validates this trend. Bitcoin is evolving from a mere digital currency to a noteworthy asset class.

BlackRock’s launch of IBIT highlights the broader adoption of Bitcoin in the financial industry.

It further signifies a deeper understanding of Bitcoin’s potential beyond speculative trading.

Will spot ETF accumulation continue the Bitcoin bullish sentiments in the months ahead?