TL;DR

- Bitcoin surpasses silver in becoming the eighth largest asset by market capitalization globally.

- The remarkable milestone is attributed to Bitcoin’s price increase, which set a new all-time high of $71,000 on 11th March 2024.

Bitcoin’s Market Capitalization Overtakes Silver

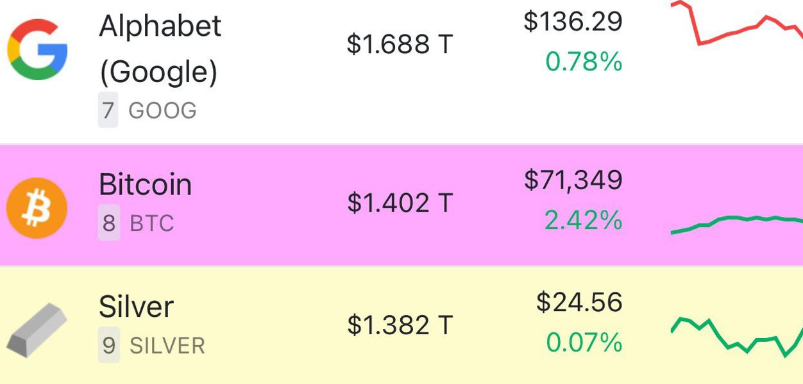

In a remarkable milestone, Bitcoin’s market cap overtakes silver, making it the eighth largest asset globally.

Bitcoin’s (BTC) recent surge in price, which soured through the $71,000 mark, made its market cap rise to $1.398 trillion.

According to CompaniesMarketCap data, the increase has allowed Bitcoin to surpass silver’s market cap, which currently stands at $1.379 trillion.

The cryptocurrency is now behind Alphabet with a market cap of $1.6 trillion. Gold is still leading with the largest market cap of $14.66 trillion globally.

Indeed, the news solidifies Bitcoin’s position as a significant player in the global financial landscape.

Bitcoin will 100 per cent catch Gold. $750,000 is a done deal.

Max Keiser posted on X.

It highlights retail and institutional investors’ increased acceptance and adoption of digital currency.

As the cryptocurrency market continues to witness monumental growth, experts are optimistic about the future prospects of Bitcoin.

Spot Bitcoin ETFs Success Behind Bitcoin’s Bullish Price Action

The news comes as Bitcoin pumps to new heights, reaching the $72,000 mark on 11th March 2024.

Its recent price surge and increased market cap are attributed to the successful launch of several spot Bitcoin ETFs.

Interestingly, these investment vehicles provide a more regulated way for institutional investors to gain exposure to BTC.

Notably, BitMEX Research data reveal that the total net flow into spot Bitcoin ETFs since its launch now stands at $9.59 billion.

BlackRock’s Bitcoin EFT, the Ishares Bitcoin Trust (IBIT), has led the pack since its launch in Jan 2024.

It had a record daily inflow of $788.3 million on 6th March 2024, following Bitcoin’s new all-time high above $69,000.

With the introduction of ETFs, the crypto market has experienced increased liquidity and trading volumes. This indicates greater capital efficiency.

What Happens Next?

Now that Bitcoin’s market capitalization is firmly established among the world’s top ten assets, all eyes are on its future performance.

Continued open interest in centralized exchanges for Bitcoin futures may be on the books moving forward.

This reflects robust investor confidence in a sustained rally. It also shows the digital asset’s ability to overcome hurdles and maintain its growth trajectory.

In keeping with Saylor’s stance on Bitcoin’s long-term potential, MicroStrategy stated it would raise $600 million to buy more BTC. The move solidifies renewed interest in cryptocurrency.

Market watchers are now predicting BTC will reach the $100,000 level before the end of 2024.

They are backing their sentiments by highlighting that the coin has created new all-time highs. Additionally, the BTC surge is also pushing the price of popular altcoins.

With ever-evolving regulatory developments and market dynamics, Bitcoin’s future remains a point of great interest and speculation.

Will Bitcoin have the ability to continue to attract institutional investments in the future?