TL;DR

- Reports claiming the SEC “will decline” the spot Bitcoin ETF is not the cause of the BTC price crash down to $42,000.

- Many analysts have an optimistic outlook and believe there’s a higher likelihood of the SEC approving ETF applications.

Bitcoin Price Flash Crashes After Matrixport Report

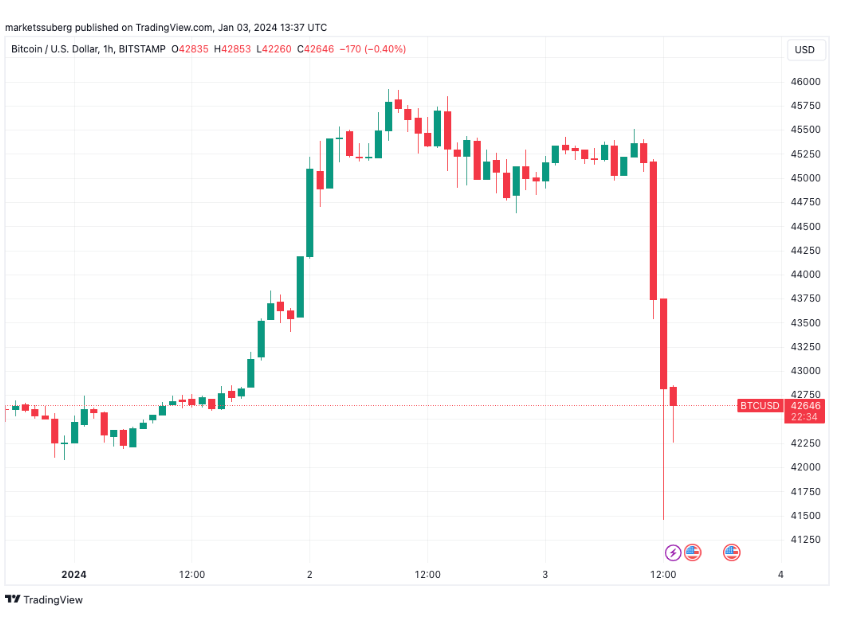

On Jan 4, 2024, Bitcoin’s price took a hit after a Matrixport report spooked the market. The report had a negative stance on Bitcoin and ETF approval.

However, many analysts believe this is not the case. Bitcoin (BTC) didn’t crash by $4,000 in hours due to panic over the US SEC rejecting the Spot exchange-traded fund (ETF).

As Bitcoin is about to celebrate its 15th birthday, the latest decline triggered a market drop of about 9%.

Popular commentators suggest that the BTC price weakness caused half a billion dollars of long liquidations.

Analytical data from CoinGlass shows the day’s current long liquidations reaching $514 million.

Matrixport’s report claims that the SEC will likely reject all Bitcoin ETF applications this coming January. It indicated that the SEC’s voting group has a majority of Democrats.

In addition, its Chair has never embraced cryptocurrency operations in the USA. The report comes days after Grayscale filed an amended S-3 form for Bitcoin ETF approval.

Report Suggests “No Reason” to Approve Bitcoin ETF

The Matrixport report stated that ETF approval would enable crypto overall take-off, and Gensler still sees the industry needing stringent compliance. Therefore, an ETF approval may not happen.

From a political perspective, there is no reason to approve a Bitcoin Spot ETF that would legitimize Bitcoin as an alternative store of value.

Part of the Matrixport Report stated.

The report had a mixed reaction in the crypto market. Some believe that it’s the reason why Bitcoin prices plummet.

However, other experts are refuting these claims, labeling them as misguided. It should have provided tangible evidence of why the ETF will fail to debut.

All eyes are now on the Securities Exchange and Commission (SEC) as the official open window for ETF approval begins.

Responding to the Matrixport report, Scott Melker needed help to substantiate the reasoning behind the firm’s report.

Other analysts reiterated that the liquidation of Bitcoin during the day was not unusual. In fact, they are part of the standard Bitcoin bull market behavior.

Joe Carlasare agreed with these sentiments, adding that Bitcoin sold off because nothing goes straight up.

Moreover, he said it’s easy to grab liquidity for a long squeeze. He concluded that the market was overbought.

Further Decline for Bitcoin Should Rejection Become Reality

On the other hand, Matrixport predicts Bitcoin will experience a further decline should the rejection become a reality.

It reiterated that any SEC rejection would see cascading liquidations. Moreover, most of the $5.1 billion in added perpetual long Bitcoin futures will be unwound.

Matrixport says BTC prices will decline by -20% and may fall back to the $36,000 – $38,000 range.

Eric Balchunas, senior ETF analyst at Bloomberg, differed with Matrixport. He claims the report would have made sense if it was back in the fall.

Moreover, given all the SEC meetings with potential Bitcoin ETF issuers, it is all but a done deal.

While Matrixport is bearish about ETF prospects, it’s confident that regulators will approve other crypto operations in 2024.

Do you think the Matrixport report caused Bitcoin’s price crash?