TL;DR

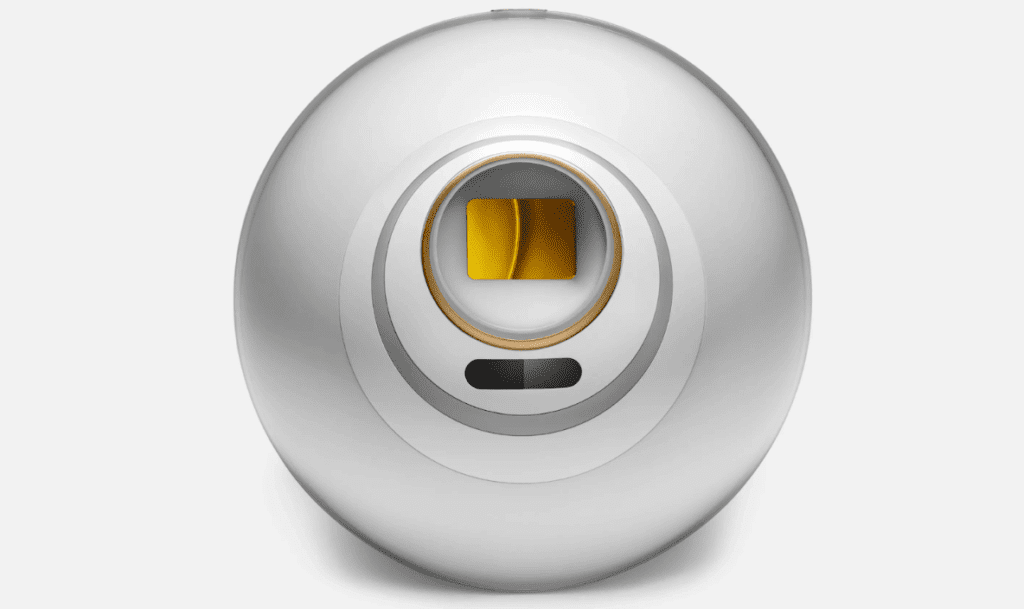

- Starting in November, Worldcoin will shift its reward structure for Orb Operators from USD Coin (USDC) to its proprietary Worldcoin tokens.

- The decision to transition to WLD payouts for orb operators marks a significant stage after the project’s formal introduction on July 24.

Worldcoin to Transition Orb Operators’ Rewards to Native Tokens

Worldcoin is preparing to shift its reward structure for Orb Operators from USDC to its proprietary Worldcoin tokens.

The company could potentially initiate this changeover as soon as the coming month.

The operators will discontinue receiving their payments in USDC starting in November.

This update is slated to be implemented across most areas where the service is available.

The decision to transition to WLD payouts for orb operators marks a significant stage after the project’s formal introduction on July 24.

The Worldcoin Foundation had previously embarked on a trial run on October 10. It allows a handful of operators to start receiving compensations in WLD tokens.

The update further clarified that Worldcoin tokens are currently inaccessible for individuals or enterprises based in the US.

Meanwhile, just a month ago, the company announced that it desires governments and businesses to adopt its ID management system.

WLD Tokenomics Are On The Rise

As indicated by Worldcoin’s Dune Analytics dashboard figures, there’s been an upsurge in the WLD token’s supply.

The supply climbed from an initial 100 million during its debut to approximately 134 million at the moment of reporting.

Out of the 134 million WLD tokens generated, market makers received 100 million as loans.

At the same time, Orb operators and new entrants received the residual 34 million through complimentary user grants.

Worldcoin detailed that five market-making partners have 100 million WLD in loans, with an original maturity date set for October 24, 2023.

Nevertheless, there’s a plan underway to push this deadline to December 15, simultaneously decreasing the loan volume to 75 million WLD.

WLD Will Become a Highly Used Crypto

As a result of Worldcoin adopting this tactic, the usage of WLD as a cryptocurrency is expected to rise. However, there’s a huge disadvantage that users need to take care of.

Operators previously receiving USDC payments will now be exposed to the volatility common in native cryptocurrencies.

While USDC is pegged to the US dollar, WLD’s value can fluctuate significantly depending on market dynamics.

If the value of WLD decreases, operators might find their rewards are worth less than before.

This move signals a shift in Worldcoin’s operational strategy for investors and market observers and could impact market dynamics.

The increased circulation of WLD tokens could influence the token’s market liquidity, valuation, and investor interest.

How market makers respond to the change in loan conditions could also affect perceptions of WLD’s market stability and investor confidence.

Do you think that Worldcoin and Sam Altman made the right decision to change from USDC payments to WLD?