TLDR

- Popular cryptocurrency-oriented media company CoinDesk announced a 45% staff reduction as part of its goal to reduce costs.

- DGC has been negotiating with a syndicate led by crypto investor Matthew Roszak; the deal to sell a stake in the company could be worth $125 million.

CoinDesk announced on August 14th that it will lay off 20 people from its editorial staff. This accounts for approximately 45% of the workforce.

The move is part of the broader plan to bring in new investors, as rumors from a month ago suggest the company is close to getting the deal done.

Established in 2013, CoinDesk has since become one of the most popular media brands in cryptocurrency.

Despite its dominant position, the 2022 crypto bear market and this year’s slow recovery make things difficult, especially at a time when the current management wants to sell a stake.

The internal note shows staff will be let go.

According to a memo reviewed by The Block on Monday, CoinDesk CEO Kevin Worth emailed the staff about the pending workforce reduction.

Based on his message, the roles are predominantly in the media team. It justified the need to ensure the business was financially sound before closing the deal to sell a stake in the company.

DGC selling stake in Coindesk

On July 22nd, we reported that Digital Currency Group is close to a deal to sell its media company CoinDesk.

Our article revealed that a syndicate of investors, led by Matthew Roszak and Peter Vessenes, is trying to buy the brand in a move worth $125 million.

The current CoinDesk management is expected to stay as part of the deal. At the same time, DGC will keep a stake in the company’s media, events, data, and index business.

CoinDesk impacted by the crypto market downturn?

As a result of the bear market in cryptocurrency assets, tech layoffs became an important theme. Some companies, like Prime Trust, even had to file for bankruptcy.

Brands in the industry need to cope with lower revenues. In the context of a sale, convincing new investors to join requires drastic measures.

To secure the deal, CoinDesk laid off editorial staff to ensure its excellent financial condition.

The picture in the crypto space remains mixed since gains are concentrated in a few big names. Although Bitcoin is hovering near a 13-month high, that is not true with the broader market.

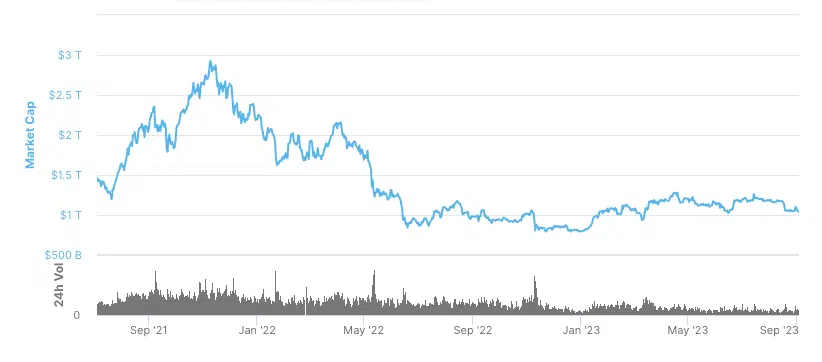

Data provided by coinmarketcap.com shows that the global market capitalization is recovering from last year’s low at a sluggish pace. That means investors and traders are still not confident enough to deploy much capital, as they did in 2021.

However, the CoinDesk deal stands out in terms of its value. Especially considering Digital Currency Group acquired the company for only $500,000 in 2016.

The question remains whether buying a crypto company after a bear market will be a good investment.