TL;DR

- Prime Trust, the crypto custodian, has officially filed for bankruptcy, revealing liabilities ranging between $100 to $500 million.

- Platform users have been facing difficulties in withdrawing their funds for several months.

Another Crypto Pillar Falls

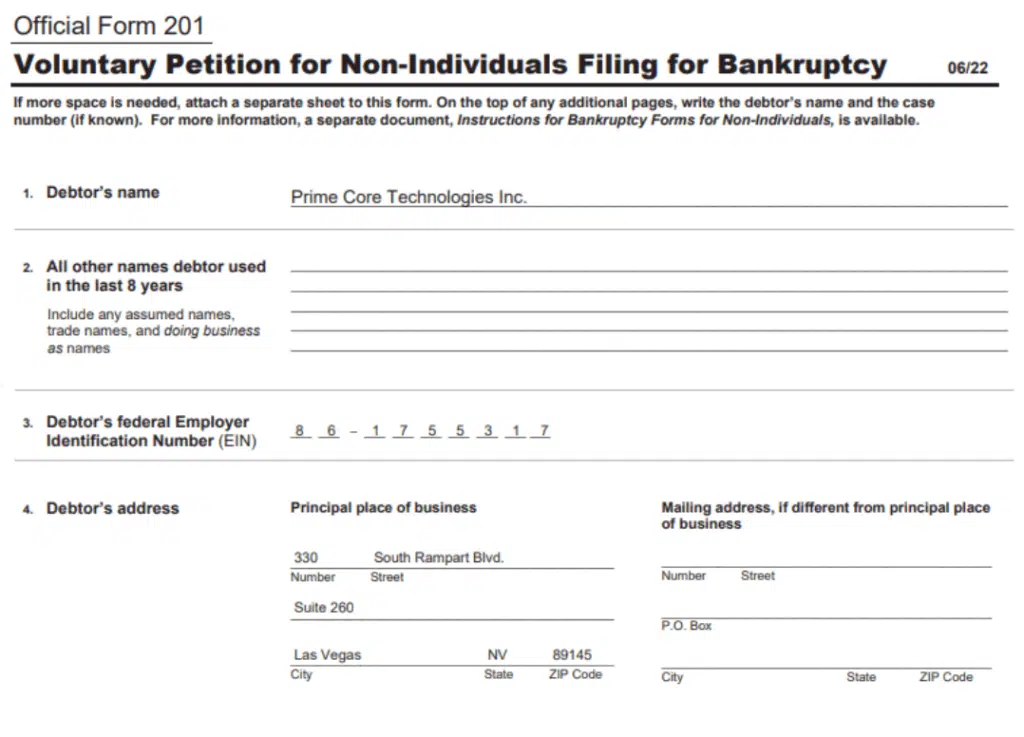

In somewhat expected news, the crypto custodian Prime Trust has filed for Chapter 11 in the U.S. Bankruptcy Court in Delaware.

The move comes after months of reports that users have been facing issues withdrawing their funds from the crypto custodian firm.

According to the official filing, Prime Core Technologies (Prime Trust) has liabilities ranging between $100 million to $500 million. This contrasts with its assets, which range from $50 million to $100 million. The filing also indicates a substantial number of users affected, ranging from 25,000 to 50,000.

The top 5 creditors collectively hold $105 million in claims against the trust, and the largest user claim amounts to $55 million.

Prime Trust plans to submit multiple motions after the bankruptcy filing. The company aims to explore various alternatives, such as the potential sale of its assets and operations. Requests could also be made to ensure the payment of employee wages throughout the process.

The Company intends to file several motions with the Bankruptcy Court designed to facilitate the Company’s orderly evaluation of all strategic alternatives, including potentially a sale of the Company’s assets and operations.

Prime Trust

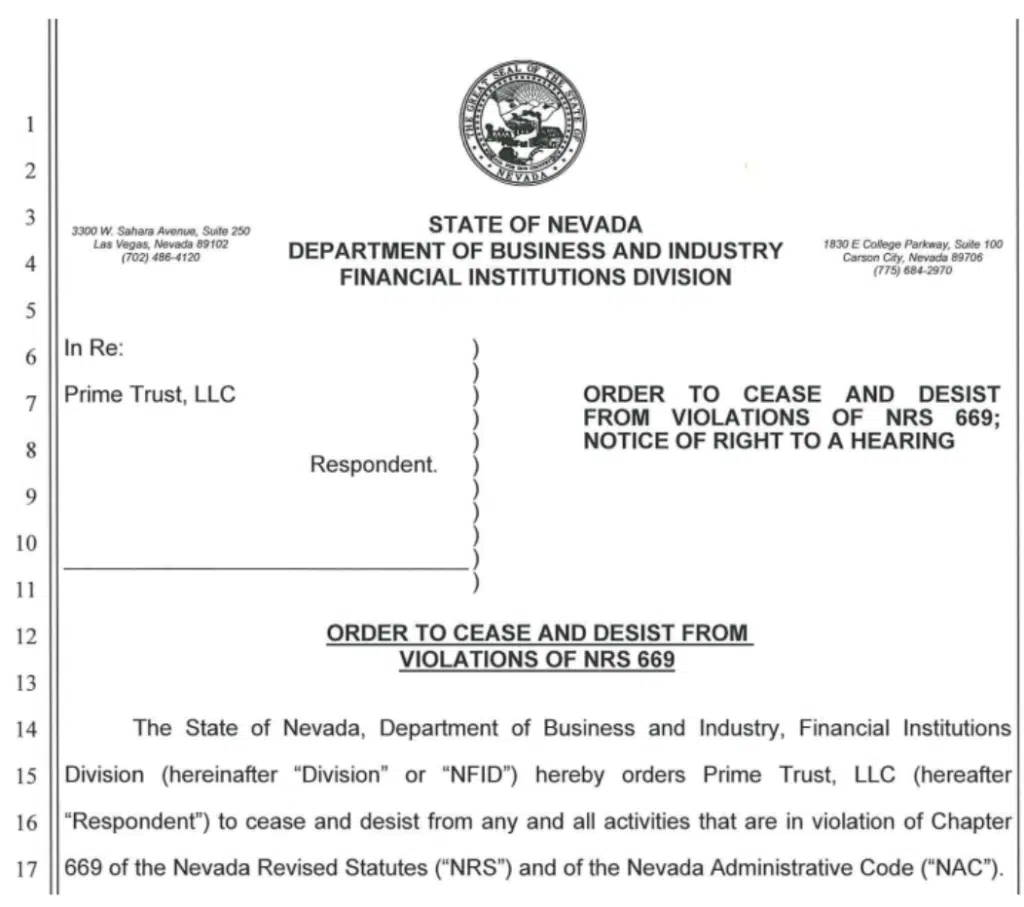

Prime Trust Was Issued A Cease and Desist Order Earlier

A cease and desist order had already been issued to Prime Trust by Nevada regulators in June of this year.

The order was prompted by user complaints that the firm failed to honor withdrawal requests.

The Department of Business and Industry in Nevada claimed in the order that the financial situation of Prime Trust had seriously deteriorated. It said the firm was in an “unsafe or unsound condition.”

Banq, the payment subsidiary of Prime Trust, filed for bankruptcy a week after the cease and desist order was issued.

Prime Trust talked with another digital asset custodian regarding acquiring the former. However, after the cease and desist order was issued, the interested party, BitGo, decided to back out of the deal.

2023: A String of Crypto Bankruptcies

Following months of market shakeups, 2023 has witnessed some of the most powerful crypto firms and institutions take a fall.

Crypto exchange Bittrex also filed for bankruptcy in Delaware back in May. Genesis Global Capital also went bankrupt but was eventually bought out by KaJ Labs. The buyer hopes to extend its AI and blockchain development by tapping Genesis investors.

The implosions of FTX and Luna in 2022 and the ones in 2023 highlight how unpredictable the crypto industry can be.

However, with many other large crypto firms growing stronger, one wonders if it is simply a case of bad management.

Established in 2016 and headquartered in Las Vegas, Nevada, the company offers trust and custody solutions for cryptocurrency and digital asset enterprises.

Prime Trust is recognized as a "bank" according to the SEC Rule 15c2-4 and as a "Qualified Third Party" under Reg CF.