- The 2024 Bitcoin halving means that less supply is entering the market, and a lower supply tends to lead to a higher price.

- Price predictions are generally positive, but depend on how much of the impact is already priced-in, the macroeconomic background and the effect on miners.

One of the hottest crypto topics of the year is the impact of the 2024 Bitcoin (BTC) halving. Especially on price predictions for Bitcoin in 2024 and beyond.

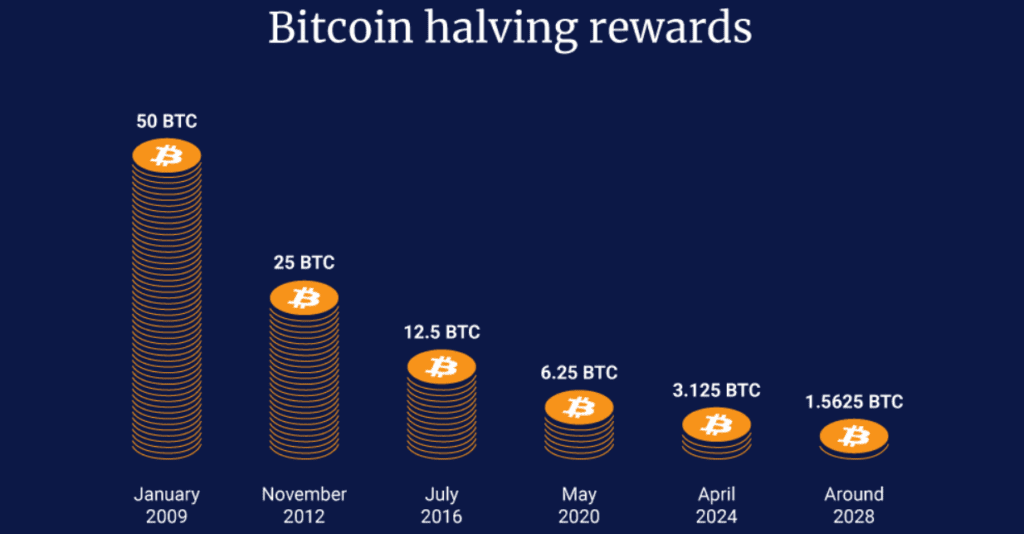

Bitcoin halving events happen around every four years when the reward for mining transactions is reduced by half.

Everyone knows that reducing the supply of something leads to an increase in its price. The question is exactly how much of a positive impact the 2024 halving will have on the price of Bitcoin going forward?

3 Key Factors for the 2024 Bitcoin Halving Price Prediction

The predictions about just how much of a positive impact the 2024 halving will make on the price of Bitcoin focus on three key factors:

- Investors anticipate the increase in price.

- The macroeconomic climate.

- The impact of the halving on miners.

Starting with the issue of market-timing around halving events, we can see that they gradually impacted the price.

Trading volumes tended to see the biggest increase over the 60 days before the halving event, as the investor interest increased and the prices gained momentum.

The historical pattern has been for the price to rise sharply right before the halving event and then fall slightly. After that, the price increase tended to be more subdued over the long term.

“While Bitcoin’s price has historically risen before and after each halving event, it has not always been a straight line up. Following previous halvings, prices have often pulled back before reaching a new peak around 220 and 240 days later.”

Megan Stals, market analyst at trading platform Stake, stated.

Gloomier Economic Outlook Than Previous Halvings

However, many Bitcoin price predictions caution that we cannot extrapolate too far based on the impact of previous halving events.

All three previous halvings occurred when the macroeconomic climate was very supportive for investors, with low-interest rates driving up the prices of all assets.

This is currently not the case, with the Federal Reserve rate around 5% and dwindling expectations that significant rate cuts will occur soon.

Most other major central banks around the globe are also expected to maintain higher rates for longer.

Transaction Costs May Be a Drag on the Price

Another possible drag on Bitcoin’s price resulting from the 2024 halving is the potential for increased transaction costs due to lower miners’ rewards.

Lower rewards for mining mean that there is less incentive for miners to maintain lower transaction costs, and higher transaction costs tend to be a drag on the price of a cryptocurrency.

However, analysts tend to agree that the effect on transaction costs should be comparatively minor for this halving event, and that the industry will consolidate further around larger miners who can maintain profitability at lower rates.

2024 Bitcoin Price Projections Perspectives

Most 2024 Bitcoin price predictions believe that the halving is a net positive, but the actual expected impact varies widely.

Following past Bitcoin halvings we can expect the price to drop slightly after the event itself as the effect of the investor anticipation plays out, and then a steady climb upwards for the next 12 to 18 months.

However, the different macroeconomic background with high interest rates around the globe is a serious concern that this time will, in fact, be different.

That said, it is generally agreed that this will only temper the positive impact of the halving on the price of Bitcoin, while it will still be a strong positive trend overall.