TL;DR

- The world’s most prominent crypto exchange founder, Changpeng Zhao, agrees to plead guilty to money laundering in a sweeping settlement deal.

- Zhao will step down as Binance CEO due to his pleading guilty but will retain majority ownership of the crypto exchange.

Changpeng Zhao Resigns as CEO in A Settlement Deal

Binance founder and CEO Changpeng Zhao agrees to plead guilty to money laundering violations.

He resigns as CEO of the world’s largest crypto exchange in a sweeping settlement with U.S. law enforcement and financial regulators.

Changpeng Zhao will pay a $50 million fine, while Binance will pay $4.3 billion as part of the settlement deal. The deal will also allow Binance to continue its operations.

The announcement from the DOJ comes less than a month after Sam Bankman-Fried (SBF) was convicted of multi-million FTX fraud.

Richard Teng, former global head of regional markets for Binance, will now take charge as CEO.

CZ admits this was the right thing to do in response to stepping down. He says that he made a mistake and must take responsibility.

Zhao will remain a shareholder and be available for consultation when the Binance team needs it.

Binance became the world’s largest cryptocurrency exchange partly because of its crimes—now it is paying one of the largest corporate penalties in U.S. history.

Attorney: Merrick B. Garland

DOJ to Maintain its Aggressive Stance against Crypto Players

The Department of Justice also notes that it’s maintaining its aggressive stance against crypto players.

In the announcement, the DOJ reiterated how it had successfully prosecuted two CEOs of the world’s largest cryptocurrency in separate criminal cases.

Janet Yellen, the Treasury Secretary, said that the settlement deal marks the end of Binance investigations by the DOJ and the commodities regulator.

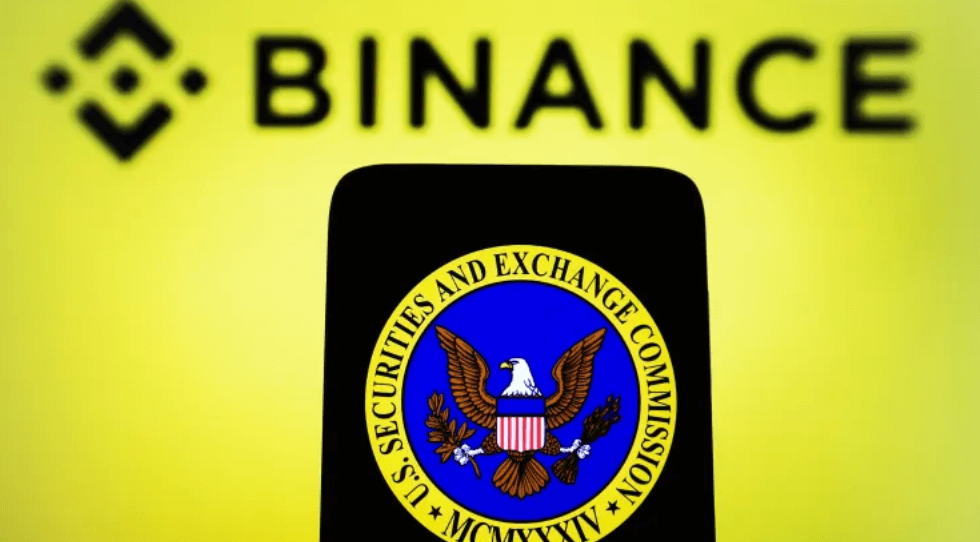

However, the firm may still face huge penalties from the U.S. Securities and Exchange Commission.

She sternly warned other crypto players, insisting they must adhere to U.S regulations.

Binance’s Woes with Cryptocurrency Regulators

As a one-stop shop for investors in cryptocurrencies and other digital assets, Binance is a symbol of the borderlessness of the digital economy.

The crypto exchange market share grew immensely after the FTX collapse.

In recent months, Binance users fled to other exchanges as regulators scrutinized its business, causing Binance to lose $500M in customer funds.

Moreover, news of Binance’s top executives leaving the platform raised concerns in the crypto sphere.

While the settlement marks a huge reprieve for the company, its legal troubles may not be over.

Under existing rules, the U.S. Securities and Exchange Commission (SEC) is aggressively targeting the crypto industry.

The Commission accuses Zhao and Binance of engaging in a web of deception, lack of disclosure, and conflict of interest, among other things, over its operation.

Binance and Zhao kept its U.S. and international businesses separate from the current regulators.

Additionally, it allowed illicit activities like money laundering to happen at the crypto exchange.

The crypto space observes intensively how the whole situation would unravel.

Do you think Zhao will continue to exert influence on Binance?