TL;DR

Court filings by FTX reveal its intention to reboot the failed trading platform.

FTT surged more than 17% after the news broke out, even though documentation submitted shows no plans to use the token.

FTX 2.0 – Is it really coming to life?

FTX bankruptcy administrations filed court documents on Monday (31st June 2023) with debtors’ claims and a proposed plan for a restart. The documents categorize claimants into different classes:

- Dotcom Customers (claimants of FTX.com).

- FTX US Exchange Claimants

- NFT Exchange Claimants.

- General, Secured, Unsecured, and Subordinated Claimants.

The FTX international claimants (dotcom customers) will decide on the reboot of FTX.com. The plans show that these customers will have the option to pool assets and restart the offshore exchange.

If the dotcom customers agree, the rebooted exchange will provide securities or other assets as equity, “Rather than all cash; the Debtors may determine that the Offshore Exchange Company remit non-cash consideration to the Dotcom Customer Pool in the form of equity securities, tokens or other interests in the Offshore Exchange Company, or rights to invest in such equity securities, tokens or other interests.”

Many regard the news as a positive step, especially those who lost their assets in the collapse. Jon J. Ray III’s attempt to restart the exchange is public knowledge. He had already started discussion of the relaunch in June 2023 with claimants.

FTX Minus FTT Formula

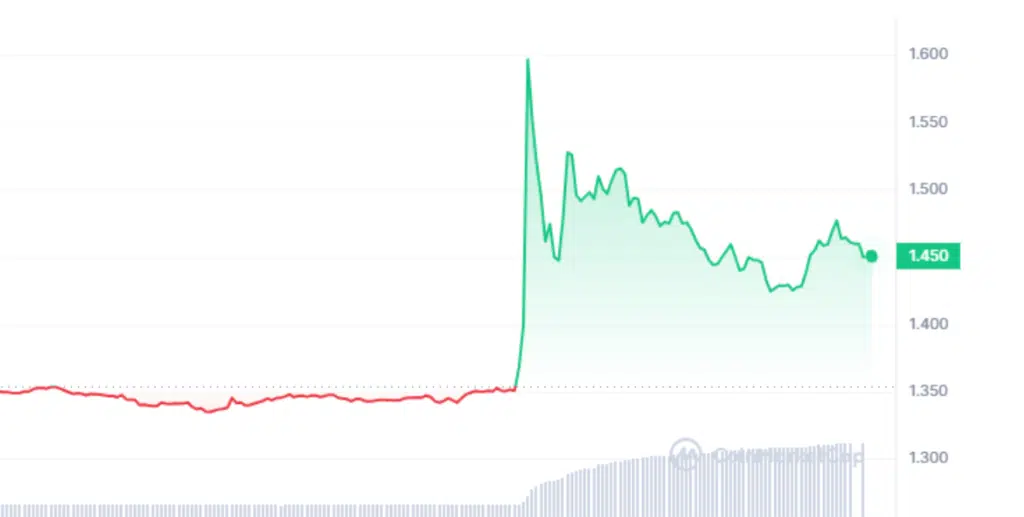

The news of a possible relaunch of the FTX exchange led to FTT, the native token, to surge more than 17%. FTT was trading around $1.36 before the news broke out. The token peaked at $1.6 before settling at around 1.46 at the time of writing.

However, several people have quickly pointed out that FTT is not mentioned anywhere in the court filings. Many believe the FTX reboot will not include the FTT as its official token.

SEC has already declared FTT an unregistered security. Unless the FTX management decides to challenge it (and win), using FTT as a part of the exchange is highly unlikely.

FTX Recent News

While the collapse of FTX sent a shock in the crypto sphere, the saga is not over, and its shockwaves are felt repeatedly, both good and bad.

The exchange remains closed. Yet the FTX and Genesis issue is finally ending as both parties agree to find a solution to their dispute. On the other end of the spectrum, courts have restricted public access to Sam Bankman-Fried (SBF). SBF attempted to discredit Caroline Ellison.

Ellison is the main witness in his case. She is due to testify against SBF in his trial set for October.

The FTX exchange imploded last year. The platform used its customer assets to finance Alameda Research, its sister trading firm. The revelation and shock led to a bank run, and without user assets, FTX crumbled in just a few days.

As it fell, the value of its native FTT token became almost worthless.