Understanding a Black Swan Event

A black swan event refers to an extremely rare and impactful occurrence that is nearly impossible to predict. The term was coined by Nassim Nicholas Taleb, a finance professor, writer, and former Wall Street trader.

In his 2007 book, Taleb introduces the concept of a black swan event, describing it as an event with catastrophic consequences but is highly unexpected. According to Taleb, these events are exceptionally rare and unpredictable, emphasizing the need for individuals to be prepared for their potential occurrence.

A black swan event, as defined by Taleb, is an event that is so uncommon that its probability is unknown. It possesses three key characteristics:

- When it does occur, it has severe and far-reaching consequences.

- It can only be explained in hindsight.

- Observers tend to speculate on how it could have been predicted after it has already happened.

The concept of a black swan event draws inspiration from a Latin phrase used by the Roman poet Juvenal in the 2nd century. The phrase refers to something as a “black swan event” that is “rara avis in terris nigroque simillima cygno,” meaning “a rare bird in the lands and very much like a black swan.” At the time, it was believed that black swans did not exist.

In the context of financial and cryptocurrency markets, a black swan event is highly unfavorable and leads to widespread devastation with notoriously unpredictable consequences.

Global Housing Market – 2008

The most notable example of a black swan event in finance is the Global Financial Crisis of 2008, triggered by the unexpected and catastrophic collapse of the previously thriving real estate market. Lenders in the United States had significantly relaxed their mortgage eligibility requirements under pressure from the government, resulting in people with poor credit being granted mortgages they couldn’t afford.

Subprime mortgages rapidly inflated into a massive bubble that eventually burst. Major financial institutions like Lehman Brothers collapsed as mortgage defaults soared. To mitigate the crisis, the US government implemented the Troubled Asset Relief Program (TARP), a trillion-dollar initiative aimed at rescuing large banks and restoring liquidity in the economy. Governments worldwide also tightened financial regulations to prevent a similar crisis in the future.

Covid-19

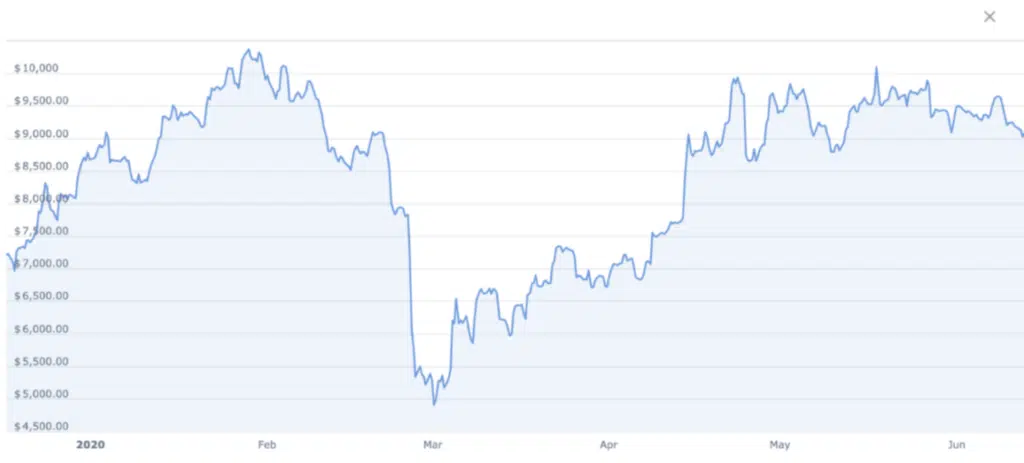

The world is grappling with one of the most prominent examples of a black swan event—the COVID-19 pandemic. This event aligns with all of Taleb’s criteria for a black swan event. The pandemic struck suddenly and revealed the unpreparedness of countries to deal with its impact. The devastating consequences of the pandemic include record unemployment rates, stock market crashes, and escalating death tolls.

Just as it is impossible to predict the presence of a black swan among a flock of white swans, the occurrence of a black swan event remains unknown until it happens.