Understanding the Arbitrage Pricing Theory (APT)

The Arbitrage Pricing Theory (APT) is a model that extends the Capital Asset Pricing Model, aiming to evaluate market efficiency and identify arbitrage opportunities within financial markets. This theory is founded on three fundamental principles: risk, opportunity cost, and equilibrium.

Defining Arbitrage

Arbitrage is a trading technique that allows for risk-free profits by simultaneously trading in two or more markets. While arbitrage opportunities are generally scarce due to market differences, the arbitrage pricing theory (APT) focuses on analyzing the relationship between asset prices and risk. It proposes that if two securities are priced differently, an investor can capitalize on a risk-free profit by buying and selling the other.

Arbitrage Pricing Theory (APT) and Market Efficiency

The APT assumes market efficiency, asserting that asset prices represent the best estimate of an asset’s true value. In essence, an asset’s price reflects all available information. Any deviation from the APT’s predictions suggests that market prices may not accurately reflect the relevant information.

According to the APT, the expected return of an asset is determined by the associated risk. The absence of arbitrage opportunities characterizes efficient markets. The APT states that securities within efficient markets should have equal rates of return, with each security’s expected return being proportional to its associated risk.

The Mathematical Model for the Arbitrage Pricing Theory (APT)

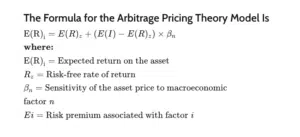

The APT employs arbitrage to forecast the expected return of each asset. This calculation relies on assessing the risk associated with the asset, employing the following formula:

The Mathematical Model for the Arbitrage Pricing Theor

Limitations of the Arbitrage Pricing Theory

The APT assumes that all investors are rational, all securities are efficiently priced, and the markets approach equilibrium. However, the assumption of rationality among investors is debatable, as investors often make irrational investment decisions.

The assumption that all securities are efficiently priced, and the markets tend towards equilibrium is also subject to scrutiny. While some financial markets demonstrate relative efficiency, others do not. Even in relatively efficient markets, arbitrage opportunities may arise. The constant fluctuations in markets make it challenging to measure convergence rates accurately. The APT predicts that the expected return on each asset should be proportional to its associated risk rather than exact equality.