TLDR

This article will review the State of Crypto 2023’ report provided by A16z. Indicators suggest that the ecosystem is healthier and more advancements have been made with brighter hopes for the future of cryptocurrency. They don’t focus on the market price but other more relevant indicators for the broader ecosystem. So “wen moon”- people, this is not for you.

We will cover the following:

- 3 Key Views on Web3

- Positive Market Cycles

- Web 3: The Next Evolution of the Internet

- Trends to keep an eye on

- US Regulation

- Indicators: Innovation & Adoption

Introduction

Andreessen Horowitz (a16z), a leading VC firm, published the ‘State of Crypto 2023’ report in April 2023. They invested over $1,000,000,000 in crypto. That is a billion dollars with a B.

Marc Andreessen (General Partner of a16z) is a tech OG who believes in the underlying technology. Marc co-founded the influential Mosaic Internet browser and co-founded Netscape, which later sold to AOL for $4.2 billion. That means he knows what he is talking about.

We have summarized the top insights you need to know from the report. Relax, and let your FOMO bar go off the chart.

3 Key Views on Web3

Let’s start with a16zs top 3 key views on how the Web 3 industry will develop as a warm-up.

- Web3 is more than a financial movement. It’s an evolution of the internet.

- Blockchains are more than ledgers. They are computers.

- Crypto isn’t just a new financial system. It’s a new computing platform.

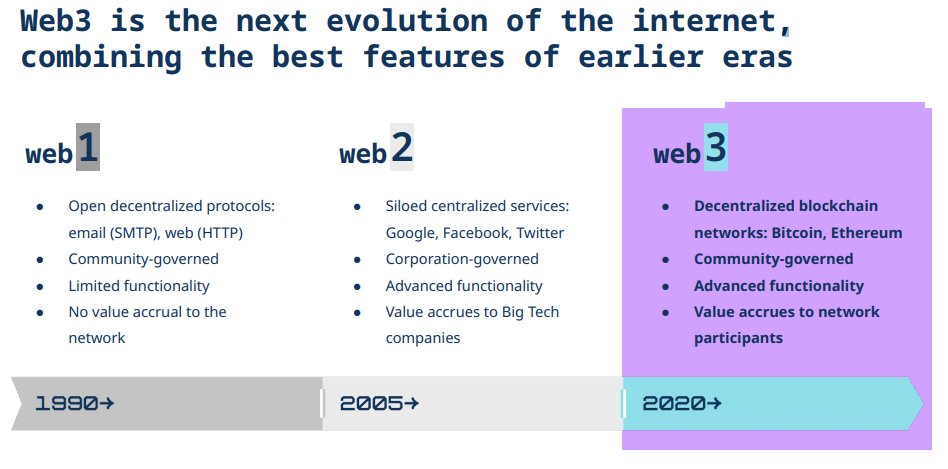

Web 3: The Next Evolution of the Internet

Web 3 is the next evolution of the internet, combining the best features of earlier eras. We will look at the earlier eras one by one.

Web 1 and 2 democratized information:

- Web 1 was the open, decentralized protocol through e-mail and the Internet. It was community governed, with limited functionality and reach. People were not incentivized to create as the network had no value accrual. Timeline-wise – we are in the 1990 era.

- Web 2 produced and siloed centralized services like Google, Facebook, and Twitter. Corporations were in control. It gave us advanced functionality, but all the value accrued to Big Tech companies. We are in 2005 and onward.

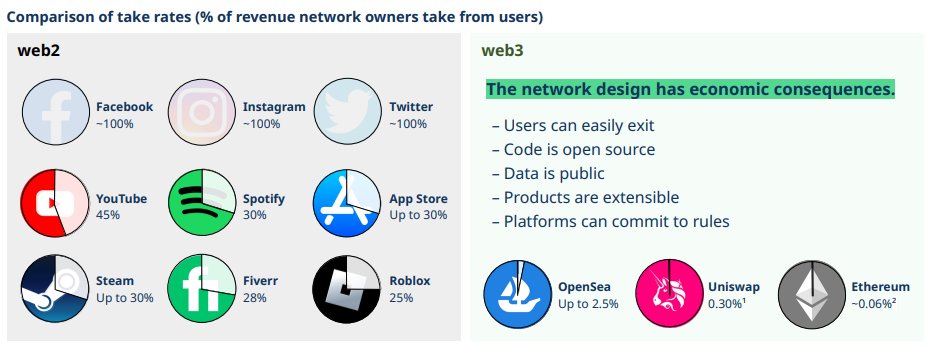

Web 3 kicks that in the face by providing decentralized blockchain networks like Bitcoin and Ethereum. The process has changed to community governance, with more advanced functionality that we will spend the next decade exploring. The best part, the value accrues to the network.

In short, Web 3:

- Democratizes ownership

- Users have more power and earn greater shares.

- Decentralizes the internet

Positive Market cycles

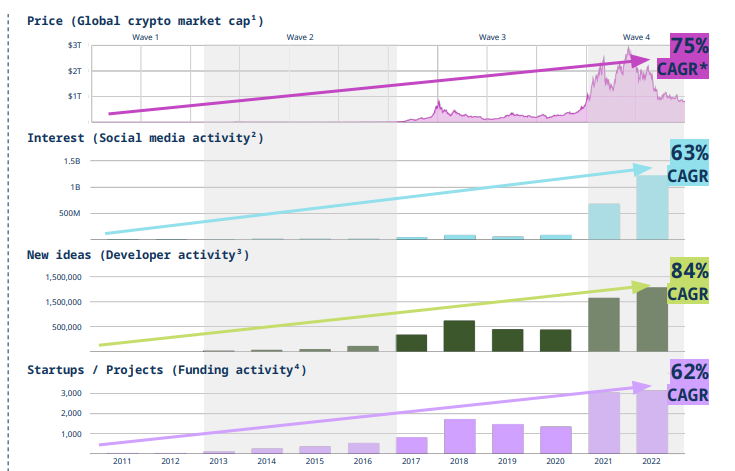

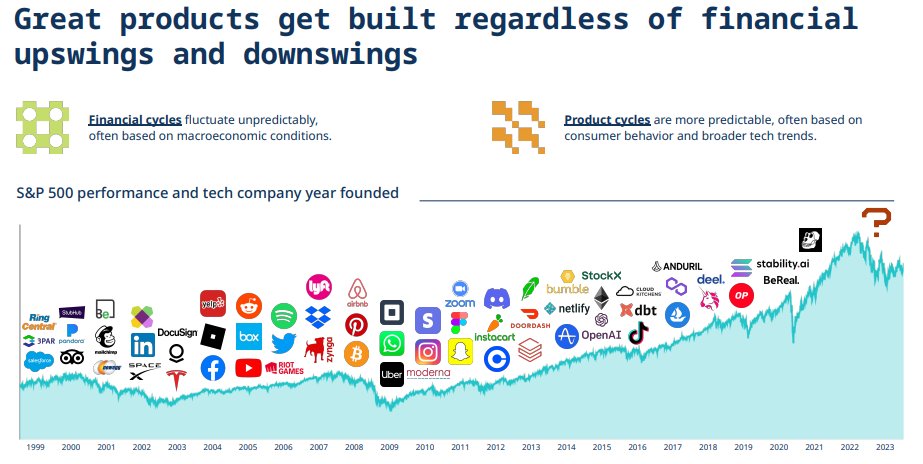

New ideas lead to startups. Their price movement leads to interest and new ideas that begin the next cycle.

The market already went through four cycles. We are currently in the 4th wave. Regardless of global crypto market price, we see huge year-over-year growth in social media activity, developer activity, and startup/funding activity. Each one is bigger than the last.

Even if we, per financial definition, are in a recession, great products get built regardless of market behavior. Uber, Whatsapp, and Instagram were made during the worst downturn in the 2000s.

Trends to watch out for (from a16z)

We will not go into the depth of each trend, but you can review the full report on trends here. To summarize what to look for in the next years and where the activity will be emerging is in the following sectors:

- New L1 Blockchains

- Optimistic Rollups

- Zero Knowledge Rollups

- Application specific Blockchains

- Data Availability Solutions (e.g Celestia)

State of Crypto: US Regulation

The US is quickly losing its lead in Web 3. Emerging markets from China, Europe, and the Middle East are gaining momentum.

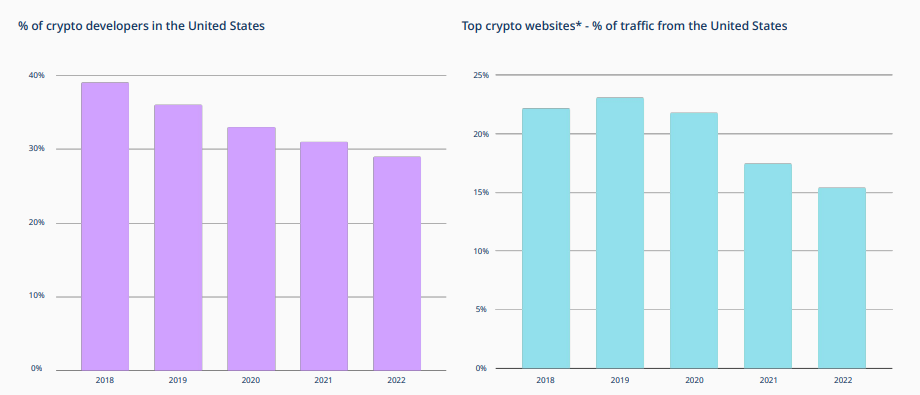

We see a reduction in number of crypto developers in the US, going from almost 40% in 2018 to sub-30 % in 2022.

A16z Views on the impact:

- Banning new tech & business models goes against American values, pushing innovation & jobs away.

- Clear rules via agency guidance or legislation can protect consumers & help the web3 industry thrive.

- Legal businesses & customers deserve access to financial services.

- Focus regulation on businesses, not decentralized, autonomous software.

- Target web3 apps, not the underlying protocols, to ensure a fair & innovative ecosystem for all.

Adoption and Innovation Indicators

Let’s move over to the fun part – seeing growth in the industry.

A16Z looked at the following:

- Active Developers

- Contract deployers

- Verified Smart Contracts

- Dev Library Downloads

- Academic Publications

- Job search Interest

We will take a look at a few that are most relevant.

Steady Number of Active Developers

Despite the market speculations on prices, we are seeing a steady increase in developers in the industry. This is based on the number of unique GitHub users committed to or forked public crypto during the month. About 30,000 monthly active developers are currently advancing and building new products.

Increasing Number of DeFi and NFT activities

Like the above point, more users find more organic engagement using DeFi and NFTs. The common uses of these applications extend to arts, lending, collectibles, remittances, and on-chain gaming.

DEX activity

There has also been an astronomical increase in the volume of DEX trading. In the past two months, Uniswap-has experienced trading over $100B monthly – higher trading volume than Coinbase – US’s largest centralized exchange.

What’s next?

So, after all is said and done, what is next? A16z believes we are just at the tip of the iceberg and have not started to open the floodgates on what is to come.

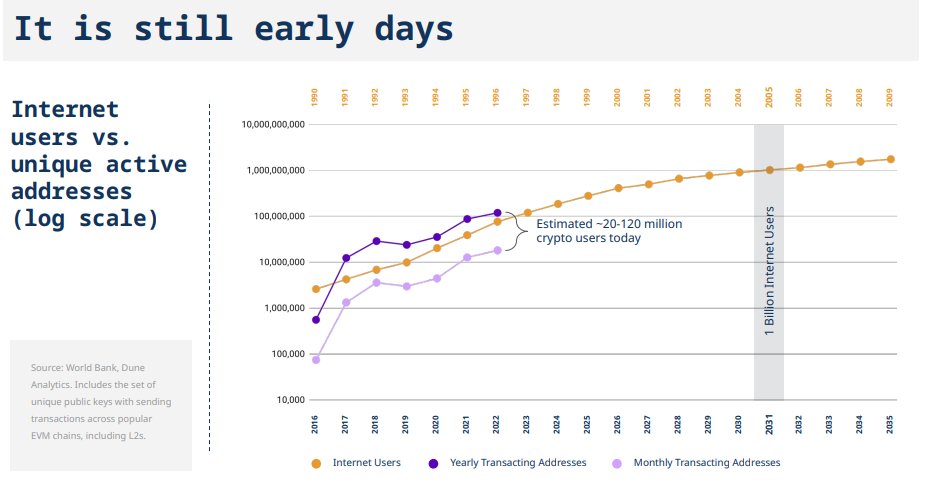

To showcase how early we are, A16z shared a chart that shows how early we are compared to the growth of the internet.

Our conclusion: Based on yearly and monthly transactions, we are between 1994-1996 with 20-120 Million Crypto Users.

In conclusion, the ‘State of Crypto 2023’ report by Andreessen Horowitz demonstrates a promising outlook for the future of the Web3 world. This is the time to take this opportunity seriously. Happy building, fellow degens.