TL;DR

- Spot bitcoin ETFs had their first day of trading in the U.S. markets on Jan, 11th 2024.

- On day one of trading, there were ten spot bitcoin ETFs on the market; Grayscale accounted for more than half the trading volumes.

Anticipated ETF Products Debut the U.S Market

After a decade of trying, the Securities and Exchange Commission (SEC) officially approved Spot Bitcoin ETFs.

Following the SEC’s greenlight, the anticipated product debuted on the U.S. markets run by the NYSE, Nasdaq, and Cboe Global Markets.

They are aided by major trading firms that plan on providing liquidity. Investors jumped into the approval by the SEC on Jan 10, 2024.

According to LSEG data, the listed bitcoin ETFs registered $4.6 billion worth of share trade hands as of Thursday afternoon.

The Grayscale Bitcoin Trust (GBTC)—which was allowed to convert to an ETF Wednesday—accounted for half the volumes.

On the other hand, BlackRock registered an estimated quarter of the volumes. The high trading numbers closed out the day that started quickly.

Ten funds registered over $1 billion in trade volume in the first 30 minutes of trading.

Although it’s still early to draw definitive conclusions, this high volume suggests a substantial inflow of investor capital into the spot-based Bitcoin ETFs. The market price impact on the first day is moderate, which we attribute to the unwinding of futures positions in response to this significant event for the asset class.

CoinShares research head James Butterfill stated.

Interestingly, Hashdex revealed in a late press release that it’s excited about the rule changes to list its Bitcoin futures fund as a spot product.

However, it’s still waiting for the SEC to review and approve its registration statement to convert the fund.

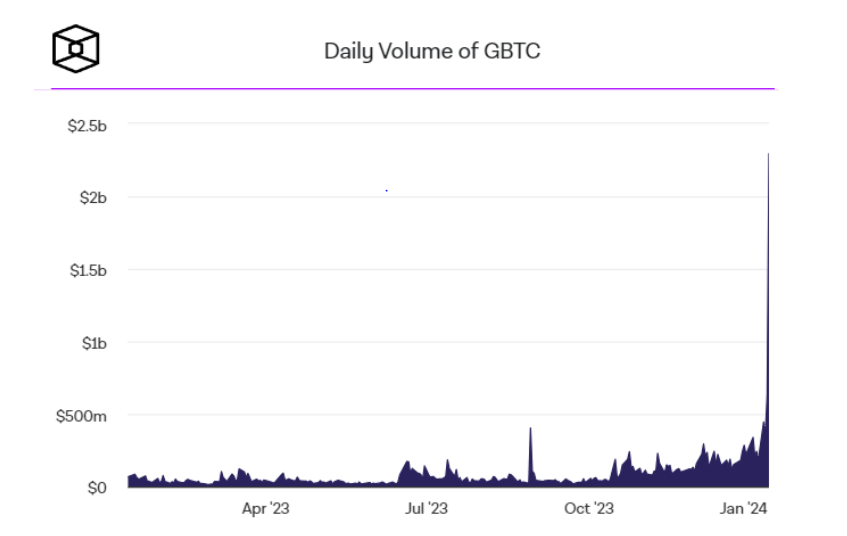

Grayscale Leads the Pack with the Largest Trading Volume

Grayscale and BlackRock ETFs led the pack with an estimated 56 million and 38 million shares traded, respectively.

GBTC ended the day with roughly $2.3 billion in trade volume. The success is worthwhile, given the firm’s many obstacles it faced on its way to getting this approval.

On the other hand, BlackRock’s ishares of Bitcoin ETF (IBIT) ended at $1 billion in trade volume.

Many believe that it was quickly the biggest day-one splash in ETF history. IBIT’s day-one trading volumes registered a similar trend to those seen on the first Bitcoin futures ETF.

The ProShares Bitcoin Strategy ETF (BITO) saw roughly $950 million in volume on Oct 19, 2021. BITO, however, didn’t have any other competing products launched on the same day.

Fidelity’s Wise Origin Bitcoin fund also registered over $700 million in volume. Combining the total for three accounted for about 87% of the total spot Bitcoin ETF trading volume.

Battle for Spot Bitcoin ETF Dominance

In a CNBC interview, Galaxy Investment Partners CEO Michael Novogratz shared his views on the battle for ETF dominance.

He suggested that the battle for dominance will be between BlackRock, Invesco, and Fidelity. He wrote off Grayscale despite its early centralization of activity around it.

Bitcoin ETF approval was a remarkable milestone in the regulatory and crypto spheres. Investors are quickly jumping on the ETF frenzy and investing in the best crypto ETFs in 2024. However, some financial firms still operate on the sidelines.

Vanguard reiterated that spot bitcoin ETFs were unavailable on its platform. It also added that it had no plans to offer Vanguard Bitcoin ETFs or other crypto-related products.

Other financial firms are cautious—UBS allows its clients access more than half. However, not all spot Bitcoin ETFs are available.

Will Grayscale (GBTC) continue to showcase its dominance in the market?