TL;DR

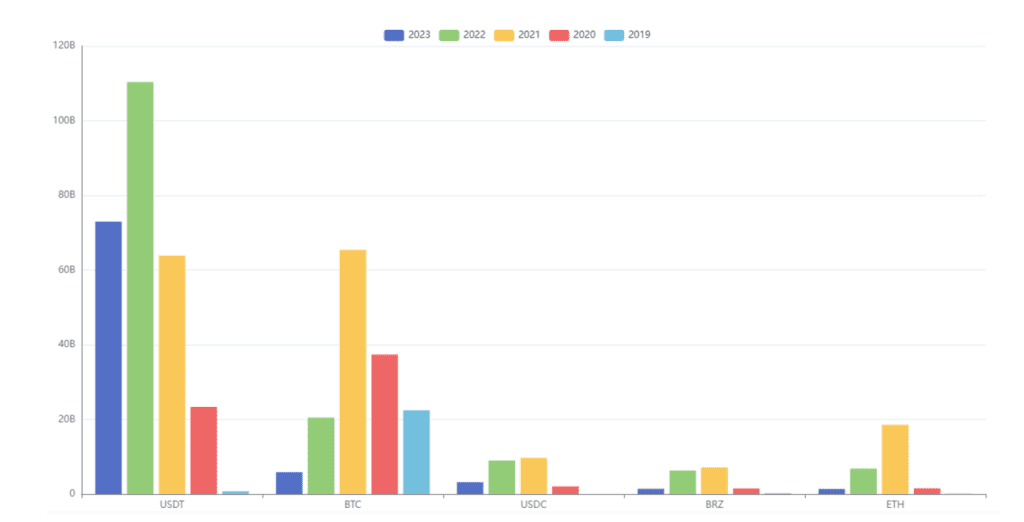

- The trading volume of USDT in Brazil exceeded the combined trading volume of all other cryptocurrencies in 2022.

- Stablecoins make up roughly 10% of the global trading volume of the crypto industry and are generally trusted more as a safe haven when volatility peaks.

Tether Experiences a Trading Boom in Brazil

The Brazilian Federal Revenue Department, Receita Federal, has noted a marked rise in the use of stablecoins, particularly USDT.

The department’s findings reveal that in 2022, the trade volume of USDT surpassed that of all other cryptocurrencies combined.

In the worldwide crypto trade, stablecoins account for approximately 10%. They are often viewed as a more reliable option during heightened crypto market volatility.

Stablecoins are a fundamental asset for those engaged with digital currencies, serving as a bridge between traditional fiat and cryptocurrency.

Their predictability also makes stablecoins increasingly sought after for different financial dealings.

USDT vs. Other Cryptocurrencies in Brazil

Data from Brazil’s Receita Federal reveals that among stablecoins. USDT and USDC, as well as BRZ, are the most traded.

Since 2019, Receita Federal has initiated monthly reviews to monitor the rise in stablecoin activity.

From the authority’s findings, transaction volumes of stablecoins have now outpaced Bitcoin.

Preliminary figures for 2023 suggest that USDT transactions account for 80% of the total cryptocurrency trades. This positioned it as the dominant digital asset traded in Brazil over the past 10 months.

Bitcoin Behind in Race

Per regulatory data, 2022 saw USDT eclipsing Bitcoin in trade volume, a shift attributed to the downfall of Terra LUNA.

This event spurred investors to pivot to assets less susceptible to heightened volatility, like stablecoins. Consequently, USDT’s prominence rose.

In Brazil, USDT’s trading figures touched 271 billion Brazilian reais (around $54 billion) within the monitored period.

This volume was almost double that of Bitcoin, the leading crypto, which recorded trades of just above 151 billion reais.

Globally, in a 24-hour window, USDT and Bitcoin had trading volumes of $14.58 billion and $14.01 billion, respectively.

Though USDT consistently posts higher volumes, its lead over Bitcoin has never surpassed roughly 50%.

Furthermore, USDT’s volume has yet to exceed the collective trading volume of all other digital assets.

How This Impacts The End Crypto User

In our opinion, this is a positive sign for Tether. The surge in USDT’s trading volume in Brazil underscores its growing acceptance and trustworthiness among users.

For the average USDT user, this implies enhanced liquidity and ease of trading.

Additionally, the coin’s heightened prominence may lead to better infrastructure and support for USDT transactions.

However, you should also be aware of the increased regulatory scrutiny often accompanying such rapid growth in cryptocurrency’s popularity.

This news comes after Tether announced they will provide live reserve data starting in 2024.

Will Tether dominate the crypto market?