TL:DR

- The much anticipated Bitcoin halving is fast approaching, with less than 5000 blocks remaining.

- As the Bitcoin community awaits the event, BTC has already recorded all-time highs, with growing on-chain data. Will the halving pave the way for further increases in crypto prices?

Less Than 5000 Blocks to Bitcoin Halving

The Bitcoin (BTC) community is in a frenzy for its fourth halving. This cryptographic protocol is less than 5000 blocks from execution, approximately 30 days away.

Bitcoin halving, programmed initially by Satoshi Nakamoto, happens every four years, or more precisely, every 210,000 blocks.

At press time, the Bitcoin blockchain stood at block 835,195; therefore, 4805 blocks remain until the long-awaited halving.

Historically, miners’ reward for validating a block will be halved, reducing the current 6.25 BTC to 3.125 BTC.

Miners are ready to cash half of what they’ve mined with each block. They are also celebrating an utterly unnatural situation compared to previous market cycles.

Miners to Reach Halving With High BTC Price

In the past years, Bitcoin rallied after the halving or in the days leading up to the event. This is because the demand push was not significant.

However, the next halving is different. If there are no significant dumps in the coming days, miners will reach the fourth halving with a high price of BTC.

It’ll, therefore, compensate for the halving of the block reward. Interestingly, the Ordinals field also positively contributes to the miner’s income by increasing the network’s transaction fees.

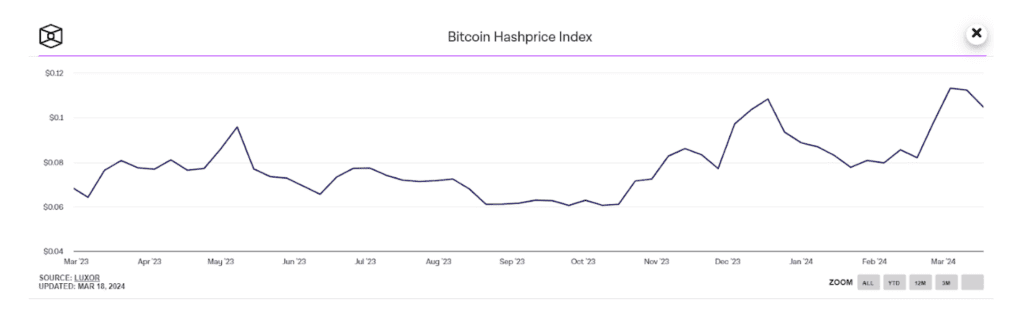

The cost of 1TH/S is roughly 65% higher than one year ago. Currently, miners earn 0.1 dollars for every terahash donated to the network per second.

On the other hand, the BTC blockchain’s hash rate continues to grow. Its total computational power is hovering around a historical high of 600 EH/s.

Will History Repeat Itself?

As market watchers await the event, they’re wondering if the price of Bitcoin will behave as it has in the past.

Will there be significant growth after the halving? It seems not. Bitcoin had recorded all-time highs before the anticipated halving.

The rally was triggered by the introduction of spot Bitcoin ETF on Wall Street. It heightened fresh demand for Bitcoin, disrupting the pioneer cryptocurrency’s price action.

In any case, each recurrence of BTC’s growth rate has been lower than the previous halving. Looking at BTC halving stats, the cryptocurrency’s price in July 2016 was more than 8,000% higher than the halving of 2012.

Currently, Bitcoin’s market capitalization is over 600% higher than in 2020, and it continues to rally gradually.

Analysts believe Bitcoin could rally after Halving but with less bullish momentum than in previous years.

According to technical analysis, Bitcoin’s price may decrease as we approach the halving event. However, it will rebound after a solid support level is found on the charts.

Market watchers believe Bitcoin would push towards new highs past the $100,000 mark.

Will the price of Bitcoin push past the $100,000 mark after the halving event?