What Is Day Trading?

Day trading is a type of trading that involves entering and exiting a position on the same day.

Traders will take advantage of short-term price fluctuations to make quick gains, often using leverage to amplify their returns. Day trading most often takes place in times of high volatility, which creates more opportunities for low time-frame trades.

The goal is to buy and sell an asset before the end of the trading session so that no uncontrolled risks remain unattended afterward.

Day trading vs intraday trading

Day trading and intraday trading are two different names for the same thing. “Day trading” is used more commonly in the U.S., while “intraday trading” is a more popular term in the rest of the world.

The Basics of Day Trading

The basics of day trading are tailored specifically to short-term conditions rather than long-term trends.

The goal of day trading is to make quick money without leaving any risk on the table at the end of the day. Trades must be opened and closed within the same session – even if they’re at a loss.

Day traders make most of their decisions based on candlestick charts, indicators, and patterns—a technique known as technical analysis. One of the core basics of day trading is technical analysis on charts with short time frames, such as 1-minute, 5-minute, or 15-minute candles.

Day trading will often revolve around patterns and behavior that form in these charts, which accompany certain styles of trading.

Scalping and trading a range

Both of these methods involve trading back and forth frequently within a specific range.

In the case of scalping, this is usually very rapid and involves making many trades for small profits – often focusing on the bid-ask spread, i.e., the gap in price between sell orders and buy orders.

Range trading usually involves identifying buying and selling at recent support and resistance points. This type of trading is slower than scalping but involves larger price swings.

Breakouts and momentum

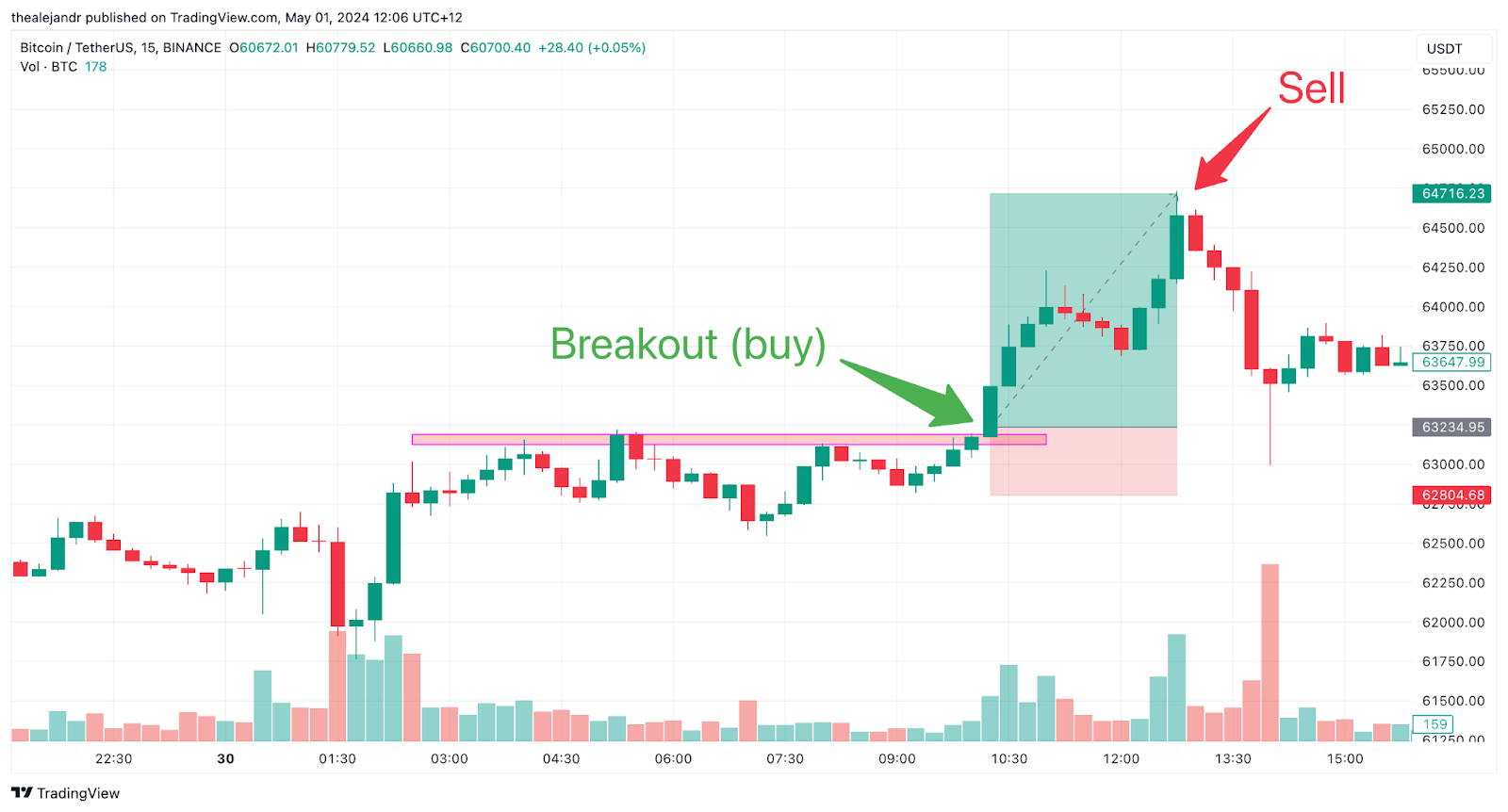

Breakout trading and momentum trading take advantage of signs of strength or weakness in the chart for an asset.

Breakout trading waits for an asset’s price to break through a key price range or key level, which shows strength in that direction. This is most often a break through a simple line of support or resistance, which has been acting as a price floor or ceiling.

In a similar way, momentum trading takes advantage of a clear short-term trend that is already on the move.

News and events

Noteworthy news and events often create volatility in a market. This provides day traders with short-term price changes, which create trading opportunities.

Notable past examples include the SEC’s approval of Bitcoin ETFs and the FTX exchange crash.

Profits can be made by reacting to the news early or taking advantage of price corrections once the hype settles.

Pattern day trading

Day traders will also often use candlestick chart patterns to help their decision-making.

Candlestick charts are a visual representation of price movements in financial markets, showing the open, high, low, and close prices during specific time frames. Certain recurring patterns in these charts help traders find potentially predictable outcomes.

Some popular chart patterns include the triangle, flag, pennant, wedge, and head-and-shoulders patterns.

Is Day Trading Profitable?

Day trading can be profitable but has a notoriously low success rate.

Successful day trading typically requires more than an in-depth understanding of the market at hand. It also requires a comprehensive trading plan and the discipline to stick to it, as the market never sleeps.

It is widely accepted that a majority of day traders struggle to achieve consistent profits.

Disadvantages and Risks of Day Trading

Day trading comes with plenty of major risks, surplus to those found in regular investing.

It requires quick decision-making, more trades, and often uses leverage. Trading on shorter time frames also comes with more unpredictable conditions, swayed more easily by rumors and news.

Some of the main risks associated with day trading include:

- Human Error: The need for quick decision-making can lead to mistakes due to pressure. Traders need to be quick to respond to market changes, which can result in clumsy mistakes or fat-finger errors.

- Short-Term Fluctuations: Cryptocurrency prices can be very volatile over short time frames. This volatility means traders need to be prepared for sudden price swings, including when a position is already open.

- Leverage and Liquidation: Using leverage means borrowing money to trade sizing. This can amplify profits, but also losses, potentially leading to the liquidation of positions if the market moves the wrong way.

- Technical Issues: Technical issues with trading platforms and infrastructure can interrupt trading, despite cryptocurrency markets continuing to function. This can disrupt the ability to open or close trades, leading to losses or liquidation.

- Trading Fees: Day trades’ high frequency and large size can significantly cut into profits, more so than other styles of trading. Understanding and managing these costs is critical for profitability.

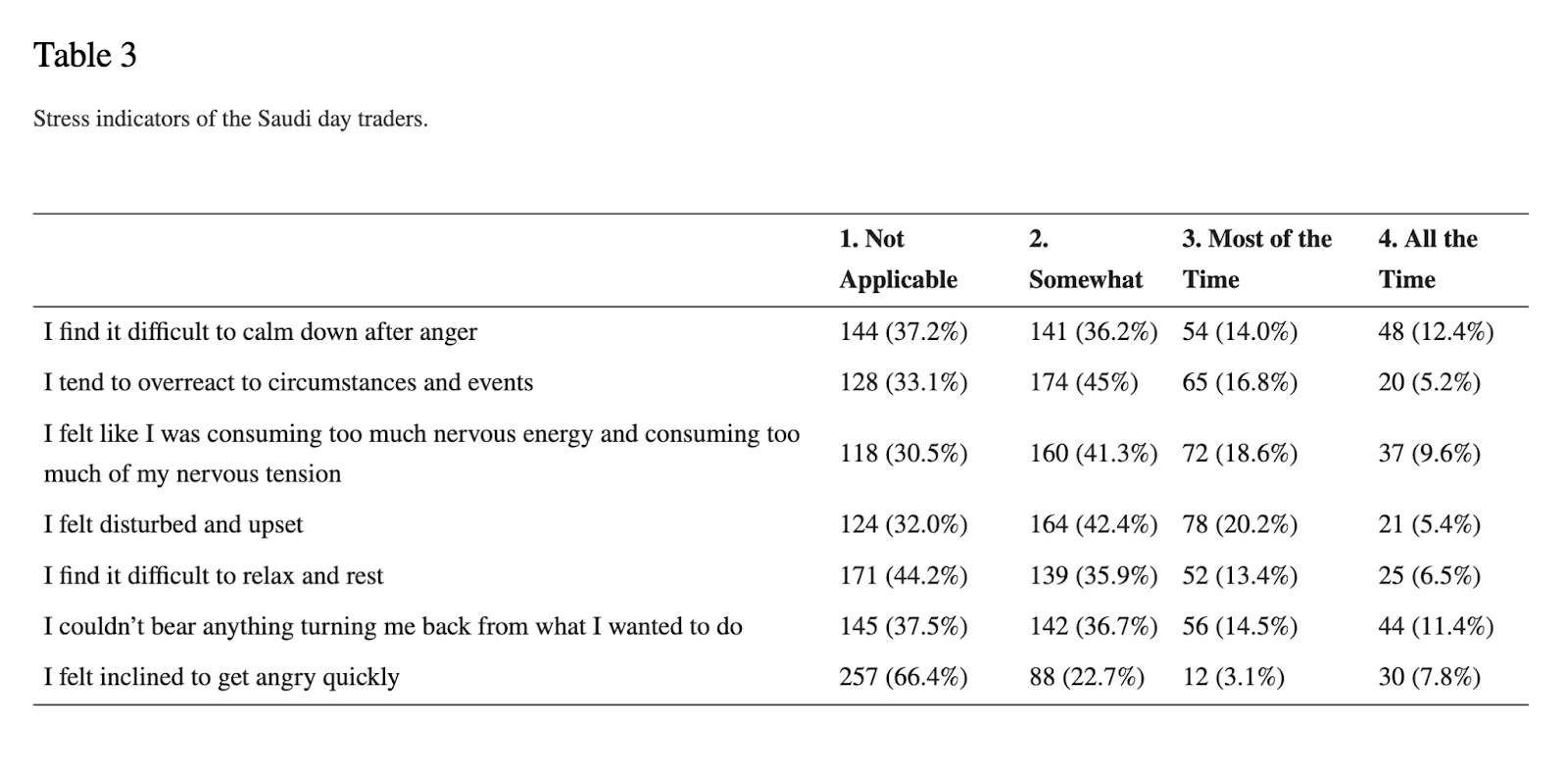

- Stress: The intense nature of day trading requires constant monitoring and quick responses for hours on end. This can be highly stressful and impact both decision-making and overall mental health.

Day Trading Risk Management

Risk management is crucial in day trading in order to counter the risks above.

Day traders typically follow a well-thought-out plan to guide them on when and how to make their trades. Sticking to personalized day trading rules can help mitigate a majority of day trading risks.

Some effective risk-management tools include:

Position Sizing

Setting a limit on the maximum size of a trade to keep any single loss from impacting the overall account. Expert traders recommend risking no more than 1% of a portfolio on any one trade.

Cory Mitchell, trader and trading educator, explains the logic behind the 1% rule as follows:

“Losing trades will happen, and if they aren’t controlled, even one losing trade that’s allowed to run can decimate an account. The 1% risk rule prevents a loss from getting out of hand. By following the rule, it takes many losing trades in a row to hurt the account.

Even while controlling risk and keeping it to 1% per trade, high returns are still possible. So you aren’t losing out by following this rule. In fact, following a rule like this is necessary if you want to achieve good returns, consistently, because controlling losses and keeping them small is a key component of successful trading.”

(Mitchell, 2024)

Stop-Loss Orders

Stop-loss orders can be used to automatically exit a trade at a set price. This can minimize potential losses by setting a hard limit on the downside, as well as execute the trade faster than doing it manually.

Diversify

Don’t put all your eggs in one basket. Spreading investments across multiple coins or tokens to balance out risk against poor performance from any single position.

Minimize Leverage

Using a reasonable degree of leverage will reduce the risk of liquidation. Although this will also limit gains, it will provide more wiggle room for a trade to survive if things go south.

Is Day Trading Stressful?

Yes, day trading can be stressful due to its fast-paced nature.

It demands constant attention to market changes, quick decision-making, and the emotional control to handle any losses. The pressure to perform consistently well can also lead to stress and burnout among day traders.

Due to these factors, day trading is generally only recommended for traders with high experience in other trading styles.

Stress from day trading can be managed by keeping certain factors under control. This may include risk management, responsible position sizing, having a trading plan, limiting screen time, and having realistic expectations.

Day Trading In Cryptocurrency Statistics

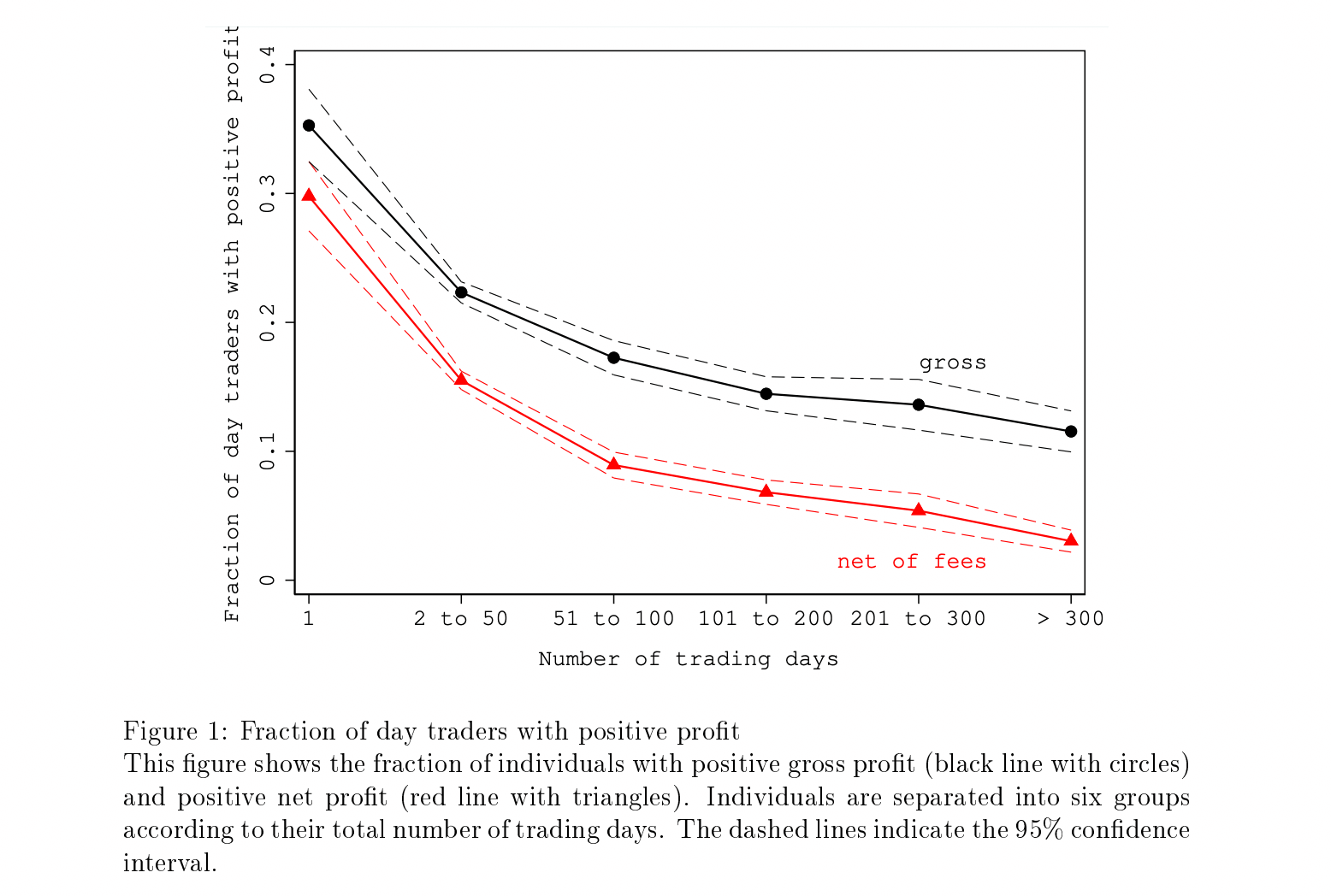

Most research to date has shown very low success rates for day trading.

One study from Brazil, conducted by researchers at the São Paulo School of Economics, found that over a period, only about 3% of day traders consistently earned money.

A similar 2010 study by Brad Barber of the University of California, Davis, revealed an even worse day trading success rate. Only around 1% of day traders consistently turned a profit.

The findings also show that this number of successful day traders continues to fall, the longer they keep trading. This is due to the difficulty of maintaining consistent returns over a long time period.

Although these studies were not related to day trading cryptocurrency specifically, it is likely that day trading carries a similar success rate across all markets.

Conclusion

Day trading is an advanced style of trading where investors buy and sell cryptocurrencies all in the same day.

It requires in-depth trading experience, quick decision-making, discipline, and the ability to handle stress. For the best odds of being successful at day trading, an individual will ideally have a proper understanding of the market and a good risk-mitigation plan.

While day trading can lead to large gains from small price changes, a consistent success rate is rare. Studies show that only a small fraction of day traders make money in the long run.

Article Sources

Mitchell, C. (2024, March 30). The 1% Risk Rule for Day Trading and Swing Trading. Trading Strategies and Education. https://tradethatswing.com/the-1-risk-rule-for-day-trading-and-swing-trading/

A. Bin Abdulrahman, K., & Alsharif, A. Y. (2022). Anxiety and Stress among Day Traders in Saudi Arabia (thesis). (A. Nienhaus & P. B. Tchounwou, Eds.) International Journal of Environmental Research and Public Health.

Chague, F., De-Losso, R., & Giovannetti, B. (2020). Day Trading for a Living? SSRN. https://ssrn.com/abstract=3423101